UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) OR 13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

COMSTOCK

RESOURCES, INC.

(Name of Subject Company (Issuer) and Filing Person (Offeror))

7

3

/

4

% CONVERTIBLE SECURED PIK

NOTES DUE 2019 (CUSIP NO. 205768 AM6)

AND

9

1

/

2

% CONVERTIBLE SECURED PIK

NOTES DUE 2020 (CUSIP NO. 205768 AN4)

(Title of Class of Securities)

M. Jay Allison

Chairman

of the Board of Directors and Chief Executive Officer

Comstock Resources, Inc.

5300 Town and Country Blvd., Suite 500

Frisco, Texas 75034

(972) 668-8800

(Name, Address and Telephone Number of Person Authorized to Receive Notices and

Communications on Behalf of the Filing Person)

Copy to:

Jack E. Jacobsen

Locke

Lord LLP

2200 Ross Avenue, Suite 2800

Dallas, Texas 75201

(214) 740-8000

CALCULATION

OF FILING FEE

|

|

|

|

|

TRANSACTION VALUATION*

|

|

AMOUNT OF FILING FEE**

|

|

$491,412,188

|

|

$61,180.82

|

|

|

|

*

|

Calculated solely for purposes of determining the filing fee. This amount is based on the purchase of $295,464,697 and $195,947,491 in aggregate principal amount of outstanding 7

3

/

4

% Convertible Secured PIK Notes due 2019 and 9

1

/

2

% Convertible Secured PIK Notes due 2020, respectively, as described herein at a tender offer price of $1,000 per $1,000 principal amount outstanding, plus an amount in cash equal to the accrued

and unpaid interest, if any, up to, but not including, the date of purchase.

|

|

**

|

The amount of the filing fee was calculated at a rate of $124.50 per $1,000,000 of transaction value.

|

|

☐

|

Check box if any part of the fee is offset as provided by Rule

0-11(a)(2)

and identify the filing with which the offsetting fee was previously paid. Identify the previous filing

by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

Amount Previously Paid: Not applicable

|

|

Filing party: Not applicable

|

|

Form or Registration No.: Not applicable

|

|

Date Filed: Not applicable

|

|

☐

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

Check the appropriate boxes below to designate any transactions to which the statement relates:

|

|

☐

|

third-party tender offer subject to

Rule 14d-1

|

|

|

☒

|

issuer tender offer subject to

Rule 13e-4

|

|

|

☐

|

going-private transaction subject to

Rule 13e-3

|

|

|

☐

|

amendment to Schedule 13D under

Rule 13d-2

|

Check the following box if the filing is a final amendment reporting the results of the tender offer: ☐

This Tender Offer Statement on Schedule TO relates to the offer by Comstock Resources, Inc., a Nevada corporation

(the “Company”), to holders (the “Holders”) of the Company’s (i) 7

3

/

4

% Convertible Secured PIK Notes due 2019 (the

“2019 Notes”) and (ii) 9

1

/

2

% Convertible Secured PIK Notes due 2020 (the “2020 Notes”, and together with the 2019

Notes, the “Notes”) to purchase all of the aggregate outstanding principal amount of the Notes, upon the terms and subject to the conditions set forth in the Offer to Purchase and Consent Solicitation dated July 13, 2018 (the

“Offer to Purchase”) and in the accompanying Consent and Letter of Transmittal (the “Consent and Letter of Transmittal”) (the “Tender Offer”). The Offer to Purchase also relates to separate concurrent tender offers for

the Company’s Senior Secured Toggle Notes due 2020, 10% Senior Secured Notes due 2020, 7

3

/

4

% Senior Notes due 2019 and 9

1

/

2

% Senior Notes due 2020.

Holders who validly

tender their Notes will receive $1,000.00 in cash per each $1,000 principal amount of Notes validly tendered and not validly withdrawn, plus an amount in cash equal to accrued and unpaid interest, if any, up to, but not including, the date of

purchase.

