Securities Registration (foreign Private Issuer) (f-1/a)

July 18 2018 - 1:58PM

Edgar (US Regulatory)

As filed with the Securities

and Exchange Commission on July 18, 2018

Registration No. 333-225610

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

AMENDMENT NO.

3

TO

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES

ACT OF 1933

Medigus

Ltd.

(Exact Name of

Registrant as Specified in its Charter)

|

State

of Israel

|

|

3841

|

|

Not

Applicable

|

|

(State or Other Jurisdiction

of

Incorporation or Organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification No.)

|

Oded Yatzkan

7A Industrial

Park, P.O. Box 3030

Omer, 8496500,

Israel

Tel: +972-72-260-2200

Fax: +972-72-260-2237

(Address, including

zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Medigus USA LLC

140 Town &

Country Dr., Suite C

Danville, CA 94526,

USA

Tel: +1 925-217-4677

(Name, address,

including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

Shachar Hadar

Meitar Liquornik Geva

Leshem Tal

16 Abba Hillel Silver Rd.

Ramat Gan 52506, Israel

Tel: +972-3-610-3100

|

|

Oded Har-Even,

Esq.

Robert V. Condon, III, Esq.

Zysman, Aharoni, Gayer and

Sullivan & Worcester LLP

1633 Broadway

New York, NY 10019

Tel: 212-660-5000

|

|

Gary Emmanuel,

Esq.

McDermott Will &

Emery LLP

340 Madison Ave.

New York, NY 10173

Tel: 212-547-5400

|

|

Zvi Gabbay

Barnea & Co.

Electra City Tower

58 HaRakevet St.

Tel Aviv 6777016, Israel

Tel: +972-3-640-0600

|

Approximate date of commencement of proposed

sale to the public:

As soon as practicable after effectiveness of this registration statement.

If any of the securities being registered

on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the

following box. ☒

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment

filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares

its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended

transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B)

of the Securities Act. ☐

The registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment

which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of

the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission acting pursuant

to said Section 8(a), may determine.

EXPLANATORY NOTE

This Amendment No. 3 to Form F-1 Registration

Statement (No. 333-225610) is filed solely to file Exhibits 5.1, 5.2, 23.2 and 23.3, and to reflect such filings in the Index to

Exhibits. No change is made to the preliminary prospectus constituting Part I of the Registration Statement or Items 6, 7,

or 9 of Part II of the Registration Statement.

Part

II

Information

Not Required in Prospectus

Item 6. Indemnification of Office Holders

(including Directors).

Under the Companies Law, a company may

not exculpate an office holder from liability for a breach of a fiduciary duty. An Israeli company may exculpate an office holder

in advance from liability to the company, in whole or in part, for damages caused to the company as a result of a breach of duty

of care but only if a provision authorizing such exculpation is included in its articles of association. Our articles of association

include such a provision. The company may not exculpate in advance a director from liability arising out of a prohibited dividend

or distribution to shareholders.

Under the Companies Law and the Securities

Law, 5738-1968 (the “Securities Law”) a company may indemnify an office holder in respect of the following liabilities,

payments and expenses incurred for acts performed by him or her as an office holder, either in advance of an event or following

an event, provided its articles of association include a provision authorizing such indemnification:

|

|

●

|

a monetary liability incurred by or imposed

on the office holder in favor of another person pursuant to a court judgment, including pursuant to a settlement confirmed

as judgment or arbitrator’s decision approved by a competent court. However, if an undertaking to indemnify an office

holder with respect to such liability is provided in advance, then such an undertaking must be limited to events which, in

the opinion of the board of directors, can be foreseen based on the company’s activities when the undertaking to indemnify

is given, and to an amount or according to criteria determined by the board of directors as reasonable under the circumstances,

and such undertaking shall detail the abovementioned foreseen events and amount or criteria;

|

|

|

●

|

reasonable litigation expenses, including reasonable

attorneys’ fees, which were incurred by the office holder as a result of an investigation or proceeding filed against

the office holder by an authority authorized to conduct such investigation or proceeding, provided that such investigation

