UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed

by the Registrant [X]

Filed

by a Party other than the Registrant [ ]

Check

the appropriate box:

|

[ ]

|

Preliminary

Proxy Statement

|

|

|

|

|

[ ]

|

Confidential,

For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)

|

|

|

|

|

[X]

|

Definitive

Proxy Statement

|

|

|

|

|

[ ]

|

Definitive

Additional Materials

|

|

|

|

|

[ ]

|

Soliciting

Material Pursuant to §240.14a-12

|

STEM

HOLDINGS, INC.

(Name

of Registrant as Specified in Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment

of Filing Fee (Check the appropriate box):

|

|

|

|

|

[X]

|

No

fee required.

|

|

|

|

|

[ ]

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

(1)

|

Title

of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

(2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

|

|

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

(5)

|

Total

fee paid:

|

|

|

|

|

|

|

|

[ ]

|

Fee

paid previously with preliminary materials.

|

|

|

|

|

[ ]

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date

of its filing.

|

|

|

|

|

(1)

|

Amount

Previously Paid:

|

|

|

|

|

|

|

|

(2)

|

Form,

Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

(3)

|

Filing

Party:

|

|

|

|

|

|

|

|

(4)

|

Date

Filed:

|

|

|

|

STEM

HOLDINGS, INC.

7777

Glades Road, Suite 203,

Boca

Raton, FL 33434

(561)

948-5406

NOTICE

OF ANNUAL

MEETING OF

SHAREHOLDERS TO BE

HELD JULY 13, 2018

TO

OUR SHAREHOLDERS:

You

are cordially invited to attend the Annual Meeting of Shareholders (the “Annual Meeting”) of Stem Holdings, Inc.,

a Nevada corporation (together with its subsidiaries, “Company”, “Stem”, “we”, “us”

or “our”), which will be held on July 13, 2018, at 12:00 Noon at Wyndham Hotel (Palm Suites East Meeting Room), 1950

Glades Road, Boca Raton, FL 33431 for the following purposes:

|

|

1.

|

To

elect six (6) directors to hold office for a one-year term and until each of their successors

are elected and qualified.

|

|

|

|

|

|

|

2.

|

To

adopt a resolution authorizing the Board of Directors, in its sole discretion, to amend

the Company’s Articles of Incorporation to increase the number of authorized shares

of Company Common Stock from 100,000,000 to 300,000,000.

|

|

|

|

|

|

|

3.

|

To

ratify the appointment of LJ Soldinger, LLC, Certified Public Accountants, as our independent

registered public accounting firm for the fiscal year ending September 30, 2018; and

|

|

|

|

|

|

|

4.

|

To

transact such other business as may properly come before the Annual Meeting or any postponement

or adjournment thereof.

|

A

copy of the Annual Report of the Company’s operations during the fiscal year ended September 30, 2017 is available on request

or at www.sec.gov.

The

Board of Directors has fixed the close of business on June 11, 2018, as the record date for the determination of shareholders

entitled to receive notice of and to vote at the Annual Meeting of Shareholders and any adjournment or postponement thereof. A

complete list of shareholders entitled to vote at the Annual Meeting will be available for inspection for ten days prior to the

Annual Meeting at the Offices of the Company located at 7777 Glades Road, Suite 203, Boca Raton, FL 33434.

|

|

By

Order of the Board of Directors

|

|

|

|

|

|

/s/

Adam Berk

|

|

|

Adam

Berk

|

|

|

CEO

and Chairman of the Board

|

|

June

25, 2018

|

|

|

Boca

Raton, FL

|

|

YOUR

VOTE IS IMPORTANT

WHETHER

OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING IN PERSON, TO ASSURE THAT YOUR SHARES WILL BE REPRESENTED, PLEASE COMPLETE, DATE,

SIGN AND RETURN THE ENCLOSED PROXY WITHOUT DELAY IN THE ENCLOSED ENVELOPE, WHICH REQUIRES NO ADDITIONAL POSTAGE IF MAILED IN THE

UNITED STATES. IF YOU ATTEND THE ANNUAL MEETING, YOU MAY VOTE IN PERSON IF YOU WISH TO DO SO EVEN IF YOU HAVE PREVIOUSLY SENT

IN YOUR PROXY.

TABLE

OF CONTENTS

STEM

HOLDINGS, INC.

7777

Glades Road, Suite 203

Boca

Raton, FL 33434

PROXY

STATEMENT

ANNUAL

MEETING OF SHAREHOLDERS

TO

BE HELD ON JULY 13, 2017

GENERAL

INFORMATION ABOUT THE PROXY STATEMENT AND ANNUAL MEETING

General

This

Proxy Statement is being furnished to the shareholders of Stem Holdings, Inc. (together with its subsidiaries, “Company”,

“Stem”, “we”, “us” or “our”) in connection with the solicitation of proxies by

our Board of Directors (the “Board of Directors” or the “Board”) for use at the Annual Meeting of Shareholders

to be held at Wyndham Hotel (Palm Suites East Meeting Room), 1950 Glades Road, Boca Raton, FL 33431 on July 13, 2018, and at any

and all adjournments or postponements thereof (the “Annual Meeting”) for the purposes set forth in the accompanying

Notice of Annual Meeting of Shareholders. Accompanying this Proxy Statement is a proxy/voting instruction form (the “Proxy”)

for the Annual Meeting, which you may use to indicate your vote as to the proposals described in this Proxy Statement. It is contemplated

that this Proxy Statement and the accompanying form of Proxy will be first mailed to Stem shareholders on or about June 29, 2018.

The

Company will directly solicit shareholders by mail through its transfer agent. In addition, the Company may use the service of

its officers and directors to solicit proxies, personally or by telephone, without additional compensation.

