Highlights of First Quarter

2018:

Seanergy Maritime Holdings Corp. (the “Company”) (NASDAQ:SHIP)

announced today its financial results for the first quarter ended

March 31, 2018.

For the quarter ended March 31, 2018, the

Company generated net revenues of $21.3 million, a 60% increase

compared to the first quarter of 2017. As of March 31, 2018,

stockholders’ equity was $37.2 million and cash and cash

equivalents, including restricted cash, was $8.2 million.

Stamatis Tsantanis, the Company’s

Chairman & Chief Executive Officer, stated:

“Our financial results for the quarter that

ended on March 31, 2018 were improved due to the higher average

daily charter rates earned by our vessels, and the addition of the

M/V Partnership to our fleet in the second quarter of 2017,

resulting in a 10% increase in our total ownership days.

Specifically, we achieved a daily time charter equivalent (“TCE”)1

rate of $11,712 in the first quarter of 2018, which is 92% higher

than the $6,106 per day earned in the first quarter of 2017.

“The improvement in charter rates was reflected

positively in our financial performance, as EBITDA for the first

quarter of 2018 increased to $4.6 million as compared to a negative

EBITDA of $62 thousand in the same period of 2017. Our bottom line

was affected by sizeable non-cash expenses including $934 thousand

in non-cash amortization of our convertible notes.

“Most importantly, our corporate leverage has

drastically improved following the commencement of debt principal

repayments in all our bank facilities in the last quarter of 2017,

as well as with the refinancing of the M/V Championship in the

third quarter of 2017. In this context, our book equity has

strengthened significantly by increasing to $37.2 million as of

March 31, 2018 from $26.7 million as of March 31, 2017. Our total

equity, as adjusted for the market value of our fleet, stood at

$40.7 million as of March 31, 2018, as compared to $5.8 million as

of March 31, 2017.

“As regards general market conditions, in the

first quarter of 2018 we experienced a period of weakness caused by

adverse weather conditions in Brazil and a slowdown in Chinese

imports due to the Chinese New Year, which was further exacerbated

by restrictions on industrial production introduced in 2017

pursuant to environmental regulations. Nevertheless, in the first

quarter of 2018 the market increased materially in terms of the

daily average earnings of the Baltic Capesize Index as compared to

the same period in 2017, mainly due to the dramatic reduction in

newbuilding deliveries, which is expected to continue for the

foreseeable future. Overall we expect the seaborne transportation

of iron ore and coal to increase by 3% to 4% on an annual basis

while the historically low order book should facilitate a

substantial increase in freight rates.

“Having delivered a significant improvement in

our performance during what is seasonally the weakest and most

volatile part of the year, we are optimistic about the second half

of 2018, and we remain confident that the improved day-rate and

asset value environment should further benefit the net asset value

of our fleet.”

1 EBITDA and Time Charter Equivalent (“TCE”)

rate are non-GAAP measures. Please see the reconciliation below of

EBITDA to net loss and TCE rate to net revenues from vessels, in

each case the most directly comparable U.S. GAAP measure.

Company Fleet:

|

Vessel Name |

Vessel Class |

Capacity (in dwt) |

Year Built |

Yard |

|

Championship |

Capesize |

179,238 |

2011 |

Sungdong |

|

Partnership (1) |

Capesize |

179,213 |

2012 |

Hyundai |

|

Knightship (2) |

Capesize |

178,978 |

2010 |

Hyundai |

|

Lordship (3) |

Capesize |

178,838 |

2010 |

Hyundai |

|

Gloriuship |

Capesize |

171,314 |

2004 |

Hyundai |

|

Leadership |

Capesize |

171,199 |

2001 |

Koyo – Imabari |

|

Geniuship |

Capesize |

170,057 |

2010 |

Sungdong |

|

Premiership |

Capesize |

170,024 |

2010 |

Sungdong |

|

Squireship |

Capesize |

170,018 |

2010 |

Sungdong |

|

Guardianship |

Supramax |

56,884 |

2011 |

CSC Jinling |

|

Gladiatorship |

Supramax |

56,819 |

2010 |

CSC Jinling |

| Total / Average |

|

1,682,582 |

9.2

years |

|

(1) This vessel is being chartered by a

major European utility and energy company and was delivered to the

charterer on June 13, 2017 for a period of employment of about 12

months to about 18 months at a gross daily rate of $16,200.

(2) This vessel was sold to and leased

back from a major Chinese leasing institution on June 29, 2018 for

an eight year period.

