Current Report Filing (8-k)

July 19 2018 - 8:34AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 or 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of report (date of earliest event reported): July 16, 2018

HealthLynked

Corp.

(Exact Name of Registrant as Specified in its Charter)

|

Nevada

|

|

47-1634127

|

|

(State

of Incorporation)

|

|

(I.R.S.

Employer Identification No.)

|

|

|

|

|

|

1726

Medical Blvd., Suite 101, Naples, Florida

|

|

34110

|

|

(Address

of Principal Executive Offices)

|

|

(ZIP

Code)

|

(239)

513-1992

(Registrant’s

Telephone Number, Including Area Code)

N/A

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant

under any of the following provisions:

|

☐

|

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

☐

|

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

☐

|

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

☐

|

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item

1.01

|

Entry

Into A Material Definitive Agreement

|

|

Item

3.02

|

Unregistered

Sales of Equity Securities

|

On

July 16, 2018, HealthLynked Corp. (the “

Corporation

”) entered into a Securities Purchase Agreement (the “

Securities

Purchase Agreement

”) with certain accredited investors (the “

Investors

”) pursuant to which it sold

the following securities for aggregate gross proceeds of approximately $2,000,000 (the “

Private Placement

”):

(i) an aggregate of 3,900,000 shares of the Corporation’s common stock, par value $0.0001 per share (the “

Common

Stock

”), (ii) warrants to purchase up to an aggregate of 8,000,000 shares of Common Stock with an exercise price of

$0.25 per share, subject to anti-dilution adjustments, and a term of five years (the “

Series A Warrants

”),

(iii) warrants to purchase up to a maximum of 17,000,000 shares of Common Stock (of which, none are initially exercisable) for

a nominal exercise price based on the difference between the 8,000,000 shares of Common Stock and Pre-Funded Warrants issued pursuant

to the Securities Purchase Agreement based on a purchase price per share of $0.25, and the number of shares of Common Stock and

Pre-Funded Warrants that would have been issued pursuant to the Securities Purchase Agreement based on a reset purchase price

equal to the greater of (i) $0.08 per share and (ii) a 10% discount to the market price of the Common Stock at and around the

time when the Registration Statement (as defined below) is declared effective by the U.S. Securities and Exchange Commission (the

“SEC”) (and, if certain conditions are not satisfied, at other specified times) (the “

Series B Warrants

”),

and (iv) pre-funded warrants to purchase an aggregate of 4,100,000 shares of Common Stock (the “

Pre-Funded Warrants

”

and, together with the Series A Warrants and Series B Warrants, the “

Warrants

”). The Common Stock and the Warrants

are herein referred to as the “

Securities

.” On July 17, 2018 (the “

Closing Date

”), the Corporation

and the Investors consummated the transactions contemplated by the Securities Purchase Agreement.

In

connection with the Securities Purchase Agreement, the Corporation also entered into a Registration Rights Agreement with the

Investors (the “

Registration Rights Agreement

”), pursuant to which the Corporation is required to file a Registration

Statement on Form S-1 (a “

Registration Statement

”) covering the resale of the Securities with thirty (30) days

of the Closing Date. The Corporation is further required to use its best efforts to have the Registration Statement declared effective

by the SEC as soon as practicable, but in no event later than the earlier of: (x) (i) in the event that the Registration Statement

is not subject to a full review by the SEC, ninety (90) calendar days after the Closing Date or (ii) in the event that the Registration

Statement is subject to a full review by the SEC, one hundred twenty (120) calendar days after the Closing Date; and (y) the fifth

(5

th

) Business Day (as such term is defined in the Registration Rights Agreement) after the date the Corporation is

notified (orally or in writing, whichever is earlier) by the SEC that such Registration Statement will not be reviewed or will

not be subject to further review. If the Corporation fails to (i) file the Registration Statement when required, (ii) have the

Registration Statement declared effective when required or (iii) maintain the effectiveness of the Registration Statement, the

Corporation will be required to pay certain liquidated damages to the Investors.