Voting

Securities

Only

shareholders of record as of the close of business on June 11, 2018 (the “Record Date”) will be entitled to vote at

the Annual Meeting and any adjournment or postponement thereof. As of the Record Date, there were approximately 8,930,360 shares

of common stock of the Company, issued and outstanding and entitled to vote representing approximately 245 holders of record.

Shareholders may vote in person or by proxy. Each holder of shares of common stock is entitled to one vote for each share of stock

held on the proposals presented in this Proxy Statement. The Company’s bylaws provide that a majority of all the shares

of stock entitled to vote, whether present in person or represented by proxy, shall constitute a quorum for the transaction of

business at the Annual Meeting. The enclosed Proxy reflects the number of shares that you are entitled to vote. Shares of common

stock may not be voted cumulatively.

Voting

of Proxies

All

valid proxies received prior to the Annual Meeting will be voted. The Board of Directors recommends that you vote by proxy even

if you plan to attend the Annual Meeting. To vote by proxy, you must fill out the enclosed Proxy, sign and date it, and return

it in the enclosed postage-paid envelope. Voting by proxy will not limit your right to vote at the Annual Meeting if you attend

the Annual Meeting and vote in person. However, if your shares are held in the name of a bank, broker or other holder of record,

you must obtain a proxy executed in your favor, from the holder of record to be able to vote at the Annual Meeting.

Revocability

of Proxies

All

Proxies which are properly completed, signed and returned prior to the Annual Meeting, and which have not been revoked, will be

voted in favor of the proposals described in this Proxy Statement unless otherwise directed. A shareholder may revoke his or her

Proxy at any time before it is voted either by filing with the Secretary of the Company, at its principal executive offices located

at 7777 Glades Road, Suite 203, Boca Raton, FL 33434, a written notice of revocation or a duly-executed Proxy bearing a later

date or by attending the Annual Meeting and voting in person.

Required

Vote

Representation

at the Annual Meeting of the holders of a majority of the outstanding shares of our common stock entitled to vote, either in person

or by a properly executed Proxy, is required to constitute a quorum. Abstentions and broker non-votes, which are indications by

a broker that it does not have discretionary authority to vote on a particular matter, will be counted as “represented”

for the purpose of determining the presence or absence of a quorum. Under the Nevada Revised Statutes, once a quorum is established,

shareholder approval with respect to a particular proposal is generally obtained when the votes cast in favor of the proposal

exceed the votes cast against such proposal.

In

the election of our Board of Directors, shareholders are not allowed to cumulate their votes. Shareholders are entitled to cast

a vote for each of the openings on the Board to be filled at the Annual Meeting. The six nominees receiving the highest vote totals

will be elected as our Board of Directors. For approval of the proposed ratification of our independent registered accountants,

the votes cast in favor of the proposal must exceed the votes cast against the proposal. Accordingly, abstentions and broker non-votes

will not affect the outcome of the election of the Board of Directors or the ratification of the independent public accountants.

Shareholders

List

For

a period of at least ten days prior to the Annual Meeting, a complete list of shareholders entitled to vote at the Annual Meeting

will be available at the principal executive offices of the Company located at 7777 Glades Road, Suite 203, Boca Raton, FL 33434

so that stockholders of record may inspect the list only for proper purposes.

Expenses

of Solicitation

The

Company will pay the cost of preparing, assembling and mailing this proxy-soliciting material, and all costs of solicitation,

including certain expenses of brokers and nominees who mail proxy material to their customers or principals.

PROPOSAL

NO. 1

ELECTION

OF SIX (6) DIRECTORS

The

Company’s Board of Directors currently consists of six authorized directors. A total of six directors will be elected at

the Annual Meeting to serve until the next annual shareholder meeting. The persons named as “Proxies” in the enclosed

Proxy will vote the shares represented by all valid returned proxies in accordance with the specifications of the shareholders

returning such proxies. If no choice has been specified by a shareholder, the shares will be voted FOR the nominees. If at the

time of the Annual Meeting any of the nominees named below should be unable or unwilling to serve, which event is not expected

to occur, the discretionary authority provided in the Proxy will be exercised to vote for such substitute nominee or nominees,

if any, as shall be designated by the Board of Directors. If a quorum is present and voting, the nominees for directors receiving

the highest number of votes will be elected. Abstentions and broker non-votes will have no effect on the vote.

NOMINEES

FOR ELECTION AS DIRECTOR

The

following sets forth certain information about each of the director nominees:

|

Adam

Berk (40)

|

|

|

|

|

Mr.

Berk has been a director, President and Chief Executive Officer of the Company since its inception in June 2016. From January

2013 until January 2015 Adam was the CEO of HYD For Men, an artisanal men’s grooming company that patented the first

solution to extend the life of a razor blade by 400%. HYD For Men is currently sold at HSN, Walgreens, BedBathBeyond, Drugstore.

com, Birchbox, GiantEagle, Meijers, and Kinney Drugs. Recently, HYD For Men was acquired by Lucas Investment Group. From January

2015 until January 2017 Adam was the Co-President of Consolidated Ventures of Oregon a Cannabis holding company. Mr. Berk’s

experience as a founder and principal executive of several start-up companies and skills associated therewith led to the conclusion

that he should serve as an executive and director of the Company. From 2002 through 2013, Mr. Berk was employed with Osmio,

Inc. (currently GrubHub, an Aramark subsidiary), the first patented web-based corporate expense management system that concentrated

on food ordering for law firms, investment banks and consulting firms. He served as chief executive of Osmio from 2002-2007.

|

|

|

|

|

Steve

Hubbard (69)

|

|

|

|

|

Mr.