(3) This vessel is being chartered by a

major European charterer and was delivered to the charterer on June

28, 2017 for a period of about 18 months to about 22 months. The

net daily charter hire is calculated at an index linked rate based

on the five routes average time charter rate of the Baltic Capesize

Index. In addition, the time charter provides us an option for any

period of time during the term to be converted into a fixed rate

time charter with a duration of between three months and 12 months,

with a rate corresponding to the prevailing value of the respective

Capesize forward freight agreement.

Fleet Data:

(U.S. Dollars in thousands)

|

|

Q1 2018 |

|

Q1 2017 |

|

|

Ownership days (1) |

|

990 |

|

|

900 |

|

|

Available days (2) |

|

990 |

|

|

887 |

|

|

Operating days (3) |

|

987 |

|

|

885 |

|

|

Fleet utilization (4) |

|

99.7 |

% |

|

98.3 |

% |

|

TCE rate (5) |

$ |

11,712 |

|

$ |

6,106 |

|

|

Daily Vessel Operating Expenses (6) |

$ |

5,114 |

|

$ |

4,648 |

|

(1) Ownership days are the total number of

calendar days in a period during which the vessels in a fleet have

been owned. Ownership days are an indicator of the size of the

Company’s fleet over a period and affect both the amount of

revenues and the amount of expenses that the Company recorded

during a period.

(2) Available days are the number of

ownership days less the aggregate number of days that the vessels

are off-hire due to drydockings, special and intermediate surveys,

or days when the vessels are in lay-up. The shipping industry uses

available days to measure the number of ownership days in a period

during which the vessels should be capable of generating revenues.

During the three months ended March 31, 2018, the Company incurred

0 off-hire days for vessel dry dockings. During the three months

ended March 31, 2017, the Company incurred 13 off-hire days for one

vessel dry docking.

(3) Operating days are the number of

available days in a period less the aggregate number of days that

the vessels are off-hire due to unforeseen circumstances. The

shipping industry uses operating days to measure the aggregate

number of days in a period during which the vessels actually

generate revenues. In the quarter ended March 31, 2018, the Company

incurred three off-hire days due to unforeseen circumstances. In

the quarter ended March 31, 2017, the Company incurred two off-hire

days due to unforeseen circumstances.

(4) Fleet utilization is the percentage of

time that the vessels are generating revenue, and is determined by

dividing operating days by ownership days for the relevant

period.

(5) Time Charter Equivalent (TCE) rate is

defined as the Company’s net revenue less voyage expenses during a

period divided by the number of the Company’s operating days during

the period. Voyage expenses include port charges, bunker (fuel oil

and diesel oil) expenses, canal charges and other commissions. The

Company includes the TCE rate, a non-GAAP measure, as it believes

it provides additional meaningful information in conjunction with

net revenues from vessels, the most directly comparable U.S. GAAP

measure, and because it assists the Company’s management in making

decisions regarding the deployment and use of the Company’s vessels

and in evaluating their financial performance. The Company’s

calculation of TCE rate may not be comparable to that reported by

other companies. The following table reconciles the Company’s net

revenues from vessels to the TCE

rate. (In thousands

of U.S. Dollars, except operating days and TCE rate)

|

|

Q1 2018 |

Q1 2017 |

| Net revenues from

vessels |

21,322 |

13,322 |

| Less: Voyage

expenses |

9,762 |

7,918 |

| Net operating

revenues |

11,560 |

5,404 |

| Operating days |

987 |

885 |

| TCE rate |

11,712 |

6,106 |

| |

|

|

(6) Vessel operating expenses include crew

costs, provisions, deck and engine stores, lubricants, insurance,

maintenance and repairs. Daily Vessel Operating Expenses are

calculated by dividing vessel operating expenses by ownership days

for the relevant time periods. The Company’s calculation of daily

vessel operating expenses may not be comparable to that reported by

other companies. The following table reconciles the Company’s

vessel operating expenses to daily vessel operating

expenses. (In

thousands of U.S. Dollars, except ownership days and Daily Vessel

Operating Expenses)

|

|

Q1 2018 |

Q1 2017 |

| Vessel operating

expenses |

5,063 |

4,183 |

| Ownership days |

990 |

900 |

| Daily Vessel Operating

Expenses |

5,114 |

4,648 |

| |

|

|

EBITDA Reconciliation:(In thousands of U.S.