or proceeding was either (i) concluded without the filing of an indictment against such office holder and without the imposition

on him of any monetary obligation in lieu of a criminal proceeding; (ii) concluded without the filing of an indictment against

the office holder but with the imposition of a monetary obligation on the office holder in lieu of criminal proceedings for

an offense that does not require proof of criminal intent; or (iii) in connection with a monetary sanction;

|

|

|

●

|

reasonable litigation expenses, including attorneys’

fees, incurred by the office holder or which were imposed on the office holder by a court (i) in a proceeding instituted against

him or her by the company, on its behalf, or by a third party, (ii) in connection with criminal indictment of which the office

holder was acquitted, or (iii) in a criminal indictment which the office holder was convicted of an offense that does not

require proof of criminal intent;

|

|

|

●

|

a monetary liability imposed on the office holder

in favor of a payment for a breach offended at an Administrative Procedure (as defined below) as set forth in Section 52(54)(a)(1)(a)

to the Securities Law;

|

|

|

●

|

expenses expended by the office holder with

respect to an Administrative Procedure under the Securities Law, including reasonable litigation expenses and reasonable attorneys’

fees; and

|

|

|

●

|

any other obligation or expense in respect of

which it is permitted or will be permitted under applicable law to indemnify an office holder, including, without limitation,

matters referenced in Section 56H(b)(1) of the Securities Law.

|

An “Administrative Procedure”

is defined as a procedure pursuant to chapters H3 (Monetary Sanction by the Israeli Securities Authority), H4 (Administrative

Enforcement Procedures of the Administrative Enforcement Committee) or I1 (Arrangement to prevent Procedures or Interruption of

procedures subject to conditions) to the

Under the Companies Law and the Securities

Law, a company may insure an office holder against the following liabilities incurred for acts performed by him or her as an office

holder if and to the extent provided in the company’s articles of association:

|

|

●

|

a breach of a fiduciary duty to the company,

provided that the office holder acted in good faith and had a reasonable basis to believe that the act would not harm the

company;

|

|

|

●

|

a breach of duty of care to the company or to

a third party, to the extent such a breach arises out of the negligent conduct of the office holder;

|

|

|

●

|

a monetary liability imposed on the office holder

in favor of a third party;

|

|

|

●

|

a monetary liability imposed on the office holder

in favor of an injured party at an Administrative Procedure pursuant to Section 52(54)(a)(1)(a) of the Securities Law; and

|

|

|

●

|

expenses incurred by an office holder in connection

with an Administrative Procedure, including reasonable litigation expenses and reasonable attorneys’ fees.

|

Under the Companies Law, a company may

not indemnify, exculpate or insure an office holder against any of the following:

|

|

●

|

a breach of fiduciary duty, except for indemnification

and insurance for a breach of the fiduciary duty to the company to the extent that the office holder acted in good faith and

had a reasonable basis to believe that the act would not prejudice the company;

|

|

|

●

|

a breach of duty of care committed intentionally

or recklessly, excluding a breach arising out of the negligent conduct of the office holder;

|

|

|

●

|

an act or omission committed with intent to

derive illegal personal benefit; or

|

|

|

●

|

a civil or administrative fine or forfeit levied

against the office holder.

|

Under the Companies Law, exculpation, indemnification

and insurance of office holders must be approved by the compensation committee and the board of directors and, with respect to

directors or controlling shareholders, their relatives and third parties in which such controlling shareholders have a personal

interest, also by the shareholders.

Our articles of association permit us to

exculpate, indemnify and insure our office holders to the fullest extent permitted or to be permitted by law. Our office holders

are currently covered by a directors’ and officers’ liability insurance policy. As of the date of this registration

statement on Form F-1, no claims for directors’ and officers’ liability insurance have been filed under this policy

and we are not aware of any pending or threatened litigation or proceeding involving any of our office holders, including our

directors, in which indemnification is sought.

