UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 11- K

FOR ANNUAL REPORTS OF EMPLOYEE STOCK PURCHASE, SAVINGS

AND SIMILAR PLANS PURSUANT TO SECTION 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Mark One)

|

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the Fiscal Year Ended December 31,

2017

OR

|

|

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission File Number 1-5975

|

|

|

|

A.

|

Full Title of Plan: Humana Retirement Savings Plan

|

|

|

|

|

B.

|

Name of Issuer of the Securities held Pursuant to the Plan and the Address of its Principal Executive Office:

|

Humana Inc.

500 West Main Street

Louisville, Kentucky 40202

Humana Retirement Savings Plan

Index

December 31, 2017 and 2016

|

|

|

|

|

|

|

|

|

|

|

|

|

Page

|

|

|

|

|

|

|

|

|

Report of Independent Registered Public Accounting Firm

|

|

|

|

|

|

|

|

|

|

|

|

Financial Statements

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Statements of Net Assets Available for Benefits,

December 31, 2017 and 2016

|

|

|

|

|

|

|

|

|

|

|

|

Statements of Changes in Net Assets Available for Benefits,

for the years ended December 31, 2017 and 2016

|

|

|

|

|

|

|

|

|

|

|

|

Notes to Financial Statements

|

|

|

|

–

|

|

|

|

|

|

|

|

|

|

Supplemental Schedule

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule of Assets (Held at End of Year), December 31, 2017

|

|

|

|

|

|

|

|

|

|

|

|

Signatures

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit Index

|

|

|

|

Note: Other Schedules required by Section 2520.103-10 of the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974 (ERISA) have been omitted because they are not applicable.

Report of Independent Registered Public Accounting Firm

To

the Administrator and Plan Participants of

Humana Retirement Savings Plan:

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of Humana Retirement Savings Plan

(the “Plan”) as of December 31, 2017 and 2016 and the related statements of changes in net assets available for benefits for the years then ended, including the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2017

and

2016, and the changes in net assets available for benefits for the years then ended in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Information

The supplemental Schedule of Assets (Held at End of Year) at December 31, 2017 has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental schedule is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental schedule reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the supplemental schedule, we evaluated whether the supplemental schedule, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974.

In our opinion, the supplemental schedule is fairly stated, in all material respects, in relation to the financial statements as a whole.

[PricewaterhouseCoopers LLP (signed)]

Louisville, Kentucky

June 21, 2018

We have served as the Plan’s auditor since at least 1993. We have not determined the specific year we began serving as auditor of the Plan.

Humana Retirement Savings Plan

Statements of Net Assets Available for Benefits

December 31, 2017 and 2016

|

|

|

|

|

|

|

|

|

|

|

|

|

2017

|

|

2016

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Investments, at fair value

|

$

|

4,253,857,506

|

|

|

$

|

3,520,112,734

|

|

|

Fully-benefit responsive investment contracts, at contract value

|

263,615,395

|

|

|

270,214,043

|

|

|

Total investments

|

4,517,472,901

|

|

|

3,790,326,777

|

|

|

|

|

|

|

|

Employer contributions receivable

|

8,563,238

|

|

|

6,351,095

|

|

|

Participant contributions receivable

|

116,880

|

|

|

113,131

|

|

|

Notes receivable from participants

|

122,442,849

|

|

|

109,760,249

|

|

|

Total receivables

|

131,122,967

|

|

|

116,224,475

|

|

|

|

|

|

|

|

Total assets

|

4,648,595,868

|

|

|

3,906,551,252

|

|

|

|

|

|

|

|

Liabilities

|

|

|

|

|

|

|

|

|

|

Accrued expenses

|

2,182,495

|

|

|

896,274

|

|

|

|

|

|

|

|

Total liabilities

|

2,182,495

|

|

|

896,274

|

|

|

|

|

|

|

|

Net assets available for benefits

|

$

|

4,646,413,373

|

|

|

$

|

3,905,654,978

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements.

3

Humana Retirement Savings Plan

Statements of Changes in Net Assets Available for Benefits

Years Ended December 31, 2017 and 2016

|

|

|

|

|

|

|

|

|

|

|

|

|

2017

|

|

2016

|

|

Additions to net assets attributed to:

|

|

|

|

|

Investment income:

|

|

|

|

|

Net appreciation in fair value of investments

|

$

|

667,240,235

|

|

|

$

|

259,038,336

|

|

|

Interest and dividend income

|

21,899,746

|

|

|

27,332,851

|

|

|

Total investment income

|

689,139,981

|

|

|

286,371,187

|

|

|

|

|

|

|

|

Contributions:

|

|

|

|

|

Participant

|

247,363,564

|

|

|

233,825,483

|

|

|

Employer (net of forfeitures)

|

187,690,526

|

|

|

183,908,586

|

|

|

Total contributions

|

435,054,090

|

|

|

417,734,069

|

|

|

|

|

|

|

|

Interest on notes receivable from participants

|

4,734,653

|

|

|

4,060,476

|

|

|

Total additions

|

1,128,928,724

|

|

|

708,165,732

|

|

|

|

|

|

|

|

Deductions from net assets attributed to:

|

|

|

|

|

Benefits paid to participants

|

385,848,384

|

|

|

244,283,329

|

|

|

Administrative expenses

|

2,321,945

|

|

|

2,816,461

|

|

|

|

|

|

|

|

Total deductions

|

388,170,329

|

|

|

247,099,790

|

|

|

|

|

|

|

|

Net increase

|

740,758,395

|

|

|

461,065,942

|

|

|

|

|

|

|

|

Net assets available for benefits:

|

|

|

|

|

Beginning of year

|

3,905,654,978

|

|

|

3,444,589,036

|

|

|

|

|

|

|

|

End of year

|

$

|

4,646,413,373

|

|

|

$

|

3,905,654,978

|

|

The accompanying notes are an integral part of these financial statements.