Dollars)

|

|

Q1 2018 |

|

Q1 2017 |

|

|

Net loss |

(3,442 |

) |

(6,285 |

) |

|

Add: Net interest and finance cost |

5,141 |

|

3,596 |

|

|

Add: Taxes |

- |

|

4 |

|

|

Add: Depreciation and amortization |

2,939 |

|

2,623 |

|

|

EBITDA |

4,638 |

|

(62 |

) |

Earnings Before Interest, Taxes, Depreciation

and Amortization ("EBITDA") represents the sum of net income /

(loss), interest and finance costs, interest income, depreciation

and amortization and, if any, income taxes during a period. EBITDA

is not a recognized measurement under U.S. GAAP.

EBITDA is presented as we believe that this

measure is useful to investors as a widely-used means of evaluating

operating profitability. EBITDA as presented here may not be

comparable to similarly-titled measures presented by other

companies. This non-GAAP measure should not be considered in

isolation from, as a substitute for, or superior to, financial

measures prepared in accordance with U.S. GAAP.

First Quarter 2018 Developments:

Relaxation on Loan Facility and Covenant

Deferrals

On March 28, 2018, the Company agreed

proactively with HSH Nordbank AG (i) to temporarily defer the

application date of the security cover undertaking until September

2018 and temporarily relax the security cover undertaking until

September 2019 and (ii) to temporarily amend and relax

until June 2019, certain other financial covenants contained

in its senior secured loan facility dated September 1, 2015, as

this has been further amended.

Subsequent Developments:

Relaxation on Loan Facilities and

Covenant Deferrals

On April 30, 2018, the Company agreed

proactively with UniCredit Bank (i) to temporarily relax the

minimum security cover undertaking until June 2019 and (ii) to

temporarily amend and relax until June 2019 certain other financial

covenants contained in its senior secured loan facility dated

September 11, 2015, as this has been further amended.

On May 18, 2018, the Company agreed proactively

with Amsterdam Trade Bank to temporarily amend and relax until June

2019 certain of its financial covenants contained in its senior

secured loan facility dated May 24, 2017, as amended and restated

on September 25, 2017.

On June 29, 2018, the Company agreed with Alpha

Bank (i) to temporarily waive and defer the application date of the

security requirement undertaking until March 2021 and (ii) to

temporarily amend and relax until June 2019 certain other financial

covenants contained in its senior secured loan facilities dated

March 6, 2015 and November 4, 2015, respectively, as these have

been further amended.

Refinancing of the M/V Lordship and M/V

Knightship

New Loan Facility

On June 11, 2018, the Company entered into a

$24.5 million loan agreement for the purpose of refinancing the

outstanding indebtedness of M/V Lordship under the previous loan

facility with Northern Shipping Funds dated November 28, 2016. The

earliest maturity date of the new facility is in June 2023, which

can be extended until June 2025 subject to certain conditions.

Sale and Leaseback

Transaction

On June 28, 2018, the Company has entered into a

$26.5 million sale and leaseback transaction for the M/V Knightship

with a major Chinese leasing institution for the purpose of

refinancing the outstanding indebtedness of M/V Knightship under

the previous loan facility with Northern Shipping Funds dated

November 28, 2016. Seanergy sold and chartered back the vessel on a

bareboat basis for an eight year period, having a purchase

obligation at the end of the eighth year. The Company has the

option to repurchase M/V Knightship at any time following the

second anniversary of the bareboat charter party.

Following these two transactions, the aggregate

amount of capital released was approximately $10 million.

Seanergy Maritime Holdings

Corp.Unaudited Condensed Consolidated Balance Sheets(In

thousands of U.S. Dollars)

| |

| |

|

March 31, 2018 |

|

|

December 31,2017* |

|

|

ASSETS |

|

|

|

|

|

|

| Cash and

restricted cash |

|

8,240 |

|

|

11,039 |

|

| Vessels,

net |

|

252,028 |

|

|

254,730 |

|

| Other

assets |

|

9,055 |

|

|

9,936 |

|

| TOTAL

ASSETS |

|

269,323 |

|

|

275,705 |

|

|

|

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

| Bank

debt |

|

190,794 |

|

|

195,021 |

|

|

Convertible promissory note |

|

7,719 |

|

|

6,785 |

|

| Due to

related parties |

|

17,344 |

|

|

17,342 |

|

| Other

liabilities |

|

16,250 |

|

|

15,244 |

|

|

Stockholders’ equity |

|

37,216 |

|

|

41,313 |

|

| TOTAL

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

269,323 |

|

|

275,705 |

|

| |

*Derived from the

audited consolidated financial statements as of the period as of

that date

Seanergy Maritime Holdings

Corp.Unaudited Condensed Consolidated Statements of

Operations (In thousands of U.S. Dollars, except for share and

per share data, unless otherwise stated)