In

connection with the Private Placement, the Corporation entered into a Placement Agency Agreement with ThinkEquity, a division

of Fordham Financial Management, Inc. (the “

Placement Agent

”), pursuant to which the Corporation paid a cash

fee of $160,000 to the Placement Agent and agreed to issue to certain designees of the Placement Agent two (2) series of warrants

to purchase, in the aggregate, shares of Common Stock equal to 8.0% of the aggregate number of: (i) shares sold to the Investors,

(ii) shares underlying the Pre-Funded Warrants, and (iii) shares which ultimately become issuable upon exercise of the Series

B Warrants, if any.

The

Securities discussed herein have not been registered under the Securities Act of 1933, as amended (the “

Securities Act

”),

or the securities laws of any state, and were offered and issued in reliance on the exemption from registration under the Securities

Act afforded by Section 4(a)(2) thereof and Rule 506 of Regulation D promulgated thereunder.

Simultaneously with the execution of the

Securities Purchase Agreement, the Corporation and Naples Women’s Center LLC, one of the Corporation’s subsidiaries,

each entered into agreements (the “

Note Amendments

”) with a related party to amend the terms of each of the

notes issued to such related party such that no payments will be, or required to be, made under any of those notes prior to December

31, 2019.

The

foregoing descriptions of the Securities Purchase Agreement, the Registration Rights Agreement, the Warrants and the Note Amendments

do not purport to be complete and are qualified in their entirety by reference to the full text of the Securities Purchase Agreement,

the Registration Rights Agreement, and the Warrants, which are attached as Exhibits to this Current Report on Form 8-K, and are

incorporated herein by reference.

|

Item

7.01

|

Regulation

FD Disclosure

|

On

July 19, 2018, the Corporation issued a press release announcing the Private Placement.

A

copy of the press release is filed as Exhibit 99.1 to, and incorporated by reference in, this Current Report on Form 8-K. The

information in this Current Report on Form 8-K is being furnished and shall not be deemed “filed” for the purposes

of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The

information in this Current Report on Form 8-K shall not be incorporated by reference into any registration statement or other

document pursuant to the Securities Act, except as shall be expressly set forth by specific reference in any such filing.

|

Item

9.01.

|

Financial

Statements and Exhibits.

|

(d)

Exhibits

.

|

Exhibit

No.

|

|

Description

|

|

|

|

|

|

10.1

|

|

Securities Purchase Agreement, dated July 16, 2018, by and among HealthLynked Corp. and the Buyers listed therein

|

|

10.2

|

|

Registration Rights Agreement, dated July 16, 2018, by and among HealthLynked Corp. and the Buyers listed therein

|

|

10.3

|

|

Form of Series A Warrant

|

|

10.4

|

|

Form of Series B Warrant

|

|

10.5

|

|

Form of Pre-Funded Warrants

|

|

10.6

|

|

Amendment

to Notes, dated July 16, 2018

|

|

10.7

|

|

Amendment to Note, dated July 16, 2018

|

|

99.1

|

|

Press Release, dated July 19, 2018

|

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

HealthLynked

Corp.

|

|

|

|

|

|

Dated:

July 19, 2018

|

By:

|

/s/

George O’Leary

|

|

|

|

George

O’Leary

|

|

|

|

Chief

Financial Officer

|

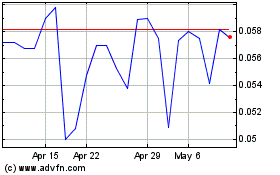

HealthLynked (QB) (USOTC:HLYK)

Historical Stock Chart

From Mar 2024 to Apr 2024

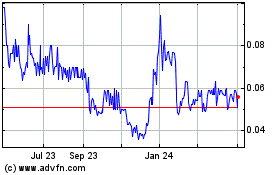

HealthLynked (QB) (USOTC:HLYK)

Historical Stock Chart

From Apr 2023 to Apr 2024