We have entered into agreements with each

of our current director and officers exculpating them from a breach of their duty of care to us to the fullest extent permitted

by law, subject to limited exceptions, and undertaking to indemnify them to the fullest extent permitted by law, to the extent

that these liabilities are not covered by insurance. This indemnification is limited, with respect to any monetary liability imposed

in favor of a third party, to events determined as foreseeable by the board of directors based on our activities. The maximum

aggregate amount of indemnification that we may pay to our directors and officers based on such indemnification agreement is equal

to 25% of our shareholders’ equity pursuant to our latest audited or unaudited consolidated financial statements, as applicable,

as of the date of the indemnification payment. Such indemnification amounts are in addition to any insurance amounts. Each director

or officer who agrees to receive this letter of indemnification also gives his approval to the termination of all previous letters

of indemnification that we have provided to him or her in the past, if any. However, in the opinion of the SEC, indemnification

of office holders for liabilities arising under the Securities Act is against public policy and therefore unenforceable.

Item 7. Recent Sales of Unregistered

Securities.

Set forth below are the sales of all securities

by the Company during the three years preceding this offering, which were not registered under the Securities Act.

In November 2017, we issued investors warrants

to purchase up to a total of 101,250

ADSs representing 2,025,000 ordinary shares at an exercise

price of $9.00 per ADS.

In November 2017, we issued H.C. Wainwright &

Co. warrants to purchase up to a total of 14,175

ADSs representing 283,500 ordinary shares

at an exercise price of $10.00 per ADS as part of the consideration for its services as placement agent.

In December 2016, we issued investors warrants

to purchase of 9,968

ADSs representing 199,360 ordinary shares at an exercise price of $36.00

per ADS.

In December 2016, we issued Rodman &

Renshaw a unit of H.C. Wainwright & Co. warrants to purchase up to a total of

997 ADSs

representing 19,940 ordinary shares at an exercise price of $29.48 per ADS as part of the consideration for its services as placement

agent.

In December 2016, we issued Roth Capital

Partners and Maxim Group LLC warrants to purchase up to a total of 498

ADSs representing

9,965 ordinary shares at an exercise price of $36.00 per ADS as part of a “tail” fee consideration for its services

as placement agent.

In

September 2016, we issued to Roth Capital Partners and Maxim Group LLC warrants purchase up to 989 ADSs representing 19,780 ordinary

share at an exercise price of $57.50 per ADS as part of the consideration for its services as placement agent.

In July 2015, pursuant to a public offering

under our shelf prospectus in Israel, we raised approximately NIS 26.8 million (gross) (approximately $7 million) through the

issuance of a total of 705,250 of our ordinary shares at a price of NIS 38.00 per share and warrants exercisable into additional

352,625 of our ordinary shares. The warrants expired on July 8, 2018.

The foregoing issuances

of warrants to purchase ADSs in 2016 and 2017 were offered pursuant to Rule 506 of Regulation D and Section 4(a)(2) of the Securities

Act.

The foregoing issuances in 2015 were all

made outside of the United States pursuant to Regulation S or to U.S. entities pursuant to Section 4(a)(2) of the Securities Act.

The foregoing issuances were (i) adjusted

retroactively to reflect the 10:1 reverse share split effected on July 15, 2018 and the change in the ratio of ordinary shares

per ADS to twenty deposited ordinary shares per ADS effected on July 16, 2018, (ii) adjusted retroactively to reflect the

change

in the ratio of ordinary shares per ADS from five deposited ordinary shares per ADS to 50 deposited ordinary shares per ADS effected

on March 15, 2017

,

and (iii) adjusted

retroactively to reflect

the

10:1 reverse share split and the change in the ratio of ordinary shares per ADS to five deposited ordinary shares per ADS effected

on November 6, 2015

.

Item 8. Exhibits and Financial Statement Schedules.

|

|

(a)

|

The Exhibit Index is hereby incorporated herein

by reference.

|

|

|

|

|

|

|

(b)

|

Financial Statement Schedules.

|

All Financial Statement Schedules have

been omitted because either they are not required, are not applicable or the information required therein is otherwise set forth

in the Registrant’s consolidated financial statements and related notes thereto.

