SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11‑K

FOR ANNUAL REPORTS OF EMPLOYEE STOCK

REPURCHASE SAVINGS AND SIMILAR PLANS

PURSUANT TO SECTION 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

|

☒

|

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

for the year ended December 31, 2017

|

|

|

|

or

|

|

|

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

For the transition period from to

|

Commission File No. 000‑14719

ATLANTIC SOUTHEAST AIRLINES, INC. INVESTMENT

SAVINGS PLAN

(Full title of the plan)

SKYWEST, INC.

444 South River Road

St. George, Utah 84790

(Name of issuer of the securities held pursuant to the

plan and the address of its principal executive office)

Atlantic Southeast Airlines, Inc. Investment Savings Plan

Index to Financial Statements and Supplemental Schedule

* Other supplemental schedules required by section 2520‑103.10 of the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974 have been omitted because they are not applicable.

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

To the Plan Administrators of the

Atlantic Southeast Airlines, Inc. Investment Savings Plan

Opinion on the Financial Statements

We have audited the accompanying statements of assets available for benefits of the Atlantic Southeast Airlines, Inc. Investment Savings Plan (the “Plan”) as of December 31, 2017 and 2016, and the related statement of changes in assets available for benefits for the year ended December 31, 2017, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the assets available for benefits of the Plan as of December 31, 2017 and 2016, and the changes in assets available for benefits for the year ended December 31, 2017, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Information

The supplemental schedule of assets (held at end of year) as of December 31, 2017, referred to as supplemental information, has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974, as amended. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Tanner LLC

We have served as the Plan’s auditor since 2007.

Salt Lake City, Utah

June 26, 2018

ATLANTIC SOUTHEAST AIRLINES, INC. INVESTMENT SAVINGS PLAN

Statements of Assets Available for Benefits

|

|

|

|

|

|

|

|

|

|

|

As of December 31,

|

|

|

|

2017

|

|

2016

|

|

Assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments, at fair value:

|

|

|

|

|

|

|

|

Mutual funds and participant-directed brokerage accounts

|

|

$

|

261,528,460

|

|

$

|

229,342,235

|

|

Stable value funds

|

|

|

28,455,101

|

|

|

29,106,288

|

|

SkyWest, Inc. Common Stock Fund

|

|

|

3,147,988

|

|

|

3,145,398

|

|

Total investments, at fair value

|

|

|

293,131,549

|

|

|

261,593,921

|

|

|

|

|

|

|

|

|

|

Receivables:

|

|

|

|

|

|

|

|

Notes receivable from participants

|

|

|

4,304,842

|

|

|

6,107,488

|

|

Participants

|

|

|

268,410

|

|

|

—

|

|

Employer

|

|

|

245,680

|

|

|

137,642

|

|

Total receivables

|

|

|

4,818,932

|

|

|

6,245,130

|

|

Assets available for benefits

|

|

$

|

297,950,481

|

|

$

|

267,839,051

|

See accompanying notes to financial statements.

Atlantic Southeast Airlines, Inc. Investment Savings Plan

Statement of Changes in Assets Available for Benefits

For the Year Ended December 31, 2017

|

|

|

|

|

|

Additions:

|

|

|

|

Contributions:

|

|

|

|

|

Participants

|

|

$

|

11,777,031

|

|

Employer

|

|

|

5,459,259

|

|

Total contributions

|

|

|

17,236,290

|

|

|

|

|

|

|

Interest income on notes receivable from participants

|

|

|

226,666

|

|

|

|

|

|

|

Net investment income:

|

|

|

|

|

Interest and dividends

|

|

|

3,645,774

|

|

Net appreciation in fair value of investments

|

|

|

49,090,856

|

|

Total net investment income

|

|

|

52,736,630

|

|

|

|

|

|

|

Total additions

|

|

|

70,199,586

|

|

|

|

|

|

|

Deductions:

|

|

|

|

|

Distributions to participants

|

|

|

39,908,818

|

|

Administrative expenses

|

|

|

179,338

|

|

Total deductions

|

|

|

40,088,156

|

|

|

|

|

|

|

Net increase in assets available for benefits

|

|

|

30,111,430

|

|

|

|

|

|

|

Assets available for benefits:

|

|

|

|

|

Beginning of the year

|

|

|

267,839,051

|

|

End of the year

|

|

$

|

297,950,481

|

See accompanying notes to financial statements.

