SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

-------------

FORM 11-K

-------------

|

|

|

|

|

|

[ X ]

|

Annual Report Pursuant to Section 15(d) of the Securities Exchange Act of 1934

|

|

|

For the Fiscal Year Ended December 31, 2017

|

|

|

|

|

or

|

|

|

|

|

[ ]

|

Transition Report Pursuant to Section 15(d) of the Securities Exchange Act of

|

|

|

1934

|

|

|

|

|

|

For the transition period from _______________ to _______________

|

|

|

|

|

Commission File Number:

001-10607

|

-------------

THE REPUBLIC MORTGAGE INSURANCE COMPANY AND

AFFILIATED COMPANIES PROFIT SHARING PLAN

-------------

OLD REPUBLIC INTERNATIONAL CORPORATION

307 NORTH MICHIGAN AVENUE

CHICAGO, ILLINOIS 60601

Total Pages: 17

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Administration Committee has duly caused this Annual Report to be signed on behalf of the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

THE REPUBLIC MORTGAGE INSURANCE COMPANY AND

AFFILIATED COMPANIES PROFIT SHARING PLAN

|

|

|

|

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ D Christopher Cash

|

|

|

|

|

|

D. Christopher Cash, Plan Administrator

|

Date: June 23, 2018

The Republic Mortgage Insurance Company

And Affiliated Companies

Profit Sharing Plan

Financial Statements and

Supplemental Schedule

December 31, 2017 and 2016

The Republic Mortgage Insurance Company and Affiliated Companies

Profit Sharing Plan

Index

Page(s)

Report of Independent Registered Public Accounting Firm

1-2

Financial Statements

Statements of Net Assets Available for Benefits

December 31, 2017 and 2016 3

Statement of Changes in Net Assets Available for Benefits

Year Ended December 31, 2017 4

Notes to Financial Statements 5-11

Supplemental Schedule

Schedule H, line 4i - Schedule of Assets (Held at End of Year)

December 31, 2017 13

Note: Supplemental schedules required by the Employee Retirement Income Security Act of 1974, as amended that have not been included herein are not applicable.

Report of Independent Registered Public Accounting Firm

To the Participants and Administrator of

The Republic Mortgage Insurance Company and Affiliated Companies Profit Sharing Plan

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of The Republic Mortgage Insurance Company and Affiliated Companies Profit Sharing Plan (the Plan) as of December 31, 2017 and 2016, and the related statement of changes in net assets available for benefits for the year ended December 31, 2017, and the related notes (collectively referred to as the financial statements). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2017 and 2016, and the changes in net assets available for benefits for the year ended December 31, 2017, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Information

The supplemental information has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

1

/s/ Mayer Hoffman McCann P.C.

We have served as the Plan's auditor since 2007.

Minneapolis, Minnesota

June 21, 2018

2

The Republic Mortgage Insurance Company and Affiliated Companies Profit Sharing Plan

Statements of Net Assets Available for Benefits

December 31, 2017 and 2016

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2017

|

|

|

2016

|

|

Assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments:

|

|

|

|

|

|

|

|

Insurance Company Guaranteed Interest Account, at contract value

|

$

|

20,510,758

|

|

$

|

21,561,218

|

|

|

Insurance company pooled separate accounts, at net asset value

|

|

12,077,247

|

|

|

14,029,171

|

|

|

Mutual funds, at fair value

|

|

4,115,033

|

|

|

0

|

|

|

Old Republic International Corporation common stock fund, at fair value

|

|

3,053,771

|

|

|

2,762,807

|

|

|

|

Total investments

|

|

39,756,809

|

|

|

38,353,196

|

|

|

|

|

|

|

|

|

|

|

Receivables:

|

|

|

|

|

|

|

|

Employer contributions

|

|

220,700

|

|

|

248,650

|

|

|

Other employer contributions

|

|

0

|

|

|

247,900

|

|

|

Notes receivable from participants

|

|

123,233

|

|

|

120,977

|

|

|

|

Total receivables

|

|

343,933

|

|

|

617,527

|

|

|

|

|

|

|

|

|

|

|

Net Assets Available for Benefits

|

$

|

40,100,742

|

|

$

|

38,970,723

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements.

