FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to rule 13a-16 or 15d-16 of

The Securities Exchange Act of 1934

For the month of

July, 2018

National Bank of Greece S.A.

(Translation of registrant’s name into English)

86 Eolou Street, 10232 Athens, Greece

(Address of principal executive offices)

[Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.]

Form 20-F

x

Form 40-F

o

[Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to rule 12g3-2(b) under the Securities Exchange Act of 1934.]

Yes

o

No

x

[If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ]

ANNUAL GENERAL MEETING

of 26 Ju

ly

2018

Draft Resolutions/Board Remarks

on the items on the agenda of the General Meeting

1. Amendment of the Articles of Association of the National Bank of Greece S.A., in accordance with changes in the current legislation.

|

Required quorum:

|

1/5 of total common(*) voting shares

|

|

|

|

|

Required majority:

|

50% of the total voting rights (present or represented by proxy) + 1 (present or represented by proxy)

|

Taking into consideration changes to Codified Law 2190/1920 on Sociétés Anonymes, as well as within the framework of the provisions of the Relationship Framework Agreement (RFA) between the Bank and the HFSF, and while considering latest developments and with a view to further facilitating the operation of the Bank’s governance bodies, it is proposed to amend a series of Articles of the Bank’s Articles of Association

, as follows:

|

AMENDMENT

(in track changes)

|

|

NEW ARTICLE

(incorporating amendments)

|

|

|

|

|

|

Article 5

1.

2.

3.

4.

Under the provisions of Article 13 of the Companies Act, as in force, the GM may empower the Board to decide for a share capital increase, or - insofar as the GM is the appropriate corporate body to decide thereon - for a bond issue, by GM resolution subject to the publication formalities provided for under the current legal framework. In this case, the share capital increase may be up to the level of the capital paid up at the date the said powers are

|

|

Article 5

1.

2.

3.

4. Under the provisions of Article 13 of the Companies Act, as in force the GM may empower the Board to decide for a share capital increase, or - insofar as the GM is the appropriate corporate body to decide thereon - for a bond issue, by GM resolution subject to the publication formalities provided for under the current legal framework. In this case, the share capital increase may be up to the level of the capital paid up at the date the said powers are

|

*Please see Number of Shares and Voting Rights below

|

|

National Bank of Greece S.A.

|

|

delegated to the Board, whereas the amount of the bond issue may not exceed half of the share capital paid up at such date. The said powers of the Board may be renewed by the GM for a period each time not exceeding five years and shall come into effect on expiry of each such period. The said GM resolution is subject to the publication formalities provided for under the current legal framework.

By exception to the provisions of the previous sub-paragraph, when corporate reserves exceed 1/4 of the paid-up share capital the share capital increase is subject to a GM resolution, to be adopted in accordance with the provisions of Article 29.3, 29.4 and 31.2 of the Companies Act, as in force, along with a respective amendment to the Article hereof regarding the share capital.

The share capital increase provided for under sub-par. 1 of this paragraph shall not constitute an amendment to the Articles of Association.

5. The GM that resolves on a share capital increase pursuant to pars 3 and 4 of Article 29 and par. 2 of Article 31 of the Companies Act, as in force, may authorize the Board to resolve on the new shares’ offering price, and/or interest rate and method of determination thereof, in the event of issue of interest-earning shares, within a term determined by the GM, that cannot exceed one year. In this case, the time period for the payment of the relevant funds under Article 11 of the Companies Act, as in force, shall begin on the date when the said resolution determining the shares’ offering price and/or interest rate or method of determination thereof, as the case may be, is adopted by the Board.

6. In any share capital increase, even by contribution in kind, or of a convertible bond issue, a pre-emptive right to the entire amount of the new capital or bond issue shall be granted to shareholders of record, pro rata to their equity holding as at the time of issue. In the event that the Bank has already issued shares of more than one category, and voting rights,

or rights to profit distribution or liquidation proceeds vary among these different categories of shares, then

|

|

delegated to the Board, whereas the amount of the bond issue may not exceed half of the share capital paid up at such date. The said powers of the Board may be renewed by the GM for a period each time not exceeding five years and shall come into effect on expiry of each such period. The said GM resolution is subject to the publication formalities provided for under the current legal framework.

By exception to the provisions of the previous sub-paragraph, when corporate reserves exceed 1/4 of the paid-up share capital the share capital increase is subject to a GM resolution, to be adopted in accordance with the provisions of Article 29.3, 29.4 and 31.2 of the Companies Act, as in force, along with a respective amendment to the Article hereof regarding the share capital.

The share capital increase provided for under sub-par. 1 of this paragraph shall not constitute an amendment to the Articles of Association.

5. The GM that resolves on a share capital increase pursuant to pars 3 and 4 of Article 29 and par. 2 of Article 31 of the Companies Act, as in force, may authorize the Board to resolve on the new shares’ offering price, and/or interest rate and method of determination thereof, in the event of issue of interest-earning shares, within a term determined by the GM, that cannot exceed one year. In this case, the time period for the payment of the relevant funds under Article 11 of the Companies Act, as in force, shall begin on the date when the said resolution determining the shares’ offering price and/or interest rate or method of determination thereof, as the case may be, is adopted by the Board.

6. In any share capital increase, even by contribution in kind, or of a convertible bond

issue, a pre-emptive right to the entire amount of the new capital or bond issue shall be granted to shareholders of record, pro rata to their equity holding as at the time of issue. In the event that the Bank has already issued shares of more than

|

2

|

the share capital increase may be implemented through one such category of shares alone; in this case, the holders of the other categories of shares shall be granted a pre-emptive right only following non-exercise thereof by the holders of shares of the same category as the new shares.

The pre-emptive right shall be exercised within the time period set by the corporate body that decided for the share capital increase. The said time period, subject to the payment deadline provided for in Article 11 of the Companies Act, as in force, shall not be less than 15 days. In the case of par. 5 of this Article, the time period for the exercise of the pre-emptive right shall not begin before the date of the Board resolution determining the new shares’ offering price. In the cases of sub-pars 2 and 3 of par. 6 of this Article, the corporate body that decided for the increase shall also determine the time period for the exercise of the said right by the rest of the shareholders; the said time period shall not be less than 10 days and shall begin on the date following the expiry date of the respective time period provided for the holders of shares of the same category as the new shares.

Following expiry of the said deadlines, any shares not taken up as above shall be freely disposed of by the Board of Directors, at a price not lower than that paid by the existing shareholders.

In the event that the corporate body which decides for the share capital increase fails to set a deadline for the exercise of the pre-emptive right, such deadline, or any extension thereof, shall be set by resolution of the Board adopted within the time limits provided for under Article 11 of the Companies Act, as in force.

The invitation to exercise the pre-emptive right, which must also indicate the deadline set for the exercise thereof, shall be published

in accordance with the current legal framework.

Without prejudice to par. 5 of this Article, the said invitation and deadline for the exercise of the pre-emptive right may be omitted in the event that the shareholders who attended the GM represented the entire share capital and were informed of the deadline set for the

|

|

one category, and voting rights, or rights to profit distribution or liquidation proceeds vary among these different categories of shares, then the share capital increase may be implemented through one such category of shares alone; in this case, the holders of the other categories of shares shall be granted a pre-emptive right only following non-exercise thereof by the holders of shares of the same category as the new shares.

The pre-emptive right shall be exercised within the time period set by the corporate body that decided for the share capital increase. The said time period, subject to the payment deadline provided for in Article 11 of the Companies Act, as in force, shall not be less than 15 days. In the case of par. 5 of this Article, the time period for the exercise of the pre-emptive right shall not begin before the date of the Board resolution determining the new shares’ offering price. In the cases of sub-pars 2 and 3 of par. 6 of this Article, the corporate body that decided for the increase shall also determine the time period for the exercise of the said right by the rest of the shareholders; the said time period shall not be less than 10 days and shall begin on the date following the expiry date of the respective time period provided for the holders of shares of the same category as the new shares.

