|

PROSPECTUS SUPPLEMENT

|

Filed Pursuant to Rule

424(b)(5)

|

|

(To Prospectus Dated September 6, 2016)

|

Registration No. 333-207600

|

Anavex

Life Sciences Corp.

Up

to $50,000,000

Common

Stock

We have entered into a Controlled Equity

Offering

SM

Sales Agreement, or Sales Agreement, with Cantor Fitzgerald & Co., or Cantor Fitzgerald, relating

to shares of our common stock,

par value $.001 per share,

offered

by this prospectus supplement and accompanying prospectus. In accordance with the terms of the Sales Agreement, we may offer and

sell shares of our common stock having an aggregate offering price of up to $50,000,000 from time to time through Cantor Fitzgerald,

acting as our sales agent.

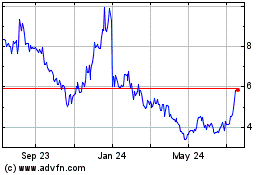

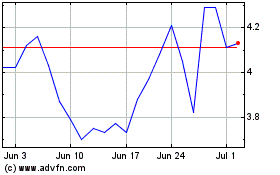

Our common stock is currently listed

on the Nasdaq Capital Market under the symbol “AVXL”. On July 2, 2018 the last reported sale price

of our common stock was $2.66 per share.

Sales of our common stock, if any, under

this prospectus will be made by any method that is deemed to be an “at the market offering” as defined in Rule 415(a)(4)under

the Securities Act of 1933, as amended, or the Securities Act. Cantor Fitzgerald is not required to sell any specific amount of

securities, but will act as our sales agent using commercially reasonable efforts consistent with its normal trading and sales

practices, on mutually agreed terms between Cantor Fitzgerald and us. There is no arrangement for funds to be received in any escrow,

trust or similar arrangement.

Cantor will be entitled to compensation

at a fixed commission rate of 3.0% of the gross proceeds from the sale of our common stock pursuant to the Sales Agreement. In

connection with the sale of the common stock on our behalf, Cantor Fitzgerald will be deemed to be an “underwriter”

within the meaning of the Securities Act, and the compensation of Cantor Fitzgerald will be deemed to be underwriting commissions

or discounts. We have also agreed to provide indemnification and contribution to Cantor Fitzgerald against certain civil liabilities,

including liabilities under the Securities Act or the Securities Exchange Act of 1934, as amended, or the Exchange Act.

Investing in our securities involves

a high degree of risk. See the section entitled “Risk Factors” on page S-6 of this prospectus supplement and the section

entitled “Risk Factors” beginning on page 9

of the accompanying prospectus, and in the documents we filed

with the Securities and Exchange Commission that are incorporated in this prospectus supplement by reference for certain risks

and uncertainties you should consider.

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy

of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement

is July 6, 2018.

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

PROSPECTUS

ABOUT THIS PROSPECTUS SUPPLEMENT

We are providing information to you

about this offering of our common stock in two separate documents that are bound together: (1) this prospectus supplement,

which describes the specific terms of this offering, and (2) the accompanying base prospectus, which provides general information,

some of which may not apply to this offering. This prospectus supplement may also add to, update or change information contained

in the accompanying base prospectus. If information in this prospectus supplement is inconsistent with the accompanying base prospectus,

you should rely on this prospectus supplement. Generally, when we refer to this “prospectus,” we are referring to both

documents combined.

This prospectus supplement, the accompanying

base prospectus and any free-writing prospectus that we prepare or authorize contain and incorporate by reference information that

you should consider when making your investment decision. We have not, and Cantor has not, authorized anyone to provide you with

additional or different information. If anyone provides you with different or inconsistent information, you should not rely on

it. You should not assume that the information contained in this prospectus supplement or the accompanying base prospectus is accurate

as of any date other than the date on the front of those documents or that any information we have incorporated by reference is

accurate as of any date other than the date of the document incorporated by reference. Our business, financial condition, results

of operations and prospects may have changed since those dates.

We are not, and Cantor is not, making

an offer or sale of our common stock in any jurisdiction where such offer or sale is not permitted.

The information in this prospectus supplement

is not complete. You should carefully read this prospectus supplement and the accompanying base prospectus, including the information

incorporated by reference herein and therein, before you invest, as these documents contain information you should consider when

making your investment decision.

None of Anavex Life Sciences Corp.,

Cantor or any of their representatives are making any representation to you regarding the legality of an investment in our common

stock by you under applicable laws. You should consult with your own advisors as to legal, tax, business, financial and related

aspects of an investment in our common stock.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus supplement contains

forward-looking statements. All statements other than statements of historical facts contained in this prospectus supplement, including

statements regarding our anticipated future clinical and regulatory milestone events, future financial position, business strategy

and plans and objectives of management for future operations, are forward-looking statements. The words “believe,”

“may,” “estimate,” “continue,” “anticipate,” “intend,” “expect,”

“should,” “forecast,” “could,” “suggest,” “plan,” and similar expressions,

as they relate to us, are intended to identify forward-looking statements. Such forward-looking statements include, without limitation,

statements regarding:

|

|

·

|

our ability to generate any revenue or to continue as a going concern;

|

|

|

·

|

our ability to successfully conduct clinical

and preclinical trials for our product candidates;

|

|

|

·

|

our ability to raise additional capital

on favorable terms;

|

|

|

·

|

our ability to execute our development

plan on time and on budget;

|

|

|

·

|

our products ability to demonstrate efficacy

or an acceptable safety profile;

|

|

|

·

|

our ability to obtain the support of qualified

scientific collaborators;

|

|

|

·

|

our ability, whether alone or with commercial

partners, to successfully commercialize any of our product candidates that may be approved for sale;

|

|

|

·

|

our ability to identify and obtain additional

product candidates;

|

|

|

·

|

intellectual property rights and protections;

|

|

|

·

|

the anticipated start dates, durations

and completion dates of our ongoing and future clinical studies;

|

|

|

·

|

the anticipated designs of our future

clinical studies;

|

|

|

·

|

our anticipated future regulatory submissions

and our ability to receive regulatory approvals to develop and market our product candidates; and

|

|

|

·

|

our anticipated future cash position.

|

We have based these forward-looking

statements largely on our current expectations and projections about future events, including the responses we expect from the

U.S. Food and Drug Administration, or FDA, and other regulatory authorities and financial trends that we believe may affect our

financial condition, results of operations, business strategy, preclinical and clinical trials and financial needs. These forward-looking

statements are subject to a number of risks, uncertainties and assumptions including without limitation the risks described in

“Risk Factors” in “Part I, Item 1A” of or Annual Report on Form 10-K for the year ended September 30, 2017.

These risks are not exhaustive. We operate in a very competitive and rapidly changing environment. New risk factors emerge from

time to time and it is not possible for our management to predict all risk factors, nor can we assess the impact of all factors

on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from

those contained in any forward-looking statements. You should not rely upon forward-looking statements as predictions of future

events. We cannot assure you that the events and circumstances reflected in the forward-looking statements will be achieved or

occur and actual results could differ materially from those projected in the forward-looking statements. Except as required by

applicable laws including the securities laws of the United States, we assume no obligation to update or supplement forward-looking

statements.