ATLANTIC SOUTHEAST AIRLINES, INC. INVESTMENT SAVINGS PLAN

Notes to Financial Statements

1. Description of the Plan

The following description of the Atlantic Southeast Airlines, Inc. Investment Savings Plan (the “Plan”) is provided for general information purposes only. Participants should refer to the Plan document and summary plan description for a more complete description of the Plan’s provisions.

General

The Plan is a defined contribution plan covering all eligible employees of ExpressJet Airlines, Inc. (the “Company”, “Plan Sponsor” or the “Employer”). Eligible employees are automatically enrolled to make pre-tax salary deferral contributions to the Plan, at a rate of 3%, unless they affirmatively elect not to participate or to contribute at a different rate.

The Plan is intended to be a qualified retirement plan under the Internal Revenue Code (“IRC”) and is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”).

Participant Accounts

Individual accounts are maintained for each Plan participant. Each participant’s account is credited with the participant’s contributions, the Company’s matching contributions, and an allocation of investment earnings, and is charged with withdrawals and an allocation of investment losses and expenses. The allocations are based on participant earnings on account balances. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested account.

Participant-Directed Options for Investments

Participants direct the investment of their contributions and the Company matching contributions into various investments offered by the Plan. Investment options include mutual funds, stable value funds, and SkyWest, Inc. common stock. Participants may change their elections or transfer investments between funds at any time.

Participants with common stock of SkyWest, Inc. in their accounts may direct the sale of the stock and the investment of the resulting proceeds into other investments offered by the Plan.

Contributions

Each year, participants are able to contribute up to 50% of their pretax annual compensation, as defined by the Plan. Contributions are limited by the IRC, which established a maximum contribution of $18,000 ($24,000 for participants age 50 and older) for the year ended December 31, 2017. Participants may also make rollover contributions from other qualified defined benefit or defined contribution plans.

The Company may make a discretionary matching contribution of up to 8% of a participant’s eligible compensation, as defined by the Plan. Allocation of this matching contribution is further subject to a factor based on years of service for participants and ranges from 20% to 75%, regardless of the date of participation.

Vesting

All participant contributions and earnings thereon are 100% vested. Company matching contributions to participant accounts vest on a graded basis at 10% per year for two years of service, increasing to 20% per year thereafter until full vesting after six years of service.

Payment of Benefits

Upon termination, participants, or their beneficiaries, may elect lump-sum distributions or periodic distributions over either a 5 or 10‑year period. The full value of benefits are payable to the participant upon normal or postponed retirement, or total or permanent disability, or to beneficiaries upon death of the participant.

Plan Termination

Under the provisions of the Plan, the Company reserves the right to amend or terminate the Plan at any time in accordance with the provisions of ERISA, provided that amendments will not divert a vested interest or permit any part of the funds to revert to the Company or to be used for any purpose other than for the exclusive benefit of participants or their beneficiaries. If the Plan is terminated, each participant’s account will become fully vested.

Notes Receivable from Participants

Participants may borrow a minimum of $1,000 up to a maximum of the lesser of $50,000 or 50% of their vested account balances. Loan terms range from one to five years. Loans are secured by the vested balance in the participant’s account and bear interest at a rate commensurate with local prevailing rates as determined at the time of the loan.

Forfeitures

Forfeitures of terminated participants’ nonvested accounts are used to reduce future matching contributions of the Company. The forfeitures account had a balance of approximately $43 and $19 as of December 31, 2017 and 2016, respectively.

2. Summary of Significant Accounting Policies

Basis of Presentation

The Plan’s financial statements have been prepared on the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

Risks and Uncertainties

The Plan provides for investments in securities that are exposed to various risks, such as interest rate, currency exchange rate, credit and overall market fluctuation. Due to the level of risk associated with certain investment securities, it is reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the statements of assets available for benefits.

Valuation of Investments and Income Recognition

Mutual funds are valued at quoted market prices, which represent the net asset values of units held by the Plan at year-end. Units of the Company’s common stock fund and stable value funds are valued using the net asset value, which approximates fair value, on the last business day of the Plan year. Unrealized appreciation or depreciation caused by fluctuations in the market value of investments is recognized in the statement of changes in assets available for benefits. Dividends and interest are reinvested as earned. Purchases and sales of investments are recorded on a trade-date basis.

Payment of Benefits

Benefits are recorded when paid by the Plan.