Following expiry of the said deadlines, any shares not taken up as above shall be freely disposed of by the Board of Directors, at a price not lower than that paid by the existing shareholders.

In the event that the corporate body which decides for the share capital increase fails to set a deadline for the exercise of the pre-emptive right, such deadline, or any extension thereof, shall be set by resolution of the Board adopted within the time limits provided for under Article 11 of the Companies Act, as in force.

The invitation to exercise the pre-emptive right, which must also indicate the deadline set for the exercise thereof, shall be published

in accordance with the current legal framework.

|

3

|

exercise of the pre-emptive right, or stated their decision to exercise same or not. Publication of the invitation to exercise the pre-emptive right may be substituted by registered letters, return receipt requested, to the shareholders.

7. The pre-emptive right may be limited or abolished by GM resolution and subject to the provisions of Article 13.10 of the Companies Act, as in force.

8. The share capital increase is allowed through the issue of redeemable shares, which may be issued either as common redeemable shares or as preferred shares, with or without voting right, pursuant to the provisions of Article 3 of the Companies Act, as in force. Redemption thereof shall be by corporate declaration to shareholders, subject to the publication requirements of Article 11 hereof, and valid only on release to shareholders of the corresponding contribution. The capital increase, the issue of redeemable shares and potential exclusion of the pre-emptive right shall be subject to the provisions of this Article; the redemption option shall be subject to the requirements of Article 17b of the Companies Act, as in force. Furthermore, the Bank is entitled to issue preference shares of any type permitted by applicable legislation. In departure from the provisions of Article 6 hereof, the said preference and in general redeemable shares may be physical shares.

9.

|

|

Without prejudice to par. 5 of this Article, the said invitation and deadline for the exercise of the pre-emptive right may be omitted in the event that the shareholders who attended the GM represented the entire share capital and were informed of the deadline set for the exercise of the pre-emptive right, or stated their decision to exercise same or not. Publication of the invitation to exercise the pre-emptive right may be substituted by registered letters, return receipt requested, to the shareholders.

7. The pre-emptive right may be limited or abolished by GM resolution and subject to the provisions of Article 13.10 of the Companies Act, as in force.

8. The share capital increase is allowed through the issue of redeemable shares, which may be issued either as common redeemable shares or as preferred shares, with or without voting right, pursuant to the provisions of Article 3 of the Companies Act, as in force. Redemption thereof shall be by corporate declaration to shareholders, subject to the publication requirements of Article 11 hereof, and valid only on release to shareholders of the corresponding contribution. The capital increase, the issue of redeemable shares and potential exclusion of the pre-emptive right shall be subject to the provisions of this Article; the redemption option shall be subject to the requirements of Article 17b of the Companies Act, as in force. Furthermore, the Bank is entitled to issue preference shares of any type permitted by applicable legislation. In departure from the provisions of Article 6 hereof, the said preference and in general redeemable shares may be physical shares.

9.

|

|

|

|

|

|

Article 6

1.

The Bank’s shares are registered, pursuant to Article 11a of the Companies Act.

2.

3.

4.

5.

6. By resolution adopted in line with the provisions of Article 29.3, 29.4 and 31.2 of the

|

|

Article 6

1.

The Bank’s shares are registered, pursuant to Article 11a of the Companies Act.

2.

3.

|

4

|

Companies Act, as in force, the GM may establish a plan for allocating corporate shares to the Directors and employees of the Bank and of associated companies thereof in the sense of Article 32 of L. 4308/2014, in the form of stock options (stock option plan) pursuant to the provisions of Article 13.13-14 of the Companies Act, as in force, and of the resolution of the said GM, a summary of which shall be subject to the publication formalities provided for under the current legal framework.

|

|

4.

5.

6. By resolution adopted in line with the provisions of Article 29.3, 29.4 and 31.2 of the Companies Act, as in force, the GM may establish a plan for allocating corporate shares to the Directors and employees of the Bank and of associated companies thereof in the sense of Article 32 of L. 4308/2014 , in the form of stock options (stock option plan) pursuant to the provisions of Article 13.13-14 of the Companies Act, as in force, and of the resolution of the said GM, a summary of which shall be subject to the publication formalities provided for under the current legal framework.

|

|

|

|

|

|

Article 9

1.

2. The provisions of the previous paragraph do not apply to: (a) capital increases by Board resolution pursuant to Article 13.1 and 13.4 of the Companies Act, as in force, or capital increases imposed by provisions of other laws, (b) amendments to the Articles of Association introduced by the Board under Article 11.5, 13.2, 13.5 and 17b.4 of the Companies Act, as in force, (c) the election of Directors in replacement of Directors resigned, deceased or having forfeited their office for whatever reason, in line with the provisions of these Articles of Association pursuant to Article 18.7 of the Companies Act, (d) the absorption of a company fully owned by another company as per Article 78 of the Companies Act, and (e) the option for distribution of profits or non-mandatory reserves within the current financial year by resolution of the Board, subject to prior GM authorization.

3.

|

|

Article 9

1.

2. The provisions of the previous paragraph do not apply to: (a) capital increases by Board resolution pursuant to Article 13.1 and 13.4 of the Companies Act, as in force, or capital increases imposed by provisions of other laws, (b) amendments to the Articles of Association introduced by the Board under Article 11.5, 13.2, 13.5 and 17b.4 of the Companies Act, as in force, (c) the election of Directors in replacement of Directors resigned, deceased or having forfeited their office for whatever reason, in line with the provisions of these Articles of Association pursuant to Article 18.7 of the Companies Act, (d) the absorption of a company fully owned by another company as per Article 78 of the Companies Act, and (e) the option for distribution of profits or non-mandatory reserves within the current financial year by resolution of the Board, subject to prior GM authorization.

3.

|

|

|

|

|

|

Article 10

1. The GM shall be convened by the Board, or as otherwise provided for by law, and held ordinarily (“AGM”) at the Bank’s registered office or in the region of another municipality within the prefecture where the Bank’s registered office is located, at least once a year, at the latest until the tenth (10th) calendar day of the ninth month following the end of each financial year. The GM may also be convened extraordinarily (“EGM”)

|

|

Article 10

1. The GM shall be convened by the Board, or as otherwise provided for by law, and held ordinarily (“AGM”) at the Bank’s registered office or in the region of another municipality within the prefecture where the Bank’s registered office is located, at least once a year, at the latest until the tenth (10th) calendar day of the ninth month following the end of each financial year. The GM may also be convened extraordinarily (“EGM”)

|

5

|

whenever deemed expedient, at the discretion of the Board.

2.

3.

4. Following approval of the annual financial statements, the AGM shall, by special voting, by roll-call, decide on the discharge from personal liability of the Board and the auditors. Such discharge shall have no effect in cases falling under Article 22a of the Companies Act, as in force. The members of the Board and employees that are shareholders of the Bank may take part in the roll call only on the basis of the number of shares they hold or as proxies of other shareholders provided they have obtained relevant authorization with express and specific voting instructions.

|

|

whenever deemed expedient, at the discretion of the Board.

2.

3.

4. Following approval of the annual financial statements, the AGM shall, by special voting, by roll-call, decide on the discharge from personal liability of the Board and the auditors. Such discharge shall have no effect in cases falling under Article 22a of the Companies Act, as in force. The members of the Board and employees that are shareholders of the Bank may take part in the roll call only on the basis of the number of shares they hold or as proxies of other shareholders provided they have obtained relevant authorization with express and specific voting instructions.

|

|

|

|

|

|

Article 11

1.