PROSPECTUS

SUPPLEMENT SUMMARY

This summary highlights information

contained elsewhere in this prospectus supplement and the accompanying base prospectus. It does not contain all of the information

that you should consider before making an investment decision. You should read this entire prospectus supplement, the accompanying

base prospectus and the documents incorporated herein by reference for a more complete understanding of this offering of common

stock. Please read “Risk Factors” in our Annual Report on Form 10-K for the year ended September 30, 2017 for information

regarding risks you should consider before investing in our common stock.

Throughout this prospectus supplement,

when we use the terms “Anavex,” “we,” “us,” “our” or the “Company,”

we are referring either to Anavex Life Sciences Corp. in its individual capacity or to Anavex Life Sciences Corp. and its operating

subsidiaries collectively, as the context requires.

Our Company

Overview

We are a clinical stage biopharmaceutical

company engaged in the development of differentiated therapeutics for the treatment of neurodegenerative and neurodevelopmental

diseases including drug candidates to treat Alzheimer’s disease, other central nervous system (“CNS”) diseases,

pain and various types of cancer. The Company’s lead compound ANAVEX

®

2-73, is being developed to treat Alzheimer’s

disease, Parkinson’s disease and potentially other central nervous system diseases, including rare diseases, such as Rett

syndrome, a severe neurological disorder caused by mutations in the X-linked gene, methyl-CpG-binding protein 2 (MECP2).

In November 2016, a Phase 2a clinical trial,

consisting of PART A and PART B, which lasted a total of 57 weeks, was completed for ANAVEX

®

2-73 in mild-to-moderate

Alzheimer’s patients. This open-label randomized trial met both primary and secondary endpoints, and was designed to assess

the safety and exploratory efficacy of ANAVEX

®

2-73 in 32 patients. ANAVEX

®

2-73 targets sigma-1 and

muscarinic receptors, which have been shown in preclinical studies to reduce stress levels in the brain believed to restore cellular

homeostasis and to reverse the pathological hallmarks observed in Alzheimer’s disease. In October 2017, we presented pharmacokinetic

(PK) and pharmacodynamic (PD) data from the positive Phase 2a study, which established a concentration-effect relationship between

ANAVEX

®

2-73 and study measurements. These measures obtained from all patients who participated in the entire 57

weeks include exploratory cognitive and functional scores as well as biomarker signals of brain activity. Additionally, the study

appears to show that ANAVEX

®

2-73 activity is enhanced by its active metabolite (ANAVEX19-144), which also targets

the sigma-1 receptor and has a half-life approximately twice as long as the parent molecule.

In March 2016, we received approval from the

Ethics Committee in Australia to extend the Phase 2a clinical trial, which had been requested by patients and their caregivers.

The trial extension allows participants who completed the 52-week PART B of the study to roll-over into a new trial and continue

taking ANAVEX

®

2-73 for an additional 104 weeks, providing an opportunity to gather extended safety data. The trial

is independent of our planned larger Phase 2/3 double-blind, placebo-controlled study of ANAVEX

®

2-73 in Alzheimer’s

disease.

In February 2016, we presented positive preclinical data for ANAVEX

®

2-73

in Rett syndrome, a rare neurodevelopmental disease. The study was funded by the International Rett Syndrome Foundation (the Rettsyndrome.org

Foundation). In January 2017, we were awarded a financial grant from the Rettsyndrome.org Foundation of a minimum of $0.6 million

to cover some of the cost of a planned U.S. multicenter Phase 2 clinical trial of ANAVEX

®

2-73 for the treatment

of Rett syndrome. The Phase 2 trial is scheduled to begin following the FDA’s approval of the Company’s investigational

new drug (IND) application and will be a randomized, double blind, placebo-controlled study of ANAVEX

®

2-73 in patients

with Rett syndrome lasting up to 12 weeks. Primary and secondary endpoints include safety as well as Rett syndrome conditions such

as cognitive impairment, motor impairment, behavioral symptoms and seizure activity.

In September 2016, we presented positive preclinical

data for ANAVEX

®

2-73 in Parkinson’s disease, which demonstrated significant improvements on all measures:

behavioral, histopathological, and neuroinflammatory endpoints. The study was funded by the Michael J Fox Foundation. Additional

data was announced in October 2017 from the model for experimental parkinsonism. The data presented indicates that ANAVEX

®

2-73

induces robust neurorestoration in experimental parkinsonism. The encouraging results we have gathered in this model, coupled with

the favorable profile of this compound in the Alzheimer’s disease trial, support the notion that ANAVEX

®

2-73

is a promising clinical candidate drug for Parkinson’s disease. We are also moving forward with a Phase 2 trial with ANAVEX

®

2-73

in Parkinson’s Disease Dementia (PDD), which will study the effect of the compound on both the cognitive and motor impairment

of Parkinson’s disease. The double-blind, randomized, placebo-controlled Phase 2 PDD study has been submitted to regulatory

authorities in Europe, and pending approval, we plan to initiate this clinical trial in the second half of calendar 2018.

Recent Developments

On July 2, 2018, the Human Research

Ethics Committee in Australia approved the initiation of our Phase 2b/3, double-blind, randomized, placebo-controlled 48-week

safety and efficacy trial of ANAVEX®2-73 for the treatment of early Alzheimer’s disease in Australia. This Phase 2b/3

study design incorporates inclusion of genomic precision medicine biomarkers identified in the ANAVEX®2-73 Phase 2a study.

The Phase 2b/3 study, which is expected to enroll approximately 450 patients, randomized 1:1:1 to either two different ANAVEX®2-73

doses or placebo, is scheduled to begin the next month.

In May 2018, we received approval from

the Human Research Ethics Committee in Australia to further extend the current Phase 2a Alzheimer’s clinical trial of ANAVEX®2-73

for an additional two years. The extension, again requested by existing patients, their caregivers and physicians, will allow patients

who participated in the first 57-week study and continued in the 104-week extension study, to continue taking ANAVEX®2-73 for

an additional two years. As a result, we will have over five years of cumulative safety and tolerability data for ANAVEX®2-73.

The further extension is in addition and independent of the Company’s larger Phase 2b/3 double-blinded, placebo-controlled

study of ANAVEX®2-73 in Alzheimer’s disease discussed above.

Corporate Information

Our principal executive office is located at

51 West 52nd Street, 7th Floor, New York, NY 10019-6163, and our telephone number is 844.689.3939. Our website address is

www.anavex.com

.

No information found on our website is part of this prospectus. Also, this prospectus may include the names of various government

agencies or the trade names of other companies. Unless specifically stated otherwise, the use or display by us of such other parties’

names and trade names in this prospectus is not intended to and does not imply a relationship with, or endorsement or sponsorship

of us by, any of these other parties.