Hubbard has served as Chief Financial Officer, Secretary and a member of the Board of Directors of the Company since its inception

in June 2016. He served as Chief Financial Officer and Secretary of Diego Pellecer, Inc., a cannabis-related real estate company

From April 2013 through September 2013 and Chief Financial Officer and Secretary of Diego Pellicer Worldwide, Inc. (a publicly

reporting company) from September 2013 through December 2014. He served as Chief Financial Officer of Kind Care LLC DBA TJ’s

Organic Gardent from December 2014 through August 2015 and has been Chief Financial Officer of Consolidated Ventures of Oregon,

Inc. since August 2015. Commencing several years prior to April 2013, Mr. Hubbard served as a outside management consultant

to several early stage companies, primarily providing financial services. Mr. Hubbard’s experience as a founder and

principal executive of several start-up companies, his experience as an auditor with Arthur Andersen & Co prior to 2012

and the skills associated therewith led to the conclusion that he should serve as a director of the Company.

|

|

|

|

|

Garrett

M. Bender (56)

|

|

|

|

|

Mr.

Bender has served as a member of the Board of Directors of the Company since its inception in June 2016. He is the Principal

and Co-Founder of Ascot Development LLC, a real estate development firm, which commenced operations in 2003. He has guided

Ascot through numerous acquisition and sale transactions and strategically manages Ascot’s land portfolio. Mr. Bender’s

experience as a founder and principal executive of several start-up companies and the sales and marketing skills associated

therewith led to the conclusion that he should serve as a director of the Company.

|

|

Lindy

Snider (56)

|

|

|

|

|

Ms.

Snider has served as a member of the Board of Directors of the Company since its inception

in June 2016. She is the founder and for over five years has been CEO of Lindi Skin,

the first full line of skin care products for cancer patients. This botanically based

skin care line serves the special needs of individuals undergoing cancer treatment and

is found in most major cancer centers in the U.S.

Ms.

Snider is an active investor in cannabis related businesses. Focused on new business development, brand marketing and

investing, Ms. Snider identifies and helps develop innovative companies in the space. She is a passionate entrepreneur

and a champion of both start-ups and women-owned businesses. She serves on the following boards and advisories: Sqor.com,

Greenhouse Ventures, Intiva, Blazenow, Kind Financial, Elevated Nation, as well as the following philanthropic boards:

Fox Chase Cancer Foundation, Cancer Forward, Philadelphia Orchestra, PSPCA, Schuylkill Center for Environmental Education,

National Museum of American Jewish History, The Middle East Forum, Shoah Foundation’s Next Generation Council, The

Ed Snider Youth Hockey Foundation, and The Snider Foundation. Ms. Snider’s experience as a founder and principal

executive of several start-up companies and her service as an independent director of several for-profit and charitable

organizations and the skills associated therewith led to the conclusion that she should serve as a director of the Company.

|

|

|

|

|

Rajiv

“Roger” Rai (48)

|

|

|

|

|

Mr.

Rai was appointed a director of the Company in May 2018. In his capacity as Special Advisor to the Chairman at Rogers Communications,

Roger Rai advises Edward Rogers, who is the representative controlling shareholder of Rogers Communications (TSX:RCI.b), on

business development, revenue development, partnership development, talent development and sports. Previously, Roger was the

Managing Director for E.S. Rogers Enterprises from 2004 to 2018. In that capacity, he gained extensive experience in strategic

management services, including business processes assessment and advisory services.

|

|

|

|

|

|

Roger

is currently the President of R3 Concepts Inc., a consulting and investments company located in Toronto, Canada. Since 2012,

he has also served as an advisor to Chobani, Inc., a retail food services company.

|

|

|

|

|

|

From

2010 to 2016, Roger was the Vice President, Business Development, Keek Inc. (TSXV:KEK). In this capacity, Roger was responsible

for all new business and partnership development at the Company.

|

|

|

|

|

|

Before

Keek Inc., Roger was the Director of Development at C.O.R.E. Feature Animation, a Company that produced the children’s

animation movie “The Wild.” He was the Founder and VP, Business Development of Fastvibe Inc., a web-streaming

equipment and services company located in To ronto. Roger also held various managerial positions at Rogers Cable Systems and

Rogers Wireless, one Canada’s largest Communications.

|

|

|

|

|

|

Roger

sits on the Board of Directors for CONSTANTINE Enterprises Inc., a privately held real estate Company based in Toronto, with

operations in Canada and the Bahamas.

|

|

|

|

|

|

He

is one of the founders and on the Board of Directors for the ONEXONE Foundation, a charitable organization focused on global

child welfare.

|

|

|

|

|

|

Roger

holds a Bachelor of Arts from the University of Western Ontario and lives in Toronto.

|

|

Jessica

Michelle Feingold (35)

|

|

|

|

|

Jessica

Michelle Feingold is General Counsel and a member of the Company’s Board of Directors, having been appointed to these

positions in March 2018. She is an attorney at Law qualified to practice in the States of Florida, Texas and Colorado and

the District of Columbia.

|

|

|

|

|

|

Ms.

Feingold has been Of Counsel to McAllister Garfield, P.C. in Denver, CO since May 2015 and served as General Counsel of Medically

Correct, LLC d/b/a Incredibles from December 2016 to February 2018. She was the Owner and a Consultant with E & F Epstein

Feingold Consulting Group, LLC operating in Arizona and Florida from June 2014 through April 2015. She served as Associate

General Counsel of the Florida State Trust from December 2013 through June 2014 and as an Associate Attorney with Akerman

LLP in Miami, FL from April 2012 through April 2013.

|

|

|

|

|

|

She

attended The George Washington University and received a Bachelor of Arts degree from the University of Miami. She later received

a Juris Doctor degree from the Shephard Broad Law Center at Nova Southeastern University and a Master of Laws degree in Real Property

development from the University of Miami School of Law.

|

RECOMMENDATION

OF THE BOARD OF DIRECTORS:

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF THE DIRECTOR NOMINEES LISTED ABOVE.