2.

3. The invitation to the GM, including the information provided for by law from time to time, including inter alia the place where the GM is to be held, along with the exact address, the date and time thereof, the items on the agenda, clearly specified, and the shareholders entitled to participate therein, along with precise instructions as to the method of participation and exercise of the rights thereof in person or by legally authorized proxy or even by distance participation, shall be displayed in a conspicuous place at the Bank’s Head Office and published, if the company’s shares are listed on the stock exchange, on the website of the General Commercial Register (GEMI), in line with the provisions of law, and posted on the company’s website as per

the current legal and regulatory framework.

In addition, the Bank is also entitled to publish, at its own discretion and without being under relevant obligation by law, specific invitation to the GM:

(a) in the newspapers stipulated in subparagraphs (b), (c) and (e) of Article 26.2 of the Companies Act 2190/1920, as in force, or

(b) if the company’s shares are listed on the

|

|

Article 11

1.

2.

3.

The invitation to the GM, including the information provided for by law from time to time, including inter alia the place where the GM is to be held, along with the exact address, the date and time thereof, the items on the agenda, clearly specified, and the shareholders entitled to participate therein, along with precise instructions as to the method of participation and exercise of the rights thereof in person or by legally authorized proxy or even by distance participation, shall be displayed in a conspicuous place at the Bank’s Head Office and published, if the company’s shares are listed on the stock exchange, on the website of the General Commercial Register (GEMI), in line with the provisions of law, and posted on the company’s website as per the current legal and regulatory framework.

In addition, the Bank is also entitled to publish, at its own discretion and without being under relevant obligation by law, specific invitation to the GM:

(a) in the newspapers stipulated in subparagraphs (b), (c) and (e) of Article 26.2 of

|

6

|

stock exchange - a summary invitation in the newspapers of subparagraphs (b), (c) and (e) of Article 26.2c of the Companies Act 2190/1920, as in force, and to post the full invitation on the company’s website.

The Invitation shall be published on the website of the General Commercial Registry (GE.MI.), as defined by law and also,

within the same deadline provisioned for the publication in GE.MI.on the company’s website. In the event of additional publication in the newspapers of subparagraphs (b), (c) and (e) of Article 26.2c of the Companies Act 2190/1920, the relevant publication shall take place 20 full days in advance. The above time limits do not include the day of publication of the invitation of the GM, or the day of the meeting, while in the event of a posting on the company’s website the said time limits start and end on the date on which the company announced the posting on the website to the relevant registry. In the event of repeat GMs, the specific provisions of the current legal and regulatory framework apply.

|

|

the Companies Act 2190/1920, as in force, or

(b) if the company’s shares are listed on the stock exchange - a summary invitation in the newspapers of subparagraphs (b), (c) and (e) of Article 26.2c of the Companies Act 2190/1920, as in force, and to post the full invitation on the company’s website.

The Invitation shall be published on the website of the General Commercial Registry (GE.MI.), as defined by law and also, within the same deadline provisioned for the publication in GE.MI., on the company’s website. In the event of additional publication in the newspapers of subparagraphs (b), (c) and (e) of Article 26.2c of the Companies Act 2190/1920, the relevant publication shall take place 20 full days in advance. The above time limits do not include the day of publication of the invitation of the GM, or the day of the meeting, while in the event of a posting on the company’s website the said time limits start and end on the date on which the company announced the posting on the website to the relevant registry. In the event of repeat GMs, the specific provisions of the current legal and regulatory framework apply.

|

|

|

|

|

|

Article 13

1. 24 hours before each GM, a list of the names of the shareholders entitled to vote thereat, along with each shareholder’s number of shares and votes, the names of their proxies, where applicable, and the said shareholders’ and proxies’ addresses shall be displayed in a conspicuous place at the Bank’s Head Office. The Board shall include in the said list all shareholders that hall have adhered to the provisions of the preceding article.

As of the date the invitation to the GM is published until the date the GM is held, the Bank is required to have the information provided under article 27.3 of the Companies Act,

as in force, displayed on its corporate website, and to inform the shareholders through its website of the way the relevant material can be provided in case access to such information via the internet is impossible due to technical reasons.

2.

|

|

Article 13

1. 24 hours before each GM, a list of the names of the shareholders entitled to vote thereat, along with each shareholder’s number of shares and votes, the names of their proxies, where applicable, and the said shareholders’ and proxies’ addresses shall be displayed in a conspicuous place at the Bank’s Head Office. The Board shall include in the said list all shareholders that hall have adhered to the provisions of the preceding article.

As of the date the invitation to the GM is published until the date the GM is held, the Bank is required to have the information provided under article 27.3 of the Companies Act, as in force, displayed on its corporate website, and to inform the shareholders through its website of the way the relevant material can be provided in case access to such information via the internet is impossible due to technical reasons.

2.

|

7

|

Article 14

1. The Chairman of the Board shall also provisionally chair the GM. Should the Chairman be unable to attend the GM, he shall be replaced by his substitute or the CEO, as per par. 3 ofArticle 21 hereof. Should such substitute be also unable to attend, the GM shall be provisionally chaired by the shareholder that owns the largest number of shares, or by the proxy thereof. Two of the shareholders or proxies present, designated by the Chairman, shall act as provisional secretaries.

2.

|

|

Article 14

1.

The Chairman of the Board shall also provisionally chair the GM. Should the Chairman be unable to attend the GM, he shall be replaced by his substitute or the CEO, as per par. 3 of Article 21 hereof. Should such substitute be also unable to attend, the GM shall be provisionally chaired by the shareholder that owns the largest number of shares, or by the proxy thereof. Two of the shareholders or proxies present, designated by the Chairman, shall act as provisional secretaries.

2.

|

|

|

|

|

|

Article 18

1. The Bank is managed by the Board of Directors, consisting of 7 to 15 members, and represented in all its affairs as per articles 22-24 below. A representative of the Hellenic Financial Stability Fund shall participate in the Bank’s Board, pursuant to Law 3864/2010, as in force.

2.

3. In the event that as a result of resignation, death or forfeiture for whatever reason a director ceases to be on the Board, and his replacement by substitute directors elected by the GM as provided for in paragraph 2 is not feasible, the remaining directors may, by decision taken as provided for in article 26, either provisionally elect another director to fill the vacancy for the remaining term of office of the director replaced, or continue to manage and represent the Bank without replacing the missing director(s), provided that the number of the remaining directors shall be at least 7. In the event that a new director is elected, the election shall be valid for the remaining term of office of the director replaced, and announced by the Board to the immediately following GM, which may replace the directors elected even if no relevant item is included in the agenda.

Under all circumstances, the remaining directors, irrespective of number, may call a GM solely for electing a new Board.

4. The appointment and the discharge, for whatever reason, of members of the Board and persons authorized to represent the Bank on a joint or sole representation basis, along with

|

|

Article 18

1. The Bank is managed by the Board of Directors, consisting of 7 to 15 members, and represented in all its affairs as per articles 22-24 below. A representative of the Hellenic Financial Stability Fund shall participate in the Bank’s Board, pursuant to Law 3864/2010, as in force.

2.

3. In the event that as a result of resignation, death or forfeiture for whatever reason a director ceases to be on the Board, and his replacement by substitute directors elected by the GM as provided for in paragraph 2 is not feasible, the remaining directors may, by decision taken as provided for in article 26, either provisionally elect another director to fill the vacancy for the remaining term of office of the director replaced, or continue to manage and represent the Bank without replacing the missing director(s), provided that the number of the remaining directors shall be at least 7. In the event that a new director is elected, the election shall be valid for the remaining term of office of the director replaced, and announced by the Board to the immediately following GM, which may replace the

|

8

|

their identity particulars, shall be subject to publication requirements as per the each time applicable legal and regulatory framework.

|

|

directors elected even if no relevant item is included in the agenda.

