Survey Reveals Entrepreneurial Spirit,

Frustrations of Established Financial Reps

Examining the Mindset of U.S. Financial Professionals, a survey

released today by Schwab Independent Branch Services, finds that

while client-facing financial professionals are generally fulfilled

and optimistic about their careers, they are brimming with

entrepreneurial drive and drawn to independence. The majority of

survey participants care deeply about their work and are pleased

with their jobs, yet 76 percent say they have experienced obstacles

that have limited their success, citing lack of support and limited

autonomy.

The 994 survey participants, who have worked in the financial

services industry for at least seven years and interact with

investors once a week, prioritize clients’ happiness over

everything, yet 73 percent wish they could better assist clients

and had more time to make an impact in the communities they

serve.

Schwab Independent Branch Services launched in December 2011 to

accelerate growth in new markets by attracting successful financial

advisors to run franchise branches that complement Schwab’s

existing company-managed branches. Today there are 44 franchise

offices in 24 states.

“These survey findings reflect common perspectives that we’ve

heard when talking to candidates about running our franchise

branches,” said Craig Taucher, senior vice president, Schwab

Independent Branch Services. “Their clients are at the heart of

what they do; some want to be employees within established firms,

but many feel they can serve clients more effectively by operating

totally independently. Our hybrid model is the ideal solution for

those who want the best of both worlds.”

Focused on client service and optimistic about the

future

By and large, survey participants report that making clients

happy is a top priority and see a bright future ahead for their

industry:

- Eighty percent are optimistic about the

future of the industry, and 82 percent feel it is going in the

right direction.

- Seventy-seven percent would recommend

the industry to a recent graduate.

- Seventy-one percent agree that recent

and impending regulations benefit clients.

Continually improving the client experience through innovation

(78%) is crucial, according to those surveyed. In fact, 86 percent

say that the financial industry has changed more in the last five

years than in the previous 15 years, and 76 percent believe that

new technology is changing the industry to the point where it will

be unrecognizable in 10 years.

Fulfilled, but not without frustrations

Those who participated in the survey say their profession is the

most important thing to them (61%). The vast majority (86%) feel

successful; however, respondents did identify a number of obstacles

that they’ve encountered in their careers:

- Forty-one percent say they’ve had

negative experiences in their professional lives that still keep

them up at night, and 26 percent fear compromising their personal

values.

- Sixty-nine percent don’t regret

anything about the professional path they’ve taken, but 71 percent

wonder what life would be like if they had taken a different

professional path.

- Thirty percent of those who experience

obstacles say they are too busy servicing existing clients and lack

support to pursue new business.

- Twenty-six percent say they’ve been

promised things by employers that were never delivered.

“We frequently hear from those who are confined in the

traditional model that they are drawn to the opportunity to own a

Schwab franchise because they are struggling with competing

priorities, trying to be all things to all people, and hitting a

ceiling in terms of their growth, professionally and financially,”

said Christine Baker, head of franchise sales, Schwab Independent

Branch Services. “They see our model as transformational: one that

enables them to create a business that is based on seeing through

the client’s eyes and can fully align with their personal values

and growth appetite.”

A strong desire for independence abounds

When reflecting on their careers, 46 percent of those surveyed

wish they had built something from scratch.

The majority feel that independence is important for those who

work in the financial services industry, and many expressed a

desire to gain more personal control over their careers:

- Sixty-eight percent consider themselves

or aspire to be entrepreneurs.

- Fifty-eight percent say it’s important

to be masters of their own destinies.

- Fifty-five percent dream of owning

their own businesses.

- Forty-seven percent say they want to

build something new overall.

The survey findings reveal some feelings of discontent and

frustration; notably, 80 percent say they are ready to take their

career to the next level, and 63 percent are ready for a

change.

To learn more about Schwab Independent Branch Services, visit

www.schwabfranchise.com.

About the Survey

This online survey of U.S. financial professionals was conducted

by Edelman Intelligence for Schwab Independent Branch Services.

Edelman Intelligence is neither affiliated with, nor employed by,

Charles Schwab & Co., Inc. The survey is based on 994

interviews and has a 3 percent margin of error. Survey respondents

are U.S. residents over 18 years old who have worked in the

financial services industry for at least seven years. All data is

self-reported by study participants and is not verified or

validated. Respondents participated in the study between March 8

and March 23, 2018. Detailed results can be found here:

www.aboutschwab.com/press/research.

About Schwab Independent Branch Services

The Schwab franchise opportunity is a model for entrepreneurial

financial advisors with deep industry experience and strong

community roots who want to run a business that reflects their

values. IBLs nurture strong client relationships with the

operational support, vast resources, products/services, and brand

recognition of Charles Schwab. Independent Branches are run by

Independent Branch Leaders (IBLs) who are independent franchisees

and registered representatives and investment advisors of Schwab.

They are licensed independent contractors, not Schwab

employees.

About Charles Schwab

At Charles Schwab we believe in the power of investing to help

individuals create a better tomorrow. We have a history of

challenging the status quo in our industry, innovating in ways that

benefit investors and the advisors and employers who serve them,

and championing our clients’ goals with passion and integrity.

More information is available at www.aboutschwab.com.

Follow us on

Twitter, Facebook, YouTube and LinkedIn.

Disclosures:

The Charles Schwab Corporation (NYSE: SCHW) is a leading

provider of financial services, with more than 345 offices and

11.0 million active brokerage accounts, 1.6 million corporate

retirement plan participants, 1.2 million banking accounts, and

$3.31 trillion in client assets as of March 31, 2018. Through its

operating subsidiaries, the company provides a full range of wealth

management, securities brokerage, banking, money management,

custody, and financial advisory services to individual investors

and independent investment advisors. Its broker-dealer subsidiary,

Charles Schwab & Co., Inc.

(member SIPC, www.sipc.org), and affiliates offer a

complete range of investment services and products including an

extensive selection of mutual funds; financial planning and

investment advice; retirement plan and equity compensation plan

services; referrals to independent fee-based investment advisors;

and custodial, operational and trading support for independent,

fee-based investment advisors through Schwab Advisor Services. Its

banking subsidiary, Charles Schwab Bank (member FDIC and an Equal

Housing Lender), provides banking and lending services and

products. More information is available

at www.schwab.com and www.aboutschwab.com.

This advertising, and the franchise sales information within it,

is not intended as an offer to sell, or the solicitation of an

offer to buy, a franchise. It is for informational purposes only.

Currently, the following states regulate the offer and sale of

franchises: California, Hawaii, Illinois, Indiana, Maryland,

Michigan, Minnesota, New York, North Dakota, Oregon, Rhode Island,

South Dakota, Virginia, Washington and Wisconsin. If you are a

resident of one of these states, or if you wish to operate a

franchise in one of these states, we will not offer you a franchise

unless and until we have complied with any applicable pre-sale

registration and disclosure requirements in that state.

©2018 Charles Schwab & Co., Inc. All rights reserved.

211 Main Street, San Francisco CA 94105 (1- 877-520-6470) MN

Franchise Registration Number: F-6699

(0618-8V7P)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180618005195/en/

The Charles Schwab CorporationMeredith Richard,

212-403-9255Meredith.Richard@schwab.com

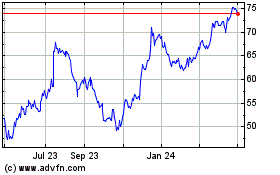

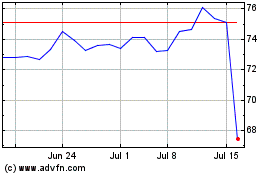

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Apr 2023 to Apr 2024