Item 9. Undertakings.

|

|

(a)

|

The undersigned Registrant hereby undertakes:

|

|

|

(1)

|

To file, during any period in which offers or

sales are being made, a post-effective amendment to this registration statement:

|

|

|

i.

|

To include any prospectus required by section

10(a)(3) of the Securities Act of 1933;

|

|

|

ii.

|

To reflect in the prospectus any facts or events

arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which,

individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement.

Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering

range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the

changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation

of Registration Fee” table in the effective registration statement;

|

|

|

iii.

|

To include any material information with respect

to the plan of distribution not previously disclosed in the registration statement or any material change to such information

in the registration statement.

|

|

|

(2)

|

That, for the purpose of determining any liability

under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating

to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona

fide offering thereof.

|

|

|

(3)

|

To remove from registration by means of a post-effective

amendment any of the securities being registered which remain unsold at the termination of the offering.

|

|

|

(4)

|

To file a post-effective amendment to the registration

statement to include any financial statements required by Item 8.A. of Form 20-F at the start of any delayed offering or throughout

a continuous offering. Financial statements and information otherwise required by Section 10(a)(3) of the Act need not be

furnished, provided that the registrant includes in the prospectus, by means of a post-effective amendment, financial statements

required pursuant to this paragraph (a)(4) and other information necessary to ensure that all other information in the prospectus

is at least as current as the date of those financial statements. Notwithstanding the foregoing, with respect to registration

statements on Form F-3, a post-effective amendment need not be filed to include financial statements and information required

by Section 10(a)(3) of the Act or Rule 3-19 of this chapter if such financial statements and information are contained in

periodic reports filed with or furnished to the Commission by the registrant pursuant to section 13 or section 15(d) of the

Securities Exchange Act of 1934 that are incorporated by reference in the Form F-3.

|

|

|

(5)

|

That, for the purpose of determining liability

under the Securities Act of 1933 to any purchaser:

|

|

|

i.

|

If the registrant is relying on Rule 430B:

|

|

|

A.

|

Each prospectus filed by the registrant pursuant

to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed

part of and included in the registration statement; and

|

|

|

B.

|

Each prospectus required to be filed pursuant

to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering

made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of

the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the

date such form of prospectus is first used after effectiveness of the date of the first contract or sale of securities in

the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that

is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating

to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that

time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration

statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated

by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser

with a time of contract sale prior to such effective date, supersede or modify any statement that was made in the registration

statement or prospectus that was part of the registration statement or made in any such document immediately prior to such

effective date; or

|

|

|

ii.

|

If the registrant is subject to Rule 430C, each

prospectus filed pursuant to Rule 424(b) as part of a registration statement relating to an offering, other than registration

statements relying on Rule 430B or other prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included

in the registration statement as of the date it is first used after effectiveness. Provided, however, that no statement made

in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or

deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement

will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was

made in the registration statement or prospectus that was part of the registration statement or made in any such document

immediately prior to such date of first use.

|

|

|

(6)

|

That, for the purpose of determining liability

of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities, the undersigned

registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration

statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered

or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to

the purchaser and will be considered to offer or sell securities to such purchaser:

|

|

|

i.

|

Any preliminary prospectus or prospectus of

the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

|

|

|

|

|

|

|

ii.

|

Any free writing prospectus relating to the

offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

|

|

|

|

|

|

|

iii.

|

The portion of any other free writing prospectus

relating to the offering containing material information about the undersigned registrant or its securities provided by or

on behalf of the undersigned registrant; and

|

|

|

|

|

|

|

iv.

|

Any other communication that is an offer in

the offering made by the undersigned registrant to the purchaser.

|

|

|

(b)

|

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers

and controlling persons of the registrant pursuant to the provisions described in Item 6 hereof, or otherwise, the registrant

has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Act and

is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment

by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful

defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with

the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by

controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against

public policy as expressed in the Act and will be governed by the final adjudication of such issue.

|

|

|

(c)

|

The undersigned registrant hereby undertakes that:

|

|

|

(1)

|

That for purposes of determining any liability under the Securities Act of 1933, the information omitted from the form

of prospectus filed as part of this registration statement in reliance upon Rule 430A and contained in a form of prospectus

filed by the registrant pursuant to Rule 424(b)(1) or (4), or 497(h) under the Securities Act shall be deemed to be part

of this registration statement as of the time it was declared effective.

