Current Report Filing (8-k)

July 17 2018 - 4:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): July 12, 2018

DASAN ZHONE SOLUTIONS, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

000-32743

|

|

22-3509099

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File No.)

|

|

(I.R.S. Employer

Identification No.)

|

7195 Oakport Street

Oakland, California 94621

(Address of Principal Executive Offices, Including Zip Code)

(510) 777-7000

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

Emerging growth company

¨

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

|

|

|

|

|

|

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

Amended and Restated Credit Agreements

On July 12, 2018, DASAN Zhone Solutions, Inc., a Delaware corporation (the “

Company

”), ZTI Merger Subsidiary III, Inc. and certain subsidiaries of the Company entered into that certain Amended and Restated Credit and Security Agreement (the “

A&R Domestic Credit Agreement

”) and that certain Amended and Restated Credit and Security Agreement (Ex-Im Subfacility) (the “

A&R Ex-Im Credit Agreement

” and, together with the A&R Domestic Credit Agreement, the “

A&R Credit Agreements

”) with Wells Fargo Bank, National Association (“

WFB

”), which amended and replaced the Company’s existing senior secured revolving line of credit and letter of credit facilities with WFB. The A&R Credit Agreements provide for a revolving line of credit of $25.0 million (including up to $5.0 million of letters of credit), with the amount that the Company is able to borrow based on eligible accounts receivable and inventory, as defined in the WFB Facility, less the amount committed as security for letters of credit. To maintain availability of funds under the A&R Credit Agreements, the Company pays a commitment fee of 0.25% per annum on the unused portion. Borrowings under the A&R Credit Agreements bear interest at a floating rate equal to three-month LIBOR plus a margin that is based on the Company's average excess availability (as calculated under the A&R Credit Agreements). The maturity date under the A&R Credit Agreements is July 12, 2021.

The Company’s obligations under the A&R Credit Agreements are secured by substantially all of its personal property assets and those of its subsidiaries that guarantee the A&R Credit Agreements, including their intellectual property. The A&R Credit Agreements contain certain financial covenants, and customary affirmative covenants and negative covenants that restrict, among other things, the ability of the Company and its domestic subsidiaries to incur indebtedness, grant liens, sell assets, make investments and acquisitions, pay dividends and make certain other restricted payments. The A&R Credit Agreements also contain customary events of default. Upon the occurrence and during the continuance of an event of default, WFB may be entitled to, among other things, require the immediate repayment of all outstanding amounts under the A&R Credit Agreements, terminate commitments to make any additional advances thereunder and sell the assets of the Company and its subsidiary guarantors to satisfy the obligations under the A&R Credit Agreements.

WFB and its affiliates have performed, and may in the future perform, for the Company and its affiliates various commercial banking, investment banking, financial advisory or other services for which they have received and/or may in the future receive customary compensation and expense reimbursement.

The foregoing description of the A&R Credit Agreements does not purport to be complete and is qualified in its entirety by reference to the full text of the A&R Credit Agreement and A&R Ex-Im Credit Agreement, which are filed as Exhibit 10.1 and Exhibit 10.2 hereto, respectively, and incorporated herein by reference.

|

|

|

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information set forth in Item 1.01 above is incorporated herein by reference.

|

|

|

|

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

|

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

10.1

|

|

Amended and Restated Credit and Security Agreement, dated as of July 12, 2018, by and among DASAN Zhone Solutions, Inc., ZTI Merger Subsidiary III, Inc., Premisys Communications, Inc., Zhone Technologies International, Inc., Paradyne Networks, Inc., Paradyne Corporation, DASAN Network Solutions, Inc. and Wells Fargo Bank, National Association

|

|

10.2

|

|

Amended and Restated Credit and Security Agreement (Ex-Im Subfacility), dated as of July 12, 2018, by and among DASAN Zhone Solutions, Inc., ZTI Merger Subsidiary III, Inc., Premisys Communications, Inc., Zhone Technologies International, Inc., Paradyne Networks, Inc., Paradyne Corporation, DASAN Network Solutions, Inc. and Wells Fargo Bank, National Association

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: July 17, 2018

|

|

DASAN Zhone Solutions, Inc.

|

|

|

|

|

|

|

|

By:

|

|

/s/ MICHAEL GOLOMB

|

|

|

|

|

|

Michael Golomb

|

|

|

|

|

|

Chief Financial Officer, Corporate Treasurer and Secretary

|

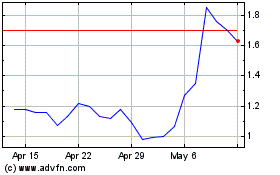

DZS (NASDAQ:DZSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

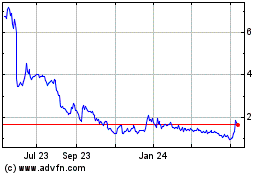

DZS (NASDAQ:DZSI)

Historical Stock Chart

From Apr 2023 to Apr 2024