July 1, 2018

Quarterly Report Under Section 13 or 15(d) of

The Securities Exchange Act of 1934

Commission File Number 333-65069

EXACT NAME as this appears in our Charter: Access Power, Inc.

YEAR: 1996

STATE OF INC: FLORIDA

QUARTERLY REPORT Period Ending: June 30, 2018

I.R.S. Employer Identification No. 59-3420985

17164 Dune View Dr # 106 Grand Haven, MI 49417

(Address of principal executive office) (Zip Code)

Issuer's telephone number, including area code: (616) 312-5390

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-QSB

/X/ Quarterly Report Under Section 13 or 15(d) of

The Securities Exchange Act of 1934

For the Quarterly Period Ended March 31, 2001

/_/ Transition Report Under Section 13 or 15(d) of The Exchange Act

Commission File Number 333-65069

Access Power, Inc.

(Exact Name of Small Business Issuer as Specified in its Charter)

Florida 59-3420985

(State or other jurisdiction of

(State or other jurisdiction of

|

Corporation or organization) (I.R.S. Employer Identification No.)

17164 Dune View Drive Apt 106, Grand Haven MI 49417

(Address of principal executive office) (Zip Code)

Issuer's telephone number, including area code: (616)312-5390

Transitional Small Business Disclosure Format (check one): Yes __ No X

SMALL

Smaller Reporting Company: Yes X NO ___

Emerging Growth Company: Yes X NO ___

|

The Company is aware that the ECG disclosure occured in the Fall 2017.

We are including this disclosure in our financial documents because we

intend to catch up our on filings. A Super 10K

was discussed with the Commission; however, we have elected to file

individual quarterly and annual reports as required by federal law.

https://www.sec.gov/rules/final/2017/33-10332.pdf

Indicate whether registrant is a shell company: Yes ___ NO X

MOST RECENT CLOSING PRICE $.0006 PER SHARE. There is no bid for our

common stock while ACCR is traded on the grey sheets.

AS OF THE CLOSE OF BUSINESS JUNE 30, 2018, THE AGGREGATE MARKET

CAPITALIZATION ON A FULLY DILLUTED BASIS IS $ 146,486.27, BASED ON A

CLOSING PRICE OF $.0006 PER SHARE.

****CURRENT UPDATE****

pjensen@myaccess-power.com

http://www.myaccess-power.com

https://www.otcmarkets.com/stock/ACCR/profile

Management has decided to retain the IRS EIN# 59-3420985 now that we are

officially IRS debt free.

As of July 1, 2018

Authorized Common Stock: 500,000,000

Outstanding Common Stock: 244,144,121

Available Stock for Issuance: 255,855,879

Restricted Common Stock: 129,641,475

We have $168.36 in our premiere checking account now.

ROAD OF PERDITION to a SONG OF HOPE

https://www.youtube.com/watch?v=xbhCPt6PZIU

In 2012, Access-Power, Inc. created owned the website

http://www.access-power.com

https://web.archive.org/web/20120918231458/http://www.access-power.com:80

Sometime in 2013, someone purchsed our website, and the owner

http://www.dmcc.ae purchased our website. The DUBAI GOVERNMENT

owns the website, and it saysso on their website:

"The Website is owned and operated by Access, whose principal office is at

Office 3001, BB1 Tower Mazaya Business Avenue, JLT, PO Box 73766 Dubai,

UAE. Access is a Dubai Multi Commodities Center Companies."

http://www.access-power.com/terms-and-conditions

I want to buy it back! That is the reason for my new website

http://www.myaccess-power.com.

Management plans to sell controlling interest to Access-Power MEA, via

a merger with the hopes of one day granting them the ability to finance

their global growth renewable projects around the World. We share the

same name, and that is all we share at the moment. There

is a very good chance that we will never sell the Corporation. ACWA POWER

was in the news very recently with stated plans to go public sooner rather

than later:

https://www.arabianbusiness.com/energy/399394-acwa-power-

considering-an-ipo-sooner-rather-than-later

We have only dreams that Wall Street will help us, and communicate our

story with them. We have no relationship to Access Power MEA or

ACWA POWER. We plan to sell controlling interest in the Company,

so that they can use our common stock as a way to fund their Global

Growth in the power renewables energy sector.

