Royal Gold, Inc. (NASDAQ: RGLD) (together with its

subsidiaries, “Royal Gold” or the “Company”) today announced that

its wholly owned subsidiary, RGLD Gold AG, sold approximately

64,000 gold equivalent ounces comprised of approximately 51,000

gold ounces, 659,000 silver ounces and 700 tonnes of copper related

to its streaming agreements during its fiscal 2018 fourth quarter

ended June 30, 2018 (“fourth quarter”). The Company had

approximately 22,000 gold ounces and 573,000 silver ounces in

inventory at June 30, 2018.

RGLD Gold AG’s average realized gold, silver and copper prices

for the fourth quarter were $1,314 per ounce, $16.55 per ounce, and

$6,847 per tonne ($3.11 per pound), respectively, compared to

$1,328, $16.77, and $6,902 ($3.13 per pound) in the prior quarter,

respectively. Cost of sales was approximately $349 per gold

equivalent ounce for the fourth quarter using the quarterly average

silver-gold ratio of approximately 79 to 1 and copper-gold ratio of

approximately 0.19 tonnes per ounce, compared to $342 per gold

equivalent ounce in the prior quarter. Cost of sales is specific to

our stream agreements and is the result of the Company’s purchase

of gold, silver or copper for cash payments at a set contractual

price, or a percentage of the prevailing market price of gold,

silver or copper when purchased.

Lower deliveries during the quarter, largely due to the

temporary shutdown of the mill processing facility at Mount

Milligan that occurred in early calendar 2018, were offset by a

slight inventory drawdown. Due to the timing of shipments and

deliveries of gold and copper, we expect the remaining impact of

the early calendar 2018 temporary shutdown to be reflected in Royal

Gold’s first quarter 2019 results, as some of the deliveries of

gold and copper that were expected in July and August 2018 will be

deferred to a later date.

On May 1, 2018, Centerra reported that milling operations

achieved a throughput of 40,000 tonnes per day, and that they

expect to achieve average sustainable throughput levels of 55,000

tonnes per day for the second half of the calendar year. On July 5,

2018, Centerra reported that satisfactory long-term water supply is

still subject to permitting and consultation. If approvals are not

obtained timely, throughput levels at Mount Milligan may need to be

reduced in the fourth calendar quarter of 2018.

Revolving Credit Facility

Royal Gold repaid the remaining $75 million

outstanding under its revolving credit facility during the fourth

quarter. As of June 30, 2018, the Company had $1 billion available

and no amounts outstanding under its revolving credit facility.

Receipt of Repayment of Golden Star Loan Facility

On June 29, 2018, a subsidiary of Golden Star Resources, Ltd.

repaid its $20 million term loan facility, including accrued

interest, to Royal Gold, well in advance of its May 2019

maturity.

Royal Gold has a streaming interest on 10.5% of the gold at

Wassa and Prestea until 240,000 ounces are delivered and 5.5%

thereafter. Through March 31, 2018, Wassa and Prestea have

delivered approximately 61,500 ounces of gold to Royal Gold.

Purchase of 1.75% NSR on Mara Rosa

On June 29, 2018, Royal Gold entered into an agreement to

purchase a 1.75% Net Smelter Return Royalty on Amarillo Gold’s Mara

Rosa gold project in Goias State, Brazil for $10.8 million. The

acquisition adds to a 1.00% Net Smelter Return Royalty previously

acquired by Royal Gold, increasing its total royalty interest over

the project area to a 2.75% Net Smelter Return. The Mara Rosa

Royalty Agreement includes a right of first refusal on future

financing opportunities for the project.

Purchase of Shares of Contango ORE

On June 28, 2018, Royal Gold acquired 682,556 shares of common

stock of Contango ORE, Inc. (“CORE”) for consideration of $26 per

share, pursuant to a Stock Purchase Agreement entered into on April

5, 2018 between Royal Gold and certain individual stockholders of

CORE. Royal Gold expects to acquire a second and final tranche of

127,188 shares of CORE common stock pursuant to the Stock Purchase

Agreement at a subsequent closing.

Conference Call

Royal Gold’s fourth quarter and fiscal year 2018 results will be

released after the market close on Wednesday, August 8, 2018,

followed by a conference call the following day at noon Eastern

Time (10:00 a.m. Mountain Time). The call will be webcast and

archived on the Company’s website for a limited time.

Fiscal 2018 Fourth Quarter Earnings Call Information:

Dial-In Numbers:

855-209-8260 (U.S.); toll free 855-669-9657 (Canada); toll

free 412-542-4106 (International) Conference Title: Royal Gold

Webcast URL:

www.royalgold.com under Investors, Events

& Presentations

About Royal Gold

Royal Gold is a precious metals stream and royalty company

engaged in the acquisition and management of precious metal

streams, royalties, and similar production based interests. At June

30, 2018, the Company owns interests on 191 properties on six

continents, including interests on 39 producing mines and 22

development stage projects. Royal Gold is publicly traded on the

NASDAQ Global Select Market under the symbol “RGLD.” The Company’s

website is located at www.royalgold.com.

Cautionary “Safe Harbor” Statement Under the Private

Securities Litigation Reform Act of 1995: With the exception of

historical matters, the matters discussed in this press release are

forward-looking statements that involve risks and uncertainties

that could cause actual results to differ materially from

projections or estimates contained herein. Such forward-looking

statements include: statements about preliminary results of

streaming sales volume, average realized price per ounce and per

tonne, cost of sales per gold equivalent ounce, and the impact of

the temporary shutdown, subsequent re-start of mill processing

operations, and possible future reduction of throughput at Mount

Milligan on Royal Gold’s financial results. Factors that could

cause actual results to differ materially from the projections

include, among others, precious metals, copper and nickel prices;

performance of and production at the Company's stream and royalty

properties, including gold and copper production at Mount Milligan,

gold production at Andacollo and Wassa and Prestea, and gold and

silver production at Pueblo Viejo and Rainy River; changes in

estimates of reserves and mineralization by the operators of the

Company’s stream and royalty properties; errors or disputes in

calculating or accounting for stream and royalty deliveries and

payments, or deliveries and payments not made in accordance with

stream and royalty agreements; economic and market conditions;

risks associated with conducting business in foreign countries;

changes in laws governing the Company and its stream and royalty

properties or the operators of such properties; and other

subsequent events; as well as other factors described in the

Company's Annual Report on Form 10-K, Quarterly Reports on Form

10-Q, and other filings with the Securities and Exchange

Commission. Most of these factors are beyond the Company’s ability

to predict or control. The Company disclaims any obligation to

update any forward-looking statement made herein. Readers are

cautioned not to put undue reliance on forward-looking

statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180709005284/en/

Royal Gold, Inc.Karli Anderson, 303-575-6517Vice

President Investor Relations

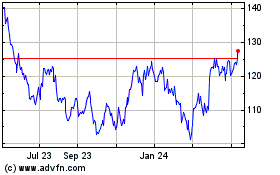

Royal Gold (NASDAQ:RGLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Royal Gold (NASDAQ:RGLD)

Historical Stock Chart

From Apr 2023 to Apr 2024