THE OFFERING

|

Common stock offered by us

:

|

Common stock, par value $.001 per share, having an aggregate sales price of up to $50,000,000.

|

|

|

|

|

Common stock to be outstanding after this offering:

|

Up to 63,657,757 shares assuming the sale of 19,083,969 shares of our common stock in this offering at an offering price of $2.62 per share, which was the closing price of our common stock on The Nasdaq Capital Market on June 29, 2018. The actual number of shares issued will vary depending on the sales prices under this offering.

|

|

|

|

|

Plan of Distribution

|

“At the market offering” that may be made from time to time through our sales agent, Cantor Fitzgerald. See “Plan of Distribution.”

|

|

|

|

|

Use of Proceeds

|

We intend to use the net proceeds from this offering, after deducting the sales agent’s commissions and our offering expenses, for general corporate purposes, which may include, among other things, working capital, capital expenditures and funding additional clinical and preclinical development of our pipeline candidates. See “Use of Proceeds” on page S-7.

|

|

|

|

|

Risk Factors

|

You should read the “Risk Factors” section on page S-6 of this prospectus supplement and the other risks identified in the documents incorporated by reference herein before making a decision to purchase common stock in this offering.

|

|

|

|

|

Nasdaq Capital Market symbol

|

“AVXL.”

|

The number of shares of common stock shown above to be outstanding

after this offering is based on 44,573,788 shares of common stock outstanding as of March 31, 2018 and exclude the following:

|

|

·

|

5,867,030 shares of common stock issuable upon the exercise of outstanding

stock options, vested and unvested, with a weighted-average exercise price of $4.00 per share; and

|

|

|

·

|

1,609,309 shares of common stock issuable upon the exercise of outstanding

warrants with a weighted-average exercise price of $2.66 per share.

|

RISK FACTORS

An investment in our common stock

involves a significant degree of risk. Before you invest in our common stock you should carefully consider those risk factors included

in our most recent Annual Report on Form 10-K, our most recent Quarterly Report on Form 10-Q, any subsequently filed Quarterly

Reports on Form 10-Q and any subsequently filed Current Reports on Form 8-K, which are incorporated herein by reference, and those

risk factors that may be included in any applicable prospectus supplement, together with all of the other information included

in this prospectus supplement, the accompanying base prospectus and the documents we incorporate by reference, in evaluating an

investment in our common stock. If any of the risks discussed in the foregoing documents were to occur, our business, financial

condition, results of operations and cash flows could be materially adversely affected. Please read “Cautionary Statement

Regarding Forward-Looking Statements.”

You may experience dilution.

The offering price per share in this offering may exceed

the net tangible book value per share of our common stock outstanding prior to this offering. Assuming that an aggregate of 19,083,969

shares of our common stock are sold at a price of $2.62 per share, the last reported sale price of our common stock on the Nasdaq

Capital Market on June 29, 2018, for aggregate gross proceeds of $50.0 million, and after deducting commissions and estimated offering

expenses payable by us, you would experience immediate dilution of $1.51 per share, representing the difference between our as

adjusted net tangible book value per share as of March 31, 2018, after giving effect to this offering, and the assumed offering

price. The exercise of outstanding stock options and warrants would result in further dilution of your investment. See the section

entitled “Dilution” below for a more detailed illustration of the dilution you would incur if you participate in this

offering. Because the sales of the shares offered hereby will be made directly into the market or in negotiated transactions, the

prices at which we sell these shares will vary and these variations may be significant. Purchasers of the shares we sell, as well

as our existing shareholders, will experience significant dilution if we sell shares at prices significantly below the price at

which they invested.

You may experience future dilution as a result of future

equity offerings.

To raise additional capital, we may in the future offer additional

shares of our common stock or other securities convertible into or exchangeable for our common stock at prices that may not be

the same as the price per share in this offering. We may sell shares or other securities in any other offering at a price per share

that is less than the price per share paid by investors in this offering, and investors purchasing shares or other securities in

the future could have rights superior to existing stockholders. The price per share at which we sell additional shares of our common

stock, or securities convertible or exchangeable into common stock, in future transactions may be higher or lower than the price

per share paid by investors in this offering.

The actual number of shares we will issue under the

sales agreement, at any one time or in total, is uncertain.

Subject to certain limitations in the sales agreement with

Cantor, the sales agent in this offering, and compliance with applicable law, we have the discretion to deliver placement notices

to the sales agent at any time throughout the term of the sales agreement. The number of shares that are sold by the sales agent

after delivering a placement notice will fluctuate based on the market price of the common stock during the sales period and limits

we set with the sales agent.

Our management might apply the net proceeds from this

offering in ways with which you do not agree and in ways that may impair the value of your investment.

We currently intend to use the net proceeds from this offering

primarily for working capital and general corporate purposes. Our management has broad discretion as to the use of such proceeds

and you will be relying on the judgment of our management regarding the application of these proceeds. Our management might apply

these proceeds in ways with which you do not agree, or in ways that ultimately do not yield a favorable return. If our management

applies such proceeds in a manner that does not yield a significant return, if any, on our investment of such net proceeds, it

could compromise our ability to pursue our growth strategy and adversely affect the market price of our common stock

USE OF PROCEEDS

We intend to use the net proceeds from this offering, after

deducting the sales agent’s commissions and our offering expenses, for general corporate purposes, which may include, among

other things, working capital, capital expenditures and funding additional clinical and preclinical development of our pipeline

candidates.

DILUTION

If you purchase shares of common stock in this offering,

your ownership interest in the Company will be diluted to the extent of the difference between the public offering price per share

and the as adjusted net tangible book value per share after giving effect to this offering. We calculate net tangible book value

per share by dividing the net tangible book value, which is tangible assets less total liabilities, by the number of outstanding

shares of common stock. Dilution represents the difference between the portion of the amount per share paid by purchasers of shares

in this offering and the as adjusted net tangible book value per share of our common stock immediately after giving effect to this

offering. Our net tangible book value as of March 31, 2018 was approximately $22.5 million, or $0.50 per share.

After giving effect to the sale of common stock pursuant

to this prospectus supplement and accompanying prospectus in the aggregate amount of $50,000,000 at an assumed offering price of

$2.62 per share, the last reported sale price of our common stock on the Nasdaq Capital Market on June 29, 2018, and after deducting

commissions and estimated aggregate offering expenses payable by us, our net tangible book value as of March 31, 2018 would have

been $70.8 million, or $1.11 per share of common stock. This represents an immediate increase in the net tangible book value of

$0.61 per share to our existing stockholders and an immediate dilution in net tangible book value of $1.51 per share to new investors.

The following table illustrates this per share dilution:

|

Assumed public offering price per share

|

|

|

|

|

|

$

|

2.62

|

|

|

Net tangible book value per share as of March 31, 2018

|

|

$

|

0.50

|

|

|

|

|

|

|

Increase per share attributable to new investors

|

|

$

|

0.61

|

|

|

|

|

|

|

As adjusted net tangible book value per share as of March 31, 2018 after giving effect to this offering

|

|

|

|

|

|

$

|

1.11

|

|

|

Dilution per share to new investors purchasing shares in this offering

|

|

|

|

|

|

$

|

1.51

|

|

The table above assumes for illustrative purposes that an

aggregate of 19,083,969 shares of our common stock are sold pursuant to this prospectus supplement and the accompanying prospectus

at a price of $2.62 per share, the last reported sale price of our common stock on the Nasdaq Capital Market on June 29, 2018,

for aggregate gross proceeds of $50.0 million. The shares sold in this offering, if any, will be sold from time to time at various

prices. An increase of $1.00 per share in the price at which the shares are sold from the assumed offering price of $2.62 per share

shown in the table above, assuming all of our common stock in the aggregate amount of $50.0 million is sold at that price, would

result in an adjusted net tangible book value per share after the offering of $1.21 per share and would increase the dilution in

net tangible book value per share to new investors in this offering to $2.41 per share, after deducting commissions and estimated

aggregate offering expenses payable by us. A decrease of $1.00 per share in the price at which the shares are sold from the assumed

offering price of $2.62 per share shown in the table above, assuming all of our common stock in the aggregate amount of $50.0 million

is sold at that price, would result in an adjusted net tangible book value per share after the offering of $0.94 per share and

would decrease the dilution in net tangible book value per share to new investors in this offering to $0.68 per share, after deducting

commissions and estimated aggregate offering expenses payable by us.