Under all circumstances, the remaining directors, irrespective of number, may call a GM solely for electing a new Board.

4. The appointment and the discharge, for whatever reason, of members of the Board and persons authorized to represent the Bank on a joint or sole representation basis, along with their identity particulars, shall be subject to publication requirements as per the each time applicable legal and regulatory framework.

|

|

|

|

|

|

Article 19

1. Without prejudice to the provisions of par. 3 of Article 18 hereof, the directors shall be elected by the GM for a term that cannot exceed three (3) years.

Uneven terms of office may be provisioned for each Director, insofar as this is prescribed by the current legal and regulatory framework.The directors’ term of office shall end at the AGM of the year in which such provisioned term expires.

2. The directors can be re-elected indefinitely

, subject to the meeting of requirements set by the each time applicable legal and regulatory framework.

|

|

Article 19

1. Without prejudice to the provisions of par. 3 of Article 18 hereof, the directors shall be elected by the GM for a term that cannot exceed three (3) years. Uneven terms of office may be provisioned for each Director, insofar as this is prescribed by the current legal and regulatory framework. The directors’ term of office shall end at the AGM of the year in which such provisioned term expires.

2. The directors can be re-elected indefinitely, subject to the meeting of requirements set by the each time applicable legal and regulatory framework.

|

|

|

|

|

|

Article 21

1. The Board elects by absolute majority from among its members the Chairman of the Board and the Bank’s Chief Executive Officer, who manages the affairs of the Bank, and decides on the appointment of executive and non-executive members of the Board. The Board may also elect from among its members one or more Vice Chairmen.

2. The Board decides on the appointment and duties of Deputy Chief Executive Officers.

3. In the event of absence, impediment or death of the Chairman of the Board he shall be replaced by the Vice Chairman, and in the event of impediment of the latter, by the longest serving — with respect to the term of office — non-executive Board member, or by the CEO following approval by the Bank of Greece or the

|

|

Article 21

1. The Board elects by absolute majority from among its members the Chairman of the Board and the Bank’s Chief Executive Officer, who manages the affairs of the Bank, and decides on the appointment of executive and non-executive members of the Board. The Board may also elect from among its members one or more Vice Chairmen.

2. The Board decides on the appointment and duties of Deputy Chief Executive Officers.

3. In the event of absence, impediment or death of the Chairman of the Board he shall be replaced by the Vice Chairman, and in the event of impediment of the latter, by the longest serving — with respect to the term of office — non-executive Board member, or by the CEO following approval by the Bank of Greece or the

|

9

|

Hellenic Capital Market Commission, according to the applicable provisions, as the case may be. In the event of absence, impediment or death of the CEO he shall be replaced by the longest serving Deputy CEO and in the event of concurrent absence or impediment of all the Deputy CEOs, by the longest serving Board member.

4

. The Board shall be constituted into a body at the first meeting thereof following each election of Directors by the GM, as well as under any circumstances when the Chairman’s or the Chief Executive Officer’s post is vacated for whatever reason. Until the Board elects a new Chairman or Chief Executive Officer, the relevant duties shall be exercised by the substitute thereof.

Furthermore, the Board may be constituted into a body anytime, following relevant decision by majority, determining anew its executive and non-executive members.

5. The Chairman of the Board or his substitute shall chair the meetings of the Board, introduce the items for deliberation and manage the affairs of the Board.

6. The Board elects a Board secretary who may or may not be a member thereof.

|

|

Hellenic Capital Market Commission, according to the applicable provisions, as the case may be. In the event of absence, impediment or death of the CEO he shall be replaced by the longest serving Deputy CEO and in the event of concurrent absence or impediment of all the Deputy CEOs, by the longest serving Board member.

4. The Board shall be constituted into a body at the first meeting thereof following each election of Directors by the GM, as well as under any circumstances when the Chairman’s or the Chief Executive Officer’s post is vacated for whatever reason. Until the Board elects a new Chairman or Chief Executive Officer, the relevant duties shall be exercised by the substitute thereof. Furthermore, the Board may be constituted into a body anytime, following relevant decision by majority, determining anew its executive and non-executive members.

5. The Chairman of the Board or his substitute shall chair the meetings of the Board, introduce the items for deliberation and manage the affairs of the Board.

6. The Board elects a Board secretary who may or may not be a member thereof.

|

|

|

|

|

|

Article 22

1. The Board represents the Bank in court and out of court and may delegate its powers and functions, in all or in part, including the right of representation, to the Chief Executive Officer, the Deputy Chief Executive Officers, one or more of its members, the Bank’s general managers, assistant general managers, staff members or other persons meeting the requisite standards in terms of technical and other qualifications, attorneys and third parties in general, by virtue of a Board resolution, which shall also determine the matters in respect of which the said powers and functions are delegated. Excluded are any such matters as may require collective action by the Board. The Board may also delegate the Bank’s internal control to one or more persons other than members of the Board, or to

|

|

Article 22

1. The Board represents the Bank in court and out of court and may delegate its powers and functions, in all or in part, including the right of representation, to the Chief Executive Officer, the Deputy Chief Executive Officers, one or more of its members, the Bank’s general managers, assistant general managers, staff members or other persons meeting the requisite standards in terms of technical and other qualifications, attorneys and third parties in general, by virtue of a Board resolution, which shall also determine the matters in respect of which the said powers and functions are delegated. Excluded are any such matters as may require collective action by the Board. The Board may also delegate the Bank’s internal control to one or more persons other than members of the Board, or to

|

10

|

members of the Board also, insofar as this is not prohibited by law. The persons referred to in the previous sub-paragraphs may, insofar as this is provided for under the relevant Board resolutions, further delegate all or part of the functions delegated to them to, and further confer the powers conferred on them on, other persons, directors, employees, attorneys or third parties in general.

2.

|

|

members of the Board also, insofar as this is not prohibited by law. The persons referred to in the previous sub-paragraphs may, insofar as this is provided for under the relevant Board resolutions, further delegate all or part of the functions delegated to them to, and further confer the powers conferred on them on, other persons, directors, employees, attorneys or third parties in general.

2.

|

|

|

|

|

|

Article 23

1.

2.

3. The Board is the appropriate corporate body to decide on matters such as:

(a) Establishment of branch offices, agencies and representative offices in Greece and abroad;

(b) Acquisition of shareholdings in other banks in Greece or abroad, or divestment thereof;

(c) Approval of the Bank’s by-laws;

(d) Nomination of the Bank’s General Managers and Assistant General Managers following the Chief Executive Officer’s recommendation;

(e) Audit and approval of the Bank’s annual and consolidated financial statements;

(f) Establishment of associations and foundations under Article 108 and participation in companies falling under Article 784 of the Greek Civil Code.

(g) Bond issues of any type, except those that by law fall exclusively within the jurisdiction of the GM.

4.

|

|

Article 23

1.

2.

3. The Board is the appropriate corporate body to decide on matters such as:

(a) Establishment of branch offices, agencies and representative offices in Greece and abroad;

(b) Acquisition of shareholdings in other banks in Greece or abroad, or divestment thereof;

(c) Approval of the Bank’s by-laws;

(d) Nomination of the Bank’s General Managers and Assistant General Managers following the Chief Executive Officer’s recommendation;

(e) Audit and approval of the Bank’s annual and consolidated financial statements;

(f) Establishment of associations and foundations under Article 108 and participation in companies falling under Article 784 of the Greek Civil Code.

