Current Report Filing (8-k)

June 19 2018 - 4:21PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date

of Report (date of earliest event reported):

June 13, 2018

|

TAYLOR DEVICES, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

New York

|

0-3498

|

16-0797789

|

|

(State or other

jurisdiction of

incorporation)

|

(Commission File

Number)

|

(IRS Employer

Identification No.)

|

|

90 Taylor Drive

|

North Tonawanda, New York

|

14120-0748

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Registrant's telephone number, including area code:

|

(716) 694-0800

|

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§203.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act [ ]

Section

1 – Registrant's Business and Operations

Item 1.01 Entry into a Material Definitive Agreement.

On June 13, 2018, the Compensation Committee

of Taylor Devices, Inc. approved Employment Agreements between Taylor Devices, Inc. and both Alan R. Klembczyk, President, and

Mark V. McDonough, Chief Financial Officer.

By the terms, the Company will continue to

employ the Executive for a period of one year after the date of the Agreement. After the initial term, this Agreement will automatically

renew each year for one additional year. However, either party may elect not to renew this Agreement for any renewal period by

providing ninety days written notice of such election prior to the end of the initial term or renewal period. If this agreement

is not renewed by the Executive, no Severance Package shall be paid. If this Agreement is not renewed by the Company, the Executive

shall be entitled to the Severance Package. The Severance Package consists of the continuation of the Executive's base salary for

a period of 12 months and, if the Executive elects COBRA continuation of health insurance under the applicable Company plan, reimbursement

of premiums for up to twelve (12) months.

Under the Agreements, the Company agrees to

pay Mr. Klembczyk a base salary of two hundred thirty-five thousand dollars per year and Mr. McDonough a base salary of two hundred

twenty thousand dollars per year, subject to increase at the discretion of the Board. The Executives shall be eligible for an Incentive

Compensation Plan based on Company performance as approved by the Board of Directors.

The Company may terminate the employment of

the Executive without further obligation to the Executive at any time for Cause, as defined in Article 1(e) of the Employment Agreement.

The Company may terminate the employment of the Executive without Cause, or for any reason. The Executive may terminate this Agreement

and his employment with the Company at any time for Good Reason, as defined in Article 1(f) of the Employment Agreement. If, within

ninety (90) days after the effective date of the termination of the Executive’s employment by the Company without Cause or

by the Executive for Good Reason (or such longer period as the Company, in its discretion, may designate), the Executive executes

a waiver and release agreement, in a form satisfactory to the Company, that releases the Company and all Affiliates from any and

all claims of any nature whatsoever relating to Executive’s employment (including, without limitation, any and all statutory

claims), the Company shall provide the Executive with the Severance Package, paid monthly in accordance with the Company’s

normal payroll practices. The Company shall provide the form of waiver and release to Executive within ten (10) days of the effective

date of Executive’s termination of employment. The provisions of the Severance Package will constitute full and final satisfaction

of all rights and entitlements that the Executive has or may have arising from or related to the termination of his employment,

whether pursuant to statute, contract, common law or otherwise.

Section 9 - Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

Exhibit

No.

Description

|

|

10(i)

|

Employment Agreement dated as of June 1, 2018

between the Registrant and Alan R. Klembczyk.

|

|

|

10(ii)

|

Employment Agreement dated as of June 1, 2018 between the Registrant and Mark V. McDonough.

|

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

TAYLOR DEVICES, INC.

(registrant)

Dated: June 19, 2018 By:

/s/Alan R. Klembczyk

Alan R. Klembczyk

President

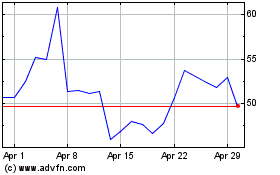

Taylor Devices (NASDAQ:TAYD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Taylor Devices (NASDAQ:TAYD)

Historical Stock Chart

From Apr 2023 to Apr 2024