|

|

|

(2)

|

That for the purpose of determining any liability under the Securities Act of 1933, each post-effective amendment that

contains a form of prospectus shall be deemed to be a new registration statement relating to the securities offered therein,

and the offering of such securities at that time shall be deemed to be the initial

bona fide

offering thereof.

|

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing

on Form F-1 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized,

in the City of Omer, State of Israel on July 18, 2018.

|

|

Medigus Ltd.

|

|

|

|

|

|

By:

|

/s/

Christopher Rowland

|

|

|

Name:

|

Christopher Rowland

|

|

|

Title:

|

Chief Executive Officer

|

Pursuant to the requirements of the Securities

Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

|

Signatures

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

/s/

Christopher Rowland

|

|

Chief Executive Officer and Director

|

|

July 18, 2018

|

|

Christopher Rowland

|

|

|

|

|

|

|

|

|

|

|

|

/s/

Oded Yatzkan

|

|

Chief Financial Officer

|

|

July 18, 2018

|

|

Oded Yatzkan

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Chairman of the Board of Directors

|

|

July 18, 2018

|

|

Doron Birger

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

July 18, 2018

|

|

Eitan Machover

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

July 18, 2018

|

|

Efrat Venkert

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

July 18, 2018

|

|

Yuval Yanai

|

|

|

|

|

|

*

|

/s/

Christopher Rowland

|

|

|

|

Christopher Rowland

|

|

|

|

Attorney-in-fact

|

|

Signature

of authorized representative in the United States

Pursuant to the requirements of the Securities

Act of 1933, as amended, the Registrant’s duly authorized representative has signed this registration statement on Form

F-1 in on this 18th day of July 2018.

|

|

Medigus USA LLC

|

|

|

|

|

|

By:

|

/s/

Christopher Rowland

|

|

|

Name:

|

Christopher Rowland

|

|

|

Title:

|

Chief Executive Officer

|

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

|

1.1

|

|

Form

of Underwriting Agreement

(9)

|

|

3.1

|

|

Articles

of Association of Medigus Ltd., as amended

(9)

|

|

4.1

|

|

Form

of Warrant Agent Agreement between Medigus Ltd. and Computershare Inc., as warrant agent, including the Form of Series C Warrant

(9)

|

|

4.2

|

|

Form

of Pre-Funded Warrant

(9)

|

|

4.3

|

|

Form

of Underwriter Warrant

(9)

|

|

4.4

|

|

Form

of Series A Warrant to purchase Ordinary Shares Represented by American Depositary Shares issued in connection with the March

2017 Securities Purchase Agreement

(6)

|

|

4.5

|

|

Form

of Placement Agent Warrant to purchase Ordinary Shares Represented by American Depositary Shares issued in connection with

the March 2017 Securities Purchase Agreement

(6)

|

|

4.6

|

|

Form

of Deposit Agreement between Medigus Ltd., The Bank of New York Mellon as Depositary, and owners and holders from time to

time of ADSs issued thereunder, including the Form of American Depositary Shares

(2)

|

|

5.1

|

|

Form

of Opinion of Meitar Liquornik Geva Leshem Tal, Israeli counsel to the Registrant, as to the validity of the ordinary shares

(1)

|

|

5.2

|

|

Form

of Opinion of Zysman, Aharoni, Gayer and Sullivan & Worcester, LLP, U.S. counsel to the Registrant, as to the validity

of the warrants and units

(1)

|

|

10.1

|

|

Form

of Deposit Agreement between Medigus Ltd., The Bank of New York Mellon as Depositary, and owners and holders from time to

time of ADSs issued thereunder, including the Form of American Depositary Shares.

(2)

|

|

10.2

|

|

2013

Share Option and Incentive Plan

(2)

|

|

10.3

|

|

Series

A Option Plan

(2)

∞

|

|

10.4

|

|

Series

B Option Plan

(2)

∞

|

|

10.5

|

|

Compensation

Policy of Medigus Ltd.