| |

|

| |

|

Three months endedMarch 31, |

|

| |

|

2018 |

|

2017 |

|

|

Revenues: |

|

|

|

|

|

| Vessel

revenue, net |

|

21,322 |

|

13,322 |

|

|

Expenses: |

|

|

|

|

|

| Voyage

expenses |

|

(9,762 |

) |

(7,918 |

) |

| Vessel

operating expenses |

|

(5,063 |

) |

(4,183 |

) |

|

Management fees |

|

(264 |

) |

(240 |

) |

| General

and administrative expenses |

|

(1,552 |

) |

(1,039 |

) |

|

Depreciation and amortization |

|

(2,939 |

) |

(2,623 |

) |

| Operating

income / (loss) |

|

1,742 |

|

(2,681 |

) |

| Other

expenses: |

|

|

|

|

|

| Interest

and finance costs |

|

(5,141 |

) |

(3,603 |

) |

| Other,

net |

|

(43 |

) |

(1 |

) |

| Total other

expenses, net: |

|

(5,184 |

) |

(3,604 |

) |

| Net

loss |

|

(3,442 |

) |

(6,285 |

) |

|

|

|

|

|

|

|

| Net loss per

common share, basic |

|

(0.09 |

) |

(0.18 |

) |

| Weighted average number

of common shares outstanding, basic |

|

36,877,095 |

|

34,291,347 |

|

| |

|

|

|

|

|

About Seanergy Maritime Holdings Corp.

Seanergy Maritime Holdings Corp. is an

international shipping company that provides marine dry bulk

transportation services through the ownership and operation of dry

bulk vessels. The Company currently operates a modern fleet of

eleven dry bulk carriers, consisting of nine Capesizes and two

Supramaxes, with a combined cargo-carrying capacity of

approximately 1,682,582 dwt and an average fleet age of about 9.2

years.

The Company is incorporated in the Marshall

Islands with executive offices in Athens, Greece and an office in

Hong Kong. The Company's common shares and class A warrants trade

on the Nasdaq Capital Market under the symbols “SHIP” and “SHIPW”,

respectively.

Please visit our company website at:

www.seanergymaritime.com

Forward-Looking Statements

This press release contains forward-looking

statements (as defined in Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended) concerning future events. Words such as "may",

"should", "expects", "intends", "plans", "believes", "anticipates",

"hopes", "estimates" and variations of such words and similar

expressions are intended to identify forward-looking statements.

These statements involve known and unknown risks and are based upon

a number of assumptions and estimates, which are inherently subject

to significant uncertainties and contingencies, many of which are

beyond the control of the Company. Actual results may differ

materially from those expressed or implied by such forward-looking

statements. Factors that could cause actual results to differ

materially include, but are not limited to, the Company's ability

to continue as a going concern; the Company's operating or

financial results; the Company's liquidity, including its ability

to pay amounts that it owes and obtain additional financing in the

future to fund capital expenditures, acquisitions and other general

corporate activities; competitive factors in the market in which

the Company operates; shipping industry trends, including charter

rates, vessel values and factors affecting vessel supply and

demand; future, pending or recent acquisitions and dispositions,

business strategy, areas of possible expansion or contraction, and

expected capital spending or operating expenses; risks associated

with operations outside the United States; and other factors listed

from time to time in the Company's filings with the SEC, including

its most recent annual report on Form 20-F. The Company's filings

can be obtained free of charge on the SEC's website at www.sec.gov.

Except to the extent required by law, the Company expressly

disclaims any obligations or undertaking to release publicly any

updates or revisions to any forward-looking statements contained

herein to reflect any change in the Company's expectations with

respect thereto or any change in events, conditions or

circumstances on which any statement is based.

For further information please

contact:Capital Link, Inc.Paul Lampoutis230 Park Avenue

Suite 1536New York, NY 10169Tel: (212) 661-7566E-mail:

seanergy@capitallink.com

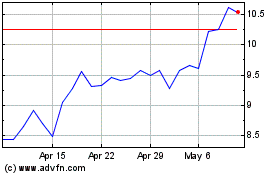

Seanergy Maritime (NASDAQ:SHIP)

Historical Stock Chart

From Mar 2024 to Apr 2024

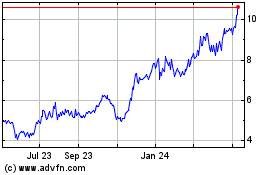

Seanergy Maritime (NASDAQ:SHIP)

Historical Stock Chart

From Apr 2023 to Apr 2024