The Tender Offer will expire at 11:59 p.m., New York City time, on August 10, 2018, unless extended by the Company in its sole discretion

(such time and date, as the same may be extended, the “Expiration Date”). The Company is concurrently soliciting consents (the “Consents”) from Holders to amend the indentures governing the Notes to make certain changes to the

redemption provisions of the Notes, to release the liens on the collateral securing the Notes and to eliminate most of the covenants and certain default provisions applicable to the Notes. Holders who validly tender their Notes pursuant to the

Tender Offer must also validly tender Consents related to such Notes. Validly tendered Notes may be validly withdrawn and the related Consents may be validly revoked at any time prior to the Expiration Date (such time and date, the “Withdrawal

Time”), but not thereafter. The settlement date (the “Settlement Date”) for the Tender Offer will be promptly following the Expiration Date.

This Tender Offer Statement on Schedule TO is being filed in satisfaction of the reporting requirements of Rules

13e-4(b)(1)

and (c)(2) promulgated under the Securities Exchange Act of 1934, as amended. Information set forth in the Offer to Purchase is incorporated herein by reference in response to Items 1 through 13 of

this Schedule TO, except those items as to which information is specifically provided herein.

Item 1. Summary Term Sheet.

The information set forth under “Summary” in the Offer to Purchase is incorporated herein by reference.

Item 2. Subject Company Information.

(a)

Name and Address.

The name of the Company is Comstock Resources Inc. and the address of its principal executive office is 5300 Town

and Country Blvd., Suite 500, Frisco, Texas 75034. The telephone number at that address is (972)

668-8800.

The information set forth under “Information about the Company” in the Offer to Purchase is

incorporated herein by reference.

(b)

Securities.

The subject classes of securities are the 7

3

/

4

% Convertible Secured PIK Notes due 2019 and the 9

1

/

2

% Convertible Secured PIK Notes due 2020. As of the date hereof, there is

approximately $295,464,697 and $195,947,491 in aggregate principal amount of the 2019 Notes and 2020 Notes outstanding, respectively.

(c)

Trading Market and Price.

The information set forth under “Market and Trading Information” in the Offer to Purchase is incorporated herein by reference.

Item 3. Identity and Background of Filing Person.

The Company is both the filing person and the subject company. The information set forth under Item 2(a) above is incorporated herein by

reference. The information set forth in the Offer to Purchase under “Interests of Directors and Executive Officers; Transactions and Arrangements Concerning the Notes” is incorporated herein by reference.

Item 4. Terms of the Transaction.

(a)

Material Terms.

The information set forth in the Offer to Purchase under the headings “Summary,” “The Tender Offer

and the Consent Solicitation,” “Proposed Amendments,” “Certain Significant Considerations,” “Procedures for Tendering Notes and Delivering Consents,” “Acceptance of Outstanding Notes for Purchase; Payment for

Notes,” and “Certain Federal Income Tax Considerations” is incorporated herein by reference.

(b)

Purchases.

The

information set forth in the Offer to Purchase under the heading “Interests of Directors and Executive Officers; Transaction and Arrangements Concerning the Notes” is incorporated herein by reference.

Item 5. Past Contacts, Transactions, Negotiations and Agreements.

(e)

Agreements Involving the Issuer’s Securities.

The information set forth in the documents referred to under the heading

“Incorporation of Documents by Reference” in the Offer to Purchase is incorporated herein by reference. The information set forth in the Offer to Purchase under the headings “Recent Developments,” “Proposed Amendments,”

“Dealer Manager and Solicitation Agent; Depositary and Information Agent,” and “Interests of Directors and Executive Officers; Transaction and Arrangements Concerning the Notes” is incorporated herein by reference. The Company

has entered into the following agreements in connection with the Company’s securities:

|

|

•

|

|

Indenture dated September 6, 2016, among Comstock Resources, Inc., the Subsidiary Guarantors party thereto, and American Stock Transfer & Trust Company, LLC, Trustee for the 7

3

/

4

% Convertible Secured PIK Notes due 2019 (incorporated by reference to Exhibit 4.2

to the Company’s Current Report on Form

8-K

dated September 8, 2016).

|

|

|

•

|

|

First Supplemental Indenture dated November 17, 2016, among Comstock Resources, Inc., the Subsidiary Guarantors party thereto, and American Stock Transfer & Trust Company, LLC, Trustee for the 7

3

/

4

% Convertible Secured PIK Notes due 2019 (incorporated by reference to Exhibit 4.9

to the Company’s Annual Report on Form

10-K

for the year ended December 31, 2016).