(g) Bond issues of any type, except those that by law fall exclusively within the jurisdiction of the GM.

4.

|

|

|

|

|

|

Article 24

1. The Bank shall be represented in courts as provided for by Article 22 above. The Chief Executive Officer, the Deputy Chief Executive Officers and the general managers and assistant general managers may delegate to one or more of the Bank’s employees or attorneys-at-law, acting on a sole or joint basis, powers to represent the Bank in any court action and with respect to any matter relating to enforcement proceedings.

2.

3.

4.

5.

|

|

Article 24

1.The Bank shall be represented in courts as provided for by Article 22 above. The Chief Executive Officer, the Deputy Chief Executive Officers and the general managers and assistant general managers may delegate to one or more of the Bank’s employees or attorneys-at-law, acting on a sole or joint basis, powers to represent the Bank in any court action and with respect to any matter relating to enforcement proceedings.

2.

3.

4.

5.

|

11

|

Article 25

1.

2. The Board shall be convened by the Chairman thereof, by means of an invitation to the directors at least two business days prior to the meeting, unless otherwise specified in the current legal and regulatory framework. The invitation must clearly specify the items on the agenda, otherwise resolutions may not be adopted at the meeting unless all directors are present or represented and no director objects to resolutions being adopted thereat.

3.

4.

|

|

Article 25

1.

2. The Board shall be convened by the Chairman thereof, by means of an invitation to the directors at least two business days prior to the meeting, unless otherwise specified in the current legal and regulatory framework. The invitation must clearly specify the items on the agenda, otherwise resolutions may not be adopted at the meeting unless all directors are present or represented and no director objects to resolutions being adopted thereat.

3.

4.

|

|

|

|

|

|

Article 27

1.

2.

3. Board minutes drafted and signed by all directors or the representatives thereof shall be equivalent to a Board resolution, even where no Board meeting has been held. The signing by directors or the representatives thereof may be replaced by the exchange of messages via e-mail or other electronic means.

4. Copies of Board meeting minutes that are subject to filing with the GE.MI., shall be filed with the competent GE.MI. department, in accordance with the current legal and regulatory framework.

5. Board meeting minutes shall be signed by the Board Chairman or Secretary; copies of and excerpts from the said minutes issued by the said persons shall be official without further validation, as per the current legal and regulatory framework also.

|

|

Article 27

1.

2.

3. Board minutes drafted and signed by all directors or the representatives thereof shall be equivalent to a Board resolution, even where no Board meeting has been held. The signing by directors or the representatives thereof may be replaced by the exchange of messages via e-mail or other electronic means.

4. Copies of Board meeting minutes that are subject to filing with the GE.MI., shall be filed with the competent GE.MI. department, in accordance with the current legal and regulatory framework.

5. Board meeting minutes shall be signed by the Board Chairman or Secretary; copies of and excerpts from the said minutes issued by the said persons shall be official without further validation, as per the current legal and regulatory framework also.

|

|

|

|

|

|

Article 29

Pursuant to the current legal and regulatory framework, Board members are liable to the Bank for acts and/or omissions thereof while managing corporate affairs. Specifically, no such liability exists in the event that the Board

|

|

Article 29

Pursuant to the current legal and regulatory framework, Board members are liable to the Bank for acts and/or omissions thereof while managing corporate affairs. Specifically, no such liability exists in the event that the Board

|

12

|

member proves that he has acted with the diligence of a prudent businessman, such diligence being determined also in the light of the capacity and duties of each member of the Board, or in the event of acts or omissions that are based on lawful resolutions of the GM or that regard a reasonable corporate decision taken in good faith, on the basis of adequate information and solely to serve corporate interests.

|

|

member proves that he has acted with the diligence of a prudent businessman , such diligence being determined also in the light of the capacity and duties of each member of the Board, or in the event of acts or omissions that are based on lawful resolutions of the GM or that regard a reasonable corporate decision taken in good faith, on the basis of adequate information and solely to serve corporate interests.

|

|

|

|

|

|

Article 30

1.

2.

3. The directors and any third parties to whom the Board has delegated powers and authorities shall disclose to the other directors in a timely and adequate manner own interests that may arise from corporate transactions within their responsibility, and any other conflict of interests between them and the Bank or any affiliate thereof that may arise in the course of their duties, in the sense of Article 32 of L. 4308/2014.

4.

|

|

Article 30

1.

2.

3. The directors and any third parties to whom the Board has delegated powers and authorities shall disclose to the other directors in a timely and adequate manner own interests that may arise from corporate transactions within their responsibility, and any other conflict of interests between them and the Bank or any affiliate thereof that may arise in the course of their duties, in the sense of Article 32 of L. 4308/2014.

4.

|

|

|

|

|

|

Article 31

1.

2. At the request of shareholders representing 1/20 of the paid-up share capital, the Board shall add to the agenda of the General Meeting that has been convoked additional items, provided the respective request is submitted to the Board at least 15 days prior to the said General Meeting. The additional items must be published and disclosed, under the Board’s responsibility, pursuant to article 26 of the Companies Act 2190/1920, as in force, at least 7 days prior to the General Meeting. If the company’s shares are listed on the stock exchange, the request to add further items to the agenda must be accompanied by supporting reasons or draft resolution to be submitted for the General Meeting’s approval, and the revised agenda shall be published in the same way as the previous agenda, 13 days prior to the date of the General Meeting, while at the same time it shall be made available to shareholders on the company’s website, together with the respective reasons or

|

|

Article 31

1.

2. At the request of shareholders representing 1/20 of the paid-up share capital, the Board shall add to the agenda of the General Meeting that has been convoked additional items, provided the respective request is submitted to the Board at least 15 days prior to the said General Meeting. The additional items must be published and disclosed, under the Board’s responsibility, pursuant to article 26 of the Companies Act 2190/1920, as in force, at least 7 days prior to the General Meeting. If the company’s shares are listed on the stock exchange, the request to add further items to the agenda must be accompanied by supporting reasons or draft resolution to be submitted for the General Meeting’s approval, and the revised agenda shall be published in the same way as the previous agenda, 13 days prior to the date of the General Meeting, while at the same time it shall be made available to shareholders on the company’s website, together with the respective reasons or

|

13

|

draft resolution submitted by the shareholders. The Board is under no obligation to take any of these steps if the content of the respective request by shareholders clearly infringes the law and decent conduct.

3. If the company’s shares are listed on the stock exchange, by request of shareholders representing one 1/20 of the paid-up share capital, the Board shall, pursuant to article 27.3 of the Companies Act 2190/1920, as in force, provide shareholders at least 6 days prior to the date of the General Meeting draft resolutions on the items included in the initial or the revised agenda, provided the respective request has been submitted to the Board at least 7 days prior to the date of the General Meeting. The Board is under no obligation to take any of these steps if the content of the respective request by shareholders clearly infringes the law and decent conduct.

4. At the request of shareholders representing 1/20 of the paid-up share capital, the Chairman of the GM shall postpone, only once, decision-taking by the GM, whether an AGM or an EGM, for a new GM to be held on the date indicated in the shareholders’ request, but not later than 30 days as of the said postponement.

The GM held following such postponement, being a continuation of the previous GM, is not subject to publication requirements as regards the invitation to shareholders, and new shareholders may also participate therein subject to the provisions of articles 27.2, 28 and 28a of the Companies Act 2190/1920, as in force.

5.