The above table and discussion are based on 44,573,788 shares

of common stock outstanding as of March 31, 2018 and exclude the following, all as of March 31, 2018:

|

|

·

|

5,867,030 shares of common stock issuable upon the exercise of outstanding

stock options, vested and unvested, with a weighted-average exercise price of $4.00 per share; and

|

|

|

·

|

1,609,309 shares of common stock issuable upon the exercise of outstanding

warrants with a weighted-average exercise price of $2.66 per share.

|

To the extent that options or warrants outstanding as of

March 31, 2018 have been or are exercised, or other shares are issued, investors purchasing shares in this offering could experience

further dilution. In addition, we may choose to raise additional capital due to market conditions or strategic considerations,

even if we believe we have sufficient funds for our current or future operating plans. To the extent that additional capital is

raised through the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution

to our stockholders.

PLAN OF DISTRIBUTION

We

have entered into a Controlled Equity Offering

SM

Sales Agreement (the “Sales Agreement”) with Cantor

Fitzgerald, pursuant to which we may issue and sell up to $50 million shares of our common stock, $0.01 par value per share, through

Cantor Fitzgerald, acting as sales agent. This summary of the material provisions of the Sales Agreement does not purport to be

a complete statement of its terms and conditions. A copy of the Sales Agreement will be filed as an exhibit to a Current

Report on Form 8-K and will be incorporated by reference into the registration statement of which this prospectus supplement

is a part. See “Where You Can Find More Information” below.

Upon

delivery of a placement notice and subject to the terms and conditions of the Sales Agreement, Cantor Fitzgerald may sell our common

stock by any method permitted by law deemed to be an “at the market offering” as defined in Rule 415(a)(4) promulgated

under the Securities Act, including sales made directly on the Nasdaq Capital Market or any other existing trading market for our

common stock. We or Cantor Fitzgerald may suspend the offering of our common stock upon notice and subject to other conditions.

We

will pay Cantor Fitzgerald in cash, upon each sale of our common stock pursuant to the Sales Agreement, a commission in an amount

equal to 3.0% of the aggregate gross proceeds from each sale of our common stock. Because there is no minimum offering amount required

as a condition to close this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not

determinable at this time. We have also agreed to reimburse Cantor Fitzgerald for certain specified expenses, in an aggregate amount

not exceeding $50,000, including the fees and disbursements of its legal counsel. We estimate that the total expenses for

the offering, excluding compensation and reimbursements payable to Cantor Fitzgerald under the terms of the Sales Agreement, will

be approximately $90,000.

Settlement

for sales of common stock will occur on the second business day following the date on which any sales are made, or on another date

that is agreed upon by us and Cantor Fitzgerald in connection with a particular transaction, in return for payment of the net proceeds

to us. Sales of our common stock as contemplated in this prospectus supplement will be settled through the facilities of The Depository

Trust Company or by such other means as we and Cantor Fitzgerald may agree upon. There is no arrangement for funds to be received

in an escrow, trust or similar arrangement.

Cantor

Fitzgerald will use its commercially reasonable efforts, consistent with its sales and trading practices, to solicit offers to

purchase shares of our common stock under the terms and subject to the conditions set forth in the Sales Agreement. In connection

with the sale of the common stock on our behalf, Cantor Fitzgerald will be deemed to be an “underwriter” within the

meaning of the Securities Act, and the compensation of Cantor Fitzgerald will be deemed to be underwriting commissions or discounts.

We have agreed to provide indemnification and contribution to Cantor Fitzgerald against certain civil liabilities, including liabilities

under the Securities Act.

The

offering of our common stock pursuant to the Sales Agreement will terminate upon the termination of the Sales Agreement as permitted

therein. We and Cantor Fitzgerald may each terminate the Sales Agreement at any time upon ten days’ prior notice.

We have agreed to indemnify

Cantor Fitzgerald and specified other persons against certain liabilities relating to or arising out of the Cantor Fitzgerald’s

activities under Sales Agreement and to contribute to payments that Cantor Fitzgerald may be required to make in respect of such

liabilities.

Cantor

Fitzgerald and its affiliates may in the future provide various investment banking, commercial banking and other financial services

for us and our affiliates, for which services they may in the future receive customary fees. To the extent required by Regulation

M, Cantor Fitzgerald will not engage in any market making activities involving our common stock while the offering is ongoing under

this prospectus supplement.

This

prospectus supplement and the accompanying prospectus in electronic format may be made available on a website maintained by Cantor

Fitzgerald, and Cantor Fitzgerald may distribute this prospectus supplement and the accompanying prospectus electronically.

LEGAL MATTERS

The validity of the securities offered

by this prospectus has been passed upon for us by Snell & Wilmer, L.L.P., Reno, Nevada. Cantor Fitzgerald & Co. is being

represented in connection with this offering by Cooley LLP, New York, New York.

EXPERTS

The financial statements as of September

30, 2017 and 2016 and for each of the three years in the period ended September 30, 2017 and management’s assessment of the

effectiveness of internal control over financial reporting as of September 30, 2017 incorporated by reference in this Prospectus

have been so incorporated in reliance on the reports of BDO USA, LLP, an independent registered public accounting firm, incorporated

herein by reference, given on the authority of said firm as experts in auditing and accounting.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and other reports and other information

with the SEC under the Exchange Act. You may read and copy any reports, statements or other information filed by us at the SEC’s

public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information

on the public reference room. Our filings with the SEC are also available to the public from commercial document retrieval services

and at the SEC’s website at www.sec.gov.

We make available free of charge on our internet website

at www.anavex.com our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K and any

amendments to those reports, as soon as reasonably practicable after we electronically file such material with, or furnish it to,

the SEC. Information contained on our website is not incorporated by reference into this prospectus supplement and you should not

consider such information as part of this prospectus supplement.

DOCUMENTS INCORPORATED BY REFERENCE

The SEC allows us to “incorporate

by reference” into this prospectus certain information that we file with the SEC, which means that we can disclose important

information to you by referring you to other documents separately filed by us with the SEC that contain such information. The information

we incorporate by reference is considered to be part of this prospectus and information we later file with the SEC will automatically

update and supersede the information in this prospectus. The following documents filed by us with the SEC pursuant to Section 13(a)

of the Exchange Act and any of our future filings under Sections 13(a), 13(c), 14 or 15 (d) of the Exchange Act, except for

information furnished under Item 2.02 or 7.01 of Current Report on Form 8-K, or exhibits related thereto, made before the termination

of the offering are incorporated by reference herein:

|

|

(1)

|

our Annual Report on Form 10-K for the fiscal year ended September 30, 2017, filed with the SEC

on December 11, 2017;

|

|

|

(2)

|

our Proxy Statement on Schedule 14A filed on March 8, 2018 (excluding those portions that are not

incorporated by reference into our Annual Report on Form 10-K);

|

|

|

(3)

|

our Quarterly Reports on Form 10-Q for the periods ended December 31, 2017 and March 31, 2018,

filed on February 7, 2018 and May 10, 2018, respectively;

|

|

|

(4)

|

our Current Reports on Form 8-K filed on October 6, 2017, March 8, 2018 and April 20, 2018; and

|

|

|

(5)

|

the description of our Common Stock contained in the Registration Statement on Form 8-A (File No.