|

|

|

•

|

|

Second Supplemental Indenture dated July 13, 2018, among Comstock Resources, Inc., the Subsidiary Guarantors party thereto, and American Stock Transfer & Trust Company, LLC, Trustee for the 7

3

/

4

% Convertible Secured PIK Notes due 2019 (incorporated by reference to Exhibit 4.1

to the Company’s Current Report on Form

8-K

dated July 13, 2018).

|

|

|

•

|

|

Indenture dated September 6, 2016, among Comstock Resources, Inc., the Subsidiary Guarantors party thereto, and American Stock Transfer & Trust Company, LLC, Trustee for the 9

1

/

2

% Convertible Secured PIK Notes due 2020 (incorporated by reference to Exhibit 4.3

to the Company’s Current Report on Form

8-K

dated September 8, 2016).

|

|

|

•

|

|

First Supplemental Indenture dated November 17, 2016, among Comstock Resources, Inc., the Subsidiary Guarantors party thereto, and American Stock Transfer & Trust Company, LLC, Trustee for the 9

1

/

2

% Convertible Secured PIK Notes due 2020 (incorporated by reference to Exhibit 4.11

to the Company’s Annual Report on From

10-K

for the year ended December 31, 2016).

|

|

|

•

|

|

Second Supplemental Indenture dated July 13, 2018, among Comstock Resources, Inc., the Subsidiary Guarantors party thereto, and American Stock Transfer & Trust Company, LLC, Trustee for the 9

1

/

2

% Convertible Secured PIK Notes due 2020 (incorporated by reference to Exhibit 4.2

to the Company’s Current Report on Form

8-K

dated July 13, 2018).

|

|

|

•

|

|

Indenture dated September 6, 2016, among Comstock Resources, Inc., the Subsidiary Guarantors party thereto, and American Stock Transfer & Trust Company, LLC, Trustee for the Senior Secured Toggle Notes due

2020 (incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form

8-K

dated September 8, 2016).

|

|

|

•

|

|

Indenture dated March 13, 2015, among Comstock Resources, Inc., the Subsidiary Guarantors party thereto, and American Stock Transfer & Trust Company, LLC, Successor Trustee for the 10% Senior Secured Notes

due 2020 (incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form

8-K

dated March 13, 2015).

|

|

|

•

|

|

First Supplemental Indenture dated September 6, 2016, among Comstock Resources, Inc., the Subsidiary Guarantors party thereto, and American Stock Transfer & Trust Company, LLC, Successor Trustee for the

10% Senior Secured Notes due 2020 (incorporated by reference to Exhibit 4.4 to the Company’s Current Report on Form

8-K

dated September 8, 2016).

|

|

|

•

|

|

Indenture dated October 9, 2009, among Comstock Resources, Inc., the Subsidiary Guarantors party thereto, and American Stock Transfer & Trust Company, LLC, Successor Trustee (incorporated by reference to

Exhibit 4.1 to the Company’s Current Report on Form

8-K

dated October 14, 2009).

|

|

|

•

|

|

Third Supplemental Indenture dated March 14, 2011, among Comstock Resources, Inc., the Subsidiary Guarantors party thereto, and American Stock Transfer & Trust Company, LLC, Successor Trustee for the 7

3

/

4

% Senior Notes due 2019 (incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form

8-K

dated March 14, 2011).

|

|

|

•

|

|

Fourth Supplemental Indenture dated June 5, 2012, among Comstock Resources, Inc., the Subsidiary Guarantors party thereto, and American Stock Transfer & Trust Company, LLC, Successor Trustee for the 9

1

/

2

% Senior Notes due 2020 (incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form

8-K

dated June 7, 2012).

|

|

|

•

|

|

Fifth Supplemental Indenture dated September 6, 2016, among Comstock Resources, Inc., the Subsidiary Guarantors party thereto, and American Stock Transfer & Trust Company, LLC, Successor Trustee for the 7

3

/

4

% Senior Notes due 2019 (incorporated by reference to Exhibit 4.5 to the Company’s Current Report on Form

8-K

dated September 8, 2016).