6. At the request of a shareholder filed with the Bank at least 5 full days before the date of the GM, the Board shall provide the GM with any such specific information on the Bank’s business as may be requested, insofar as it serves for real assessment of items on the agenda. The Board may provide a single answer to shareholders’ requests that are of similar content. No such obligation to provide information applies in the event that the said information is already available on the company’s website, particularly

|

|

draft resolution submitted by the shareholders. The Board is under no obligation to take any of these steps if the content of the respective request by shareholders clearly infringes the law and decent conduct.

3. If the company’s shares are listed on the stock exchange, by request of shareholders representing one 1/20 of the paid-up share capital, the Board shall, pursuant to article 27.3 of the Companies Act 2190/1920, as in force, provide shareholders at least 6 days prior to the date of the General Meeting draft resolutions on the items included in the initial or the revised agenda, provided the respective request has been submitted to the Board at least 7 days prior to the date of the General Meeting. The Board is under no obligation to take any of these steps if the content of the respective request by shareholders clearly infringes the law and decent conduct.

4. At the request of shareholders representing 1/20 of the paid-up share capital, the Chairman of the GM shall postpone, only once, decision-taking by the GM, whether an AGM or an EGM, for a new GM to be held on the date indicated in the shareholders’ request, but not later than 30 days as of the said postponement.

The GM held following such postponement, being a continuation of the previous GM, is not subject to publication requirements as regards the invitation to shareholders, and new shareholders may also participate therein subject to the provisions of articles 27.2, 28 and 28a of the Companies Act 2190/1920, as in force.

5.

6. At the request of a shareholder filed with the Bank at least 5 full days before the date of the GM, the Board shall provide the GM with any such specific information on the Bank’s business as may be requested, insofar as it serves for real assessment of items on the agenda. The Board may provide a single answer to shareholders’ requests that are of similar content. No such obligation to provide information applies in the event that the said information is already available on the company’s website, particularly

|

14

|

in the form of questions and answers. Moreover, at the request of shareholders representing 1/20 of the paid-up share capital, the Board shall inform the GM, provided it is an AGM, of the moneys paid by the Bank to each director or the managers of the Bank over the last two years, and of any benefits received by such persons from the Bank for whatever reason or under any agreement with the Bank. In all of these cases the Board is entitled to decline to provide the information requested, for good reasons, to be recorded in the minutes. Depending on the circumstances, one such good reason may be the requesting shareholders’ representation on the Board as per Article 18.3 or 18.6 of the Companies Act, as in force.

7.

8.

9.

|

|

in the form of questions and answers. Moreover, at the request of shareholders representing 1/20 of the paid-up share capital, the Board shall inform the GM, provided it is an AGM, of the moneys paid by the Bank to each director or the managers of the Bank over the last two years, and of any benefits received by such persons from the Bank for whatever reason or under any agreement with the Bank. In all of these cases the Board is entitled to decline to provide the information requested, for good reasons, to be recorded in the minutes. Depending on the circumstances, one such good reason may be the requesting shareholders’ representation on the Board as per Article 18.3 or 18.6 of the Companies Act, as in force.

7.

8.

9.

|

|

|

|

|

|

Article 33

1. The Bank’s annual financial statements shall be audited by at least one certified auditor in accordance with the provisions of the legal and regulatory framework regarding auditors and the statutory audit of annual and interim financial statements.

2.

3.

4.

5. Auditors’ appointment and discharge for whatever reason, along with their identification particulars, shall be subject to publication requirements as per the current legal and regulatory framework.

|

|

Article 33

1. The Bank’s annual financial statements shall be audited by at least one certified auditor in accordance with the provisions of the relevant legal and regulatory framework regarding auditors and the statutory audit of annual and interim financial statements.

2.

3.

4.

5. Auditors’ appointment and discharge for whatever reason, along with their identification particulars, shall be subject to publication requirements as per the current legal and regulatory framework.

|

|

|

|

|

|

Article 34

1.

2.

3. The auditors’ report shall include the prescriptions of the current legal and regulatory framework. (

4.

5. The auditors shall be liable to the Bank and any third party for any damage arising from a positive act or omission affected by the use of the audit report, in accordance with the current legal and regulatory framework. Such liability cannot be excluded or modified.

|

|

Article 34

1.

2.

3. The auditors’ report shall include the prescriptions of the current legal and regulatory framework.

|

15

|

6.

|

|

4.

5. The auditors shall be liable to the Bank and any third party for any damage arising from a positive act or omission affected by the use of the audit report, in accordance with the current legal and regulatory framework. Such liability cannot be excluded or modified.

6.

|

|

|

|

|

|

Article 35

1.

2. At the end of each financial year the Board shall close the accounts, preparing a detailed inventory of the corporate assets and the annual financial statements according to the provisions of the law; furthermore, it shall submit to the AGM such annual financial statements, annual report (along with any explanatory report) and the auditors’ report, in accordance with the current legal framework.

3. The Bank publishes the following in GE.MI.: a. the legally approved by the AGM annual financial statements, b. the management report and c. the opinion of the statutory auditor or audit firm, where required, within 20 days of their approval by the AGM. When a statutory auditor’s or audit firm’s opinion is required, in accordance with the provisions of Article 2 par. A subpar. A1, first indent of Law 4336/2015, the annual financial statements and the management report are published in the same form and content as the form and content used by the statutory auditor or audit firm in the preparation of the audit certificate. They are also accompanied by the full text of the audit report.

4.

5.

|

|

Article 35

1.

2. At the end of each financial year the Board shall close the accounts, preparing a detailed inventory of the corporate assets and the annual financial statements according to the provisions of the law; furthermore, it shall submit to the AGM such annual financial statements, annual report (along with any explanatory report) and the auditors’ report, in accordance with the current legal framework.

3. The Bank publishes the following in GE.MI.: a. the legally approved by the AGM annual financial statements, b. the management report and c. the opinion of the statutory auditor or audit firm, where required, within 20 days of their approval by the AGM. When a statutory auditor’s or audit firm’s opinion is required, in accordance with the provisions of Article 2 par. A subpar. A1, first indent of Law 4336/2015, the annual financial statements and the management report are published in the same form and content as the form and content used by the statutory auditor or audit firm in the preparation of the audit certificate. They are also accompanied by the full text of the audit report.

4.

5.

|

16

|

Article 37

1. The Bank shall be wound up:

(a) On termination of its duration as specified herein, unless the GM has decided to extend its duration, as provided for by par. 2 of Article 15 and par. 2 of Article 16 hereof;

(b) Following a GM resolution adopted pursuant to the provisions of Article 15 par. 2 and Article 16, par. 2 hereof;

(c) In the event that the Bank has been declared bankrupt;

(d) By court judgment as per Articles 48 and 48a of the Companies Act, as in force.

2. In the event of share capital loss as per Article 47 of the Companies Act, as in force, the Board shall convene a GM within six (6) months from the end of the financial year to decide on the Bank’s winding up or other action to be taken.

|

|

Article 37

1. The Bank shall be wound up:

(a) On termination of its duration as specified herein, unless the GM has decided to extend its duration, as provided for by par. 2 of Article 15 and par. 2 of Article 16 hereof;

(b) Following a GM resolution adopted pursuant to the provisions of Article 15 par. 2 and Article 16, par. 2 hereof;

(c) In the event that the Bank has been declared bankrupt;

(d) By court judgment as per Articles 48 and 48a of the Companies Act, as in force.

2. In the event of share capital loss as per Article 47 of the Companies Act, as in force, the Board shall convene a GM within six (6) months from the end of the financial year to decide on the Bank’s winding up or other action to be taken.

|

|

|

|

|

|

Article 38

1.

2. On assuming their duties, the liquidators appointed by the GM shall take an inventory of corporate assets and publish a balance sheet in the G.E.MI., with a copy to the appropriate supervisory authority; they shall also publish a balance sheet each year, as provided for under the current legal and regulatory framework.