001-37606) filed with the SEC on October 23, 2005.

|

Any statement contained herein or in

any document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for the

purposes of this prospectus to the extent that a statement contained herein or in any other subsequently filed document which also

is or is deemed to be incorporated by reference herein modifies or replaces such statement. Any such statement so modified or superseded

shall not be deemed to constitute a part of this prospectus, except as so modified or superseded.

We will provide to each person, including

any beneficial owner, to whom a prospectus is delivered, a copy of any or all of the reports or documents that have been incorporated

by reference in the prospectus contained in the registration statement but not delivered with the prospectus, other than an exhibit

to these filings unless we have specifically incorporated that exhibit by reference into the filing, upon written or oral request

and at no cost to the requester. Requests should be made by writing or telephoning us at the following address:

Anavex Life Sciences Corp.

51 West 52

nd

Street, 7

th

Floor

New York, NY 10019-6163

(844) 689-3939

PROSPECTUS

Anavex

Life Sciences Corp.

$100,000,000

of Shares of Common Stock and Warrants

6,754,609

Shares of Common Stock Offered

by Selling Security Holder

Anavex

Life Sciences Corp., a Nevada corporation (“

us

”, “

we

”, “

our

”, “

Anavex

”

or the “

Company

”) may offer and sell from time to time, in one or more series or issuances and on terms that

Anavex will determine at the time of the offering, shares of our common stock, par value $0.001 per share (“

Common Stock

”)

and warrants (“

Warrants

”) described in this prospectus, up to an aggregate amount of $100,000,000.

This

prospectus also covers the resale by Lincoln Park Capital Fund, LLC (“

Lincoln Park

” or the “

Selling

Security Holder

”), of up to 6,754,609 shares of our Common Stock in one or more transactions in amounts, at prices,

and on terms that will be determined at the time these securities are offered, inclusive of 269,397 shares of Common Stock issued

or issuable to the Selling Security Holder as commitment shares, as described in further detail herein. The shares being offered

for resale by the Selling Security Holder represents approximately 18.9% of the outstanding Common Stock of the Company.

We

will not receive any of the proceeds from the sale of shares of our Common Stock sold by the Selling Security Holder. The Selling

Security Holder may sell the shares of Common Stock described in this prospectus in a number of different ways and at varying

prices. See “Plan of Distribution” for more information about how the Selling Security Holder may sell the shares

of Common Stock being registered pursuant to this prospectus. The Selling Security Holder is an “underwriter” within

the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended (the “

Securities Act

”).

This

prospectus provides you with a general description of the securities offered. We will file prospectus supplements and may provide

other offering material at later dates that will contain specific terms of each offering of securities by us. These supplements

may also add, update or change information contained in this prospectus.

You should carefully read this prospectus and the applicable prospectus supplement before you invest in any of our securities. This

prospectus may not be used to consummate sales of securities unless accompanied by a prospectus supplement.

We

may offer and sell the securities described in this prospectus and any prospectus supplement directly to our stockholders or to

other purchasers or through agents on our behalf or through underwriters or dealers as designated from time to time. If any agents

or underwriters are involved in the sale of any of these securities, the applicable prospectus supplement will provide the names

of the agents or underwriters and any applicable fees, commission or discounts.

Our

Common Stock is currently quoted on the Nasdaq Capital Market under the symbol “AVXL”. On August 30, 2016, the last

reported sale price of our Common Stock was $3.04 per share.

Investing

in our securities involves a high degree of risk. See the section entitled “Risk Factors” on page 9 of this prospectus

and in the documents we filed with the Securities and Exchange Commission that are incorporated in this prospectus by reference

for certain risks and uncertainties you should consider.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

This

prospectus is dated September 6, 2016.

TABLE

OF CONTENTS

i

ABOUT

THIS PROSPECTUS

This

prospectus of Anavex Life Sciences Corp., a Nevada corporation (collectively with all of its subsidiaries, the “Company”,

“Anavex”, or “we”, “us”, or “our”) is a part of a registration statement that

we filed with the Securities and Exchange Commission (“

SEC

”) utilizing a “shelf” registration process.

Under this shelf registration process, we may, from time to time, sell the securities described in this prospectus in one or more

offerings up to a total dollar amount of $100,000,000 as described in this prospectus. In addition, Lincoln Park may, from time

to time, offer and sell up to an aggregate of 6,754,609 shares of our Common Stock in one or more transactions.

The

registration statement containing this prospectus, including the exhibits to the registration statement, provides additional information

about us and the securities offered under this prospectus. The registration statement, including the exhibits and the documents

incorporated herein by reference, can be read on the SEC website or at the SEC offices mentioned under the heading “Prospectus

Summary - Where You Can Find More Information.”

We

may provide a prospectus supplement containing specific information about the amounts, prices and terms of the securities for

a particular offering. The prospectus supplement may add, update or change information in this prospectus. If the information

in the prospectus is inconsistent with a prospectus supplement, you should rely on the information in that prospectus supplement.

You should read both this prospectus and, if applicable, any prospectus supplement. See “Prospectus Summary — Where

You Can Find More Information” for more information.

We

have not authorized any dealer, salesman or other person to give any information or to make any representation other than those

contained or incorporated by reference in this prospectus or any prospectus supplement. You must not rely upon any information

or representation not contained or incorporated by reference in this prospectus or any prospectus supplement. This prospectus

and any prospectus supplement do not constitute an offer to sell or the solicitation of an offer to buy any securities other than

the registered securities to which they relate, nor do this prospectus and any prospectus supplement constitute an offer to sell

or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer

or solicitation in such jurisdiction. You should not assume that the information contained in this prospectus or any prospectus

supplement is accurate on any date subsequent to the date set forth on the front of such document or that any information we have

incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though

this prospectus and any prospectus supplement is delivered or securities are sold on a later date.

1

PROSPECTUS

SUMMARY

The

items in the following summary are described in more detail later in this prospectus. This summary does not contain all of the

information you should consider. Before investing in our securities, you should read the entire prospectus carefully, including

the “Risk Factors” beginning on page 9 and the financial statements incorporated by reference.

Overview

Our

Current Business

We

are a clinical stage biopharmaceutical company engaged in the development of differentiated therapeutics for the treatment of

neurodegenerative and neurodevelopmental diseases including drug candidates to treat Alzheimer’s disease, other central

nervous system (“CNS”) diseases, pain and various types of cancer. The Company’s lead compound ANAVEX 2-73 is

being developed to treat Alzheimer’s disease and potentially other central nervous system diseases, including rare diseases,

such as Rett syndrome.

In

December 2014 a Phase 2a clinical trial was initiated for ANAVEX 2-73, which is being evaluated for the treatment of Alzheimer’s

disease. This randomized trial is designed to assess the safety and exploratory efficacy of ANAVEX 2-73 alone as well as in combination

with donepezil (ANAVEX PLUS) in patients with mild to moderate Alzheimer’s disease. ANAVEX 2-73 targets sigma-1 and muscarinic

receptors, which have been shown in preclinical studies to reduce stress levels in the brain and to reverse the pathological hallmarks

observed in Alzheimer’s disease. ANAVEX 2-73 showed no serious adverse events in a previously performed Phase 1 study. In

pre-clinical studies, ANAVEX 2-73 demonstrated anti-amnesic and neuroprotective properties in various animal models including

the transgenic mouse model Tg2576. In March, 2016, we received approval from the Ethics Committee in Australia to extend the ongoing

Phase 2a clinical trial, which had been requested by patients and their caregivers. The trial extension allows participants who

complete 52 weeks in PART B to roll-over into a new trial and continue taking ANAVEX 2-73 for an additional 104 weeks, providing

an opportunity to gather extended safety data. The trial is independent of the Company’s planned larger Phase 2/3 double-blinded,

placebo-controlled study of ANAVEX 2-73 in Alzheimer’s disease.