4

Humana Retirement Savings Plan

Notes to Financial Statements

December 31, 2017 and 2016

|

|

|

|

1.

|

DESCRIPTION OF THE PLAN

|

The following description of the Humana Retirement Savings Plan (the “Plan”) is provided for general information purposes only. Participants should refer to the Plan or the Plan’s Summary Plan Description, not included herein, for a more complete description of the Plan and its provisions.

General

The Plan is a qualified defined contribution plan established for the benefit of the employees of Humana Inc. and its participating subsidiaries (the “Company” or “Humana”) who are not employed in Puerto Rico (“eligible employees”), or eligible for the Humana Savings Plan or Humana Partnership Savings Plan and is subject to the Employee Retirement Income Security Act of 1974, as amended (“ERISA”). The Plan is a Safe Harbor Plan. The Company is the sponsor (“Plan Sponsor”) and a committee appointed by the Company is the administrator (“Plan Administrator”) of the Plan. The Company appointed Schwab Retirement Plan Services as the recordkeeper and Charles Schwab Trust Company as the trustee.

The Company appointed Evercore Trust Company, N.A. (“Evercore Trust Company”) as the named fiduciary and investment manager of the investment fund under the Plan that holds shares of common stock of the Company (the “Humana Unitized Stock Fund”). Evercore Trust Company was acquired by Newport Trust Company during 2017.

Participant Accounts

Employees of the Company are generally eligible to participate upon employment. Individual accounts are maintained by the Plan for each eligible employee (“Participant”). Each Participant's account is credited with the Participant's contributions, the Company's contributions, and an allocation of Plan earnings or losses, reduced by Participant withdrawals and an allocation of administrative expenses. Allocations are based on Participants' account balances as discussed further below. The benefit to which a participant is entitled is the benefit that can be provided from the participant's vested account.

Contributions

Contributions to the Plan by or on behalf of employees may be restricted in amount and timing so as to meet certain requirements of the Internal Revenue Code of 1986, as amended (“IRC”). For the plan years ended December 31,

2017

and

2016

, the Plan maintained various accounts including the Pre-tax Savings Account, the Company Matching Account, the After Tax Account, the Roth Contribution Account, and the Rollover Account, each as described below. A Participant’s Roth contributions, discussed below, when combined with their Pre-tax contributions and After-tax contributions, may not exceed

37%

of their compensation. A Participant’s combined Pre-tax and Roth contributions may not exceed the IRC limitation in effect for the calendar year, which was

$18,000

for both

2017

and

2016

.

Pre-tax Savings Account

Employees of the Company may participate in the Pre-tax Savings Account beginning on the employee’s date of eligibility. A Participant, through payroll deductions, may contribute not less than 1% nor more than 35% of the Participant's eligible compensation. The Company automatically enrolls eligible employees at a contribution rate of 4% of compensation on their date of hire, unless the employee elects not to participate in the Pre-tax Savings Account or elects a different percentage up to 35%. Automatically enrolled Participants who have not made any contribution election will have their contributions automatically increased by 1% annually, effective with the beginning of the second plan year following the year of automatic enrollment, to a maximum of 10%. Eligible employees will be automatically enrolled in the Pre-tax Savings account at a contribution rate of 3% beginning in 2018.

Participants who are age 50 or older and contribute the maximum federal limit or maximum Plan limit may elect to contribute an additional amount, a “catch-up” contribution, up to

$6,000

in both

2017

and

2016

, through payroll deductions in an amount not less than 1% nor more than 35% of the Participant's annual compensation.

Humana Retirement Savings Plan

Notes to Financial Statements

December 31, 2017 and 2016

Company Matching Account

The Company matches 125% of a Participant’s eligible pre-tax, Roth (discussed below) and catch-up contributions that combined do not exceed 6% of their eligible compensation. After-tax, Rollover, Roth Rollover and Roth Conversion contributions are not matched. The Company may increase, decrease, or cease matching contributions, with approval from the Board of Directors. Matching contributions are funded bi-weekly and follow the Participants' investment elections.

After Tax Account

Eligible employees of the Company may participate in the Plan’s After Tax Account beginning on the employee’s date of hire. A Participant, through payroll deductions, may contribute not less than 1% nor more than 2% of the Participant's eligible compensation, on an after tax basis. Contributions to the After Tax Account are not eligible for Company matching contributions.

Roth Contribution Account

Participants may elect to contribute to a Roth Contribution Account. A Participant may elect to contribute between 1% and 35% of their eligible compensation to the Roth Account. This account is credited with amounts from a Participant’s compensation that they have elected to contribute to the Plan after paying income taxes, including catch-up contributions that are designated as Roth contributions. A participant will pay income taxes on their Roth contribution before they are contributed to the Plan, but while they remain in the Plan, Roth contributions grow tax free, and may be distributed from the Plan tax free under certain circumstances. Federal law imposes a 5-taxable-year period holding requirement for Roth contributions before they may be eligible for tax-free distribution from the Plan.

Rollover Account

The Plan allows Participants to rollover assets from other qualified retirement plans into this Plan

subject to approval by the Plan Administrator.