3.

4.

5. The annual financial statements and the financial statements issued on completion of the liquidation shall be subject to GM approval. The results of the liquidation process shall be submitted to the GM annually, along with a report on any reasons preventing completion thereof. On completion of the liquidation process, the liquidators shall prepare the final financial statements, to be published pursuant to the current legal and regulatory framework, release to the shareholders contribution and share premium amounts paid, and distribute the balance of the liquidation proceeds thereto pro rata to each shareholder’s participation in the paid up share capital.

6. Should the liquidation process last for over a

|

|

Article 38

1.

2. On assuming their duties, the liquidators appointed by the GM shall take an inventory of corporate assets and publish a balance sheet in the G.E.MI., with a copy to the appropriate supervisory authority; they shall also publish a balance sheet each year, as provided for under the current legal and regulatory framework.

3.

4.

5. The annual financial statements and the financial statements issued on completion of the liquidation shall be subject to GM approval. The results of the liquidation process shall be submitted to the GM annually, along with a report on any reasons preventing completion thereof. On completion of the liquidation process, the liquidators shall prepare the final financial statements, to be published pursuant to the current legal and regulatory framework, release to the shareholders contribution and share premium amounts paid, and distribute the

|

17

|

5-year period, the liquidator shall convene a GM and submit to it for approval a plan for speeding up its completion. The plan shall include a report on the liquidation work performed so far, the reasons for the delay and proposed measures to speed up completion of the liquidation process. Proposed measures may include waiver of corporate rights, legal proceedings and petitions, should they be deemed inexpedient vis-à-vis expected benefits, or of uncertain outcome, or time consuming. The plan may also include settlement, renegotiation, terminating contracts or entering into new contracts. The GM resolution on such plan is subject to the quorum and majority provisions of Article 29.3, 29.4 and 31.2 of the Companies Act, as in force. Should the plan be approved, the liquidator shall complete administration of the liquidation process as provided for in the plan. Otherwise, the liquidator or shareholders representing 1/20 of the paid-up share capital may request the one-member court of the first instance of the place of the Bank’s registered office to approve the plan by filing with the said court a petition to that effect, to be heard by voluntary jurisdiction proceedings. The court may introduce adjustments to measures included in the plan, but not any new measures further to those included. The liquidator shall not be liable for the implementation of a plan approved as above.

7.

|

|

balance of the liquidation proceeds thereto pro rata to each shareholder’s participation in the paid up share capital.

6. Should the liquidation process last for over a 5-year period, the liquidator shall convene a GM and submit to it for approval a plan for speeding up its completion. The plan shall include a report on the liquidation work performed so far, the reasons for the delay and proposed measures to speed up completion of the liquidation process. Proposed measures may include waiver of corporate rights, legal proceedings and petitions, should they be deemed inexpedient vis-à-vis expected benefits, or of uncertain outcome, or time consuming. The plan may also include settlement, renegotiation, terminating contracts or entering into new contracts. The GM resolution on such plan is subject to the quorum and majority provisions of Article 29.3, 29.4 and 31.2 of the Companies Act, as in force. Should the plan be approved, the liquidator shall complete administration of the liquidation process as provided for in the plan. Otherwise, the liquidator or shareholders representing 1/20 of the paid-up share capital may request the one-member court of the first instance of the place of the Bank’s registered office to approve the plan by filing with the said court a petition to that effect, to be heard by voluntary jurisdiction proceedings. The court may introduce adjustments to measures included in the plan, but not any new measures further to those included. The liquidator shall not be liable for the implementation of a plan approved as above.

7.

|

|

|

|

CHAPTER SEVEN

TRANSITIONAL PROVISIONS

Article 39

Deleted

|

18

2.

(i) Increase in the share capital by EUR 0.90, due to capitalization of an equal part of the Bank’s special reserve of Article 4.4a of Codified Law 2190/1920, and concurrent (ii) increase in the nominal value of each common registered voting share of the Bank and reduction in the aggregate number of such shares by means of a reverse split. Amendment of Article 4 of the Banks Articles of Association. Granting of authorities.

|

Required quorum:

|

|

1/5 of total common(*) voting shares

|

|

|

|

|

|

Required majority:

|

|

50% of the total voting rights (present or represented by proxy) + 1 (present or represented by proxy)

|

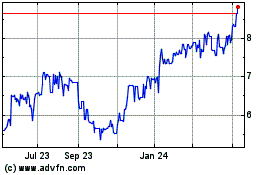

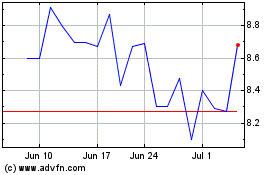

Due to the Bank’s share trading at low levels during the past years following the SCI in 2015 as well as during the current year (highest price €0.355, lowest price €0.257, closing on 16 July 2018 €0.26)

and following the publication of the positive results of Stress Test, the BoD is proposing applying a reverse split as a technical way to improve the market characteristics of the share price, by means of increasing the nominal value of each ordinary share with a corresponding decrease of the total number of the shares, thus making it more attractive to investors. The decrease of the total number of shares in issue will also result to an increase of earnings per share, therefore providing meaningful information to investors.

In addition to the above, the said intended corporate act shall result to proportionate adjustment of the market price of the Bank’s share in the Athens Exchange as well.

The intended corporate act is aligned with the Bank’s overall initiatives for its strategic and corporate transformation and aims at the enhancement of its shares and increase of investor interest.

Specifically with regard to the proposed increase in share capital under (i) hereinabove by means of capitalization of an equal part of the reserve, this move facilitates the formation of a integer (whole) number ratio (10:1) in replacing the pre-existing with the new nominal value.

To this end, it is proposed to the Annual General Meeting of Shareholders to concurrently (i) increase the share capital by EUR 0.90, due to capitalization of an equal part of the Bank’s special reserve of Article 4.4a of Codified Law 2190/1920, and (ii) increase the nominal value of each common registered voting share of the Bank from EUR 0.30 to EUR 3.00 and reduce the aggregate number of the Bank’s old common registered shares from 9,147,151,527 to 914,715,153 new common registered shares with voting rights by means of a reverse split at a rate of ten (10) old common shares of the Bank to one (1) new common share of the Bank.

Any fractions of shares arising from the reverse split and the reduction in the share capital, as above, shall be sold by the Bank as soon as possible, as per the applicable stock market legislation.

Accordingly, Article 4 of the Banks Articles of Association should be amended as follows:

1) Amendment to Article 4 par. 1 as follows:

“1. The Banks share capital amounts to EUR 2,744,145,459.00 and is divided into 914,715,153 ordinary shares of a nominal value of EUR 3.00 each.

2) Addition of the following point (lxiv) in paragraph 2 of Article 4:

19

“(lxiv) By resolution of the EGM of [26].

07.2018

it was decided to simultaneously (i) increase the share capital by EUR 0.90, due to capitalization of an equal part of the Bank’s special reserve of Article 4.4a of Codified Law 2190/1920, and (ii) increase the nominal value of each common registere

d voting share of the Bank from EUR 0.30 to EUR 3.00 and reduce the aggregate number of the Bank’s old common registered shares from

9,147,151,527 to 914,715,153

new common registered shares with voting rights by means of a reverse split at a rate of ten (10) old common shares of the Bank to one (1) new common share of the Bank.

Furthermore, it is recommended that the Chief Financial Officer and the Director of Finance Division of the Bank, acting jointly, are authorized to proceed with all the requisite actions, declarations, applications and submission of documents for the implementation of the resolutions hereinabove, the granting of any necessary approvals by the Bank of Greece, the Athens Exchange, and the Hellenic Ministry of Economy as well as any other related issue, with the capacity to further authorize and assign above powers to officers or lawyers of the Bank to the aforeme

ntioned objective.