PROPOSAL

NO. 2

INCREASE

IN AUTHORIZED CAPITAL

On

May 31, 2018, the Board of Directors of the Company unanimously adopted a resolution seeking shareholder approval to amend the

Company’s Articles of Incorporation to increase the number of authorized Company Common Shares from 100,000,000 to 300,000,000.

By Proposal No. 2 and in accordance with applicable Nevada law, the Company is seeking shareholder authorization of a resolution

authorizing the Board of Directors, in its sole discretion, to implement an amendment to the Company’s Articles of Incorporation

which increases the number of authorized shares of Company Common Stock from 100,000,000 to 300,000,000.

Specifically,

by approving Proposal No. 2, the Company’s shareholders will approve the following resolutions:

RESOLVED,

that the Board of Directors of the Company is authorized to amend the Company’s Articles of Incorporation to increase the

number of shares of Common Stock the Company is authorized to issue from 100,000,000 to 300,000.

RESOLVED

FURTHER, that the Board of Directors and officers of the Company be, and each of them individually hereby is, authorized, empowered

and directed, to execute and file with the Secretary of State of Nevada any and all such certificates, amendments, instruments

and documents, in the name of, and on behalf of, the Company, with such changes thereto as any officer may approve, and to take

all such further action as they, or any of them, may deem necessary or appropriate to carry out the purpose and intent of the

foregoing resolution.

ADVANTAGES

AND DISADVANTAGES OF INCREASING AUTHORIZED COMMON STOCK

There

are certain advantages and disadvantages of increasing the Company’s authorized common stock. The Company believes that

the impact of increasing its authorized capital is largely mitigated by increased ability of the Company to raise capital for

the future growth of the Company consistent with its Business Plan. As a result of the increase in authorized capital, authorized

but unissued Company Common Shares are increased from 91,069,640 to 291,069,640. The current number of authorized but unissued

shares does not include shares which are reserved for issuance in the event of the exercise of certain warrants and options which

required to be reserved.

The

Company believes that this increased number of authorized but unissued Common Shares will facilitate:

|

|

●

|

The

ability to raise capital by issuing capital stock under future financing transactions, if any.

|

|

|

|

|

|

|

●

|

To

have shares of common stock available to pursue business expansion opportunities, if any.

|

|

|

|

|

|

|

●

|

The

issuance of authorized but unissued stock could be used to deter a potential takeover of the Company that may otherwise be

beneficial to shareholders by diluting the shares held by a potential suitor or issuing shares to a shareholder that will

vote in accordance with the desires of the Company’s Board of Directors, at that time. Notwithstanding, a takeover may

be beneficial to independent shareholders because, among other reasons, a potential suitor may offer Company shareholders

a premium for their shares of stock compared to the then-existing market price. The Company does not have any plans or Proposal

to adopt such provisions or enter into agreements that may have material anti-takeover consequences.

|

Disadvantages

of this action include the following:

|

|

●

|

The

issuance of additional authorized but unissued shares of Common Stock could result in decreased net income per share which

could result in dilution to existing shareholders.

|

|

|

|

|

|

|

●

|

In

the long run, the Company may be limiting the number of authorized but unissued shares it can issue in the future without

a further amendment of its Articles of Incorporation. Notwithstanding, the Company believes that maintaining 291,069,640 authorized

but unissued Common shares will cover all of its reasonably foreseeable requirements.

|

RECOMMENDATION

OF THE BOARD OF DIRECTORS:

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE RESOLUTION AUTHORIZING THE BOARD OF DIRECTORS, IN ITS SOLE

DISCRETION, TO AMEND THE COMPANY’S ARTICLES OF INCORPORATION TO INCREASE THE COMPANY’S AUTHORIZED SHARES OF COMMON

STOCK FROM 100,000,000 SHARES TO 300,000,000 SHARES.

PROPOSAL

NO. 3

RATIFICATION

OF APPOINTMENT OF INDEPENDENT

REGISTERED

PUBLICACCOUNTING FIRM

The

Board of Directors has appointed LJ Soldinger LLC, Certified Public Accountants (“Soldinger”), as our independent

registered public accounting firm to examine the consolidated financial statements of the Company for fiscal year ending September

30, 2018. The Board of Directors seeks an indication from shareholders of their approval or disapproval of the appointment.

The

Board of Directors initially approved the engagement of Soldinger as the Company’s new independent registered public accounting

firm in 2016. Soldinger will audit our consolidated financial statements for the fiscal year ended September 30, 2018.

Our

consolidated financial statements for the fiscal year ended September 30, 2017 were audited by Soldinger.

In

the event shareholders fail to ratify the appointment of Soldinger, the Board of Directors will reconsider this appointment. Even

if the appointment is ratified, the Board of Directors, in its discretion, may direct the appointment of a different independent

registered public accounting firm at any time during the year if the Board of Directors determines that such a change would be

in the interests of the Company and its shareholders.

The

affirmative vote of the holders of a majority of the Company’s common stock represented and voting at the Annual Meeting

either in person or by proxy will be required for approval of this proposal. Neither abstentions nor broker non-votes shall have

any effect on the outcome of this vote.

RECOMMENDATION

OF THE BOARD OF DIRECTORS:

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE RATIFICATION OF SOLDINGER AS THE COMPANY’S INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

CORPORATE

GOVERNANCE

Board

Meetings and Annual Meeting Attendance

The

Board of Directors met two (2) times during fiscal year ended September 30, 2017. No director attended less than 50% of the meetings.

Audit

Committee

Steve

Hubbard and Rajiv Rai and currently serve as members of the Company’s separately designated Audit Committee, in accordance

with section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), with Mr. Rai acting

as its Chairman. The Board of Directors ratified the formation of its Audit Committee effective May 25, 2018.