Investment Options

In accordance with IRC Section 404(c), Participants are responsible for investment decisions in all accounts, including Participant funded and Company funded accounts. Investments can be made among various investment options in 1% increments. In the absence of Participant directed allocation, contributions are invested in a Schwab Managed Retirement Trust Fund

TM

based on a Participant's date of birth and estimated retirement date. In connection with a change in allocation of a Participant's or the Company's future contributions among the investment options or a change in the allocation of existing investments, the purchases and sales due to fund transfers are transacted at the funds’ end of day net asset value on the day the transaction is initiated.

Participant investment options consist of the Schwab Personal Choice Retirement Account (“PCRA”) and certain investment funds including mutual funds with registered investment companies and common/collective trust/separate accounts. The PCRA is a self-directed brokerage account allowing Participants to make investments that are not included as one of the Plan’s options. In-kind distributions are allowed from the PCRA. The Humana Unitized Stock Fund invests primarily in the Company's stock with a small portion held in a money market fund to provide liquidity and to accommodate daily transactions.

The Plan designates the Humana Unitized Stock Fund investment option as an employee stock ownership plan (“ESOP”). The ESOP component of the Plan allows dividends paid on Humana common stock held in the fund to be passed through to Participants. Participants may elect to have the dividends passed through quarterly and paid to them or to have the dividends reinvested in the Humana Unitized Stock Fund. If a Participant fails to make an affirmative election, the default is to reinvest the dividends. Dividends that are reinvested and paid into the Humana Unitized Stock Fund are allocated proportionately to Participants on the basis of each Participant’s investment in the fund and used to purchase additional units in the Humana Unitized Stock Fund. Amounts allocated to the portion of the Plan that is an ESOP may still be exchanged to other investments in the Plan and other investments in the Plan may be exchanged into the ESOP component of the Plan.

Humana Retirement Savings Plan

Notes to Financial Statements

December 31, 2017 and 2016

Each of the investment funds is divided into units of participation, which are calculated daily by the recordkeeper. The daily value of each unit is determined by dividing the total fair market value of all assets in each fund by the total number of units in that fund. Investment income, including certain administrative fees and net appreciation (depreciation) of the fair value of investments, is allocated to each Participant’s account based on the change in unit value for each fund in which the Participant has an account balance.

Vesting

Participant contributions are non-forfeitable. Generally, once a Participant has completed two years of service, the Company Matching Account contributions vest immediately and become non-forfeitable.

Forfeitures

The benefit to which a Participant is entitled is the benefit that can be provided from the Participant's vested account. Unvested Company Matching Account contributions are forfeited after a five year break in service, or as a result of withdrawal of the vested account following termination of employment. Forfeited Company Matching Account contributions are available to reduce the amount of subsequent employer contributions. If a former Participant is re-employed prior to five consecutive one-year breaks in service and repays the amount of his/her distribution, then any forfeited employer contributions are restored to his/her account.

For the years ended December 31,

2017

and

2016

, forfeited nonvested accounts used to reduce employer contributions were

$7,494,685

and

$5,223,407

, respectively. At December 31,

2017

and

2016

, the balance of forfeited nonvested accounts available for reducing future employer contributions totaled

$467,380

and

$394,279

, respectively.

Benefit Payments and Withdrawals

Withdrawals at Termination

Upon termination of employment, including retirement, death, or disability, the Plan may disburse funds. Terminated Participants may elect to either leave his/her money in the Plan, if their vested account balance is $1,000 or greater, or take a total distribution of their vested account balance. Partial distributions are not permitted. If a terminated Participant elects to leave their money in the Plan, he/she may request a subsequent withdrawal at any time for a total distribution of their vested account balance. Participant’s distribution options include lump sum and installment payments.

In addition, the Plan permits Participants to roll over contributions to another qualified plan. A Participant must make a written request to the Plan for a direct rollover distribution. Rollovers must comply with certain requirements before the Plan will authorize the rollover distribution.

Participants requesting a lump sum distribution may do so in the form of cash or Humana common stock to the degree that their account is invested in the Humana Unitized Stock Fund. For terminated Participants with a vested account balance less than $1,000, a lump-sum cash distribution will be made if a rollover has not been elected.

In Service Withdrawals

59 ½ Withdrawals

Participants who are 59 ½ or older may make withdrawals from eligible accounts in accordance with the terms of the Plan. The Plan contains restrictions relating to minimum withdrawal amounts and the frequency of withdrawals for each account.

Rollover Withdrawals

Generally, a Participant may make a withdrawal from rollover contributions at any time.

Hardship Withdrawals

In the event funds are needed because of extreme financial hardship, as defined by law, the Participant may be allowed to make a withdrawal of their vested account balance from eligible accounts, as defined by the Plan.

Humana Retirement Savings Plan

Notes to Financial Statements

December 31, 2017 and 2016

After Tax Account Withdrawals

Generally, a Participant may make a withdrawal from the After Tax account at any time. The Plan contains restrictions relating to minimum withdrawal amounts and the frequency of withdrawals.