20

3. Submission for approval of the Board of Directors Report on the Annual Financial Statements of the Bank and the Group for the financial year 2017 (1.1.2017 – 31.12.2017), and submission of the respective Auditors’ Report.

|

Required quorum:

|

|

1/5 of total common(*) voting shares

|

|

|

|

|

|

Required majority:

|

|

50% of the total voting rights (present or represented by proxy) + 1 (present or represented by proxy)

|

The Board of Directors (the Board) shall propose that the AGM approve the Board’s Report on the Parent Bank and Consolidated Financial Statements of NBG for 2017, as approved by the Board at its meeting of

28 March 2018, and also submits the Auditors’ Report for information purposes.

These reports can be viewed by

the shareholders on the Bank’s website at:

http://www.nbg.gr/el/the-group/investor-relations/financial-information/annual-interim-financial-statements/Documents/

21

4. Submission for approval of the Annual Financial Statements of the Bank and the Group for the financial year 2017 (1.1.2017

–

31.12.2017).

|

Required quorum:

|

|

1/5 of total common(*) voting shares

|

|

|

|

|

|

Required majority:

|

|

50% of the total voting rights (present or represented by proxy) + 1 (present or represented by proxy)

|

The Board shall propose that the AGM approve the Bank

’s and the Group’s Annual Financial Statements for the financial year 2017, including the comparative data for 2016. The Financial Statements of the Group and the Bank are comprised of the Statement of Financial Position, the Income Statement, the Statement of Comprehensive Income, the Statement of Changes in Equity, the Cash Flow Statement, and the Notes to the Financial Statements. The Financial Statements were approved by the Board on 28 March 2018 and can be viewed on the Bank’s website at:

http://www.nbg.gr/el/the-group/investor-relations/financial-information/annual-interim-financial-statements/Documents/

The Bank

’s website also includes a Press Release and a Presentation accompanying the announcement of the full-year results for 2017.

In brief, the Group’s results for 2017 were as follows:

In 2017 and 2016, the Bank reported profit of €9 million, while the Group in 2017 reported loss of €443 million compared to loss of €2,887 million in 2016. The improvement in 2017 for the Group is mainly due to decreased losses from discontinued operations of €249 million in relation to €2,884 million in 2016.

In more detail, in 2017, the Group’s losses after tax from continuing operations reached €163 million against gains of €24 million in 2016, mainly due to the decreased net interest income by €97 million, DTC fee charge of €17 million (2016: Nil) and the gain on disposal of the Astir Palace Vouliagmenis S.A. in 2016, offset by increased commission income of €63 million.

The key landmark events for 2017 were:

Completion of disposal of subsidiaries

In 2017 the Bank completed the disposal of the following subsidiaries:

Sale of Bulgarian operations

Sale of Serbian operations

Agreed disposals of subsidiaries

22

·

In addition to the completed disposals in 2017, on 2 February 2018, the Bank signed an agreement with American Bank of Investments S.A. (“ABI”) for the sale of Banka NBG Albania Sh.A. (“NBG Albania”). The disposal concluded on 3 July 2018.

23

5. Discharge of the members of the Board of Directors and the Auditors of the National Bank of Greece S.A., NBG Bancassurance S.A. (absorbed through merger) and NBG Training Center S.A. (absorbed through merger), from any liability for indemnity regarding the Annual Financial Statements and management for the year 2017 (1.1.2017

–

31.12.2017).

|

Required quorum:

|

|

1/5 of total common(*) voting shares

|

|

|

|

|

|

Required majority:

|

|

50% of the total voting rights (present or represented by proxy) + 1 (present or represented by proxy)

|

It is proposed that the members of the Board of Directors and Auditors of NBG be discharged from any liability for indemnity regarding the Annual Financial Statements and management for the year 2017. More specifically:

The Board of NBG:

Costas P. Michaelides, Panayotis (Takis) - Aristidis Thomopoulos, Leonidas Fragkiadakis, Dimitrios Dimopoulos, Paul Mylonas, Petros Sabatacakis, Claude Piret, Haris Makkas, Mike Aynsley, Marianne Økland, Spyros Lorentziadis, Eva Cederbalk, Stavros Koukos, Panagiota Iplixian, Panagiotis Leftheris

The Board of NBG Bancassurance S.A.:

Nelly Tzakou-Lambropoulou, Miltiadis Stathopoulos (replaced by Vassilios Skiadiotis on 7/9/2017), Dionysios Nodaros, Dimitrios Plessas, Aikaterini Doulmoussi, Ioannis Mavrikopoulos, Fotini Ioannou (replaced by Anastassios Sioutis on 7/9/2017), Georgios Angelides, Vassilios Skiadiotis (since 7/9/2017) and Anastassios Sioutis (since 7/9/2017).

The Board of NBG

Training Center S.A.:

Dimitrios Kouselas, Chrisoula Sgardeli, Georgios Armelinios, Petros Daskaleas, Dimitrios Tsikrikas.

Certified Auditors of NBG:

The audit firm “PriceWaterhouseCoopers (PwC)” and the regular auditor Mr Marios Psaltis.

Certified Auditors of NBG Bancassurance S.A.:

SOL AEOE Dimitrios Stavrou

Certified Auditors of NBG

Training Center S.A.:

No auditors have been elected, since NBG Training Center S.A. is considered small entity.

24

6. Election of regular and substitute Certified Auditors for the audit of the Financial Statements of the Bank and the Financial Statements of the Group for the financial year 2018, and determination of their remuneration.

|

Required quorum:

|

|

1/5 of total common(*) voting shares

|

|

|

|

|

|

Required majority:

|

|

50% of the total voting rights (present or represented by proxy) + 1 (present or represented by proxy)

|

For the audit of the Bank

’s and the Group’s Annual and Semi-annual Financial Statements for the financial year ending 31 December 2018, following proposal of the Audit Committee, the Board of Directors shall propose the appointment of PriceWaterhouseCoopers (PwC), which is responsible by law to appoint at least one regular and one substitute certified auditor, at its discretion.

Moreover, it is proposed that the AGM authorize the Board to determine the remuneration of the certified auditors, following proposal of the Audit Committee, in accordance with the law.

25

7. Election of a new Board of Directors and appointment of independent non-executive members.

|

Required quorum:

|

|

1/5 of total common(*) voting shares

|

|

|

|

|

|

Required majority:

|

|

50% of the total voting rights (present or represented by proxy) + 1 (present or represented by proxy)

|

Information regarding this item of the agenda shall be further published prior to the Annual General Meeting.

26

8. Approval of the remuneration of the Board of Directors of the Bank for the financial year 2017 (pursuant to Article 24.2 of Codified Law 2190/1920). Determination of the remuneration of the Chairman of the Board, the CEO, the Deputy CEOs and executive and non-executive Directors through to the AGM of 2019. Approval, for the financial year 2017, of the remuneration of the Bank’s Directors in their capacity as members of the Bank’s Audit, Corporate Governance & Nominations, Human Resources & Remuneration, Risk Management, and Strategy Committees, determination of their remuneration through to the AGM of 2019 and approval of contracts as per Article 23a of Codified Law 2190/1920.

|

Required quorum:

|

|

1/5 of total common(*) voting shares

|

|

|

|

|

|

Required majority:

|

|

50% of the total voting rights (present or represented by proxy) + 1 (present or represented by proxy)

|

Information regarding this item of the agenda shall be further published prior to the Annual General Meeting.

27