Report of Foreign Issuer (6-k)

June 22 2018 - 7:35AM

Edgar (US Regulatory)

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to rule 13a-16 or 15d-16 of

The Securities Exchange Act of 1934

For the month of June

, 2018

National Bank of Greece S.A.

(Translation of registrant’s name into English)

86 Eolou Street, 10232 Athens, Greece

(Address of principal executive offices)

[Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.]

[Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to rule 12g3-2(b) under the Securities Exchange Act of 1934.]

[If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ]

NATIONAL BANK OF GREECE

S.A.

PRESS RELEASE

Athens, 21/06/18

National Bank of Greece sells non-performing loan portfolio to CarVal Investors and Intrum

National Bank of Greece (“NBG”) announces that it has entered into an agreement with CarVal Investors (“CarVal”) and Intrum AB (“Intrum”) for the disposal of a portfolio of non-performing unsecured retail and small business loans in Greece (the “Portfolio”), of an outstanding principal amount of c.€2.0 billion

. CarVal and Intrum have substantial experience in servicing such portfolios and are known for their reputable practices and approaches.

The transaction is part of NBG’s NPE management strategy and in accordance with the NPE reduction plan submitted to SSM. The consideration of the transaction, which amounts to c.6% of the total outstanding principal amount, will be capital accretive adding

c.18 bps in CET1.

Paul Mylonas, acting CEO of NBG

, said, “NBG is fully committed to the delivery of its NPE reduction targets, with Sales being one of the Strategic pillars. The consideration is a testament to NBG’s asset quality and a vote of confidence to the recovery and growth potential of the Greek economy.”

‘‘We are delighted to complete this transaction with NBG and look forward to working closely with them on future opportunities in the Greek market where we see strong growth potential,” said

James Sackett, a principal for CarVal Investors

. “This transaction demonstrates our ability to deliver complex operational solutions in Greece which have been developed from our deep global credit experience over the last 30 years.”

“Once again we are proud and glad to be the preferred partner for a leading European financial institution working with NBG as they address their NPL reduction targets,” said

Mikael Ericson, CEO of Intrum

.

The servicing of the Portfolio will be undertaken by QQuant Master Servicer, a servicing company which has been licensed and is regulated by the Bank of Greece in accordance with Law 4354/2015.

The transaction is expected to be concluded in July 2018

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

National Bank of Greece S.A.

|

|

|

|

|

|

|

|

|

/s/ Ioannis Kyriakopoulos

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

Date: June

22

nd

, 2018

|

|

|

|

|

|

|

Chief Financial Officer

|

|

|

|

|

|

/s/ George Angelides

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

Date: June

22

nd

, 2018

|

|

|

|

|

|

|

Director, Financial Division

|

3

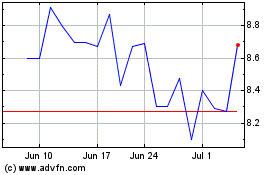

National Bank of Greece (PK) (USOTC:NBGIF)

Historical Stock Chart

From Mar 2024 to Apr 2024

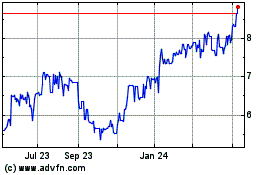

National Bank of Greece (PK) (USOTC:NBGIF)

Historical Stock Chart

From Apr 2023 to Apr 2024