Participant Loans

Participants may borrow from eligible accounts, as defined in the Plan. Generally, the aggregate amount of the loans to a Participant shall not exceed the lesser of $50,000 or 50% of the vested portion of eligible accounts. The minimum amount a Participant may borrow is $1,000. Loan transactions are treated as a transfer to (from) the various investment funds from (to) the Participant Notes Receivable. Loan terms range from one to four years or up to ten years for the purchase of a primary residence. The loans are collateralized by the balance in the Participant's account and bear interest at a reasonable rate in accordance with the Department of Labor's Rules and Regulations for Reporting and Disclosure under ERISA, as determined by the Plan Administrator. Principal and interest are repaid ratably through payroll deductions. Loans are deducted proportionately from all accounts and all fund investments. Interest income is recorded on the accrual basis. Related fees are recorded as administrative expenses and are expensed when they are incurred. No allowance for credit losses has been recorded as of December 31,

2017

or

2016

. If a participant ceases to make loan repayments and the plan administrator deems the participant loan to be in default, the participant loan balance is reduced and a benefit payment is recorded. At December 31,

2017

and December 31,

2016

participant loan interest rates in effect ranged from

4.25%

to

9.25%

with various maturity dates through

2028

.

Plan Termination

Although it has not expressed any intent to do so, the Company has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions of ERISA. In the event the Plan is terminated, Participants would become 100% vested in their accounts.

|

|

|

|

2.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

|

Basis of Presentation

The accompanying financial statements of the Plan have been prepared under the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from those estimates.

Reporting of Fully Benefit-Responsive Investment Contracts

In accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification 962 as it relates to fully benefit-responsive investment contracts, the Plan is required to report the Stable Value Fund’s investment contracts at contract value. Contract value is the relevant measurement attribute for that portion of the net assets available for benefits attributable to the fully benefit-responsive investment contracts of the Stable Value Fund because contract value is the amount Participants would receive if they were to initiate permitted transactions under the terms of the Plan. As required, the Statements of Net Assets Available for Benefits present the Stable Value Fund’s investment contracts at contract value. The Statements of Changes in Net Assets Available for Benefits also presents the Stable Value Fund's activity on a contract value basis.

Investment Valuation and Income Recognition

Assets and liabilities measured at fair value are categorized into a fair value hierarchy based on whether the inputs to valuation techniques are observable or unobservable. Observable inputs reflect market data obtained from independent sources, while unobservable inputs reflect the Company’s own assumptions about the assumptions market participants would use. The fair value hierarchy includes three levels of inputs that may be used to measure fair value as described below.

Humana Retirement Savings Plan

Notes to Financial Statements

December 31, 2017 and 2016

Level 1 – Quoted prices in active markets for identical assets or liabilities. Level 1 assets and liabilities include mutual funds that are traded in an active exchange market.

Level 2 – Observable inputs other than Level 1 prices such as quoted prices in active markets for similar assets or liabilities; quoted prices for identical or similar assets or liabilities in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities. This would include investments in collective trusts for which there are no quoted prices available for the units of the collective trust; however, the underlying investments are measured at fair value based on quoted prices or other observable inputs.

Level 3 – Unobservable inputs that are supported by little or no market activity and are significant to the fair value of the assets or liabilities. Level 3 includes assets and liabilities whose value is determined using pricing models, discounted cash flow methodologies, or similar techniques reflecting the Company’s own assumptions about the assumptions market participants would use as well as those requiring significant management judgment.

The Plan's investments are recorded at fair value. Investments in mutual funds of registered investment companies and common stock are valued based on the quoted net asset value of shares held by the Plan at year end. Investments in common/collective trusts are valued based on the net asset value of units held by the Plan at year end. There are no restrictions on Participant redemptions and there are no unfunded commitments for investments in common/collective trusts. Were the Plan to initiate a full redemption of certain common/collective trusts, however, the trustees of the common/collective trusts could impose restrictions to the extent it is determined a full redemption could disrupt the liquidity or management of the fund.

Purchases and sales of securities are recorded on a trade date basis. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date.

Net realized gains or losses on the sale of investments together with unrealized appreciation or depreciation on investments are presented as net appreciation (depreciation) in fair value of investments in the accompanying Statements of Changes in Net Assets Available for Benefits.

Participant Loans

Participant loans are measured at their unpaid principal balance plus any accrued but unpaid interest and classified as notes receivable from participants in the Statements of Net Assets Available for Benefits.

Payment of Benefits

Benefit payments to Participants are recorded when paid.

Administrative Expenses

Certain expenses of maintaining the Plan are paid by the Plan and allocated to the Participants accounts, unless otherwise paid by the Company. Expenses that are paid by the Company are excluded from these financial statements. Fees related to the administration of notes receivable from participants are charged directly to the participant’s account and are included in administrative expenses. Investment related expenses are included in net appreciation of fair value of investments.

Humana Retirement Savings Plan

Notes to Financial Statements

December 31, 2017 and 2016

The Plan invests in fully benefit-responsive synthetic guaranteed investment contracts (“synthetic GICs”) through a separate account, the Stable Value Fund. The Stable Value Fund’s primary investment objectives are to provide preservation of principal, maintain a stable interest rate, and provide daily liquidity at contract value for Participant withdrawals and transfers. To accomplish these objectives, the Stable Value Fund invests primarily in investment contracts also known as synthetic GICs. In a synthetic GIC, the underlying investments are owned by the Stable Value Fund. The Stable Value Fund purchases a wrap contract from an insurance company or bank. The wrap contracts serve to substantially offset the price fluctuations in the underlying investments caused by movements in interest rates. Each wrap contract obligates the contract provider to maintain the “contract value” of the underlying investment. The contract value is generally equal to the principal amounts invested in the underlying investments, plus interest accrued at a crediting rate established under the contract, less any adjustments for withdrawals (as specified in the wrap agreement). Under the terms of the wrap contract, the realized and unrealized gains and losses of the underlying investments are, in effect, amortized over the duration of the underlying investments through adjustments to the future contract interest crediting rate (which is the rate earned by Participants in the Stable Value Fund for the underlying investments). The wrap contract provides that the adjustments to the interest crediting rate will not result in a future interest crediting rate that is less than zero.

