Current Report Filing (8-k)

June 18 2018 - 11:33AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported) June 18, 2018

PTC Inc.

(Exact Name of

Registrant as Specified in Its Charter)

|

|

|

|

|

|

|

Massachusetts

|

|

0-18059

|

|

04-2866152

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

140 Kendrick Street

Needham, Massachusetts

|

|

02494-2714

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(781)

370-5000

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the

Form 8-K

filing is intended to simultaneously satisfy the

filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of

this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 7 – Regulation FD

|

Item 7.01

|

Regulation FD Disclosure

|

New Long-Term Financial Targets

PTC is today announcing revised financial targets for the fiscal year ending September 30, 2021 (FY2021) and introducing financial targets

for the fiscal year ending September 30, 2023 (FY2023).

|

|

|

|

|

|

|

Measure

|

|

FY2021 Target

(1)

|

|

FY2023 Target

(1)

|

|

Software Revenue

|

|

$1.7 Billion

|

|

$2.2 Billion

|

|

Total Revenue

|

|

$1.9 Billion

|

|

$2.4 Billion

|

|

Subscription Mix

|

|

85%

|

|

85%

|

|

Annual Recurring Software Revenue

|

|

95%

|

|

95%

|

|

Non-GAAP

Operating Margin

(2)

|

|

Low 30%

|

|

37%

|

|

Non-GAAP

EPS

(2)

|

|

$4.30

|

|

$6.50

|

|

Free Cash Flow

|

|

$600 Million

|

|

$850 Million

|

|

(1)

|

These future targets do not take into consideration the impact of ASC 606, which PTC will adopt as of October 1, 2018 (FY2019).

|

|

(2)

|

These future

non-GAAP

financial targets cannot be reconciled to GAAP as the items that impact GAAP results that we generally exclude from our

non-GAAP

financial measures are not known nor estimable. Those items may cause our GAAP financial results to differ materially from our

non-GAAP

financial targets and

results.

|

Stock Repurchases and Accelerated Share Repurchase

In connection with our previously announced stock repurchase program, and subject to completion of the contemplated $1.0 billion

investment by Rockwell Automation, Inc. pursuant to that certain Securities Purchase Agreement dated as of June 11, 2018 by and between PTC and Rockwell Automation, PTC intends to enter into an accelerated share repurchase agreement with an

investment bank to repurchase all or a significant portion of the additional $1.0 billion of stock repurchases authorized to be undertaken after the closing of the contemplated Rockwell Automation investment. The Company’s stock repurchase

program does not obligate the Company to repurchase any shares and may be terminated, increased or decreased by the Board in its discretion at any time.

Forward-Looking Statements

This

Current Report on Form

8-K

contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act, which are subject to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995. Statements relating to our FY2021 and FY2023 financial targets, the investment by Rockwell, the use of the proceeds therefrom, and the Company’s stock repurchase program are

forward-looking statements that involve a number of uncertainties and risks. Actual results may differ materially from these statements and from actual future events or results due to a variety of factors, including: our customers may not purchase

our solutions when or as we expect; our businesses, including our internet of things and augmented reality businesses, may not expand or generate the revenue we expect; customers may not purchase software subscriptions or convert existing software

support contracts to software subscriptions when or as we expect; the closing conditions for the Rockwell investment may not be satisfied or waived; any use of proceeds from the Rockwell investment or share repurchases may not occur as or when

expected; our assumptions about anticipated tax rates and obligations may be incorrect or may change; and the other risks described in reports and documents that the Company files from time to time with the SEC, including its Annual Report on

Form 10-K for

the fiscal year ended September 30, 2017 and its Quarterly Report on

Form 10-Q for

the quarter ended March 31, 2018. Undue reliance

should not be placed on the forward-looking statements in this Current Report on

Form 8-K, which

are based on information available to the Company on the date hereof. Except to the extent required by

applicable law, the Company disclaims any obligation to update information contained in these forward-looking statements whether as a result of new information, future events or otherwise.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

PTC Inc.

|

|

|

|

|

|

|

Date: June 18, 2018

|

|

|

|

By:

|

|

/s/ Andrew Miller

|

|

|

|

|

|

|

|

Andrew Miller

|

|

|

|

|

|

|

|

Executive Vice President and Chief Financial Officer

|

3

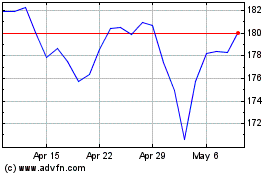

PTC (NASDAQ:PTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

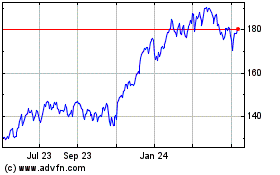

PTC (NASDAQ:PTC)

Historical Stock Chart

From Apr 2023 to Apr 2024