UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT OF

FOREIGN ISSUER

PURSUANT

TO RULE 13a-16 OR 15b-16 OF

THE

SECURITIES EXCHANGE ACT OF 1934

For the

month of

June,

2018

Commission

File Number 001-14370

|

COMPANIA DE MINAS BUENAVENTURA S.A.A.

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

BUENAVENTURA MINING COMPANY INC.

|

|

(Translation of registrant’s name into English)

|

|

|

|

Republic of Peru

|

|

(Jurisdiction of incorporation or organization)

|

|

|

|

CARLOS VILLARAN 790

SANTA CATALINA, LIMA 13, PERU

|

|

(Address of principal executive offices)

|

Indicate by

check mark whether the registrant files or will file annual reports

under cover of Form 20-F or Form 40-F:

Form 20-F

___X___ Form 40-F ______

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as

permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as

permitted by Regulation S-T Rule 101(b)(7):

[ ]

Indicate by

check mark whether the registrant by furnishing the information

contained in this Form is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act

of 1934.

Yes ______

No ___X___

If "Yes" is

marked, indicate below the file number assigned to the registrant in

connection with Rule 12g3-2(b): Not applicable.

Buenaventura

Announces Sumitomo Purchase of Five Percent Stake in Yanacocha

LIMA, Peru--(BUSINESS WIRE)--June 20, 2018--

Compañia de Minas

Buenaventura S.A.A.

(“Buenaventura” or “the Company”) (NYSE: BVN;

Lima Stock Exchange: BUE.LM), Peru’s largest publicly-traded precious

metals mining company, today announced the purchase by Sumitomo

Corporation (“Sumitomo”) of a five percent stake in Minera Yanacocha

S.R.L. (“Yanacocha”). Under this transaction between Buenaventura,

Newmont and Sumitomo, Sumitomo takes the place of the International

Finance Corporation (“IFC”) as a five percent minority shareholder in

Yanacocha in exchange for approximately US$48 million.

“We are pleased to welcome Sumitomo as our new partner in Yanacocha and

look forward to leveraging Sumitomo’s extensive mining expertise and

commitment to high performance mining standards as we develop

Yanacocha’s upcoming projects,” said Victor Gobitz, Chief Executive

Officer of Buenaventura. He continued, “Newmont and Sumitomo share not

only our commitment to safe, profitable and responsible production

extension through the Quecher Main and Yanacocha Sulfides project, but

also the sustainable economic development of local communities.”

As a result of this transaction, Buenaventura’s total ownership in

Yanacocha will return to 43.65% and Newmont’s ownership will return to

51.35%, and Newmont will continue to operate Yanacocha. The transaction

is structured as a new share issuance to Sumitomo, with the payment

contributing to Yanacocha’s cash balances.

The Quecher Main project was approved in October 2017 and is expected to

extend Yanacocha’s oxide mine life to 2027. Quecher Main will also serve

as a bridge to future growth options, including the development of

Yanacocha’s extensive sulfide deposits. If approved, the sulfides

project could extend Yanacocha’s operational mine life through 2039.

Buenaventura also partners with Sumitomo at the Cerro Verde mine in Peru.

Company Description

Compañía de Minas Buenaventura S.A.A. is Peru’s largest, publicly traded

precious and base metals Company and a major holder of mining rights in

Peru. The Company is engaged in the exploration, mining development,

processing and trade of gold, silver and other base metals via

wholly-owned mines and through its participation in joint venture

projects. Buenaventura currently operates several mines in Peru

(Orcopampa*, Uchucchacua*, Mallay*, Julcani*, Tambomayo*, El Brocal, La

Zanja and Coimolache).

The Company owns 43.65% of Minera Yanacocha S.R.L (a partnership with

Newmont Mining Corporation), an important precious metal producer and

19.58% of Sociedad Minera Cerro Verde, an important Peruvian copper

producer.

For a printed version of the Company’s 2017 Form 20-F, please contact

the persons indicated above, or download a PDF format file from the

Company’s web site.

(*) Operations wholly owned by Buenaventura

Note on Forward-Looking Statements

This press release may contain forward-looking information (as defined

in the U.S. Private Securities Litigation Reform Act of 1995) that

involve risks and uncertainties, including those concerning the

Company’s, Yanacocha’s and Cerro Verde’s costs and expenses, results of

exploration, the continued improving efficiency of operations,

prevailing market prices of gold, silver, copper and other metals mined,

the success of joint ventures, estimates of future explorations,

development and production, subsidiaries’ plans for capital

expenditures, estimates of reserves and Peruvian political, economic,

social and legal developments. These forward-looking statements reflect

the Company’s view with respect to the Company’s, Yanacocha’s and Cerro

Verde’s future financial performance. Actual results could differ

materially from those projected in the forward-looking statements as a

result of a variety of factors discussed elsewhere in this Press Release.

CONTACT:

For Compañia de Minas Buenaventura S.A.A.

In Lima:

Leandro

Garcia, (511) 419 2540

Chief Financial Officer

or

Rodrigo

Echecopar, (511) 419 2591

Investor Relations Coordinator

rodrigo.echecopar@buenaventura.pe

or

In

NY:

Barbara Cano, (646) 452 2334

barbara@inspirgroup.com

or

Company

Website:

www.buenaventura.com

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

COMPAÑÍA DE MINAS BUENAVENTURA S.A.A.

By: /s/ LEANDRO GARCÍA RAGGIO

Name: Leandro García Raggio

Title: Chief Financial Officer

Date: June 20, 2018

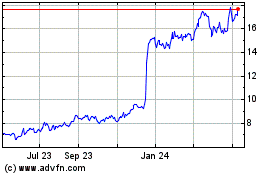

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

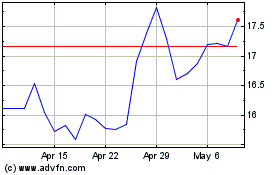

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Apr 2023 to Apr 2024