3

The Republic Mortgage Insurance Company and Affiliated Companies Profit Sharing Plan

Statement of Changes in Net Assets Available for Benefits

Year Ended December 31, 2017

|

|

|

|

|

|

|

|

|

Additions:

|

|

|

|

|

|

|

|

|

|

|

Investment Income:

|

|

|

|

|

Net appreciation in net asset value of pooled separate account investments

|

$

|

2,367,292

|

|

|

Dividends, mutual fund investments

|

|

95,212

|

|

|

Net appreciation in fair value of mutual fund investments

|

|

262,074

|

|

|

Interest, Guaranteed Interest Account

|

|

593,240

|

|

|

Dividends, Old Republic International Corporation common stock fund

|

|

102,327

|

|

|

Net appreciation in fair value of the Old Republic International Corporation

common stock fund

|

|

322,809

|

|

|

|

Investment income

|

|

3,742,954

|

|

Interest income on notes receivable form participants

|

|

3,519

|

|

|

|

|

|

|

|

Contributions:

|

|

|

|

|

Employer

|

|

220,700

|

|

|

Other Employer

|

|

6,620

|

|

|

Participants

|

|

132,264

|

|

|

|

Total contributions

|

|

359,584

|

|

|

|

Total additions

|

|

4,106,057

|

|

|

|

|

|

|

|

Deductions:

|

|

|

|

Benefits and withdrawals

|

|

2,975,280

|

|

Administrative expenses

|

|

758

|

|

|

|

Total deductions

|

|

2,976,038

|

|

|

|

Net additions

|

|

1,130,019

|

|

|

|

|

|

|

|

Net assets available for benefits:

|

|

|

|

Beginning of year

|

|

38,970,723

|

|

End of year

|

$

|

40,100,742

|

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements.

4

The Republic Mortgage Insurance Company and Affiliated Companies Profit Sharing Plan

Notes to Financial Statements

The following description of The Republic Mortgage Insurance Company and Affiliated Companies Profit Sharing Plan (the “Plan”) is provided for general information purposes only. Participants should refer to the Summary Plan Description or the Plan document for more complete information.

The Plan is a qualified defined contribution plan covering all employees of Republic Mortgage Insurance Company, RMIC Corporation, and Republic Mortgage Guaranty Insurance Corporation (formerly known as Republic Mortgage Insurance Company of North Carolina) (the “Sponsor”). Employees are eligible to participate in the Plan at the start of their employment and must elect to enroll in the plan. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974 (“ERISA”) and Internal Revenue Code (“IRC”).

Contributions

The Sponsor makes contributions to the Plan at the discretion of the Sponsor’s Board of Directors at a sum determined by the Board without regard to current and accumulated profits for the taxable year, for years ending with or within such Plan year. Contributions are allocated to eligible participants based on the participant’s eligible compensation relative to the total eligible compensation of all eligible participants.

Participants may contribute up to 25% of their compensation pre-tax and 25% after-tax for a combined maximum of 50% of compensation during any Plan year.

Participants may also make rollover contributions into the Plan from distributions from other qualified plans, as defined in the Plan.

Contributions are subject to certain limitations as prescribed by the Internal Revenue Service with contributions in excess of IRC limits returned to participants or sponsor when determined. There were no material excess contributions to be returned to participants based on qualification testing for the years ended December 31, 2017 and 2016.

Vesting

Participant account balances provided by Sponsor contributions and related allocated Plan earnings become 40% vested after one year of service. Vesting percentages increase by 10% for each of the next four years with full vesting after six years of service.

Participant account balances provided by participant contributions and allocated Plan earnings are always fully vested.

Participant Accounts

A separate account balance is maintained for each participant and is credited with participant contributions, participant rollover contributions from other qualified plans, and allocations of Sponsor contributions, Plan earnings, and forfeitures of terminated participants’ non-vested accounts. Allocations of Plan earnings are based on participants’ daily account balances. Sponsor contributions and forfeitures of non-vested accounts are allocated based on eligible annual compensation of participants. The benefit to which a participant is entitled is the participant’s vested account. Participants direct the investment of their account by electing among a variety of investment options offered by the Plan. Participants may change their investment designation with respect to their account balance and future contributions at any time.

5

The Republic Mortgage Insurance Company and Affiliated Companies Profit Sharing Plan

Notes to Financial Statements

Forfeitures

If a participant terminates employment with the Sponsor prior to becoming fully vested, the non- vested portion of the Sponsor contributions and allocated earnings thereon are forfeited and are reallocated to eligible participants when the terminated participant incurs a break-in-service. Forfeited amounts are reallocated to the active eligible participants based on eligible participant compensation, as defined in the Plan agreement. Unallocated forfeitures totaled $486 and $5,895 at December 31, 2017 and 2016, respectively. Of the December 31, 2017 total, $486 was allocated in 2018.