|

|

|

•

|

|

Sixth Supplemental Indenture dated September 6, 2016, among Comstock Resources, Inc., the Subsidiary Guarantors party thereto, and American Stock Transfer & Trust Company, LLC, Successor Trustee for the 9

1

/

2

% Senior Notes due 2020 (incorporated by reference to Exhibit 4.6 to the Company’s Current Report on Form

8-K

dated September 8, 2016).

|

|

|

•

|

|

Warrant Agreement dated September 6, 2016, between Comstock Resources, Inc. and American Stock Transfer & Trust Company, LLC, as warrant agent (incorporated by reference to Exhibit 4.9 to the

Company’s Current Report on Form

8-K

dated September 8, 2016).

|

|

|

•

|

|

Amendment No. 1 to Warrant Agreement between Comstock Resources, Inc. and American Stock Transfer & Trust Company, LLC, dated November 7, 2016 to be effective as of September 6, 2016

(incorporated by reference to Exhibit 4.1 to the Company’s Quarterly Report on Form

10-Q

dated November 9, 2016).

|

Item 6. Purposes of the Transaction and Plans or Proposals.

(a)

Purposes.

The information set forth in the Offer to Purchase under the heading “Purpose and Background of the Tender Offer and

the Consent Solicitation” is incorporated herein by reference.

(b)

Use of Securities Acquired.

Any Notes accepted for purchase

by the Company pursuant to the Tender Offer will be cancelled.

(c)

Plans.

The information set forth in the Offer to Purchase under

the headings “Recent Developments” and “Proposed Amendments” is incorporated herein by reference.

Item 7. Source and Amount

of Funds or Other Consideration.

(a)

Source of Funds.

The information set forth in the Offer to Purchase under the headings

“Summary,” “Recent Developments” and “Conditions to the Consummation of the Tender Offer” is incorporated herein by reference.

(b)

Conditions.

The information set forth in the Offer to Purchase under the heading “Conditions to the Consummation of the Tender

Offer” is incorporated herein by reference.

(d)

Borrowed Funds.

The information set forth in the Offer to Purchase under the

heading “Recent Developments” is incorporated herein by reference.

Item 8. Interest in Securities of the Subject Company.

(a)

Securities Ownership.

The information set forth in the Offer to Purchase under “Interests of Directors and Executive Officers;

Transactions and Arrangements Concerning the Notes” is incorporated herein by reference.

(b)

Securities Transactions.

Not

applicable.

Item 9. Persons/Assets, Retained, Employed, Compensated or Used.

(a) S

olicitations and Recommendations.

The information set forth in the Offer to Purchase under “Dealer Manager and Solicitation

Agent; Depositary and Information Agent” is incorporated herein by reference. None of the Company, the Dealer Manager and Solicitation Agent (as defined in the Offer to Purchase) or the Depositary and Information Agent (as defined in the Offer

to Purchase) is making any recommendation to the Holders whether to tender or refrain from tendering all or any portion of their Notes.

Item 10.

Financial Statements.

(a)

Financial Information.

The information set forth in the documents referred to under the heading

“Incorporation of Documents by Reference” in the Offer to Purchase is incorporated herein by reference. The information set forth in the Company’s Annual Report on

Form 10-K

for the year

ended December 31, 2017 under Item 6 “Selected Financial Data” and Item 8 “Financial Statements and Supplementary Data” is incorporated herein by reference. The information set forth in the Company’s Quarterly

Report on

Form 10-Q

for the three months ended March 31, 2018 under Item 1 “Financial Statements (Unaudited)” is incorporated herein by reference.

The Company’s book value (deficit) per share at March 31, 2018 was $(25.37). The following table sets forth the Company’s ratio

of earnings to fixed charges for each of the two fiscal years ended December 31, 2017 and 2016 and the three months ended March 31, 2018.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months

ended

March 31,

2018

|

|

|

Fiscal Year

ended

December 31,

2017

|

|

|

Fiscal Year

ended

December 31,

2016

|

|

|

Ratio of earnings to fixed charges

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Coverage deficiency (in millions)

|

|

$

|

(41.3

|

)

|

|

$

|

(129.3

|

)

|

|

$

|

(128.0

|

)

|

(b)

Pro Forma Information.

Not applicable.

Item 11. Additional Information.

(a)

Agreements, Regulatory Requirements and Legal Proceedings.

