S&P Affirms Assured Guaranty’s AA Financial Strength Ratings with Stable Outlook

June 26 2018 - 6:19PM

Business Wire

New Report Highlights Assured Guaranty’s

Strong Competitive Profile, Very Strong Capital Adequacy and

Leadership Position in the U.S. Public Finance Market

Assured Guaranty Ltd. (NYSE:AGO) announced today that S&P

Global Ratings (S&P) has affirmed the AA financial strength

ratings on U.S. bond insurers Assured Guaranty Municipal Corp.

(AGM), Municipal Assurance Corp. (MAC) and Assured Guaranty Corp.

(AGC); U.K. financial guarantor Assured Guaranty (Europe) plc

(AGE); and Bermuda insurers Assured Guaranty Re Ltd. (AGRe) and

Assured Guaranty Re Overseas Ltd. (AGRO). S&P also affirmed the

financial strength ratings of U.K. financial guarantor Assured

Guaranty (UK) plc and Assured Guaranty (London) plc (AG London).

The outlooks of all the Assured Guaranty entities are stable, other

than the outlook of AG London, which is positive.

In its June 26th report, S&P noted Assured Guaranty’s:

- “very strong capital adequacy”

- “proven track record of credit

discipline and market leadership in terms of par insured and

premiums written”

- “diverse underwriting strategy” with “a

well-thought-out and measured approach” to international

infrastructure and global structured finance transactions

- “capital position could absorb losses

on its entire exposure to issuers in Puerto Rico of roughly $3

billion and…there would be no change in Assured’s capital adequacy

score or financial risk profile”

In response to the report, Dominic Frederico, President and CEO

said:

“Once again, S&P affirmed Assured Guaranty’s AA stable

rating. The affirmation corroborates not only our financial

strength but also our proven business model, profitable financial

results and the success of our strategic choices. Our size and

experience allow us to lead the U.S. municipal bond market by

participating broadly, regularly insuring large municipal

transactions, including public-private partnerships, as well as

small and mid-size transactions, while achieving favorable premium

rates. Additionally, our international infrastructure and

structured finance businesses further diversify our insured

portfolio while providing a competitive advantage through the

flexibility to capitalize on growth trends and pricing

opportunities when they are better in one sector than in

others.

“Over recent years, we were able to continue to produce solid

economic results through new business origination, effective loss

mitigation, reassumptions of ceded business, and acquisitions. Our

insured portfolio has amortized significantly in recent years,

partially as a result of low interest rates limiting new business

opportunities, while our claims-paying resources have remained

substantially the same – currently at approximately $11.5 billion –

significantly reducing our leverage ratios. As a result, based on

our understanding of S&P’s capital adequacy model, we estimate

that Assured Guaranty had $2.8 billion of capital in excess of

S&P’s AAA requirement at year-end 2017.”

Any forward-looking statements made in this press release

reflect Assured Guaranty’s current views with respect to future

events and are made pursuant to the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. Such statements

involve risks and uncertainties that may cause actual results to

differ materially from those set forth in these statements. These

risks and uncertainties include, but are not limited to,

difficulties executing Assured Guaranty’s business strategy; those

risks and uncertainties resulting from changes in rating agency

models or opinions; adverse credit developments in Puerto Rico or

other portions of Assured Guaranty’s insured portfolio and the

impact of those developments on rating agency models and opinions;

other risks and uncertainties that have not been identified at this

time, management’s response to these factors, and other risk

factors identified in Assured Guaranty’s filings with the

Securities and Exchange Commission. Readers are cautioned not to

place undue reliance on these forward-looking statements, which are

made as of June 26, 2018. Assured Guaranty undertakes no obligation

to publicly update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by law.

Assured Guaranty Ltd. is a publicly traded (NYSE: AGO)

Bermuda-based holding company. Its operating subsidiaries provide

credit enhancement products to the U.S. and international public

finance, infrastructure and structured finance markets. More

information on Assured Guaranty Ltd. and its subsidiaries can be

found at AssuredGuaranty.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180626006629/en/

Assured Guaranty Ltd.Robert Tucker, 212-339-0861Senior Managing

Director, Investor Relations and Corporate

Communicationsrtucker@assuredguaranty.comorMedia:Ashweeta Durani,

212-408-6042Vice President, Corporate

Communicationsadurani@assuredguaranty.com

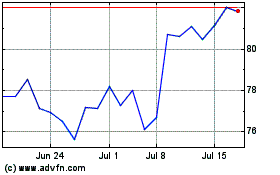

Assured Guaranty Municipal (NYSE:AGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

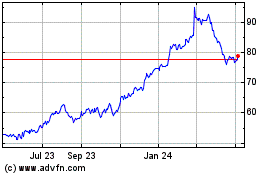

Assured Guaranty Municipal (NYSE:AGO)

Historical Stock Chart

From Apr 2023 to Apr 2024