Payment of Benefits

In the event of retirement, disability, or death, accumulated benefits become vested and are distributed to participants or designated beneficiaries by lump-sum payment or through various annuity options.

In the event of termination of employment, participants have the option of receiving vested accumulated benefits through lump-sum distributions, leaving the vested value of their accounts in the Plan until retirement, or transferring amounts into an individual retirement account.

Participants may withdraw after-tax voluntary contributions at any time. Participants may withdraw pre-tax voluntary contributions at age 59½ or for financial hardship purposes.

Participants may elect to take early withdrawals of employer contributions if they have participated in the Plan for at least five years and in-service distributions after attaining age 59½. Such early withdrawals will not result in suspension of Sponsor contribution allocations.

Net assets at December 31, 2017 and 2016, included funds totaling $29,647,157 and $29,377,225, respectively, which represent the account balances of retired and terminated participants who have elected to leave their funds in the Plan upon retirement or termination.

Notes Receivable from Participants

Participants may borrow a minimum of $1,000 from their accounts up to a maximum equal to the lesser of $50,000 or 50% of their vested account balance. Participants may have no more than two loans outstanding at one time. Loans plus interest must be repaid within five years through payroll deductions. These loans bear interest at the prevailing prime rate at the loan inception date. The loans are collateralized by the vested balance in the participant’s account. Outstanding loans of terminated participants are repaid prior to distribution of the participant’s account balance or the outstanding loans are repaid from the participant’s account balance before distribution.

Partial Plan Termination

In August 2011, the Plan Sponsor ceased writing new business and placed its insurance companies into run-off operating mode. As a result the Sponsor initiated a series of significant staff reductions. In accordance with the rules and regulations set forth by ERISA, the IRC, and by Plan documents, these involuntary terminations were considered a partial plan termination. When such an event occurs, the Plan is impacted in the following ways: (1) the number of active participants is reduced; (2) the vesting schedule for those Participants that are involuntarily terminated by the Plan Sponsor is accelerated and; (3) a market value adjustment is applied to the Insurance Company Guaranteed Interest Account (“GIA”) for those terminated

Participants invested in that option.

6

The Republic Mortgage Insurance Company and Affiliated Companies Profit Sharing Plan

Notes to Financial Statements

Notwithstanding the market value adjustment, participants who remain invested in the GIA option subsequent to termination continue to transact with the GIA at contract value. The Plan remains a viable qualified defined contribution plan for those participants remaining with the Sponsor.

|

|

|

|

2.

|

Summary of Significant Accounting Policies

|

Basis of Accounting

The Plan prepares its financial statements on an accrual basis of accounting in accordance with accounting principles generally accepted in the United States.

Investment Valuation and Income Recognition

Investment contracts held by a defined contribution plan are required to be reported at fair value except for fully benefit-responsive investment contracts, which are reported at contract value. Contract value is the relevant measure for that portion of the net assets available for benefits of a defined contribution plan attributable to fully benefit-responsive investment contracts because contract value is the amount participants would receive if they were to initiate permitted transactions under the terms of the Plan.

Investments in pooled separate accounts are valued on a net asset value per unit basis which approximates their fair value. The pooled separate accounts are credited with earnings on the underlying investments and charged for Plan benefits paid and deductions for investment expenses, risk, profit, and annual management fees. Redemptions may occur on a daily basis. The use of net asset value as fair value is deemed appropriate as the pooled separate accounts do not have a finite life, unfunded commitments relating to investments, or significant restrictions on redemptions.

Investments in mutual funds are traded on a national securities exchange and are valued at the last reported sales price on the last business day of the year.

Old Republic International Corporation common shares are traded on a national securities exchange and are valued at the last reported sales price on the last business day of the year.

Net appreciation (depreciation) in fair value of investments includes unrealized and realized gains and losses. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date. Purchases and sales of securities are recorded on a trade-date basis.

Notes Receivable from Participants

Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest. Interest income is recorded on the accrual basis. Related fees are recorded as administrative expenses when they are incurred. No allowance for credit losses has been recorded as of December 31, 2017 or 2016. If a participant ceases to make loan repayments and the Plan deems the participant loan to be in default, the participant loan balance is reduced and a benefit payment is recorded.

