Current Report Filing (8-k)

July 12 2018 - 9:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

July 6, 2018

NETLIST, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

|

001-33170

|

|

95-4812784

|

|

(State or Other Jurisdiction of

Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification Number)

|

175 Technology, Suite 150

Irvine, California 92618

(Address of Principal Executive Offices)

(949) 435-0025

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On July 6, 2018, Netlist, Inc. (the “Company”) received a letter from the Listing Qualifications Department of The Nasdaq Stock Market LLC (“Nasdaq”) formally notifying the Company that, based upon the Company’s continued non-compliance with the minimum $35 million market value of listed securities requirement set forth in Nasdaq Listing Rule 5550(b)(2) (the “Rule”) as of July 2, 2018, and its non-compliance with the alternative listing criteria set forth in the Rule, including the minimum $2.5 million stockholders’ equity requirement (the “Stockholders’ Equity Requirement”), the additional deficiency could serve as a basis for the delisting of the Company’s common stock from The Nasdaq Capital Market and, as such, the Company should present its plan to evidence compliance with the Rule for review by the Nasdaq Hearings Panel (the “Panel”).

As previously disclosed in the Company’s Current Report on Form 8-K, as filed with the Securities and Exchange Commission on April 4, 2018, on March 29, 2018, the Company received written notice from Nasdaq indicating that, due to the Company’s continued non-compliance with the $1.00 bid price requirement set forth in Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Requirement”) as of March 26, 2018, the Company’s common stock was subject to delisting unless the Company timely requested a hearing before the Panel.

The Company timely requested a hearing before the Panel and at such hearing presented its plan to evidence compliance with both the Bid Price Requirement and the Stockholders’ Equity Requirement. By decision dated May 17, 2018, the Panel granted the Company’s request for continued listing on The Nasdaq Capital Market subject to the Company evidencing compliance with all applicable requirements for continued listing on Nasdaq, including both the Bid Price Requirement and the Stockholders’ Equity Requirement, by no later than September 25, 2018.

In accordance with the terms of the Panel’s decision, the Company intends to timely provide an update to the Panel, specifically regarding its plan to evidence compliance with the Stockholders’ Equity Requirement.

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

NETLIST, INC.

|

|

|

|

|

|

|

|

|

|

Date: July 12, 2018

|

By:

|

/s/ Gail M. Sasaki

|

|

|

|

Gail M. Sasaki

|

|

|

|

Vice President, Chief Financial Officer and Secretary

|

3

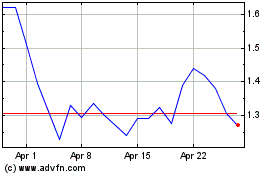

Netlist (QB) (USOTC:NLST)

Historical Stock Chart

From Mar 2024 to Apr 2024

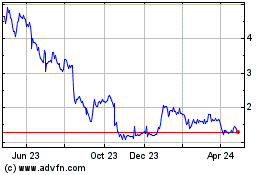

Netlist (QB) (USOTC:NLST)

Historical Stock Chart

From Apr 2023 to Apr 2024