In general, if the contract value exceeds the fair value of the underlying investments (including accrued interest), the wrap provider becomes obligated to pay that difference to the Stable Value Fund in the event that redemptions result in a total contract liquidation. In the event that there are partial redemptions that would otherwise cause the contract’s crediting rate to fall below zero, the wrap provider is obligated to contribute to the Stable Value Fund an amount necessary to maintain the contract’s crediting rate of at least zero percent. The circumstance under which payments are made and the timing of payments between the Stable Value Fund and the wrap provider may vary based on the terms of the wrap contract.

The key factors that influence future interest crediting rates include:

|

|

|

|

•

|

The level of market interest rates;

|

|

|

|

|

•

|

The amount and timing of Participant contributions, transfers, and withdrawals into/out of the Stable Value Fund;

|

|

|

|

|

•

|

The investment returns generated by the fixed income investments that back the wrap contract;

|

|

|

|

|

•

|

The duration of the underlying fixed income investments backing the wrap contract.

|

Interest crediting rates are typically reset on a monthly or quarterly basis according to each contract. While there may be slight variations from one contract to another, most contracts use a formula that is based on the characteristics of the underlying fixed income portfolio. Over time, this crediting rate formula amortizes the Stable Value Fund’s realized and unrealized fair value gains and losses over the duration of the underlying investments.

Because changes in market interest rates affect the yield to maturity and the fair value of the underlying investments, they can have a material impact on the contract's interest crediting rate. In addition, Participant withdrawals and transfers from the Stable Value Fund are paid at contract value but funded through the liquidation of the underlying investments at fair value, which also impacts the interest crediting rate. If the adjustment from fair value to contract value is positive for a given contract, this indicates that the contract value is greater than the market value of the underlying investments. The embedded fair value losses will be amortized in the future through a lower interest crediting rate than would otherwise be the case. If the adjustment from fair value to contract value is negative, this indicates that the contract value is less than the fair value of the underlying investments. The amortization of the embedded fair value gains will cause the future interest crediting rate to be higher than it otherwise would have been.

The average yield earned by the Stable Value Fund for the synthetic GICs (which may differ from the interest rate credited to Participants in the Stable Value Fund) was

2.3%

for

2017

and

1.6%

for

2016

. This average yield was calculated by dividing the annualized earnings of all investments in the Stable Value Fund (irrespective of the interest rate credited to Participants in the Stable Value Fund) by the fair value of all investments in the Stable Value Fund.

The average yield credited to Participants in the Stable Value Fund was

2.0%

for

2017

and

1.8%

for

2016

. This average yield was calculated by dividing the annualized earnings credited to Participants for all investments in the Stable Value

Humana Retirement Savings Plan

Notes to Financial Statements

December 31, 2017 and 2016

Fund (irrespective of the actual earnings of the investments in the Stable Value Fund) by the fair value of all investments in the Stable Value Fund.

In certain circumstances, the amount withdrawn from the contract would be payable at fair value rather than at contract value. These events include termination of the Plan, a material adverse change to the provisions of the Plan, the employer elects to withdraw from a contract in order to switch to a different investment provider, or the terms of a successor plan (in the event of the spin-off or sale of a division) do not meet the wrap contract issuer’s underwriting criteria for issuance of a clone wrap contract. The Company believes that the events described above that could result in the payment of benefits at fair value rather than contract value are not probable of occurring in the foreseeable future.

Examples of events that would permit a wrap contract issuer to terminate a wrap contract upon short notice include the Plan’s loss of its qualified status, un-cured material breaches of responsibilities, or material and adverse changes to the provisions of the Plan. If one of these events was to occur, the wrap contract issuer could terminate the wrap contract at the fair value of the underlying investments.

The underlying investments of the Stable Value Fund’s synthetic GICs primarily consist of collective trust funds of the Invesco Group Trust for Retirement Savings (“IGT”), a collective trust managed by Invesco National Trust Company. These funds invest in fixed income securities of the highest credit quality, generally AAA.

Humana Retirement Savings Plan

Notes to Financial Statements

December 31, 2017 and 2016

The Plan’s total investment in synthetic GICs held in the Fund as of December 31, 2017 and 2016, respectively, was as follows:

|

|

|

|

|

|

|

|

|

|

|

2017

|

|

Wrap/GIC Provider Credit Rating

|

|

Contract Value

|

|

Synthetic Guaranteed Investment Contracts:

|

|

|

|

|

|

IGT Jennison AAA Intermediate Fund, IGT Invesco High Quality Short-term Bond Fund, IGT PIMCO AAA Intermediate Fund, IGT Invesco Intermediate Fund – Transamerica wrap contract

|

|

AA-/A1

|

|

$

|

69,753,382

|

|

|

IGT Invesco High Quality Short-term Bond Fund, IGT Invesco Intermediate Government Fund – RGA Capital Markets wrap contract

|

|

AA-/A1

|

|

58,695,814

|

|

|

IGT PIMCO AAA Intermediate Fund, IGT Invesco High Quality Short-term Bond Fund – Prudential Insurance Company wrap contract

|

|

AA-/A1

|

|

57,562,314

|

|

|

IGT Invesco High Quality Short-term Bond Fund – Voya wrap contract

|

|

A/A2

|

|

32,296,319

|

|

|

IGT Invesco Intermediate Government Fund – Voya wrap contract

|

|

A/A2

|

|

26,228,938

|

|

|

IGT Invesco High Quality Short-term Bond Fund – Pacific Life Insurance Company wrap contract