Notes Receivable from Participants

Notes receivable from participants represent participant loans that are recorded at their unpaid principal balance plus any accrued but unpaid interest. Interest income on notes receivable from participants is recorded when it is earned. Related fees are recorded as administrative expenses and are expensed when they are incurred. No allowance for credit losses has

been recorded as of December 31, 2017 or 2016. If a participant ceases to make loan repayments and the Plan Administrators deem the participant loan to be a distribution, the participant loan balance is reduced and a benefit payment is recorded.

Administrative Expenses

The Plan pays substantially all administrative expenses of the Plan.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect certain reported amounts of assets available for benefits at the date of the financial statements, the changes in assets available for benefits during the reporting period, and, when applicable, the disclosure of contingent assets and liabilities at the date of the financial statements. Actual results could differ from those estimates.

Subsequent Events

The Plan Administrators have evaluated events occurring subsequent to December 31, 2017 through the date of issuance of these financial statements.

3. Fair Value Measurements

U.S. GAAP defines fair value as the price that would be received to sell an asset or paid to transfer a liability (an exit price) in an orderly transaction between market participants at the measurement date. U.S. GAAP establishes a fair value hierarchy that requires an entity to maximize the use of observable inputs when measuring fair value, with the following three levels of inputs:

Level 1 — Valuation is based upon quoted prices in active markets for identical securities.

Level 2 — Valuation is based upon other significant observable inputs that reflect the assumptions market participants would use in pricing the asset developed on market data obtained from sources independent of the Plan.

Level 3 — Valuation is based upon unobservable inputs that reflect the assumptions that Plan management believes market participants would use in pricing the asset, based on the best information available.

As of December 31, 2017 and 2016, the Plan held certain assets that are required to be measured at fair value on a recurring basis. Assets measured at fair value on a recurring basis are summarized below (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value Measurements as of December 31, 2017

|

|

|

|

(in 000’s)

|

|

|

|

Total

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Mutual funds

|

|

$

|

248,543

|

|

$

|

200,801

|

|

$

|

47,742

|

|

$

|

—

|

|

Stable value funds*

|

|

|

28,455

|

|

|

—

|

|

|

—

|

|

|

—

|

|

Participant-directed brokerage accounts

|

|

|

12,986

|

|

|

12,986

|

|

|

—

|

|

|

—

|

|

Common stock fund*

|

|

|

3,148

|

|

|

—

|

|

|

—

|

|

|

—

|

|

Total

|

|

$

|

293,132

|

|

$

|

213,787

|

|

$

|

47,742

|

|

$

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value Measurements as of December 31, 2016

|

|

|

|

(in 000’s)

|

|

|

|

Total

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Mutual funds

|

|

$

|

217,785

|

|

$

|

217,785

|

|

$

|

—

|

|

$

|

—

|

|

Stable value funds*

|

|

|

29,106

|

|

|

—

|

|

|

—

|

|

|

—

|

|

Participant-directed brokerage accounts

|

|

|

11,557

|

|

|

11,557

|

|

|

—

|

|

|

—

|

|

Common stock fund*

|

|

|

3,145

|

|

|

—

|

|

|

—

|

|

|

—

|

|

Total

|

|

$

|

261,593

|

|

$

|

229,342

|

|

$

|

—

|

|

$

|

—

|

*

The fair values for the stable value funds and common stock fund are provided above to permit the reconciliation of the fair value hierarchy to the amounts presented in the statements of assets available for benefits. The stable value fund and the common stock fund are measured using the net asset value per unit as a practical expedient and therefore are not classified in the fair value hierarchy.

The SkyWest, Inc. Common Stock Fund (the “Common Stock Fund”), the JP Morgan Stable Asset income Fund, and the T. Rowe Price Stable Value (the “Stable Value Funds”) are valued at the net asset value (NAV) of units of the respective funds. The NAV, as provided by the respective fund trustees, is used as a practical expedient to estimating fair value. The NAV is based on the fair value of the underlying investments held by the fund less its liabilities. This practical expedient is not used when it is determined to be probable that the fund will sell the investment for an amount different than the reported NAV.

The Stable Value Funds are designed to provide safety of principal with consistency of returns with minimal volatility by employing a strategy of investing in investment contracts and security-backed contracts while employing broad diversification among contract issuers and underlying securities. The Plan Sponsor is able to redeem the investment in the Stable Value Funds by providing a 12‑month notice. Although the notice requirement is 12 months, JP Morgan and T. Rowe Price have indicated the ability to redeem the investment sooner. Redemption frequency for the Stable Value Funds is immediate, and the Stable Value Funds contain no unfunded commitments. There are no other significant restrictions on the ability to redeem the investment.