Benefits and Withdrawals

Benefits and withdrawals are recorded when paid. At December 31, 2017 and 2016, there were no significant amounts due but unpaid to participants.

7

The Republic Mortgage Insurance Company and Affiliated Companies Profit Sharing Plan

Notes to Financial Statements

Income Tax Status

The Plan obtained its latest determination letter on February 20, 2015, in which the Internal Revenue Service (“IRS”) stated that the Plan, as then designed, was in compliance with the applicable requirements of the Internal Revenue Code (“IRC”). The Plan has been amended since receiving the determination letter. However, the Plan administrator believes that the Plan is currently designed and being operated in compliance with the applicable requirements of the Internal Revenue Code. Therefore, no provision for income taxes has been included in the Plan’s financial statements.

Plan management has evaluated the effects of accounting guidance related to uncertain income tax positions and concluded that the Plan had no significant financial statement exposure to uncertain income tax positions at December 31, 2017 and 2016. The Plan is not currently under audit by any tax jurisdiction.

In September 2016, the Plan filed a request for a compliance statement with the IRS under the Voluntary Correction Program (“VCP”) to resolve certain issues identified by Plan management regarding historical employer contributions. The IRS approved the Plan’s request in April 2017. The Plan’s 2016 financial statements include a receivable for Other Employer Contributions of $247,900 related to this matter. The Plan received this additional contribution plus interest accrued through the date of the deposit in June 2017.

Plan Expenses

Costs of administering the Plan are paid by the Sponsor except for investment management fees of individual fund investments which are charged to the respective investment and included in the net appreciation (depreciation) of the investment. Participating loan processing fees are charged as a reduction to the respective participant accounts.

Use of Estimates

The presentation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, and changes therein, and disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

Subsequent Events

Subsequent events have been evaluated through the date the financial statements were issued. No significant matters were identified for disclosure during this evaluation.

8

The Republic Mortgage Insurance Company and Affiliated Companies Profit Sharing Plan

Notes to Financial Statements

The Plan is invested in a group annuity contract with the Massachusetts Mutual Life Insurance Company (“Mass Mutual”). The contract allows for a participant-directed investment program in pooled separate accounts sponsored by Mass Mutual. Investment options include fixed income, asset allocation, domestic equity, and international equity subaccount options and a guaranteed interest account. In addition to the investment options offered through the Mass Mutual contract, participants may also invest in certain mutual funds and in the common stock of the Sponsor’s parent, Old Republic International Corporation (“ORI”).

|

|

|

|

A.

|

Fair Value Measurements

|

Investments, other than the guaranteed interest account, are reported at fair value in the accompanying statements of net assets available for benefits. Fair value is defined as the estimated price that is likely to be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants (an exit price) at the measurement date. A fair value hierarchy is established that prioritizes the sources (“inputs”) used to measure fair value into three broad levels: inputs based on quoted prices in active markets, including publicly traded common stocks and mutual funds (Level 1); observable inputs based on corroboration with available market data (Level 2); and unobservable inputs based on uncorroborated market data or a reporting entity’s own assumptions (Level 3). A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement.

The valuation methodologies used for assets measured at fair value are discussed further in Note 2. There have been no changes in the methodologies used at December 31, 2017 and 2016. The following tables provide information by level on the Plan’s assets which are measured at fair value on a recurring basis.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair value measurements as of December 31, 2017:

|

|

|

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Old Republic International Corporation

|

|

|

|

|

|

|

|

|

|

Common Stock Fund, at fair value

|

$ 3,053,771

|

|

0

|

|

0

|

|

$ 3,053,771

|

|

Mutual Funds, at fair value

|

|

4,115,033

|

|

0

|

|

0

|

|

4,115,033

|

|

|

|

|

|

|

$ 7,168,804

|

|

0

|

|

0

|

|

7,168,804

|

|

Insurance Company Guaranteed

|

|

|

|

|

|

|

|

|

|

Interest Account, at contract value

|

|

|

|

|

|

|

20,510,758

|

|

Pooled Separate Accounts, at net asset value

|

|

|

|

|

|

12,077,247

|

|

|

Total Investments

|

|

|

|

|

|

|

|

$39,756,809

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair value measurements as of December 31, 2016:

|

|

|

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Old Republic International Corporation

|

|

|

|

|

|

|

|

|

|

Common Stock Fund, at fair value

|

$ 2,762,807

|

|

0

|

|

0

|

|

$ 2,762,807

|

|

Insurance Company Guaranteed

|

|

|

|

|

|

|

|

|

|

Interest Account, at contract value

|

|

|

|

|

|

|

21,561,218

|

|

Pooled Separate Accounts, at net asset value

|

|

|

|

|

|

14,029,171

|

|

|

Total Investments

|

|

|

|

|

|

|

|

$38,353,196

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9

The Republic Mortgage Insurance Company and Affiliated Companies Profit Sharing Plan

