Compañia de Minas Buenaventura S.A.A. (“Buenaventura” or

“the Company”) (NYSE:BVN; Lima Stock Exchange:BUE.LM), Peru’s

largest publicly-traded precious metals mining company, today

announced preliminary 2Q18 production and volume sold results as

well as full year 2018 operating guidance (100% basis).

2Q18 Production per Metal and

2018Operating Guidance (100% basis)

1Q18(Actual)

2Q18(Actual)

6M18(Actual)

2018(Estimated)

Gold (Oz.)

Orcopampa 39,987

35,694 75,681 120k - 140k

Tambomayo 33,693

31,173 64,866 110k - 130k

La Zanja 17,722

15,660 33,382 70k - 80k

Tantahuatay 29,915

39,557 69,473 160k - 180k

Yanacocha 104,233

115,342 219,575 470k -

545k

El Brocal 7,029

5,924 12,953 25k -

30k

Silver (Oz.)

Uchucchacua

4,413,249 4,005,948

8,419,196 17.2M - 18.6M

Julcani

504,155 620,276

1,124,431 2.1M - 2.4M

Mallay

155,000 134,936

289,936 0.4M - 0.5M

Tambomayo 1,019,915

1,106,694 2,126,610

3.0M - 3.5M

El Brocal 739,454

967,763 1,707,217

4.6M - 5.0M

Lead (MT)

Julcani

283 231 514

1.0k - 2.0k

Uchucchacua

4,184 4,762 8,947

18.0k - 20.0k

Mallay 504

447 951

0.5k - 2.5k

Tambomayo 856

814 1,670

2.5k - 4.5k

El Brocal 3,737

4,700 8,438

25.0k - 35.0k

Zinc (MT)

El Brocal 13,797

12,353 26,151

45k - 55k

Uchucchacua

4,575 4,842 9,418

18.0k - 20.0k

Mallay 952

1,187 2,139

3.0k - 3.6k

Tambomayo 2,562

1,998 4,560

7.0k - 8.0k

Copper (MT)

El Brocal

10,482 11,173 21,655

45K - 55K

Production Comments

Gold Operations

In light of the Company’s strategy to prioritize its

De-bottlenecking Program over ore mineral extraction,

Buenaventura’s management has made the decision to temporarily

reduce annual production guidance for its Orcopampa asset in order

to centralize the underground operation. A more detailed

explanation will be provided during Buenaventura’s second quarter

2018 results conference call.

Operating at full capacity. 2018 guidance has been

confirmed.

Second quarter production declined due to a change of its mining

contractor. The same contractor used at Tantahuatay, San Martín

Contratistas Generales S.A, has been hired as the new contractor at

La Zanja, leveraging important synergies between the two mines.

2018 guidance therefore remains unchanged.

Positive shift in the second quarter production as was

previously announced (the first quarter was affected by heavy

rains). 2018 guidance has been confirmed.

Silver Operations

Silver and Lead guidance remains unchanged. Zinc guidance has

been increased due to improved grades in the Cachipampa area.

As was announced in previous quarters, the Julcani operation has

been centralized, thereby improving operational efficiency. 2018

guidance has been confirmed.

Centralizing and stopping the deepening of the mine has achieved

positive results. 2018 guidance has been confirmed.

Base Metals Operations

The production mix has been modified within El Brocal´s 2018

mining plan. More production will be derived from the polymetallic

open pit mine than was previously announced in early 2018. The plan

is to smoothly and efficiently transition the underground operation

from 8k TPD to 13k TPD. El Brocal´s 2018 annual EBITDA budget will

not be affected.

Volume Sold

2Q18 Volume sold per Metal (100% basis)

1Q18(Actual)

2Q18(Actual)

6M18

(Actual)

Gold (Oz.)

Orcopampa 40,015

35,155 75,170

Tambomayo

30,698 30,721

61,419

La Zanja 18,222

17,495 35,717

Tantahuatay 27,957

38,599 66,556

El Brocal

5,102 4,029 9,130

Silver (Oz.)

Uchucchacua

3,853,518 4,125,034

7,978,552

Julcani

352,236 741,469 1,093,705

Mallay 136,838

123,609 260,447

Tambomayo

837,123 1,143,540

1,980,663

El Brocal 536,585

774,576 1,311,161

Lead

(MT)

Julcani 169

275 444

Uchucchacua 3,434

4,387 7,821

Mallay

440 434 874

Tambomayo 528

1,025 1,554

El Brocal

3,339 4,490 7,829

Zinc (MT)

El Brocal

11,354 10,383

21,738

Uchucchacua 3,802

3,783 7,585

Mallay

733 986

1,718

Tambomayo 1,672

1,871 3,543

Copper (MT)

El Brocal 9,854

10,517 20,371

Company Description

Compañía de Minas Buenaventura S.A.A. is Peru’s largest,

publicly traded precious and base metals Company and a major holder

of mining rights in Peru. The Company is engaged in the

exploration, mining development, processing and trade of gold,

silver and other base metals via wholly-owned mines and through its

participation in joint venture projects. Buenaventura currently

operates several mines in Peru (Orcopampa*, Uchucchacua*, Mallay*,

Julcani*, Tambomayo*, El Brocal, La Zanja and Coimolache).

The Company owns 43.65% of Minera Yanacocha S.R.L (a partnership

with Newmont Mining Corporation), an important precious metal

producer and 19.58% of Sociedad Minera Cerro Verde, an important

Peruvian copper producer.

For a printed version of the Company’s 2017 Form 20-F, please

contact the persons indicated above, or download a PDF format file

from the Company’s web site.

(*) Operations wholly owned by Buenaventura

Note on Forward-Looking Statements

This press release may contain forward-looking information (as

defined in the U.S. Private Securities Litigation Reform Act of

1995) that involve risks and uncertainties, including those

concerning the Company’s, Yanacocha’s and Cerro Verde’s costs and

expenses, results of exploration, the continued improving

efficiency of operations, prevailing market prices of gold, silver,

copper and other metals mined, the success of joint ventures,

estimates of future explorations, development and production,

subsidiaries’ plans for capital expenditures, estimates of reserves

and Peruvian political, economic, social and legal developments.

These forward-looking statements reflect the Company’s view with

respect to the Company’s, Yanacocha’s and Cerro Verde’s future

financial performance. Actual results could differ materially from

those projected in the forward-looking statements as a result of a

variety of factors discussed elsewhere in this Press Release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180712005886/en/

Compañia de Minas Buenaventura

S.A.A.Lima:Leandro García, 511-419-2540Chief

Financial OfficerorRodrigo Echecopar,

511-419-2591Investor Relations

Coordinatorrodrigo.echecopar@buenaventura.peorNY:Barbara

Cano, 646-452-2334barbara@inspirgroup.comorCompany

Website: www.buenaventura.com.pe/ir

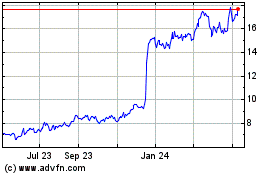

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

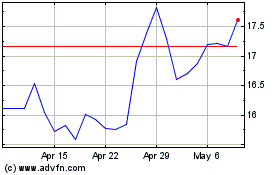

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Apr 2023 to Apr 2024