We

intend to identify and initiate discussions with potential partners in the next 12 months. Further, we may acquire or develop

new intellectual property and assign, license, or otherwise transfer our intellectual property to further our goals.

Our

Pipeline

Our

pipeline includes one clinical drug candidate and several compounds in different stages of pre-clinical study.

Our

proprietary SIGMACEPTOR™ Discovery Platform produced small molecule drug candidates with unique modes of action, based on

our understanding of sigma receptors. Sigma receptors may be targets for therapeutics to combat many human diseases, including

Alzheimer’s disease. When bound by the appropriate ligands, sigma receptors influence the functioning of multiple biochemical

signals that are involved in the pathogenesis (origin or development) of disease.

Compounds

that have been subjects of our research include the following:

ANAVEX

2-73

ANAVEX

2-73 may offer a disease-modifying approach in Alzheimer’s disease (AD) by using ligands that activate sigma-1 receptors.

In

AD animal models, ANAVEX 2-73 has shown pharmacological, histological and behavioral evidence as a potential neuroprotective,

anti-amnesic, anti-convulsive and anti-depressive therapeutic agent, due to its potent affinity to sigma-1 receptors and moderate

affinities to M1-4 type muscarinic receptors. In addition, ANAVEX 2-73 has shown a potential dual mechanism which may impact both

amyloid and tau pathology. In a transgenic AD animal model Tg2576 ANAVEX 2-73 induced a statistically significant neuroprotective

effect against the development of oxidative stress in the mouse brain, as well as significantly increased the expression of functional

and synaptic plasticity markers that is apparently amyloid-beta independent. It also statistically alleviated the learning and

memory deficits developed over time in the animals, regardless of sex, both in terms of spatial working memory and long-term spatial

reference memory.

2

Based

on the results of pre-clinical testing, we initiated and completed a Phase 1 single ascending

dose (SAD) clinical trial of ANAVEX 2-73 in 2011. In this Phase 1 SAD trial, the maximum

tolerated single dose was defined per protocol as 55–60 mg. This dose is above

the equivalent dose shown to have positive effects in mouse models of AD. There were

no significant changes in laboratory or electrocardiogram (ECG) parameters. ANAVEX 2-73

was well tolerated below the 55–60 mg dose with only mild adverse events in some

subjects. Observed adverse events at doses above the maximum tolerated single dose included

headache and dizziness, which were moderate in severity and reversible. These side effects

are often seen with drugs that target CNS conditions, including AD.

The

ANAVEX 2-73 Phase 1 SAD trial was conducted as a randomized, placebo-controlled study. Healthy male volunteers between the ages

of 18 and 55 received single, ascending oral doses over the course of the trial. Study endpoints included safety and tolerability

together with pharmacokinetic parameters. Pharmacokinetics includes the absorption and distribution of a drug, the rate at which

a drug enters the blood and the duration of its effect, as well as chemical changes of the substance in the body. This study was

conducted in Germany in collaboration with ABX-CRO, a clinical research organization that has conducted several Alzheimer’s

disease studies, and the Technical University of Dresden.

In

December 2014 a Phase 2a clinical trial was initiated for ANAVEX 2-73, which is being evaluated for the treatment of Alzheimer’s

disease. The randomized trial is designed to assess the safety and exploratory efficacy of ANAVEX 2-73 alone as well as in combination

with donepezil (ANAVEX PLUS) in patients with mild to moderate Alzheimer’s disease. ANAVEX 2-73 targets sigma-1 and muscarinic

receptors, which have been shown in preclinical studies to reduce stress levels in the brain and to reverse the pathological hallmarks

observed in Alzheimer’s disease. ANAVEX 2-73 showed no serious adverse events in a previously performed Phase 1 study. In

pre-clinical studies ANAVEX 2-73 demonstrated anti-amnesic and neuroprotective properties in various animal models including the

transgenic mouse model Tg2576.

The

Phase 2a study met both primary and secondary objectives of the study. The 31-week preliminary exploratory safety and efficacy

data from the ongoing Phase 2a study of ANAVEX 2-73 in Alzheimer’s patients demonstrated favorable safety, maximum tolerated

dose, positive dose response, sustained efficacy response through 31 weeks for both cognitive and functional measures, as well

as positive unexpected therapeutic response events. ANAVEX 2-73 continues to demonstrate a favorable adverse event (AE) profile

through 31 weeks in a patient population of elderly Alzheimer’s patients with varying degrees of physical fragility. The

most common side effects across all AE categories tended to be of mild severity grade 1, and were resolved with dose reductions

that were anticipated within the adaptive design of the study protocol. ANAVEX 2-73 data presented is prerequisite information

in order to progress into Phase 2/3 placebo controlled studies.

Recent

preclinical data validates ANAVEX 2-73 as a prospective platform drug for other neurodegenerative diseases beyond Alzheimer’s

as well as neurodevelopmental diseases, more specifically, epilepsy and Rett syndrome. For epilepsy, data demonstrates both significant

and dose related improvement in the reduction of seizures, as well as significant synergy with each of three generations of epilepsy

drugs currently on the market. In Rett syndrome, a rare neurodevelopmental disease indication, administration of ANAVEX 2-73 resulted

in both significant and dose related improvements in an array of behavioural paradigms in the MECP2 HET Rett syndrome disease

model.

ANAVEX

PLUS

ANAVEX

PLUS, a combination of ANAVEX 2-73 with donepezil (Aricept

®

) is

a potential novel combination drug for Alzheimer’s disease. Aricept

®

(donepezil) is now generic. ANAVEX 2-73 showed in combination with donepezil an unexpected and clear synergic effect of memory

improvement by up to 80% in animal models. A patent application was filed in the US for the combination of donepezil and ANAVEX

2-73 and if granted would give patent protection at least until 2033.

In

a humanized calibrated cortical network computer model the unexpected pre-clinical synergy between ANAVEX 2-73 and donepezil was

confirmed and ANAVEX PLUS showed an anticipated ADAS-Cog response of 7 points at 12 weeks and 5.5 points at 26 weeks, which represents

more than 2x the ADAS-Cog of donepezil alone.

ANAVEX

3-71

ANAVEX

3-71, previously named AF710B is a preclinical drug candidate with a novel mechanism of action via sigma-1 receptor activation

and M1 muscarinic allosteric modulation, which has shown to enhance neuroprotection and cognition in Alzheimer’s disease.

ANAVEX 3-71 is a CNS-penetrable mono-therapy that bridges treatment of both cognitive impairments with disease modifications.

It is highly effective in very small doses against the major Alzheimer’s hallmarks in transgenic (3xTg-AD) mice, including

cognitive deficits, amyloid and tau pathologies, and also has beneficial effects on inflammation and mitochondrial

3

dysfunctions.

ANAVEX 3-71 indicates extensive therapeutic advantages in Alzheimer’s and other

protein-aggregation-related diseases given its ability to enhance neuroprotection and

cognition via sigma-1 receptor activation and M1 muscarinic allosteric modulation.