(3)

|

|

10.6

|

|

Summary

of Lease Agreement between Medigus Ltd. and Tefen Yazamut Ltd. regarding main offices in Omer Industrial Park dated January

6, 2004, as amended.

(8) ∞

|

|

10.7

|

|

Form

of Indemnification and Exculpation Undertaking

(2)

|

|

10.8

|

|

Securities

Purchase Agreement by and between the Registrant and the purchasers named therein, dated September 8, 2016

(4)

|

|

10.9

|

|

Securities

Purchase Agreement by and between the Registrant and the purchasers named therein, dated November 30, 2016.

(5)

|

|

10.10

|

|

Form

of Warrant to purchase Ordinary Shares Represented by American Depositary Shares issued in connection with the November 2016

Securities Purchase Agreements

(6)

|

|

10.11

|

|

Securities

Purchase Agreement by and between the Registrant and the purchasers named therein, dated March 24, 2017.

(6)

|

|

10.12

|

|

Securities

Purchase Agreement by and between the Registrant and the purchasers in the registered direct offering dated November 24, 2017.

(7)

|

|

10.13

|

|

Form

of Warrant to purchase Ordinary Shares Represented by American Depositary Shares issued in connection with the November 24,

2017, Securities Purchase Agreement.

(7)

|

|

21.1

|

|

List

of Subsidiaries

(2)

|

|

23.1

|

|

Consent of Kesselman and Kesselman, Member Firm of PricewaterhouseCoopers International Limited

(9)

|

|

23.2

|

|

Consent

of Meitar Liquornik Geva Leshem Tal, Israeli counsel to the Registrant (included in Exhibit 5.1)

(1)

|

|

23.3

|

|

Consent

of Zysman, Aharoni, Gayer and Sullivan & Worcester, LLP, U.S. counsel to the Registrant (included in Exhibit 5.2)

(1)

|

|

24.1

|

|

Power of Attorney (included

in the signature page of the Registration Statement)

(9)

|

|

(1)

|

Filed herewith.

|

|

(2)

|

Previously filed with the Securities and Exchange

Commission on May 7, 2015, as an exhibit to the Registrant’s annual report on Form 20-F (File No 001-37381) and

incorporated by reference herein.

|

|

(3)

|

Previously filed with the Securities and Exchange

Commission on March 30, 2016, as an exhibit to the Registrant’s annual report on Form 20-F (File No 001-37381)

and incorporated by reference herein.

|

|

(4)

|

Previously filed with the Securities and Exchange

Commission on September 8, 2016, as exhibit to the Registrant’s report on Form 6-K (File No 001-37381) and incorporated

by reference herein.

|

|

(5)

|

Previously filed with the Securities and Exchange

Commission on December 1, 2016, as exhibit to the Registrant’s report on Form 6-K (File No 001-37381) and incorporated

by reference herein.

|

|

(6)

|

Previously filed with the Securities and Exchange

Commission on March 23, 2017, as an exhibit to the Registrant’s registration statement on Form F-1 (File 333-216155)

and incorporated by reference herein.

|

|

(7)

|

Previously filed with the Securities and Exchange

Commission on November 24, 2017, as an exhibit to the Registrant’s report on Form 6-K (File No 001-37381) and incorporated

by reference herein.

|

|

(8)

|

Previously filed with the Securities and Exchange

Commission on March 22, 2018, as an exhibit to the Registrant’s annual report on Form 20-F (File No 001-37381) and incorporated

by reference herein.

|

|

(9)

|

Previously filed.

|

|

∞

|

English translation of original Hebrew document.

|

8

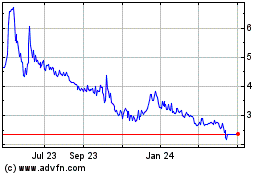

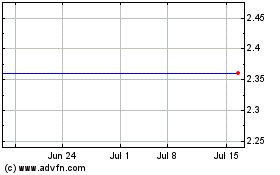

Medigus (NASDAQ:MDGS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Medigus (NASDAQ:MDGS)

Historical Stock Chart

From Apr 2023 to Apr 2024