|

|

AA-/A1

|

|

19,078,628

|

|

|

Total Synthetic Guaranteed Investment Contracts

|

|

|

|

263,615,395

|

|

|

|

|

|

|

|

|

Short-term Investments:

|

|

|

|

|

|

State Street Global Advisors Government Money Market Fund

|

|

|

|

7,279,926

|

|

|

Total

|

|

|

|

$

|

270,895,321

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

Wrap/GIC Provider Credit Rating

|

|

Contract Value

|

|

Synthetic Guaranteed Investment Contracts:

|

|

|

|

|

|

IGT Jennison AAA Intermediate Fund – Transamerica wrap contract

|

|

AA-/A1

|

|

$

|

71,449,329

|

|

|

IGT Invesco Short-term Bond Fund – RGA Capital Markets wrap contract

|

|

AA-/A1

|

|

60,177,414

|

|

|

IGT PIMCO AAA or Better Intermediate Fund – Prudential Insurance Company wrap contract

|

|

AA-/A1

|

|

59,053,806

|

|

|

IGT Invesco Short-term Bond Fund – Voya wrap contract

|

|

A/A2

|

|

33,107,085

|

|

|

IGT Invesco Intermediate Government Fund – Voya wrap contract

|

|

A/A2

|

|

26,844,015

|

|

|

IGT Invesco Short-term Bond Fund – Pacific Life Insurance Company wrap contract

|

|

AA-/A1

|

|

19,582,394

|

|

|

Total Synthetic Guaranteed Investment Contracts

|

|

|

|

270,214,043

|

|

|

|

|

|

|

|

|

Short-term Investments:

|

|

|

|

|

|

State Street Global Advisors Government Money Market Fund

|

|

|

|

20,250,598

|

|

|

Total

|

|

|

|

$

|

290,464,641

|

|

Humana Retirement Savings Plan

Notes to Financial Statements

December 31, 2017 and 2016

The following tables summarize the fair value of the Plan’s investments at December 31,

2017

and

2016

, respectively, for investments measured at fair value on a recurring basis:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value Measurements Using

|

|

|

Fair Value

|

|

Quoted Prices in Active Markets for Identical Assets

(Level 1)

|

|

Significant Other Observable Inputs

(Level 2)

|

|

Significant Unobservable Inputs

(Level 3)

|

|

December 31, 2017

|

|

|

|

|

|

|

|

|

Mutual Funds:

|

|

|

|

|

|

|

|

|

Fixed income funds

|

$

|

368,811,092

|

|

|

$

|

368,811,092

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

Value funds

|

81,647,483

|

|

|

81,647,483

|

|

|

—

|

|

|

—

|

|

|

Total Mutual Funds

|

450,458,575

|

|

|

450,458,575

|

|

|

—

|

|

|

—

|

|

|

Humana Unitized Stock Fund/Humana Common Stock

|

485,437,897

|

|

|

485,437,897

|

|

|

—

|

|

|

—

|

|

|

Personal Choice Retirement

|

139,294,988

|

|

|

86,095,328

|

|

|

53,199,660

|

|

|

—

|

|

|

Total Investments in the fair value hierarchy

|

$

|

1,075,191,460

|

|

|

$

|

1,021,991,800

|

|

|

$

|

53,199,660

|

|

|

$

|

—

|

|

|

Common/Collective Trust Funds

(1)

|

3,161,898,444

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

Stable Value Fund/Money Market Fund

(1)

|

7,279,926

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

Humana Unitized Stock Fund/ Money Market Fund

(1)

|

9,487,676

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

Total Investments, at fair value

|

$

|

4,253,857,506

|

|

|

$

|

1,021,991,800

|

|

|

$

|

53,199,660

|

|

|

$

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value Measurements Using

|

|

|

Fair Value

|

|

Quoted Prices in Active Markets for Identical Assets

(Level 1)

|

|

Significant Other Observable Inputs

(Level 2)

|

|

Significant Unobservable Inputs

(Level 3)

|

|

December 31, 2016

|

|

|

|

|

|

|

|

|

Mutual Funds:

|

|

|

|

|

|

|

|

|

Fixed income funds

|

$

|

301,277,718

|

|

|

$

|

301,277,718

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

Growth funds

|

154,199,758

|

|

|

154,199,758

|

|

|

—

|

|

|

—

|

|

|

Value funds

|

69,042,733

|

|

|

69,042,733

|

|

|

—

|

|

|

—

|

|

|

Total Mutual funds

|

524,520,209

|

|

|

524,520,209

|

|

|

—

|

|

|

—

|

|

|

Humana Unitized Stock Fund/Humana Common Stock

|

487,031,790

|

|

|

487,031,790

|

|

|

—

|

|

|

—

|

|

|

Personal Choice Retirement Account:

|

115,570,525

|

|

|

71,029,209

|

|

|

44,541,316

|

|

|

—

|

|

|

Total Investments in the fair value hierarchy

|

$

|

1,127,122,524

|

|

|

$

|

1,082,581,208

|

|

|

$

|

44,541,316

|

|

|

$

|

—

|

|

|

Common/Collective Trust Funds

(1)

|

2,362,974,944

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

Stable Value Fund/Money Market Fund

(1)

|

20,250,598

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

Humana Unitized Stock Fund/ Money Market Fund

(1)

|

9,764,668

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

Total Investments, at fair value

|

$

|

3,520,112,734

|

|

|

$

|

1,082,581,208

|

|

|

$

|

44,541,316

|

|

|

$

|

—

|

|

|

|

|

|

(1)

|

Certain investments that are measured at fair value using the net asset value per share (or its equivalent practical expedient) have not been classified in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the Statements of Net Assets Available for Benefits.

|

Humana Retirement Savings Plan

Notes to Financial Statements

December 31, 2017 and 2016

The Internal Revenue Service (“IRS”) has determined, and informed the Company by a letter dated March 19, 2015, that the Plan is designed in accordance with applicable sections of the Internal Revenue Code ("IRC"). The Plan was restated on January 1, 2016 and subsequently amended. The Plan Administrator believes that the Plan is designed and is currently operating in compliance with the applicable requirements of the IRC.