A

recent preclinical study examined the response of ANAVEX 3-71 in aged transgenic animal models, and showed a significant reduction

in rate of cognitive deficit, amyloid beta pathology and inflammation with the administration of ANAVEX 3-71. In April 2016 the

U.S. Food and Drug Administration (“FDA”) granted Orphan Drug Designation (“ODD”) to ANAVEX 3-71 for the

treatment of Frontotemporal dementia (“FTD”).

ANAVEX

1-41

ANAVEX

1-41 is a sigma-1 agonist. Pre-clinical tests revealed significant neuroprotective benefits (i.e., protects nerve cells from degeneration

or death) through the modulation of endoplasmic reticulum, mitochondrial and oxidative stress, which damages and destroys cells

and is believed by some scientists to be a primary cause of AD. In addition, in animal models, ANAVEX 1-41 prevented the expression

of caspase-3, an enzyme that plays a key role in apoptosis (programmed cell death) and loss of cells in the hippocampus, the part

of the brain that regulates learning, emotion and memory. These activities involve both muscarinic and sigma-1 receptor systems

through a novel mechanism of action.

ANAVEX

1037

ANAVEX

1037 is designed for the treatment of prostate cancer. It is a low molecular weight, synthetic compound exhibiting high affinity

for sigma-1 receptors at nanomolar levels and moderate affinity for sigma-2 receptors and sodium channels at micromolar levels.

In advanced pre-clinical studies, this compound revealed antitumor potential with no toxic side effects. It has also been shown

to selectively kill human cancer cells without affecting normal/healthy cells and also to significantly suppress tumor growth

in immune-deficient mice models. Scientific publications describe sigma receptor ligands positively, highlighting the possibility

that these ligands may stop tumor growth and induce selective cell death in various tumor cell lines. Sigma receptors are highly

expressed in different tumor cell types. Binding by appropriate sigma-1 and/or sigma-2 ligands can induce selective apoptosis.

In addition, through tumor cell membrane reorganization and interactions with ion channels, our drug candidates may play an important

role in inhibiting the processes of metastasis (spreading of cancer cells from the original site to other parts of the body),

angiogenesis (the formation of new blood vessels) and tumor cell proliferation.

Our

compounds are in the pre-clinical and clinical testing stages of development, and there is no guarantee that the activity demonstrated

in pre-clinical models will be shown in human testing.

Our

Target Indications

We

have developed compounds with potential application to two broad categories and several specific indications. The two categories

are diseases of the central nervous system, and cancer. Specific indications include:

•

Alzheimer’s disease — In 2015, an estimated 5.3 million Americans were suffering from Alzheimer’s disease.

The Alzheimer’s Association

®

reports that by 2025, 7.1 million

Americans will be afflicted by the disease, a 40 percent increase from currently affected patients. Medications on the market

today treat only the symptoms of AD and do not have the ability to stop its onset or its progression. There is an urgent and unmet

need for both a disease modifying cure for Alzheimer’s disease as well as for better symptomatic treatments.

•

Depression — Depression is a major cause of morbidity worldwide according to the World Health Organization (WHO).

Pharmaceutical treatment for depression is dominated by blockbuster brands, with the leading nine brands accounting for approximately

75% of total sales. However, the dominance of the leading brands is waning, largely due to the effects of patent expiration and

generic competition.

•

Epilepsy — Epilepsy is a common chronic neurological disorder characterized by recurrent unprovoked seizures. These

seizures are transient signs and/or symptoms of abnormal, excessive or synchronous neuronal activity in the brain. According to

the Centers for Disease Control and Prevention, epilepsy affects 2.2 million Americans. Today, epilepsy is often controlled, but

not cured, with medication that is categorized as older traditional anti-epileptic drugs and second generation anti epileptic

drugs. Because epilepsy afflicts sufferers in different ways, there is a need for drugs used in combination with both traditional

anti-epileptic drugs and second generation anti-epileptic drugs. GBI Research estimates that the epilepsy market will increase

to $4.5 billion by 2019.

4

•

Neuropathic Pain — We define neuralgia, or neuropathic pain, as pain that

is not related to activation of pain receptor cells in any part of the body. Neuralgia

is more difficult to treat than some other types of pain because it does not respond

well to normal pain medications. Special medications have become more specific to neuralgia

and typically fall under the category of membrane stabilizing drugs or antidepressants.

•

Malignant Melanoma — Predominantly a skin cancer, malignant melanoma can also occur in melanocytes found in the bowel

and the eye. Malignant melanoma accounts for 75% of all deaths associated with skin cancer. The treatment includes surgical removal

of the tumor, adjuvant treatment, chemo and immunotherapy, or radiation therapy. According to IMS Health the worldwide Malignant

Melanoma market is expected to grow to $4.4 billion by 2022.

•

Prostate Cancer — Specific to men, prostate cancer is a form of cancer that develops in the prostate, a gland in

the male reproductive system. The cancer cells may metastasize from the prostate to other parts of the body, particularly the

bones and lymph nodes. Drug therapeutics for Prostate Cancer are expected to increase to nearly $18.6 billion in 2017 according

to BCC Research.

•

Pancreatic Cancer — Pancreatic cancer is a malignant neoplasm of the pancreas. In the United States approximately

45,000 new cases of pancreatic cancer will be diagnosed this year and approximately 38,000 patients will die as a result of their

cancer. Sales predictions by GlobalData forecast that the market for the pharmaceutical treatment of pancreatic cancer in the

five largest European countries and the United States, will increase to $1.63 billion by 2017.

Corporate

Information

Our

principal executive office is located at 51 West 52

nd

Street, 7

th

Floor, New York, NY 10019-6163, and our telephone number is 844.689.3939. Our website address is

www.anavex.com

.

No information found on our website is part of this prospectus. Also, this prospectus may include the names of various government

agencies or the trade names of other companies. Unless specifically stated otherwise, the use or display by us of such other parties’

names and trade names in this prospectus is not intended to and does not imply a relationship with, or endorsement or sponsorship

of us by, any of these other parties.

The

Offerings

Primary

Offering

We

may offer and sell, from time to time, in one or more offerings, the securities that we describe in this prospectus having a total

initial offering price not exceeding $100,000,000 at prices and on terms to be determined by market conditions at the time of

any offering.

Secondary

Offering

On

October 21, 2015, the Company entered into a purchase agreement (the “

Purchase Agreement

”) with the Selling

Security Holder (such transaction, the “

Financing

”), pursuant to which the Selling Security Holder agreed to

purchase from us up to $50,000,000 of our Common Stock (subject to certain limitations) from time to time over a 36-month period.

In connection with the Financing, the Company also entered into a registration rights agreement with the Selling Security Holder

(the “

RRA

”) whereby the Company agreed to file a registration statement, of which this prospectus is a part,

with the U.S. Securities and Exchange Commission (“

SEC

”) covering the shares of the Company’s Common

Stock that may be issued to the Selling Security Holder under the Purchase Agreement. 6,754,609 shares of Common Stock are being

registered under the registration statement of which this prospectus is a part, in connection with the Company’s obligations

under the Purchase Agreement and the RRA.

After

the registration statement, of which this prospectus is a part, is declared effective, the Company may, from time to time and

at its sole discretion, direct the Selling Security Holder to purchase up to 50,000 shares of our Common Stock on any such business

day, provided that in no event shall the Selling Security Holder purchase more than $2,000,000 worth of our Common Stock on any

single business day, plus an additional “accelerated amount” under certain circumstances. Except as described in this

prospectus, there are no trading volume requirements or restrictions under the Purchase Agreement, and we will control the timing

and amount of any sales of our Common Stock to the Selling Security Holder. The purchase price of the up to 50,000 shares that

may be sold to the Selling Security Holder under the Purchase Agreement on any business day will be based on the market price

of our Common Stock immediately preceding the time of sale as computed under the Purchase Agreement without any fixed discount.

