Current Report Filing (8-k)

June 21 2018 - 4:47PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

_____________________

Date of Report

(Date of earliest event reported)

June 21, 2018

TIDEWATER INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

(State of incorporation)

|

1-6311

(Commission File Number)

|

72-0487776

(IRS Employer Identification No.)

|

|

|

|

|

6002 Rogerdale Road, Suite 600

Houston, Texas

(Address of principal executive offices)

|

77072

(Zip Code)

|

(713) 470-5300

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised accounting standards provided pursuant to Section 13(a) of the Exchange Act.

[ ]

1

{N3486509.2}

Item 8.01. Other Events.

Update

Regarding Number of Shares of Common Stock and Creditor Warrants Outstanding.

At the time of emergence from bankruptcy on July 31, 2017, pursuant to the terms of the Second Amended Joint Prepackaged Chapter 11 Plan of Reorganization and the bankruptcy court’s confirmation order (the “Plan”), Tidewater Inc. (“Tidewater” or the “Company”) issued and had outstanding a total of 18,456,186 shares of common stock. At the same time, the Company also issued or reserved for issuance a total of 11,543,814 creditor warrants, also referred to as “Jones Act warrants” and defined as warrants issued or issuable to (1) pre-emergence unsecured creditors that were either non-U.S. citizen holders or holders who failed to submit citizenship documentation under the Plan and (2) sale/leaseback claimants. All such Jones Act warrants have since been issued to the Company’s pre-emergence general unsecured creditors and sale/leaseback claimants. As previously disclosed, the Jones Act warrants have a 25-year term and are immediately exercisable for shares of the Company’s common stock on a one-for-one basis, with an exercise price of $0.001 per share, subject to certain Jones Act-related foreign ownership restrictions contained in the Creditor Warrant Agreement and the Company’s Amended Certificate of Incorporation limiting ownership by non-U.S. citizens.

Since emergence, certain holders of Jones Act warrants have exercised their warrants in exchange for Company-issued shares of common stock, subject to the Jones Act-related foreign ownership limitations. Considering all such warrant exercises to date, as of June 20, 2018, the Company had 26,085,275 shares of common stock and 3,924,440 Jones Act warrants outstanding. The Company expects that, over time, holders of Jones Act warrants will continue to exercise their warrants in exchange for Company-issued shares of common stock, subject to the Jones Act-related foreign ownership limitations.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

TIDEWATER INC.

|

|

|

|

|

|

By:

|

|

/s/ Bruce D. Lundstrom

|

|

|

|

Bruce D. Lundstrom

|

|

|

|

Executive Vice President, General Counsel and Secretary

|

Date: June 21, 2018

3

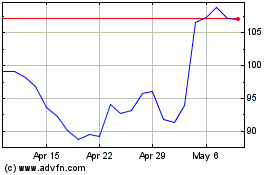

Tidewater (NYSE:TDW)

Historical Stock Chart

From Mar 2024 to Apr 2024

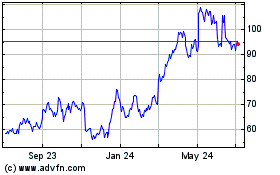

Tidewater (NYSE:TDW)

Historical Stock Chart

From Apr 2023 to Apr 2024