Visa, Mastercard Near Settlement Over Card-Swipe Fees

June 28 2018 - 10:16AM

Dow Jones News

By AnnaMaria Andriotis

Visa Inc. and Mastercard Inc. are close to settling a

long-running antitrust lawsuit with merchants over the fees they

pay when they accept card payments, according to people familiar

with the matter.

Under the settlement, Visa, Mastercard and a number of banks

that issue debit and credit cards including JPMorgan Chase &

Co., Citigroup Inc. and Bank of America Corp. would pay the

merchants around $6.5 billion, some of the people said. It is not

clear how the payment would be split up among the card networks and

the issuing banks.

The parties on Tuesday informed the U.S. District Court for the

Eastern District of New York that they reached a settlement, the

people said. They intend to draw up a draft of the deal by mid-July

and to submit a final agreement to the court by mid-August, the

people added.

The case has been a highly contentious one for merchants and has

raised questions about the longevity of the credit card fee model.

At issue are the card swipe or interchange fees that card networks

set and that merchants pay to banks when consumers use their cards

to shop. Merchants allege that the networks and banks have colluded

to inflate those fees.

Merchants first brought the class-action suit in 2005 against

Visa, Mastercard and the largest U.S. card-issuing banks. But many

large merchants opted out of the original settlement of $7.25

billion that was reached in 2012 largely due to terms that would

have barred them from filing lawsuits against the networks over

future swipe-fee increases. An appeals court invalidated that

settlement on the grounds that merchants weren't adequately

represented. The Supreme Court last year declined to hear the case,

shifting it back to the district court.

Around $5 billion of the original settlement amount remained in

escrow, according to people familiar with the matter, and would be

distributed as part of the new settlement if it is approved by the

court.

Merchants that agree to the settlement will be restricted for a

number of years from suing the card networks over the same

card-swipe-fee claims the suit addressed, according to people

familiar with the matter. Merchants who disagree with the terms of

the settlement will be able to opt out and proceed with their own

lawsuits against the networks, the people said.

Several large merchants, including Home Depot Inc. and

Amazon.com Inc., have filed separate lawsuits over the fees. Among

the terms that the merchants are challenging are the card networks'

"honor all cards" requirement. That rule prohibits merchants from

selecting between a network's cards; instead merchants that accept

one Visa credit card, for example, must accept all Visa credit

cards. Swipe fees vary significantly between the networks' cards

and are higher on cards with generous rewards programs.

Merchants were dealt a big loss this week when the Supreme Court

backed American Express Co.'s policy of preventing merchants that

accept AmEx cards from offering shoppers discounts or other

incentives to use cheaper cards. The court's decision is a setback

for the merchants' broader ambitions to take on credit card swipe

fees.

Write to AnnaMaria Andriotis at annamaria.andriotis@wsj.com

(END) Dow Jones Newswires

June 28, 2018 10:01 ET (14:01 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

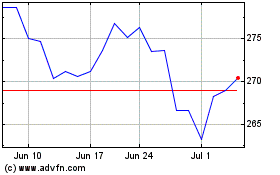

Visa (NYSE:V)

Historical Stock Chart

From Mar 2024 to Apr 2024

Visa (NYSE:V)

Historical Stock Chart

From Apr 2023 to Apr 2024