Plan investments include mutual funds and a collective trust managed by JP Morgan, the Plan trustee until July 29, 2016, and therefore were party-in-interest transactions. While transaction involving Plan assets with a party-in-interest may be prohibited, these transactions are exempt under ERISA Section 408(b)(8).

The Common Stock Fund includes investments in SkyWest, Inc. common stock. Redemption frequency for the Common Stock Fund is immediate, the Common Stock Fund contains no unfunded commitments, and has no redemption restrictions.

4. Party-in-Interest Transactions

ExpressJet Airlines, Inc. is a wholly owned subsidiary of SkyWest, Inc. SkyWest, Inc. common stock is offered as an investment option in the Plan. Transactions associated with the shares of common stock of SkyWest, Inc. are considered exempt party-in-interest transactions. The Plan held 175,131 and 250,277 shares of SkyWest, Inc. common stock with a fair value of $3,147,988 and $3,145,398 as of December 31, 2017 and 2016, respectively.

Notes receivable from participants totaling $4,304,842 and $6,107,488 as of December 31, 2017 and 2016, respectively, are also considered exempt party-in-interest transactions.

5. Income Tax Status

The Plan has received a determination letter from the Internal Revenue Service dated October 4, 2016, stating that the Plan and related trust are designed in accordance with applicable sections of the IRC and, therefore, the related trust is exempt from taxation. The Plan is required to operate in conformity with the IRC to maintain its qualification. Although the Plan has been amended since receiving the determination letter, the Plan Administrators believe the Plan is being operated in compliance with the applicable requirements of the IRC and, therefore, believe that the Plan, as amended, is qualified and the related trust is tax exempt.

6. Plan Amendments

Effective January 1, 2018, the Plan was amended to provide for 100% immediate vesting of all accounts.

Supplemental Schedule

ATLANTIC SOUTHEAST AIRLINES, INC. INVESTMENT SAVINGS PLAN

EIN: 58‑1354495 Plan No.: 001

Form 5500, Schedule H, Part IV, Line 4i

Schedule of Assets (Held at End of Year)

As of December 31, 2017

|

(a)

|

|

(b)

Identity of issue, borrower,

lessor or similar party

|

|

(c)

Description of investment including

maturity date, rate of interest, collateral,

par, or maturity value

|

|

(e)