The

function of the Audit Committee, as detailed in the Audit Committee Charter, is to provide assistance to the Board in fulfilling

its responsibility to the shareholders, potential shareholders, and investment community relating to corporate accounting, management

practices, reporting practices, and the quality and integrity of the financial reports of the Company. In so doing, it is the

responsibility of the Audit Committee to maintain free and open means of communication between the directors, the independent

auditors and Company management.

The

independent directors meet the independence standards of the NASDAQ Stock Exchange, and the SEC.

The

Board of Directors pre-approved all services provided by our independent auditors for the fiscal year ended September 30, 2017.

Compensation

Committee

Lindy

Snider and Jessica Michelle Feingold currently serve as members of the Company’s separately designated Compensation Committee,

with Ms. Sinder acting as its Chairman. The Board of Directors ratified the formation of its Compensation Committee effective

May 25, 2018.

The

Compensation Committee sets the overall compensation principles for the Company, subject to annual review. The Compensatin Committee

may not delegate its authority. However, the Compensation Committee may retain counsel or consultants as necessary.

The

independent directors meet the independence standards of the NASDAQ Stock Exchange, the New York Stock Exchange and the SEC.

The

Compensation Committee establishes the Company’s general compensation policy and, except as prohibited by law, may take

any and all actions that the Board could take relating to compensation of directors, executive officers, employees and other parties.

The Compensation Committee’s role is to (i) evaluate the performance of the Company’s executive officers, (ii) set

compensation for directors and executive officers, (iii) make recommendations to the Board on adoption of compensation plans and

(iv) administer Company compensation plans. When evaluating potential compensation adjustments, the Compensation Committee solicits

and considers input provided by the Chief Executive Officer relating to the performance and/or contribution to the Company’s

overall performance by executive officers and other key employees.

Nominating

Committee

At

this time, the entire Board of Directors functions as the Company’s Nominating Committee. The Board expects to nominate

a dedicated Nominating Committee in the near future.

The

Nominating Committee’s role is to identify and recommend candidates for positions on the Board of Directors. The Nominating

Committee’s policies are subject to annual review.

The

function of the Nominating Committee, as detailed in the Nominating Committee Charter, is to recommend to the Board the slate

of director nominees for election to the Board and to identify and recommend candidates to fill vacancies occurring between annual

shareholder meetings. The Nominating Committee has established certain broad qualifications in order to consider a proposed candidate

for election to the Board. The Nominating Committee has a strong preference for candidates with prior board experience with public

companies. The Nominating Committee will also consider such other factors as it deems appropriate to assist in developing a board

and committees that are diverse in nature and comprised of experienced and seasoned advisors. These factors include judgment,

skill, diversity (including factors such as race, gender or experience), integrity, experience with businesses and other organizations

of comparable size, the interplay of the candidate’s experience with the experience of other Board members, and the extent

to which the candidate would be a desirable addition to the Board and any committees of the Board.

It

is the policy of the Nominating Committee to consider candidates recommended by security holders, directors, executive officers

and other sources, including, but not limited to, third-party search firms. Security holders of the Company may submit recommendations

for candidates for the Board. Such submissions should include the name, contact information, a brief description of the candidate’s

business experience and such other information as the person submitting the recommendation believes is relevant to the evaluation

of the candidate. The Nominating Committee will review all such recommendations.

The

Nominating Committee will evaluate whether an incumbent director should be nominated for re-election to the Board or any Committee

of the Board upon expiration of such director’s term using the same factors as described above for other Board candidates.

The Nominating Committee will also take into account the incumbent director’s performance as a Board member. Failure of

any incumbent director to attend at least seventy-five percent (75%) of the Board meetings held in any year of service as a Board

member will be viewed negatively by the Nominating Committee in evaluating the performance of such director.

Code

of Ethics

The

Company has adopted a code of ethics that is applicable to our directors and officers.

Director’s

Compensation

The

following Director Compensation Table sets forth the compensation of our directors for the fiscal years ending on September 30,

2017 and September 30, 2016.

DIRECTOR

COMPENSATION TABLE

Name

and

Principal

Position (a)

|

|

Year

(b)

|

|

|

Salary

($)

(b)

|

|

|

Bonus

($)

(b)

|

|

|

Stock

Awards

($)

(b)

|

|

|

Option

Awards

($)

(b)

|

|

|

Non-Equity

Incentive Plan

Compensation

($)

(b)

|

|

|

All

Other Compensation ($)

(b)

|

|

|

Total

($)

(b)

|

|

|

Director

|

|

|

2017

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

56,000

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

56,000

|

|

|

Garrett

Bender (1)

|

|

|

2016

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Director

|

|

|

2017

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

56,000

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

56,000

|

|

|

Lindy Snider(2)

|

|

|

2016

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Director

|

|

|

2017

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

Jennifer

Michelle Feingold(3)

|

|

|

2016

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Director

|

|

|

2017

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

Rajiv Rai(4)

|

|

|

2016

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

1.

|

Mr.

Bender was appointed as a director of the Company in June 2016.

|

|

|

|

|

2.

|

Ms.

Snider was appointed as a director of the Company in June 2016.

|

|

|

|

|

3.

|

Ms.

Feingold was appointed as a director of the Company in March 2018.

|

|

|

|

|

4.

|

Mr.