The Plan Administrator is required to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the IRS. The Plan Administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31,

2017

, there are no uncertain positions taken or expected to be taken that would require recognition of a liability (or asset) or disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress. The Plan Administrator believes it is no longer subject to income tax examinations for the years prior to 2014.

|

|

|

|

6.

|

RELATED PARTY AND PARTY-IN-INTEREST TRANSACTIONS

|

Certain Plan investments are shares of mutual funds and common/collective trust funds managed by an affiliate of the trustee. Therefore, transactions in these investments qualify as party-in-interest transactions, which are exempt from prohibited transaction rules. The Plan also invests in the common stock of the Plan Sponsor as well as loans to Plan Participants, both of which qualify as related parties to the Plan and also are exempt from prohibited transaction rules.

For the year ended December 31,

2017

,

1,155,023

units of the Humana Unitized Stock Fund were purchased for

$93,738,507

and

2,350,733

units of the Humana Unitized Stock Fund were sold for

$188,706,704

. For the year ended December 31,

2016

,

1,702,720

units of the Humana Unitized Stock Fund were purchased for

$107,486,780

and

1,878,992

units of the Humana Unitized Stock Fund were sold for

$122,481,487

. At December 31,

2017

and

2016

, the fair value of the Humana Unitized Stock Fund was

$494,925,573

and

$496,796,458

, respectively, which represented

11.0%

and

13.1%

, respectively, of all investments held by the Plan.

The Company has authorized Newport Trust Company with sole responsibility for deciding whether to restrict investment in the Humana Unitized Stock Fund, or to sell or otherwise dispose of all or any portion of the stock held in the Humana Unitized Stock Fund in certain limited circumstances. In the event Newport Trust Company determined to sell or dispose of stock in the Humana Unitized Stock Fund, Newport Trust Company would designate an alternative investment fund under the Plan for the temporary investment of any proceeds from the sale or other disposition of the Company’s common stock.

|

|

|

|

7.

|

RISKS AND UNCERTAINTIES

|

The Plan invests in various investment securities, as discussed in Note 4. Investment securities are exposed to various risks including, but not limited to, interest rate, market, and credit risks. Due to the level of risk associated with certain investment securities, it is reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect Participants’ account balances and the amounts reported in the Statements of Net Assets Available for Benefits.

The Plan’s exposure to concentrations of credit risk is limited by diversification of investments across all Participant directed fund elections. In addition, the investments within each Participant directed fund election are further diversified into various financial instruments, with the exception of the Humana Unitized Stock Fund which principally invests in Humana common stock. If a Participant selects the PCRA option, the Participant directs whether and how such amounts will be diversified.

Humana Retirement Savings Plan

Plan #002 EIN #61-0647538

Schedule H, Line 4i – Schedule of Assets (Held at End of Year), December 31, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

|

(b)

Identity of Issuer, Borrower, Lessor or Similar Party

|

|

(c)

Description of investment

|

|

(d)

Cost**

|

|

Current Value

|

|

|

|

Registered Investment Company (Mutual Funds):

|

|

|

|

|

|

|

|

Pimco Total Return Fund

|

|

Mutual fund

|

|

—

|

|

$

|

368,811,092

|

|

|

|

|

Delaware Small Cap Value Fund I

|

|

Mutual fund

|

|

—

|

|

81,647,483

|

|

|

|

|

Total Mutual Funds

|

|

Mutual fund

|

|

—

|

|

450,458,575

|

|

|

|

|

Common/Collective Trusts:

|

|

|

|

|

|

|

|

BNY Mellon Broad Market Stock Index

|

|

Common/Collective Trust

|

|

—

|

|

415,369,793

|

|

|

|

|

Artisan International Growth Trust

|

|

Common/Collective Trust

|

|

—

|

|

353,650,706

|

|

|

*

|

|

Schwab Institutional Large Cap Value Trust Fund

|

|

Common/Collective Trust

|

|

—

|

|

391,756,475

|

|

|

|

|

BNY Mellon Small Cap Stock Index

|

|

Common/Collective Trust

|

|

—

|

|

243,635,668

|

|

|

|

|

JP Morgan Chase Bank Large Cap Growth Fund

|

|

Common/Collective Trust

|

|

—

|

|

307,809,776

|

|

|

|

|

Jennison Small Mid Cap EQ

|

|

Common/Collective Trust

|

|

—

|

|

181,130,761

|

|

|

*

|

|

Schwab Managed Retirement Trust 2010 Fund Class V

|

|

Common/Collective Trust

|

|

—

|

|

24,854,872

|

|

|

*

|

|

Schwab Managed Retirement Trust 2020 Fund Class V

|

|

Common/Collective Trust

|

|

—

|

|

187,215,471

|

|

|

*

|

|

Schwab Managed Retirement Trust 2030 Fund Class V

|

|

Common/Collective Trust

|

|

—

|

|

332,826,579

|

|

|

*

|

|

Schwab Managed Retirement Trust 2040 Fund Class V

|

|

Common/Collective Trust

|

|

—

|

|

400,759,183

|

|

|

*

|

|

Schwab Managed Retirement Trust 2050 Fund Class V

|

|

Common/Collective Trust

|

|

—

|

|

311,979,036

|

|

|

*

|

|

Schwab Managed Retirement Trust Income Fund Class V

|

|

Common/Collective Trust

|

|

—

|

|

10,910,124

|

|

|

|

|

Stable Value Fund:

|

|

|

|

—

|

|

|

|

|

|

IGT Invesco Intermediate Government Fund

|

|

Common/Collective Trust

|

|

—

|

|

26,228,938

|

|

|

|

|

Voya Synthetic GIC Wrap Contract #60398-B

|

|

Insurance Contract

|

|

—

|

|

—

|

|

|

|

|

IGT PIMCO AAA Intermediate Fund

|

|

Common/Collective Trust

|

|

—

|

|

38,345,060

|

|

|

|

|

IGT Invesco High Quality Short-term Bond Fund

|

|

Common/Collective Trust

|

|

—

|

|

19,217,254

|

|

|

|

|

Prudential Insurance Company Synthetic GIC Wrap Contract #GA-62459

|

|

Insurance Contract

|

|

—

|

|

—

|

|

|

|

|

IGT Jennison AAA Intermediate Fund

|

|

Common/Collective Trust

|

|

—

|

|

44,261,886

|

|

|

|

|

IGT Invesco High Quality Short-term Bond Fund

|

|

Common/Collective Trust

|

|

—

|

|

18,867,438

|

|

|

|

|

IGT PIMCO AAA Intermediate Fund

|

|

Common/Collective Trust

|

|

—

|

|

4,881,640

|

|

|

|

|

IGT Invesco Intermediate Government Fund

|

|

Common/Collective Trust

|

|

—

|

|

1,742,418

|

|

|

|

|

Transamerica Synthetic GIC Wrap Contract #MDA-00640TR

|

|

Insurance Contract

|

|

—

|

|

—

|

|

|

|

|

IGT Invesco High Quality Short-term Bond Fund

|

|

Common/Collective Trust

|

|

—

|

|

32,296,319

|

|

|

|

|

Voya Synthetic GIC Wrap Contract #60398-A

|

|

Insurance Contract

|

|

—

|

|

—

|

|

|

|

|

IGT Invesco High Quality Short-term Bond Fund

|

|

Common/Collective Trust

|

|

—

|

|

19,078,628

|

|

|

|

|

Pacific Life Insurance Synthetic GIC Wrap Contract #G-26956.01.0001

|

|

Insurance Contract

|

|

—

|

|

—

|

|

|

|

|

IGT Invesco High Quality Short-term Bond Fund

|

|

Common/Collective Trust

|

|

—

|

|

34,667,653

|

|

|

|

|

IGT Invesco Intermediate Government Fund

|

|

Common/Collective Trust

|

|

—

|

|

24,028,161

|

|

|

|

|

RGA Synthetic GIC Wrap Contract #RGA00029

|

|

Insurance Contract

|

|

—

|

|

—

|

|

|

|

|

Short-term Investment Fund State Street Global Advisors Contract #CSCI

|

|

Money Market Fund

|

|

—

|

|

7,279,926

|

|

|

|

|

Total Stable Value Fund

|

|

|

|

—

|

|

270,895,321

|

|

|

|

|

Total Common/Collective Trusts

|

|

|

|

—

|

|

3,432,793,765

|

|

|

|

|

Other Investments:

|

|

|

|

|

|

|

|

*

|

|

Humana Unitized Stock Fund:

|

|

|

|

|

|

|

|

|

|

Humana Common Stock

|

|

Common Stock

|

|

—

|

|

485,437,897

|

|

|

|

|

State Street Global Advisors Government Money Market Fund

|

|

Money Market Fund

|

|

—

|

|

9,487,676

|

|

|

|

|

Total Humana Unitized Stock Fund

|

|

|

|

—

|

|

494,925,573

|

|

|

*

|

|

Personal Choice Retirement Account - Self-directed Brokerage Account

|

|

Brokerage accounts

|

|

|

|

139,294,988

|

|

|

*

|

|

Notes Receivable from Participants, Interest Rate: 4.25%-9.25%, with Maturity Dates: 2018-2028

|

|

Participant loans

|

|

—

|

|

122,442,849

|

|

|

|

|

Total

|

|

|

|

—

|

|

$

|

4,639,915,750

|

|

|

*

|

|

Party-in-interest to the Plan

|

|

|

|

|

|

|

|

**

|

|

Historical cost is not required as all investments are participant-directed

|

|

|

|

|

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the plan administrator for the Humana Retirement Savings Plan has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

HUMANA RETIREMENT SAVINGS PLAN

BY:

|

|

|

|

|

/s/ BRIAN A. KANE

|

|

Brian A. Kane

|

|

Member, Humana Retirement Plans Committee

|

|

June 21, 2018

|

Exhibit Index

Exhibit 23 Consent of Independent Registered Public Accounting Firm

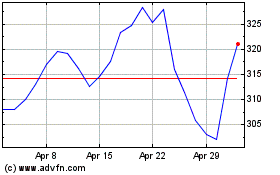

Humana (NYSE:HUM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Humana (NYSE:HUM)

Historical Stock Chart

From Apr 2023 to Apr 2024