Current

value

|

|

Number

of units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T. Rowe Price

|

|

T. Rowe Price Blue Chip Growth Trust T2

|

|

$

|

47,742,078

|

|

1,315,934

|

|

|

|

The Vanguard Group

|

|

Vanguard Institutional Index I

|

|

|

38,958,811

|

|

160,021

|

|

|

|

MFS

|

|

MFS Value R3

|

|

|

30,705,953

|

|

759,672

|

|

|

|

T. Rowe Price

|

|

T. Rowe Price Stable Value N

|

|

|

28,455,101

|

|

28,455,101

|

|

|

|

T. Rowe Price

|

|

New Horizons

|

|

|

19,787,233

|

|

376,398

|

|

|

|

American

|

|

American Funds EuroPacific Growth R6

|

|

|

15,396,444

|

|

274,251

|

|

|

|

T. Rowe Price

|

|

T. Rowe Price Retirement 2030

|

|

|

12,646,329

|

|

487,898

|

|

|

|

T. Rowe Price

|

|

T. Rowe Price Retirement 2040

|

|

|

11,922,145

|

|

437,671

|

|

|

|

|

|

Self Directed Brokerage Invested Account

|

|

|

10,262,374

|

|

N/A

|

|

|

|

T. Rowe Price

|

|

T. Rowe Price Mid-Cap Growth

|

|

|

8,731,149

|

|

100,335

|

|

|

|

Metropolitan West

|

|

Metropolitan West Total Return Bond M

|

|

|

8,703,399

|

|

816,454

|

|

|

|

T. Rowe Price

|

|

T. Rowe Price Retirement 2020

|

|

|

7,113,508

|

|

315,595

|

|

|

|

JP Morgan

|

|

Mid Cap Value

|

|

|

6,198,582

|

|

153,887

|

|

|

|

MFS

|

|

MFS International Value R3

|

|

|

5,501,397

|

|

128,297

|

|

|

|

The Vanguard Group

|

|

Vanguard Total Bond Market Index Admiral

|

|

|

5,392,318

|

|

501,611

|

|

|

|

T. Rowe Price

|

|

T. Rowe Price Retirement 2025

|

|

|

3,812,652

|

|

216,751

|

|

|

|

The Vanguard Group

|

|

Vanguard Total Intl Stock Index Admiral

|

|

|

3,735,337

|

|

122,390

|

|

|

|

The Vanguard Group

|

|

Vanguard Extended Market Index Inst

|

|

|

3,580,616

|

|

42,249

|

|

|

|

Goldman Sachs

|

|

Goldman Sachs Small Cap Value Inst

|

|

|

3,458,405

|

|

56,947

|

|

|

|

T. Rowe Price

|

|

T. Rowe Price Retirement 2050

|

|

|

3,156,451

|

|

203,380

|

|

*

|

|

SkyWest, Inc.

|

|

SkyWest, Inc. Common Stock Fund

|

|

|

3,147,988

|

|

175,131

|

|

|

|

T. Rowe Price

|

|

T. Rowe Price Retirement 2045

|

|

|

2,935,462

|

|

158,931

|

|

|

|

T. Rowe Price

|

|

T. Rowe Price Retirement 2035

|

|

|

2,764,353

|

|

145,722

|

|

|

|

|

|

Self Directed Brokerage Liquid Account

|

|

|

2,723,036

|

|

N/A

|

|

|

|

T. Rowe Price

|

|

T. Rowe Price Retirement 2015

|

|

|

1,840,680

|

|

122,876

|

|

|

|

T. Rowe Price

|

|

T. Rowe Price Retirement 2005

|

|

|

1,593,532

|

|

116,742

|

|

|

|

T. Rowe Price

|

|

T. Rowe Price Retirement 2055

|

|

|

1,269,800

|

|

81,502

|

|

|

|

T. Rowe Price

|

|

T. Rowe Price International Discovery

|

|

|

773,688

|

|

10,834

|

|

|

|

Fidelity

|

|

Fidelity Low Priced Stock

|

|

|

480,310

|

|

8,810

|

|

|

|

T. Rowe Price

|

|

T. Rowe Price Retirement 2010

|

|

|

129,163

|

|

7,066

|

|

|

|

The Vanguard Group

|

|

Vanguard Emerging Mkts Stock Idx Adm

|

|

|

122,697

|

|

3,214

|

|

|

|

T. Rowe Price

|

|

T. Rowe Price Retirement 2060

|

|

|

85,964

|

|

7,128

|

|

|

|

JP Morgan

|

|

JPMorgan Strategic Income Opps R5

|

|

|

4,594

|

|

395

|

|

*

|

|

Plan participants

|

|

Notes receivable from participants with interest rates of 3.25 - 5.50%, maturing from 2018 through 2023

|

|

|

4,304,842

|

|

N/A

|

|

|

|

|

|

|

|

$

|

297,436,391

|

|

|

* Indicates a party-in-interest to the Plan.

Column (d), cost information, is not applicable for participant-directed investments.

See accompanying Report of Independent Registered Public Accounting Firm.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on their behalf by the undersigned hereunto duly authorized.

|

Date: June 26, 2018

|

ATLANTIC SOUTHEAST AIRLINES, INC. INVESTMENT SAVINGS PLAN

|

|

|

|

|

|

|

By:

|

SkyWest, Inc., Plan Sponsor

|

|

|

|

|

|

|

|

/s/ Eric J. Woodward

|

|

|

|

Eric J. Woodward

|

|

|

|

Chief Accounting Officer

|

|

|

|

of SkyWest, Inc.

|

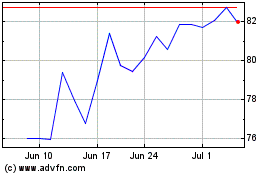

SkyWest (NASDAQ:SKYW)

Historical Stock Chart

From Mar 2024 to Apr 2024

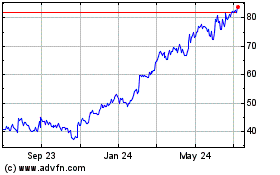

SkyWest (NASDAQ:SKYW)

Historical Stock Chart

From Apr 2023 to Apr 2024