The purchase price per share will be equitably adjusted for any reorganization, recapitalization, non-cash dividend, forward or

reverse stock split, or other similar transaction occurring during the business days used to compute such price. We may at any

time in our sole discretion terminate the Purchase Agreement without fee, penalty or cost upon one business day’s notice.

5

The

Purchase Agreement contains customary representations, warranties, covenants, closing

conditions and indemnification and termination provisions by, among and for the benefit

of the parties. The Selling Security Holder has covenanted not to cause or engage in

any manner whatsoever, any direct or indirect short selling or hedging of the Company’s

Common Stock.

In

consideration for entering into the Purchase Agreement, the Company issued to the Selling Security Holder, 179,598 shares of Common

Stock as a commitment fee and shall issue up to 89,799 shares pro rata, which commitment fee shares are also being registered

hereunder, when and if, the Selling Security Holder purchases at the Company’s discretion the $50,000,000 aggregate commitment.

The Purchase Agreement may be terminated by the Company at any time at its discretion without any cost to the Company.

This

prospectus provides you with a general description of the securities we and the Selling Security Holder may offer. Each time we

offer a type or series of securities under this prospectus, we will provide a prospectus supplement that will describe the specific

amounts, prices and other important terms of the securities.

General

The

prospectus supplement also may add, update or change information contained in this prospectus or in documents we have incorporated

by reference into this prospectus. However, no prospectus supplement will fundamentally change the terms that are set forth in

this prospectus or offer a security that is not registered and described in this prospectus at the time of its effectiveness.

Where

You Can Find More Information

We

are subject to the information requirements of the Securities Exchange Act of 1934 (the “

Exchange

Act

”).

Accordingly, we file annual, quarterly and current reports, proxy statements as may be required and other information with the

SEC and filed a registration statement on Form S-3 under the Securities Act relating to the securities offered by this prospectus.

This prospectus, which forms part of the registration statement, does not contain all of the information included in the registration

statement. For further information, you should refer to the registration statement and its exhibits.

You

may read and copy the registration statement and any document we file with the SEC at the SEC’s Public Reference Room at

100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of

the Public Reference Room. You can also review our filings by accessing the website maintained by the SEC at

http://www.sec.gov

.

The site contains reports, proxy and information statements and other information regarding issuers that file electronically with

the SEC. In addition to the foregoing, we maintain a website at

http://www.anavex.com

. Our website content is made available

for informational purposes only. It should neither be relied upon for investment purposes nor is it incorporated by reference

into this prospectus. We make available at

http://www.anavex.com/investors/share-data/

copies of our Annual Reports on

Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K and any amendments to such document as soon as practicable

after we electronically file such material with or furnish such documents to the SEC.

6

SELECTED

FINANCIAL DATA

The

following selected financial data should be read in conjunction with our financial statements and the related notes contained

in Item 8 of Part II of our Annual Report on Form 10-K for the fiscal year ended September 30, 2015 and our interim consolidated

financial statements and the related notes contained in Item 1 of Part I of our Quarterly Report on Form 10-Q for the quarter

ended June 30, 2016, which are incorporated by reference into this prospectus, except that share and per share information for

the years ended September 30, 2015 and 2014 and for the nine months ended June 30, 2016 and 2015 have been revised to reflect

the reverse stock split of our issued and outstanding shares of Common Stock effective on October 7, 2015, at a ratio of 1 to

4. The selected data in this section is not intended to replace such financial statements, except that share and per share information

has been revised for the periods presented to reflect the reverse stock split at a ratio of 1 to 4.

We

have derived the statements of operations data for each of the years ended September 30, 2015 and 2014 and the balance sheet data

as of September 30, 2015 and 2014 from the audited consolidated financial statements contained in Item 8 of Part II of our Annual

Report on Form 10-K for the year ended September 30, 2015. The consolidated statement of operations data set forth below for the

nine months ended June 30, 2016 and 2015 and the consolidated balance sheet data as of June 30, 2016 has been derived from our

consolidated financial statements included in Item 1 of Part I of our Quarterly Report on Form 10-Q for the quarter ended June

30, 2016, which is incorporated by reference into this prospectus.

The

historical financial information set forth below may not be indicative of our future performance and should be read together with

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our historical consolidated

financial statements and notes to those statements included in Item 7 of Part II and Item 8 of Part II, respectively, of our Annual

Report on Form 10-K for the year ended September 30, 2015, “Management’s Discussion and Analysis of Financial Condition

and Results of Operations” and our historical financial statements and notes to those statements included in Item 2 of Part

I and Item 1 of Part I, respectively, of our Quarterly Report on Form 10-Q for the quarter ended June 30, 2016, and updates thereto

reflected in subsequent filings with the SEC, and all other annual, quarterly and other reports that we file with the SEC after

the date of this prospectus and that also are incorporated herein by reference.

|

|

|

Nine

months ended June 30,

|

|

|

|

|

|

|

|

Research

and development expenses

|

|

$

|

2,915,432

|

|

|

$

|

1,525,233

|

|

|

General

and administrative expenses

|

|

|

6,090,835

|

|

|

|

1,616,744

|

|

|

Net

loss

|

|

|

(8,225,666

|

)

|

|

|

(6,751,821

|

)

|

|

Net

loss per share, basic and diluted

|

|

|

(0.24

|

)

|

|

|

(0.44

|

)

|

|

Weighted

average number of common shares, basic and diluted

|

|

|

34,961,838

|

|

|

|

15,438,000

|

|

|

|

|

Year

ended September 30,

|

|

|

|

|

|

|

|

Research

and development expenses

|

|

$

|

2,271,736

|

|

|

$

|

732,395

|

|

|

|

|

|

|

|

|

|

|

|

|

General

and administrative expenses

|

|

|

4,836,978

|

|

|

|

2,236,580

|

|

|

Net

loss

|

|

|

(12,108,130

|

)

|

|

|

(9,968,353

|

)

|

|

Net

loss per share

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

(0.65

|

)

|

|

|

(1.02

|

)

|

|

Diluted

|

|

|

(0.65

|

)

|

|

|

(1.02

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Weighted

average number of common shares, basic and diluted

|

|

|

18,584,820

|

|

|

|

9,804,539

|

|

7

Selected

Balance Sheet Data

|

|

|

At

June 30, 2016

|

|

At

September 30,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

|

|

$9,727,040

|

|

$15,290,976

|

|

$7,262,138

|

|

Working

Capital

|

|

7,670,925

|

|

12,808,083

|

|

5,910,106

|

|

Total

Assets

|

|

9,843,973

|

|

15,469,913

|

|

7,353,502

|

|

Long-term

debt

|

|

345

|

|

332

|

|

263,727

|

|

Total

Stockholders’ Equity

|

|

|

7,671,086

|

|

|

12,809,003

|

|

|

192,626

|

|

|

|

|

|

|

|

|

|

|

|

8

R

ISK

FACTORS

An

investment in our securities which may be offered hereby is subject to numerous risks, including the risks described under the

caption “Risk Factors” in our Annual Report on Form 10-K for the year ended September 30, 2015, which is incorporated

by reference herein. You should carefully consider these risks, along with the information provided elsewhere in this prospectus