Rai was appointed as a director of the Company in May 2018.

|

Directors

and Executive Officers

The

following table discloses our directors and executive officers as of June 11, 2018.

|

Name

|

|

Age

|

|

|

Position

|

|

|

|

|

|

|

|

|

Adam

Berk

|

|

|

40

|

|

|

Chief

Executive Officer, President and Director

|

|

|

|

|

|

|

|

|

|

Steve

Hubbard

|

|

|

70

|

|

|

Chief

Financial Officer, Secretary and Director

|

|

|

|

|

|

|

|

|

|

Garrett

M. Bender

|

|

|

57

|

|

|

Director

|

|

|

|

|

|

|

|

|

|

Lindy

Snider

|

|

|

57

|

|

|

Director

|

|

|

|

|

|

|

|

|

|

Jennifer

Michelle Feingold

|

|

|

35

|

|

|

Director

|

|

|

|

|

|

|

|

|

|

Rajiv

Rai

|

|

|

48

|

|

|

Director

|

Executive

Officer Compensation

The

following is a summary of the compensation we paid for each of the last two years ended September 30, 2017 and 2016, respectively

(i) to the persons who acted as our principal executive officer during our fiscal year ended September 30, 2017 and (ii) to the

person who acted as our next most highly compensated executive officer other than our principal executive officer who was serving

as an executive officer as of the end of our last fiscal year.

|

Name

and Principal Position

|

|

Year

|

|

|

Salary

($)

|

|

|

Bonus

($)

|

|

|

Stock

Awards

($)

|

|

|

Option

Awards

($)

|

|

|

Non-Equity

Incentive Plan

Compensation

|

|

|

Non-Qualified

Deferred

Compensation

Earnings ($)

|

|

|

All

other

Compensation

($)

|

|

|

Total

($)

|

|

|

Adam

Berk (1)

|

|

|

2017

|

|

|

$

|

—

|

|

|

|

—

|

|

|

|

240,000

|

|

|

|

92,000

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

332,000

|

|

|

CEO

|

|

|

2016

|

|

|

$

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Steven

Hubbard (2)

|

|

|

2017

|

|

|

$

|

20,000

|

|

|

|

—

|

|

|

|

120,000

|

|

|

|

184,000

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

324,000

|

|

|

CFO

|

|

|

2016

|

|

|

$

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

1.

|

Mr.

Berk was appointed as Chief Executive Officer and President of the Company in June 2016.

|

|

|

|

|

|

|

2.

|

Mr.

Hubbard was appointed as Chief Financial Officer and Secretary of the Company in June 2016.

|

2017

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

OUTSTANDING

EQUITY AWARDS

Grants

of Plan-Based Awards

|

|

|

|

|

Option

Awards

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Grant

Date

Number

of Securities

Underlying

Unexercised

Options (#)

Exercisable

|

|

Equity

Incentive

Plan Awards:

Number of

Securities

Underlying

Unexercise

Unearned Options

(#)

|

|

|

Number

of

Securities

Underlying

Unexercised

Options (#

Unexercisable (1)

|

|

|

Option

Exercise

Price ($)

|

|

|

Option

Expiration

Date

|

|

Adam

Berk, CEO, Director

|

|

June

1, 2017

|

|

|

-

|

|

|

|

50,000

|

|

|

|

2.40

|

|

|

May

31, 2020

|

|

Steven

Hubbard, CFO, Director

|

|

June

1, 2017

|

|

|

-

|

|

|

|

100,000

|

|

|

|

2.40

|

|

|

May

31, 2020

|

|

Garrett

M. Bender, Director

|

|

June

1, 2017

|

|

|

-

|

|

|

|

50,000

|

|

|

|

2.40

|

|

|

May

31, 2021

|

|

Lindy

Snider, Director

|

|

June

1, 2017

|

|

|

-

|

|

|

|

50,000

|

|

|

|

2.40

|

|

|

May

31, 2021

|

|

Equity

Compensation Plan Information

|

|

|

Plan

category

|

|

Number

of securities to be issued upon exercise of outstanding options, warrants and rights(a)

|

|

|

Weighted-average

exercise price of outstanding

options, warrants and rights

|

|

|

Number

of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column

(a) (1)

|

|

|

Equity

compensation plans approved by security holders

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Equity

compensation plans not approved by security holders

|

|

|

250,000

|

|

|

|

2.40

|

|

|

|

711,979

|

|

|

Total

|

|

|

250,000

|

|

|

|

2.40

|

|

|

|

711,979

|

|

(1)

As of September 30, 2017

Warrants

Issued to Management

|

Name

|

|

|

Grant

Date

|

|

|

Number

of

Securities

Underlying

Unexercised

Exercisable

Warrants

|

|

|

Number

of

Securities

Underlying

Unexercised

Exercisable

Warrants

|

|

|

Warrant

Exercise

Price($)

|

|

|

Warrant

Expiration

Date

|

|

|

None

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Family

Relationships

None.

Involvement

in Certain Legal Proceedings

To

the best of our knowledge during the past five years, no director or officer of the Company has been involved in any of the following:

(1) Any bankruptcy petition filed by or against such person individually, or any business of which such person was a general partner

or executive officer either at the time of the bankruptcy or within two years prior to that time; (2) Any conviction in a criminal

proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); (3) Being

subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction,

permanently or temporarily enjoining, barring, suspending or otherwise limiting his or her involvement in any type of business,

securities or banking activities; and (4) Being found by a court of competent jurisdiction (in a civil action), the SEC or the

Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not

been reversed, suspended, or vacated.

Adverse

Proceedings

There

exists no material proceeding to which any director or officer is a party adverse to the Company or has a material interest adverse

to the Company.

Compliance

with Section 16(a) of the Exchange Act

Section

16(a) of the Exchange Act requires the Company’s directors, executive officers and persons who beneficially own 10% or more

of a class of securities registered under Section 12 of the Exchange Act to file reports of beneficial ownership and changes in

beneficial ownership with the SEC. Directors, executive officers and greater than 10% stockholders are required by the rules and

regulations of the SEC to furnish the Company with copies of all reports filed by them in compliance with Section 16(a). To the

best of the Company’s knowledge, any reports required to be filed were timely filed.