Notes to Financial Statements

B. Guaranteed Interest Account

Through the group annuity contract the Plan offers a guaranteed interest account (GIA) as a stable value investment option. Participant accounts invested in the GIA are paid out at contract (or “book”) value for participant-initiated transactions such as transfers to other investment options, loans, and other distributions. The GIA account balances are maintained in MassMutual’s general investment account and there are no reserves against the contract value of this account for credit risk of Mass Mutual.

The GIA is credited with earnings at an interest rate which, by contract, cannot fall below three percent. The rate is subject to semiannual adjustments on June 1 and November 1 of each year. As of December 31, 2017 and December 31, 2016 the guaranteed interest rate was 3.16% and 3.00%, respectively.

As described in Note 2, because the guaranteed interest account is fully benefit-responsive, contract value is the relevant measurement for that portion of the net assets available for benefits attributable to the guaranteed interest account. Contract value as reported by MassMutual represents participant contributions made under the contract, plus credited interest earnings, less participant withdrawals and administrative expenses. Contract value also includes the effects of market value adjustments required in the event of a full or partial plan or contract termination as described in Note 1 - Partial Plan Termination.

Certain events limit the ability of the Plan to transact at contract value with the issuer. Such events include the following: (1) amendments to the plan documents (including complete termination or merger with another plan), (2) changes to the plan’s prohibition on competing investment options or deletion of equity wash provisions, (3) bankruptcy of the plan sponsor or other plan sponsor events (for example, divestitures or spin-offs of a subsidiary) that cause a significant withdrawal from the plan, or (4) the failure of the trust to qualify for exemption from federal income taxes or any required prohibited transaction exemption under Employee Retirement Income Security Act of 1974. The Plan administrator does not believe that the occurrence of any such event, which would limit the Plan’s ability to transact at contract value with participants, is probable.

The guaranteed investment account does not permit the insurance company to terminate the agreement prior to the scheduled maturity date.

|

|

|

|

|

|

|

|

|

|

|

Average Yields:

|

|

|

2017

|

2016

|

|

|

Based on actual earnings

|

|

2.73%

|

2.83%

|

|

|

Based on interest rate credited to participants

|

|

2.73%

|

2.83%

|

|

|

|

|

4.

|

Parties In Interest and Related Parties

|

MassMutual is deemed to be the Trustee of the assets invested in the pooled separate accounts and the guaranteed interest account and is therefore considered a party in interest.

Old Republic International Corporation, the Plan Sponsor’s ultimate parent and issuer of the common stock held within the Old Republic International Corporation (ORI) Common Stock Fund, is a party in interest.

MassMutual also provides record-keeping and other administrative services to the Plan. Fees paid to MassMutual by Plan participants and Plan Sponsor totaled $758 and $3,311, respectively, for the year ended December 31, 2017.

10

The Republic Mortgage Insurance Company and Affiliated Companies Profit Sharing Plan

Notes to Financial Statements

Although it has not expressed any intent to do so, the Sponsor has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions of ERISA. In the event of Plan termination, participants will become fully vested in their employer accounts.

|

|

|

|

6.

|

Risks and Uncertainties

|

The Plan offers investments in various investment securities. Investment securities, including those invested in the group annuity contract, are exposed to various risks such as interest rate, market and credit risk. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the statement of net assets available for benefits.

11

Supplemental Schedule

12

Republic Mortgage Insurance Company and Affiliated Companies

Profit Sharing Plan

Schedule H, line 4i - Schedule of Assets (Held at End of Year)