The information set forth in the Offer to Purchase under “Interests

of Directors, Executive Officers; Transactions and Arrangements Concerning the Notes” and “Conditions to the Consummation of the Tender Offer” is incorporated herein by reference

(c)

Other Material Information.

The information set forth in the Offer to Purchase and the Consent and Letter of Transmittal is

incorporated herein by reference.

Item 12. Exhibits.

|

|

|

|

|

(a)(1)(i) *

|

|

Offer to Purchase and Consent Solicitation, dated July 13, 2018.

|

|

|

|

|

(a)(1)(ii) *

|

|

Form of Consent and Letter of Transmittal.

|

|

|

|

|

(a)(2)

|

|

Press Release, dated July 13, 2018 announcing Tender Offer (incorporated by reference to Exhibit 99.1 to the Company’s Current Report on Form 8-K dated July 13, 2018).

|

|

|

|

|

(b)

|

|

Not applicable.

|

|

|

|

|

(d)(1)

|

|

Indenture dated September 6, 2016, among Comstock Resources, Inc., the Subsidiary Guarantors party thereto, and American Stock Transfer & Trust Company, LLC, Trustee for the 7

3

/

4

% Convertible Secured PIK Notes due 2019 (incorporated by reference to Exhibit 4.2

to the Company’s Current Report on Form

8-K

dated September 8, 2016).

|

|

|

|

|

(d)(2)

|

|

First Supplemental Indenture dated November 17, 2016, among Comstock Resources, Inc., the Subsidiary Guarantors party thereto, and American Stock Transfer & Trust Company, LLC, Trustee for the 7

3

/

4

% Convertible Secured PIK Notes due 2019 (incorporated by reference to Exhibit 4.9

to the Company’s Annual Report on Form

10-K

for the year ended December 31, 2016).

|

|

|

|

|

(d)(3)

|

|

Second Supplemental Indenture dated July 13, 2018, among Comstock Resources, Inc., the Subsidiary Guarantors party thereto, and American Stock Transfer & Trust Company, LLC, Trustee for the 7

3

/

4

% Convertible Secured PIK Notes due 2019 (incorporated by reference to Exhibit 4.1

to the Company’s Current Report on Form

8-K

dated July 13, 2018).

|

|

|

|

|

(d)(4)

|

|

Indenture dated September 6, 2016, among Comstock Resources, Inc., the Subsidiary Guarantors party thereto, and American Stock Transfer & Trust Company, LLC, Trustee for the 9

1

/

2

% Convertible Secured PIK Notes due 2020 (incorporated by reference to Exhibit 4.3

to the Company’s Current Report on Form

8-K

dated September 8, 2016).

|

|

|

|

|

(d)(5)

|

|

First Supplemental Indenture dated November 17, 2016, among Comstock Resources, Inc., the Subsidiary Guarantors party thereto, and American Stock Transfer & Trust Company, LLC, Trustee for the 9

1

/

2

% Convertible Secured PIK Notes due 2020 (incorporated by reference to Exhibit 4.11

to the Company’s Annual Report on From

10-K

for the year ended December 31, 2016).

|

|

|

|

|

(d)(6)

|

|

Second Supplemental Indenture dated July 13, 2018, among Comstock Resources, Inc., the Subsidiary Guarantors party thereto, and American Stock Transfer & Trust Company, LLC, Trustee for the 9

1

/

2

% Convertible Secured PIK Notes due 2020 (incorporated by reference to Exhibit 4.2

to the Company’s Current Report on Form

8-K

dated July 13, 2018).

|

|

|

|

|

(d)(7)

|

|

Indenture dated September 6, 2016, among Comstock Resources, Inc., the Subsidiary Guarantors party thereto, and American Stock Transfer & Trust Company, LLC, Trustee for the Senior Secured Toggle Notes due 2020

(incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form

8-K

dated September 8, 2016).

|

|

|

|

|

(d)(8)

|

|

Indenture dated March 13, 2015, among Comstock Resources, Inc., the Subsidiary Guarantors party thereto, and American Stock Transfer & Trust Company, LLC, Successor Trustee for the 10% Senior Secured Notes due 2020

(incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form

8-K

dated March 13, 2015).

