Liquidity Services Acquires Machinio, a Leading Global Platform for Used Equipment Listings

July 10 2018 - 4:30PM

Liquidity Services, Inc. (NASDAQ:LQDT), a global solution provider

in the reverse supply chain with the world’s largest marketplace

for business surplus, today announced it has acquired Machinio

Corp., a leading global online platform for listing used equipment

for sale in the construction, machine tool, transportation,

printing and agriculture sectors. The acquisition expands the

portfolio of solutions Liquidity Services offers its base of

commercial and government customers to monetize assets. Machinio

operates a robust online equipment listing marketplace, with over

1.2 million assets for sale, valued at over $25 billion, and 10

million annual website visits across 190 countries. Machinio also

provides equipment sellers with a suite of online analytics tools

and software solutions to optimize their business performance.

Machinio customers will benefit from Liquidity Services’ global

equipment industry experience and network of over three million

registered buyers, providing further global exposure for Machinio’s

equipment listings.

Machinio offers annual recurring subscriptions to over 2,200

dealers, brokers and other suppliers of used equipment that enable

them to more efficiently sell their inventory to a broad base of

interested buyers. Machinio uses proprietary technology, data

management tools and a mobile first approach to connect buyers with

the most relevant global supply of used equipment available for

sale. In turn, Machinio provides sellers highly effective,

automated tools to reach qualified business buyers. Machinio has

grown rapidly over the past five years and now has a global team

serving customers across Europe, North America, South

America and Asia.

“This acquisition supports our strategy as the world’s largest

marketplace for business surplus by expanding the services and

channels we offer our sellers to maximize recovery and growing our

network of buyers in important global equipment verticals,” said

Bill Angrick, Chairman of the Board and CEO of Liquidity Services.

“Machinio is delivering superior value to their customers and our

combined offering will enable us to grow our transaction volume,

expand our recurring revenue service offerings, and utilize

technology and innovation to improve our seller and buyer

experience.”

"We are excited to partner with Liquidity Services and look

forward to leveraging their expertise and resources to deliver

significant value to our customers. Liquidity Services’ global

brand and strong relationships will further accelerate Machinio’s

growth. Together, we will continue to enhance our platform and

services to meet the needs of global sellers and buyers of used

equipment,” said Dmitriy Rokhfeld, President of

Machinio.

Machinio, based in Chicago and Berlin, will continue to

operate under its current branding and management team led by

executive co-founders Dmitriy Rokhfeld and Dan Pinto.

Liquidity Services has paid approximately $20.0 million of

consideration for 100% of the equity in Machinio, consisting of

approximately $18.0 million in cash, subject to working capital

adjustments under the terms of the stock purchase agreement, and

$2.0 million in restricted stock issued to Machinio’s executives in

exchange for stock in Machinio. The net cash portion of the

purchase price is estimated to be $16.7 million, net of the

estimated cash assumed in the transaction and a working capital

adjustment. Additional cash consideration, totaling no more

than $5.0 million, may be paid based upon Machinio’s achievement of

certain financial targets in calendar year 2019. In connection with

the acquisition, Liquidity Services has also agreed to issue

restricted stock valued at approximately $5.0 million to Machinio’s

executives and employees. The restricted stock will be subject to

performance-based vesting, based upon the achievement of certain

annual revenue and adjusted EBITDA targets through calendar year

2021, in each case subject to each employee’s continued employment

with Liquidity Services on such vesting dates and other standard

terms and conditions set forth in the respective grant agreements.

The value of these grants will be recorded as future equity-related

compensation expense. The performance-based restricted stock

relates to 702,003 shares of Liquidity Services common

stock.

Liquidity Services expects the transaction to be dilutive to

fiscal year 2018 GAAP earnings per share and will become accretive

to GAAP earnings per share during fiscal year 2019. During this

period, we expect Machinio’s operations to be cash neutral to

Liquidity Services based on the growth of Machinio’s deferred

revenues from its subscription services.

About Liquidity ServicesLiquidity Services

(NASDAQ:LQDT) operates a network of leading e-commerce marketplaces

that enable buyers and sellers to transact in an efficient,

automated environment offering over 500 product categories. The

company employs innovative e-commerce marketplace solutions to

manage, value and sell inventory and equipment for business and

government sellers. Our superior service, unmatched scale and

ability to deliver results enable us to forge trusted, long-term

relationships with over 11,000 sellers worldwide. With over $7

billion in completed transactions, and over three million buyers in

almost 200 countries and territories, we are the proven leader in

delivering smart commerce solutions. Visit us at

LiquidityServices.com. http://www.liquidityservicesinc.com.

Forward-Looking Statements

This press release contains forward-looking

statements made under the Private Securities Litigation Reform Act

of 1995, including, but not limited to, statements regarding the

anticipated benefits of the transaction to Machinio’s and Liquidity

Services’ buyers and sellers, as well as the effects of the

transaction on Liquidity Services’ transaction volume, earnings per

share and cash position. These statements are only predictions. The

outcome of the events described in these forward-looking statements

is subject to known and unknown risks, uncertainties and other

factors that may cause our actual results, levels of activity,

performance or achievements to differ materially from any future

results, levels of activity, performance or achievements expressed

or implied by these forward-looking statements. You can identify

forward-looking statements by terminology such as "may," "will,"

"should," "could," "would," "expects," "intends," "plans,"

"anticipates," "believes," "estimates," "predicts," "potential,"

"continues" or the negative of these terms or other comparable

terminology. Although we believe that the expectations reflected in

the forward-looking statements are reasonable, we cannot guarantee

future results, levels of activity, performance or

achievements.

There are a number of risks and uncertainties

that could cause results to differ materially from the

forward-looking statements contained in this press release.

Important factors that could cause our actual results to differ

materially from those expressed as forward-looking statements

include, among others: the effect of the announcement of the

transaction on Machinio’s business relationships, operating

results, and business generally; Liquidity Services’ ability to

successfully integrate Machinio’s operations, service offerings and

technology; risks that the integration efforts disrupt operations

of Machinio’s and Liquidity Services’ ongoing business operations;

and potential difficulties in Machinio employee retention as a

result of the transaction; and other factors set forth in our

filings with the SEC from time to time. There may be other

factors of which we are currently unaware or deem immaterial that

may cause our actual results to differ materially from the

forward-looking statements.

All forward-looking statements attributable to

us or persons acting on our behalf apply only as of the date of

this document and are expressly qualified in their entirety by the

cautionary statements included in this document. Except as may be

required by law, we undertake no obligation to publicly update or

revise any forward-looking statement to reflect events or

circumstances occurring after the date of this document or to

reflect the occurrence of unanticipated events.

Contact:Julie DavisLiquidity

Services202.558.6234julie.davis@liquidityservices.com

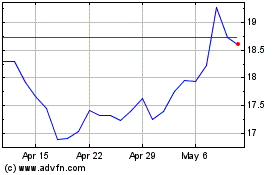

Liquidity Services (NASDAQ:LQDT)

Historical Stock Chart

From Mar 2024 to Apr 2024

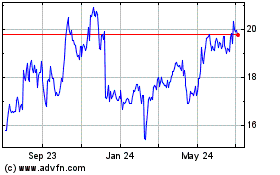

Liquidity Services (NASDAQ:LQDT)

Historical Stock Chart

From Apr 2023 to Apr 2024