REPORT

OF THE AUDIT COMMITTEE

The

Board of Directors acting as the Company’s Audit Committee has reviewed and discussed the audited financial statements for

fiscal year ended September 30, 2017 with Stem management.

The

Audit Committee has discussed with the Company’s independent auditors the matters required to be discussed by the Statement

on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1, AU section 380), as adopted by the Public Company

Accounting Oversight Board in Rule 3200T.

The

Board of Directors has received the written disclosures and the letter from the Company’s independent accountants required

by Independence Standards Board Standard No. 1 (Independence Standards Board Standard No. 1, Independence Discussions with Audit

Committees), 2 as adopted by the Public Company Accounting Oversight Board in Rule 3600T and has discussed with the independent

accountant the independent accountant’s independence.

Based

on the such review and discussions, the Board of Directors directed that the audited financial statements be included in the company’s

annual report on Form 10-K for the last fiscal year for filing with the SEC.

Respectfully

Submitted,

Adam

Berk

Chairman

of the Board of Directors

The

preceding Report will be filed with the records of the Company.

FEES

TO INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Audit

Fees

The

aggregate fees billed by our principal accountant for the audit of our annual financial statements, review of financial statements

included in the quarterly reports and other fees that are normally provided by the accountant in connection with statutory and

regulatory filings or engagements for the fiscal years ended September 30, 2017 and September 30, 2016, respectively, were approximately

$65,000 and $15,000.

Tax

Fees

No

fees were billed for professional services rendered by our principal accountant for tax compliance, tax advice and tax planning

for the fiscal years ended September 30, 2017 and 2016.

All

Other Fees

There

were no fees billed for other products or services provided by our principal accountant for 2017 or 2016.

Audit

Committee Pre-Approval Policies and Procedures

The

Company has policies and procedures that require the pre-approval by the Board of Directors of all fees paid to, and all services

performed by, the Company’s independent accounting firms. At the beginning of each year, the Board of Directors approves

the proposed services, including the nature, type and scope of services contemplated and the related fees, to be rendered by these

firms during the year. In addition, Board of Directors pre-approval is also required for those engagements that may arise during

the course of the year that are outside the scope of the initial services and fees pre-approved by the Board of Directors.

Pursuant

to the Sarbanes-Oxley Act of 2002, 100% of the fees and services provided as noted above were authorized and approved by the Board

of Directors in compliance with the pre-approval policies and procedures described herein.

TRANSACTIONS

WITH RELATED PERSONS

As

of September 30, 2017, the Company had $16,500 due to related parties. At September 30, 2016, the Company has $20,412 due from

related parties and $34,750 due to related parties.

Review,

Approval or Ratification of Transactions with Related Persons

The

Board of Directors is responsible for the review, approval or ratification of all “transactions with related persons”

as that term refers to transactions required to be disclosed by Item 404 of Regulation S-K promulgated by the SEC. In reviewing

a proposed transaction, the Audit Committee must (i) satisfy itself that it has been fully informed as to the related party’s

relationship and interest and as to the material facts of the proposed transaction and (ii) consider all of the relevant facts

and circumstances available to the Board of Directors. After its review, the Board of Directors will only approve or ratify transactions

that are fair to the Company and not inconsistent with the best interests of the Company and its stockholders.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS.

The

following table sets forth certain information with respect to the beneficial ownership of our voting securities by (i) any person

or group owning more than 5% of any class of voting securities, (ii) each director, (iii) our chief executive officer and president

and (iv) all executive officers and directors as a group as of May 31, 2018. Unless noted, the address for the following beneficial

owners and management is

7777 Glades Road, Suite

203, Boca Raton, FL 33434

.

|

Title

of Class

|

|

Name

and Address of

Beneficial Owner

|

|

Amount

and Nature

of Beneficial Owner

(1)

|

|

|

Percent

of Class

|

|

|

Common

Stock

|

|

Adam

Berk (2)

|

|

|

364,866

|

|

|

|

4.1

|

%

|

|

Common

Stock

|

|

Steven

Hubbard (3)

|

|

|

168,333

|

|

|

|

1.8

|

%

|

|

Common

Stock

|

|

Garrett

M. Bender (4)

|

|

|

178,974

|

|

|

|

2.6

|

%

|

|

Common

Stock

|

|

Lindy

Snider (5)

|

|

|

91,666

|

|

|

|

1.

0

|

%

|

|

Common

Stock

|

|

Jessica

M. Feingold (6)

|

|

|

91,666

|

|

|

|

1.0

|

%

|

|

Common

Stock

|

|

Rajiv

Rai

|

|

|

0

|

|

|

|

-

|

|

|

Common

Stock

|

|

All

executive officers and directors as a group

|

|

|

895,505

|

|

|

|

9.8

|

%

|

|

Common

Stock

|

|

Flying

High Financial Corporation (5% holder) (6)

445

W. 40

th

Street

Miami Beach, FL 33140

|

|

|

833,334

|

|

|

|

9.0

|

%

|

|

|

(1)

|

In

determining beneficial ownership of our Common Stock, the number of shares shown includes shares which the beneficial owner

may acquire upon exercise of debentures, warrants and options which may be acquired within 60 days. In determining the percent

of Common Stock owned by a person or entity on May 31, 2018, (a) the numerator is the number of shares of the class beneficially

owned by such person or entity, including shares which the beneficial ownership may acquire within 60 days of exercise of

debentures, warrants and options; and (b) the denominator is the sum of (i) the total shares of that class outstanding on

May 31, 2018 (8,845,360 shares of Common Stock) and (ii) the total number of shares that the beneficial owner may acquire

upon exercise of the debentures, warrants and options. Unless otherwise stated, each beneficial owner has sole power to vote

and dispose of its shares.

|

|

|

|

|

|

|

(2)

|

Includes

314,866 shares and options to purchase 50,000 shares.

|

|

|

|

|

|

|

(3)

|

Includes

68,333 shares and options to purchase 100,000 shares

|

|

|

|

|

|

|

(4)

|

Includes

128,974 shares and options to purchase 50,000 shares

|

|

|

|

|

|

|

(5)

|

Includes

41,666 shares and options to purchase 50,000 shares

|

|

|

|

|

|

|

(6)

|

Includes

41,666 shares and options to purchase 50,000 shares

|

|

|

|

|

|

|

(7)

|

The

beneficial owner of Flying High Financial Corporation is Mark Groussman, President.

|

SHAREHOLDER

COMMUNICATIONS

The

Board of Directors of the Company has not adopted a formal procedure that shareholders must follow to send communications to it.

