Kimco Realty Reports Second Quarter 2018 Transaction Activity

July 09 2018 - 8:30AM

Business Wire

– Second Quarter Sales Volume Exceeds $330

Million; $556 Million in First Half of 2018 –

Kimco Realty Corp. (NYSE:KIM) announced today transaction

activity for the second quarter and year to date 2018.

During the second quarter of 2018, the company sold 17 shopping

centers totaling 2.7 million square feet for $334.0 million.

Kimco’s share of these dispositions was $319.3 million. The blended

cap rate for the property sales was in line with the company’s

expected range of 7.50% to 8.00%.

“We are in a great position to meet our full-year disposition

target of $700 to $900 million, thanks to the dedication and

outstanding performance of our team this quarter,” said Ross

Cooper, President and Chief Investment Officer. “Once again,

our robust sales volume highlights the strong demand for open-air

shopping centers, supported by significant levels of capital and

historically low interest rates.”

The dispositions include Primrose Marketplace, a

368,000-square-foot property in Springfield, Missouri for $51.8

million, Broadway Plaza, a 356,000-square-foot property in

Chula Vista, California for $58.5 million, and Downers Park

Plaza, a 269,000-square-foot center in Downers Grove, Illinois

for $26.7 million. In addition, the company exited the state of

Alabama with the sale of The Grove, a 145,000-square-foot

property in Hoover, Alabama for $21.0 million.

Year to date, the company’s dispositions included 38 shopping

centers and 4 land parcels, totaling 5.0 million square feet, for a

gross sales price of $556.1 million. Kimco’s share of the sales

price was $531.8 million.

About Kimco

Kimco Realty Corp. (NYSE: KIM) is a real estate investment trust

(REIT) headquartered in New Hyde Park, N.Y., that is one of North

America’s largest publicly traded owners and operators of open-air

shopping centers. As of March 31, 2018, the company owned interests

in 475 U.S. shopping centers comprising 81 million square feet of

leasable space primarily concentrated in the top major metropolitan

markets. Publicly traded on the NYSE since 1991, and included in

the S&P 500 Index, the company has specialized in shopping

center acquisitions, development and management for 60 years. For

further information, please visit www.kimcorealty.com, the

company’s blog at blog.kimcorealty.com, or follow Kimco on Twitter

at www.twitter.com/kimcorealty.

Safe Harbor Statement

The statements in this news release state the company’s and

management’s intentions, beliefs, expectations or projections of

the future and are forward-looking statements. It is important to

note that the company’s actual results could differ materially from

those projected in such forward-looking statements. Factors which

may cause actual results to differ materially from current

expectations include, but are not limited to, (i) general adverse

economic and local real estate conditions, (ii) the inability of

major tenants to continue paying their rent obligations due to

bankruptcy, insolvency or a general downturn in their business,

(iii) financing risks, such as the inability to obtain equity, debt

or other sources of financing or refinancing on favorable terms to

the company, (iv) the company’s 4.ability to raise capital by

selling its assets, (v) changes in governmental laws and

regulations and management’s ability to estimate the impact of such

changes, (vi) the level and volatility of interest rates and

foreign currency exchange rates and management’s ability to

estimate the impact thereof, (vii) the availability of suitable

acquisition, disposition, development and redevelopment

opportunities, and risks related to acquisitions not performing in

accordance with our expectations, (viii) valuation and risks

related to the company’s joint venture and preferred equity

investments, (ix) valuation of marketable securities and other

investments, (x) increases in operating costs, (xi) changes in the

dividend policy for the company’s common and preferred stock and

the Company’s ability to pay dividends at current levels, (xii) the

reduction in the company’s income in the event of multiple lease

terminations by tenants or a failure by multiple tenants to occupy

their premises in a shopping center, (xiii) impairment charges and

(xiv) unanticipated changes in the company’s intention or ability

to prepay certain debt prior to maturity and/or hold certain

securities until maturity. Additional information concerning

factors that could cause actual results to differ materially from

those forward-looking statements is contained from time to time in

the company’s SEC filings. Copies of each filing may be obtained

from the company or the SEC.

The company refers you to the documents filed by the company

from time to time with the SEC, specifically the section titled

“Risk Factors” in the company’s Annual Report on Form 10-K for the

year ended December 31, 2017, as may be updated or supplemented in

the company’s Quarterly Reports on Form 10-Q and the company’s

other filings with the SEC, which discuss these and other factors

that could adversely affect the company’s results. The company

disclaims any intention or obligation to update the forward-looking

statements, whether as a result of new information, future events

or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180709005133/en/

Kimco Realty Corp.David F. Bujnicki, 1-866-831-4297Senior Vice

President, Investor Relations and

Strategydbujnicki@kimcorealty.com

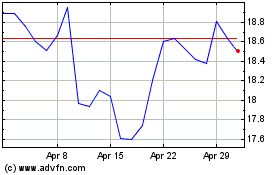

Kimco Realty (NYSE:KIM)

Historical Stock Chart

From Mar 2024 to Apr 2024

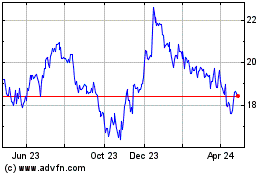

Kimco Realty (NYSE:KIM)

Historical Stock Chart

From Apr 2023 to Apr 2024