No one in the United States can use our Company name. We have priority

dating back to October 10, 1996. The Florida Secretary of State will

protect our Shareholders from any entity that tries to copy and

mimick our name. In addition, Management is diligently working

towards its #1 goal at the current moment:

#1 GOAL IS TO GET ACCESS-POWER, INC OFF THE GREY SHEETs.

Priority will be to secure a

Market Maker, who will file a Form 211 with FINRA. We are 100% committed

to achieving this goal. We are current in all our SEC filings, as

required by federal law.

There are many barriers to re-entry, so many.

For one, there is coordination between the SEC, FINRA,

CUSIP, DTC, the transfer agent, and OTCMARKETS.com.

Many entities do not want our Company to comeback. There is a

good chance that We will fail. However, if you believe that Patrick

J Jensen is going to fail, we have one thing to say in regards to this:

YOU GOT ANOTHER THING COMING!

Patrick

Part I. Financial Information

Item 1. Financial Statements

ACCESS-POWER, INC.

(An Emerging Growth Company)

UNAUDITED

Balance Sheets Comps

Assets

June 30, March 31,

2018 2018

------------------ -------------------

(unaudited)

Current assets:

Cash $168.36 $ 0

CDs

Accounts receivable $ 0 $ 0

Prepaid expenses $ 0 $ 0

---------------------------------------

Total current assets $168.36 $ 0

---------------------------------------

Property and equipment, net $ 0 $ 0

Other assets $ 0 $ 0

---------------------------------------

Total assets $168.36 $ 0

=======================================

Liabilities and

Stockholders' Equity

(Deficit)

Current liabilities:

Accounts payable and accrued

expenses $0 $ 0

Current portion of

long-term debt - -

Total current liabilities $ 0 $ 0

Convertible debentures $ 0 $ 0

------------------ ------------------

Total liabilities $ 0 $ 0

---------------------------------------

Stockholders' equity

(deficit):

Common stock,

$.001 par value,

authorized

500,000,000 shares,

issued and outstanding

244,144,121

and 244,144,121 shares

as of June 30, 2018

and Dec 31, 2017 244,144.12 $ 0

=======================================

|

Total liabilities

and stockholders'

equity (deficit) $ 244,312.48 $ 0

ACCESS-POWER, INC

CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS (unaudited)

THREE MONTHS ENDED JUNE 30, 2018

STARTED OPERATION as June 4, 2018 OPERATIONS

CASH FLOW

REVENE $ 3,209.00

COST OF REVENUE $ 3,100.00

----------------------------------------------------------

GROSS PROFIT (LOSS) $ 109.00

|

OPERATING EXPENSES

Selling, general and administrative exp

rent, and utilities $ 2,100.00

Consulting fees $ 0.00

Professional fees and related expenses $ 999.00

TOTAL OPERATING EXPENSES $ 3,100.00

Salaries $ 1.00

Fair value of derivative liability $ 0.00

OTHER INCOME nonrecurring $ 0.00

Gain on debt extinguishment $ 0.00

(LOSS) INCOME BEFORE PROVISION FOR $ 0.00

INCOME TAXES $ 0.00

PROVISION FOR INCOME TAXES

treated as prepaid expense on

balance sheet $ 0.00

NET (LOSS) INCOME $ 3,209.00

BASIC (LOSS) INCOME PER SHARE

DILUTED (LOSS) INCOME PER SHARE $ nil

WEIGHTED AVERAGE COMMON SHARES

OUTSTANDING BASIC 244,144,121 shares

RESTRICTED SHARES 129,641,475 shares

ESTIMATED FLOAT LESS THAN 103,000,000 shares

/s/

Patrick J Jensen

|

Item 2. MANAGEMENT'S DISCUSSION AND ANALYSIS

Overview and Plan of Operation

Business Overview

Access-Power, INC, or ACCR is a public holding company that serves the

various sectors in our economy. As of today, we only service the Work at

Home business model. Access-Power, Inc. has one (1) key employee.

We were incorporated back in October 1996. There was a change in control

in the Registrant on June 4, 2018.