December 31, 2017

EIN: 56-1031043

Plan Number: 001

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

(b)

|

|

(c)

|

|

(d)

|

|

(e)

|

|

|

Identity of Issue,

|

|

|

|

|

|

|

|

|

Borrower, Lessor,

|

|

Description of Investment Including

|

|

|

|

Current

|

|

|

or Similar Party

|

|

Number of Units and Rate of Interest

|

|

Cost**

|

|

Value

|

|

|

|

|

Pooled Separate Accounts

|

|

|

|

|

|

*

|

Mass Mutual

|

|

|

500 Index (Vanguard)

|

|

|

|

$ 2,082,389

|

|

*

|

Mass Mutual

|

|

|

Blue Chip Growth (T Rowe Price)

|

|

|

|

1,585,858

|

|

*

|

Mass Mutual

|

|

|

International New Discovery (MFS)

|

|

|

|

547,813

|

|

*

|

Mass Mutual

|

|

|

Mid Cap Index (Vanguard)

|

|

|

|

164,253

|

|

*

|

Mass Mutual

|

|

|

Premier Inflation Protection Bond (Babson)

|

|

|

|

130,089

|

|

*

|

Mass Mutual

|

|

|

Select Eq Opps (Wellington/TRP)

|

|

|

|

1,182,037

|

|

*

|

Mass Mutual

|

|

|

Select Fundamental Value (Wign/Brw/Hnly)

|

|

|

|

2,131,990

|

|

*

|

Mass Mutual

|

|

|

Select Mid Cap Growth II (TRP/Frontier)

|

|

|

|

709,950

|

|

*

|

Mass Mutual

|

|

|

Select Wellington/OFI Sm Cp Gr

|

|

|

|

671,699

|

|

*

|

Mass Mutual

|

|

|

Small Cap Index (Vanguard)

|

|

|

|

1,948,832

|

|

*

|

Mass Mutual

|

|

|

Spec Mid Cap Val (Wells Fargo)

|

|

|

|

68,592

|

|

*

|

Mass Mutual

|

|

|

Total Bnd Mrkt Index (Vanguard)

|

|

|

|

853,747

|

|

|

|

|

|

|

|

|

|

12,077,247

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mutual Funds at Net Asset Value

|

|

|

|

|

|

|

Vanguard

|

|

|

Vanguard Target Retirement 2015 Fund

|

|

|

|

108,555

|

|

|

Vanguard

|

|

|

Vanguard Target Retirement 2020 Fund

|

|

|

|

5,892

|

|

|

Vanguard

|

|

|

Vanguard Target Retirement 2025 Fund

|

|

|

|

1,078,221

|

|

|

Vanguard

|

|

|

Vanguard Target Retirement 2030 Fund

|

|

|

|

4,489

|

|

|

Vanguard

|

|

|

Vanguard Target Retirement 2035 Fund

|

|

|

|

1,688,904

|

|

|

Vanguard

|

|

|

Vanguard Target Retirement 2040 Fund

|

|

|

|

122,720

|

|

|

Vanguard

|

|

|

Vanguard Target Retirement 2045 Fund

|

|

|

|

204,786

|

|

|

Vanguard

|

|

|

Vanguard Target Retirement Income Fund

|

|

|

|

17,972

|

|

|

Vanguard

|

|

|

Vanguard Total Intl Stock Index Fund

|

|

|

|

883,496

|

|

|

|

|

|

|

|

|

|

|

4,115,033

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Guaranteed Interest Account at Contract Value

|

|

|

|

|

|

*

|

Mass Mutual

|

|

|

Guaranteed Investment Account

|

|

|

|

20,510,758

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Old Republic International Corporation

|

|

|

|

|

|

*

|

Stock Account

|

|

|

Old Republic International Corporation (ORI)

|

|

|

|

3,053,771

|

|

|

|

|

|

|

Common Stock Fund

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

Participants loans

|

|

Interest rates of 3.75% with maturity dates through 2018

|

|

$0

|

|

791

|

|

|

receivable

|

|

Interest rates of 3.25% with maturity dates through 2020

|

|

$0

|

|

33,495

|

|

|

|

|

Interest rates of 3.50% with maturity dates through 2021

|

|

$0

|

|

26,653

|

|

|

|

|

Interest rates of 4.25% with maturity dates through 2022

|

|

$0

|

|

62,294

|

|

|

|

|

|

|

|

|

|

|

123,233

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ 39,880,042

|

|

*

|

Indicates an asset which is a party-in-interest to the Plan.

|

|

**

|

Cost information may be omitted as Plan assets are participant directed.

|

13

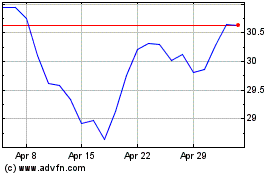

Old Republic (NYSE:ORI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Old Republic (NYSE:ORI)

Historical Stock Chart

From Apr 2023 to Apr 2024