Brown & Brown, Inc. Announces the Acquisition of Health Special Risk, Inc.

July 02 2018 - 6:45AM

J. Scott Penny, Chief Acquisitions Officer of Brown & Brown,

Inc. (NYSE:BRO), and Tom Lenihan and Phil Munson, the principals of

Health Special Risk, Inc. (“HSR”), today announce that Brown &

Brown, Inc. has acquired HSR.

Health Special Risk, which has been in business

for 40 years, is one of the leading providers of TPA and MGU

services for special risk and accident & health insurance. HSR

has annual revenues of approximately $6,500,000. The HSR team will

continue to operate from their offices in Texas and Minnesota as

Health Special Risk, Inc. Tom will remain as President of HSR

leading the new HSR profit center, and Phil, as Executive Vice

President, will continue to oversee the MGU operations of

HSR. Tom will report to Drew Smith, President of American

Specialty.

Drew Smith stated, “Tom, Phil and the HSR team

have been a constant in the special risk and accident & health

space for decades, providing top of class service for their clients

and carrier partners. We are excited about what they bring to our

collective capabilities and the complementary market focus that

they share with the American Specialty team.”

Tom and Phil are thrilled to join the Brown

& Brown team. “Through our partnership with Brown & Brown

and American Specialty, we will be provided opportunities for

growth far surpassing what we could do independently. The entire

HSR family is excited to join forces with Brown & Brown as we

enter this new phase of our journey.”

Brown & Brown, Inc., through its

subsidiaries, offers a broad range of insurance and reinsurance

products and related services. Additionally, certain Brown &

Brown subsidiaries offer a variety of risk management, third-party

administration, and other services. Serving business, public

entity, individual, trade and professional association clients

nationwide, Brown & Brown is ranked by Business Insurance

magazine as the United States’ sixth largest independent insurance

intermediary. Brown & Brown’s Web address is

www.bbinsurance.com.

This press release may contain certain

statements relating to future results which are forward-looking

statements, including those associated with this acquisition. These

statements are not historical facts, but instead represent only

Brown & Brown’s current belief regarding future events, many of

which, by their nature, are inherently uncertain and outside of

Brown & Brown’s control. It is possible that Brown &

Brown’s actual results and financial condition may differ, possibly

materially, from the anticipated results and financial condition

indicated in these forward-looking statements. Further information

concerning Brown & Brown and its business, including factors

that potentially could materially affect Brown & Brown’s

financial results and condition, as well as its other achievements,

is contained in Brown & Brown’s filings with the Securities and

Exchange Commission. Such factors include those factors relevant to

Brown & Brown’s consummation and integration of the announced

acquisition, including any matters analyzed in the due diligence

process, and material adverse changes in the business and financial

condition of the seller, the buyer, or both, and their respective

customers. All forward-looking statements made herein are made only

as of the date of this release, and Brown & Brown does not

undertake any obligation to publicly update or correct any

forward-looking statements to reflect events or circumstances that

subsequently occur or of which Brown & Brown hereafter becomes

aware.

R. Andrew WattsChief Financial Officer(386)

239-5770

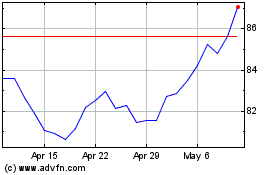

Brown and Brown (NYSE:BRO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Brown and Brown (NYSE:BRO)

Historical Stock Chart

From Apr 2023 to Apr 2024