ACCR is not currently offering any stock for sale.

Any stock to be purchased is available in the open market.

We are currently quoted in the grey market of the OTC.

We are current in our obligation to report with the SEC.

Access Power, INC owns at the moment Hunter Venture LLC, a Michigan

for profit Limited Liability Corporation. On June 4, 2018, Hunter

Venture became a wholly owned subsidiary of the Corporation.

Patrick J Jensen is a director with our company, and currently the only

employee working with Hunter Venture.

Mr. Jensen currently works about 40 hours per week with an intense

desire to return ACCR to the throne. Mr. Jensen currently services a

variety of businesses as an independent contractor. Some of his customers

include Pizza Hut, Disney Dining Reservations, and Carnival Cruise Lines.

Mr. Jensen also handles incoming (800) orders for Pro Active, Bare Minerals,

Office Depot, Derma Wand, Nutribullet, and many other infomercials that

cater to the retail segment of our economy. Mr. Jensen is a top salesman.

Mr. Jensen is fluent in Spanish. He graduated from Tulane University

with a Bachelor of Arts in Economics and a minor in Studio Art.

PART II - OTHER INFORMATION

Item 1. Legal Proceedings

NONE.

Item 2. Changes in Securities and Use of Proceeds

NONE.

ILLUSTRATIVE PURPOSES BELOW:

At $.0001 BID, the entire value of the Company shares on a fully

diluted basis is: $24,414.41

At $.001 BID, the entire value of the Company shares on a fully

diluted basis is: $244,144.12

At $.01 BID, the entire value of the Company shares on a fully

diluted basis is: $2,441,441.21

At $.06 BID, the entire value of the Company shaes on a fully

diluted basis is: $14,648,647.26

Management will make informed well processed decisions, and management

will succeed, as failure is not an option.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

There is no current risk with management. Everything is under control.

**********

Item 4. Controls and Procedures

Access-Power, Inc. will forever employ good management decisions.

PART II - OTHER INFORMATION

Item 1. Legal Proceedings

NONE

**********

Item 1A. Risk Factors

NONE

**********

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

NONE

**********

Item 3. Defaults Upon Senior Securities

NONE

**********

Item 4. Other Information

NONE.

**********

Item 5. Exhibits

(a) No Exhibits are being filed.

(b) No Reports on Form 8-K were filed during this period

Patrick J Jensen profile on LinkedIn:

https://www.linkedin.com/in/patrick-j-jensen-564946b4

I will promise to always be truthful and honest to my friends and family. We

have ZERO affiliation to Access-Power MEA, however, of all the names of

all the Power Companies in the World, why did someone in the Dubai Govt

decide to buy my old website, and call it the same name as our

Corporation. Almost, as if we were PICKED IN TIME. I do not know where this

road will lead us on this fixed-supply "244,144,121 person roller coaster ride."

Again, my #1 goal is to get our Company off the grey sheets. We are

actively seeking solicitations from a prospective market maker to

quote our securities and risk their firm capital for their gain. We believe

this is a winning proposition to their Form 211 filing.

At a closing price of $.0006, the whole Company is valued at $146,486.27.

pjensen@myaccess-power.com

616-312-5390

I will succeed because I am a WARRIOR!

SIGNATURES*

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on

its behalf by the undersigned thereunto duly authorized.

In accordance with the requirements of the Exchange Act, the Company caused this

report to be signed on its behalf by the undersigned, thereunto duly authorized.

ACCESS-POWER, INC.

BY:

/s/

Patrick J. Jensen

President, Treasurer, and Director

July 1, 2018

|

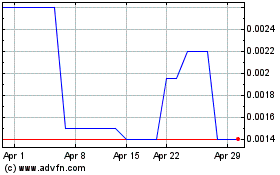

Access Power & (PK) (USOTC:ACCR)

Historical Stock Chart

From Mar 2024 to Apr 2024

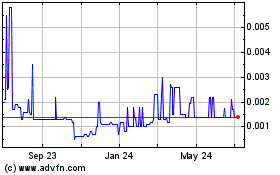

Access Power & (PK) (USOTC:ACCR)

Historical Stock Chart

From Apr 2023 to Apr 2024