The Board of Directors does receive communications from shareholders, from time to time, and addresses those communications as

appropriate. Shareholders can send communication to the Board of Directors in writing, to Stem Holdings, Inc., 7777 Glades Road,

Suite 203, Boca Raton, FL 33434, Attention: Board of Directors.

AVAILABILITY

OF ANNUAL REPORT ON FORM 10-K AND HOUSEHOLDING

A

copy of the Company’s Annual Report on Form 10-K as filed with the SEC is available upon written request and without charge

to shareholders by writing to the Company c/o Secretary, 7777 Glades Road, Suite 203, Boca Raton, FL 33434 or by calling telephone

number (561) 948-5406.

.In

certain cases, only one Proxy Statement may be delivered to multiple shareholders sharing an address unless the Company has received

contrary instructions from one or more of the stockholders at that address. The Company will undertake to deliver promptly upon

written or oral request a separate copy of the Proxy Statement, as applicable, to a stockholder at a shared address to which a

single copy of such documents was delivered. Such request should also be directed to Secretary, Stem Holdings, Inc., at the address

or telephone number indicated in the previous paragraph. In addition, shareholders sharing an address can request delivery of

a single copy of Proxy Statements if they are receiving multiple copies of Proxy Statements by directing such request to the same

mailing address.

OTHER

MATTERS

We

have not received notice of and do not expect any matters to be presented for vote at the Annual Meeting, other than the proposals

described in this Proxy Statement. If you grant a proxy, the person named as proxy holder, Adam Berk, or his nominees or substitutes,

will have the discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting. If

for any unforeseen reason, any of our nominees are not available as a candidate for director, the proxy holder will vote your

proxy for such other candidate or candidates nominated by our Board.

|

By

Order of the Board of Directors

|

|

|

|

|

|

/s/

Adam Berk

|

|

|

|

|

|

Adam

Berk

|

|

|

Chairman

of the Board

|

|

|

Boca

Raton, FL

|

|

|

June

25, 2018

|

|

PROXY

THIS

PROXY IS SOLICITED ON BEHALF OF THE BOARD OF

DIRECTORS OF STEM HOLDINGS, INC.

The

undersigned hereby appoints Adam Berk as Proxy with full power of substitution to vote all the shares of common stock which the

undersigned would be entitled to vote if personally present at the Annual Meeting of Shareholders to be held on July 13, 2018,

at 12 noon EDT at Wyndham Hotel (Palm Suites East Meeting Room), 1950 Glades Road, Boca Raton, FL 33431, or at any postponement

or adjournment thereof, and upon any and all matters which may properly be brought before the Annual Meeting or any postponement

or adjournments thereof, hereby revoking all former proxies.

Election

of Directors

The

nominees for the Board of Directors are:

Adam

Berk

Rajiv Rai

|

|

Steve

Hubbard

|

|

Garrett

M. Bender

|

|

Lindy

Snider

|

|

Jessica

Michelle Feingold

|

Instruction:

To withhold authority to vote for any individual nominee(s), write the nominee(s) name on the spaces provided below:

The

Board of Directors recommends a vote FOR Proposal Nos. 1, 2 and 3.

|

1.

|

To

elect six directors to hold office for a one-year term or until each of their successors are elected and qualified (except

as marked to the contrary above).

|

|

|

[ ]

FOR

|

[ ]

AGAINST

|

[ ]

ABSTAINS

|

|

|

[ ]

WITHHOLDS

|

|

|

|

2.

|

To

adopt a resolution authorizing the Board of Directors, in its sole discretion, to amend the Company’s Articles of Incorporation

to increase the number of authorized shares of Company Common Stock from 100,000,000 to 300,000,000.

|

|

|

[ ]

FOR

|

[ ]

AGAINST

|

[ ]

ABSTAINS

|

|

|

[ ]

WITHHOLDS

|

|

|

|

3.

|

To

ratify the appointment of LJ Soldinger LLC as the independent registered public accounting firm of the Company.

|

|

|

[ ]

FOR

|

[ ]

AGAINST

|

[ ]

ABSTAINS

|

|

|

[ ]

WITHHOLDS

|

|

|

Dated:

,

2018

|

|

|

|

Signature

of Shareholder

|

|

|

|

|

|

|

|

|

Signature

of Shareholder

|

|

Please

date and sign exactly as your name(s) appears hereon. If the shares are registered in more than one name, each joint owner or

fiduciary should sign personally. When signing as executor, administrator, trustee or guardian give full titles. Only authorized

officers should sign for a corporation.

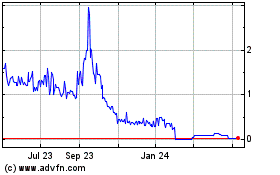

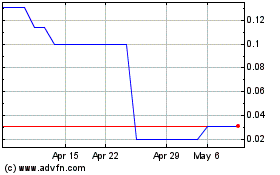

Stem (QB) (USOTC:STMH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Stem (QB) (USOTC:STMH)

Historical Stock Chart

From Apr 2023 to Apr 2024