|

|

|

|

|

(d)(9)

|

|

First Supplemental Indenture dated September 6, 2016, among Comstock Resources, Inc., the Subsidiary Guarantors party thereto, and American Stock Transfer & Trust Company, LLC, Successor Trustee for the 10% Senior

Secured Notes due 2020 (incorporated by reference to Exhibit 4.4 to the Company’s Current Report on Form

8-K

dated September 8, 2016).

|

|

|

|

|

(d)(10)

|

|

Indenture dated October 9, 2009, among Comstock Resources, Inc., the Subsidiary Guarantors party thereto, and American Stock Transfer & Trust Company, LLC, Successor Trustee (incorporated by reference to Exhibit 4.1 to

the Company’s Current Report on Form

8-K

dated October 14, 2009).

|

|

|

|

|

(d)(11)

|

|

Third Supplemental Indenture dated March 14, 2011, among Comstock Resources, Inc., the Subsidiary Guarantors party thereto, and American Stock Transfer & Trust Company, LLC, Successor Trustee for the 7

3

/

4

% Senior Notes due 2019 (incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form

8-K

dated March 14, 2011).

|

|

|

|

|

(d)(12)

|

|

Fourth Supplemental Indenture dated June 5, 2012, among Comstock Resources, Inc., the Subsidiary Guarantors party thereto, and American Stock Transfer & Trust Company, LLC, Successor Trustee for the 9

1

/

2

% Senior Notes due 2020 (incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form

8-K

dated June 7, 2012).

|

|

|

|

|

(d)(13)

|

|

Fifth Supplemental Indenture dated September 6, 2016, among Comstock Resources, Inc., the Subsidiary Guarantors party thereto, and American Stock Transfer & Trust Company, LLC, Successor Trustee for the 7

3

/

4

% Senior Notes due 2019 (incorporated by reference to Exhibit 4.5 to the Company’s Current Report on Form

8-K

dated September 8, 2016).

|

|

|

|

|

|

|

|

|

(d)(14)

|

|

Sixth Supplemental Indenture dated September 6, 2016, among Comstock Resources, Inc., the Subsidiary Guarantors party thereto, and American Stock Transfer & Trust Company, LLC, Successor Trustee for the 9

1

/

2

% Senior Notes due 2020 (incorporated by reference to Exhibit 4.6 to the Company’s Current Report on Form

8-K

dated September 8, 2016).

|

|

|

|

|

(d)(15)

|

|

Warrant Agreement dated September 6, 2016, between Comstock Resources, Inc. and American Stock Transfer & Trust Company, LLC, as warrant agent (incorporated by reference to Exhibit 4.9 to the Company’s Current

Report on Form

8-K

dated September 8, 2016).

|

|

|

|

|

(d)(16)

|

|

Amendment No. 1 to Warrant Agreement between Comstock Resources, Inc. and American Stock Transfer & Trust Company, LLC, dated November 7, 2016 to be effective as of September 6, 2016 (incorporated by

reference to Exhibit 4.1 to the Company’s Quarterly Report on Form

10-Q

dated November 9, 2016).

|

|

|

|

|

(g)

|

|

Not applicable.

|

|

|

|

|

(h)

|

|

Not applicable.

|

|

*

|

Filed electronically herewith

|

Item 13. Information Required by Schedule

13E-3.

Not applicable.

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and

correct.

|

|

|

|

|

|

|

|

|

Date: July 13, 2018

|

|

|

|

COMSTOCK RESOURCES, INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Roland O. Burns

|

|

|

|

|

|

Name:

|

|

Roland O. Burns

|

|

|

|

|

|

Title:

|

|

President and Chief Financial Officer

|

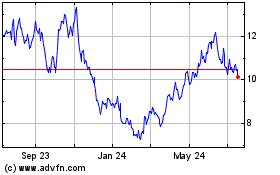

Comstock Resources (NYSE:CRK)

Historical Stock Chart

From Mar 2024 to Apr 2024

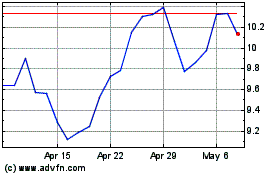

Comstock Resources (NYSE:CRK)

Historical Stock Chart

From Apr 2023 to Apr 2024