QuickLinks

-- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c) of

the Securities Exchange Act of 1934

|

|

|

|

|

Check the appropriate box:

|

|

o

|

|

Preliminary Information Statement

|

|

o

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

ý

|

|

Definitive Information Statement

|

|

|

|

AXOVANT SCIENCES LTD.

(Name of Registrant As Specified In Its Charter)

|

|

|

|

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

ý

|

|

No fee required

|

|

o

|

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

o

|

|

Fee paid previously with preliminary materials.

|

o

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

AXOVANT SCIENCES LTD.

Suite 1, 3rd Floor

11-12 St. James's Square

London SW1Y 4LB, United Kingdom

Notice of Action Taken Pursuant to Written Consent of Shareholders

Dear Shareholder:

The

accompanying Information Statement is furnished to holders of common shares of Axovant Sciences Ltd. ("

our company

,"

"

our

," "

we

" or "

us

") pursuant to Section 14 of

the Securities Exchange Act of 1934, as amended, and Regulation 14C and Schedule 14C thereunder, in connection with the approval of the matters described herein by written consent of the

holders of a majority of our issued and outstanding voting shares. The purpose of this Notice and Information Statement is to notify our shareholders that, on June 5, 2018, we received written

consent from the holders of a majority of our issued and outstanding voting shares to approve the issuance of 14,285,714 of our common shares to Roivant Sciences Ltd. at a purchase price of

$1.75 per share in a private placement for aggregate gross proceeds to us of approximately $25.0 million (the "

Private Placement

").

On

June 5, 2018, following discussion and due consideration of these matters, the independent members of our board of directors (which excluded Vivek Ramaswamy, who recused

himself from such discussions and subsequent vote) approved the Private Placement, which decision was subsequently approved by our independent audit committee pursuant to our related party transaction

policy. Following such approvals, we elected to seek the written consent of the holders of a majority of our outstanding voting shares in order to reduce associated costs and implement the proposal in

a timely manner.

This

Notice and the accompanying Information Statement are being furnished to you to inform you that the Private Placement has been approved by the holders of, or persons able to direct

the vote of, a majority of our issued and outstanding voting shares. The board of directors is not soliciting your proxy in connection with these actions and proxies are not requested from

shareholders.

The

corporate actions set forth above will not become effective before a date which is 20 calendar days after this Information Statement is first mailed to our shareholders. You are

urged to read the Information Statement in its entirety for a description of the actions taken by a majority of the holders of our voting shares.

|

|

|

|

|

|

|

BY ORDER OF THE BOARD OF DIRECTORS,

|

|

|

/s/ GREGORY WEINHOFF

Gregory Weinhoff

Principal Financial Officer

|

June 18, 2018

|

|

|

THE ACCOMPANYING INFORMATION STATEMENT IS BEING MAILED

TO SHAREHOLDERS ON OR ABOUT JUNE 18, 2018

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY

AXOVANT SCIENCES LTD.

Suite 1, 3rd Floor

11-12 St. James's Square

London SW1Y 4LB, United Kingdom

INFORMATION STATEMENT

NO VOTE OR OTHER ACTION OF THE COMPANY'S SHAREHOLDERS

IS REQUIRED IN CONNECTION WITH THIS INFORMATION STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

This Information Statement is first being furnished on or about June 18, 2018 to the holders of record of the common shares of Axovant Sciences Ltd.

("

our company

," "

our

," "

we

" or

"

us

") as of June 5, 2018 (the "

Record Date

") in connection with actions by written consents of

the holders of a majority of our issued and outstanding voting shares taken without a meeting to approve the actions described in this Information Statement.

Pursuant

to Rule 14c-2 promulgated by the Securities and Exchange Commission (the "

SEC

") under the Securities Exchange Act of 1934,

as amended (the "

Exchange Act

"), the actions described herein will not become effective until 20 calendar days following the date on which this

Information Statement is first mailed to our shareholders.

On

June 5, 2018, following discussion and due consideration of these matters, the independent members of our board of directors (which excluded Vivek Ramaswamy, who recused

himself from such discussions and subsequent vote) approved the Private Placement (as defined below), which decision was subsequently approved by our independent audit committee pursuant to our

related party transaction policy. Following such approvals, we elected to seek the written consent of the holders of a majority of our outstanding voting shares in order to reduce associated costs and

implement the proposal in a timely manner. On June 5, 2018, we received written consents from the requisite shareholders as described in this Information Statement.

Such

consents are sufficient under our amended and restated memorandum of association and our second amended and restated bye-laws to approve such actions. Accordingly, the actions will

not be submitted to the other shareholders of our company for a vote, and this Information Statement is being furnished to such other shareholders to provide them with certain information concerning

the actions in accordance with the requirements of the Exchange Act, and the regulations promulgated under the Exchange Act, including Regulation 14C.

VOTING REQUIREMENTS

Pursuant to our amended and restated memorandum of association and second amended and restated bye-laws, any action required or permitted to be

taken at a meeting of the shareholders may be taken without a meeting, with prior notice and without a vote, if a consent or consents in writing, setting forth the action so taken, shall be signed by

the holders of outstanding common shares having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote

thereon were present and voted.

Pursuant

to our amended and restated memorandum of association and second amended and restated bye-laws, approval of the actions described in this Information Statement at a meeting

would require the affirmative vote of at least a majority of the votes cast at such a meeting. Holders of our common shares are entitled to one vote per share. As of May 31, 2018, there were

107,788,074 common shares issued and outstanding.

1

SHARE ISSUANCE

Overview

On June 5, 2018, we entered into a share purchase agreement (the "

Purchase Agreement

")

with Roivant Sciences Ltd. ("

RSL

"), our majority shareholder, under which we agreed to issue and sell to RSL an aggregate of 14,285,714 common

shares at a purchase price of $1.75 per share, equal to the per share closing price of the Company's common shares on the Nasdaq Global Select Market on June 5, 2018 (the

"

Private Placement

"). The aggregate gross proceeds to us from the Private Placement are expected to be approximately $25.0 million. We intend to

use the net proceeds from the Private Placement to support the clinical development of our product candidate AXO-Lenti-PD as well as additional business development activities, and for working capital

and other general corporate purposes. The Private Placement is expected to close on or about July 9, 2018, subject to satisfaction or waiver of customary closing conditions.

On

June 5, 2018, we, through our wholly owned subsidiary Axovant Sciences GmbH, also entered into a license agreement (the "

License

Agreement

") with Oxford BioMedica (UK) Ltd. ("

BioMedica

") pursuant to which we received exclusive worldwide rights to

develop and commercialize OXB-102 (now AXO-Lenti-PD) from BioMedica. As partial consideration for the license, we made an upfront payment to BioMedica of $30.0 million, $5.0 million of

which will be applied as a credit against the process development work and clinical supply that BioMedica will provide to us. Under the terms of the License Agreement, the Company could be obligated

to make certain milestone payments to BioMedica in the future upon achievement of specified development, regulatory and commercial milestones and to pay certain royalties to BioMedica on any future

net sales.

The

Private Placement is exempt from the registration requirements of the Securities Act of 1933, as amended (the "

Securities Act

"),

pursuant to the exemption for transactions by an issuer not involving any public offering under Section 4(a)(2) of the Securities Act and in reliance on similar exemptions under applicable

state laws. RSL has represented that it is an accredited investor within the meaning of Rule 501 of Regulation D under the Securities Act, and is acquiring our common shares for

investment only and not with a view towards, or for resale in connection with, the public sale or distribution thereof. The Company's common shares have been offered without any general solicitation

by the Company or its representatives. This Information Statement does not constitute an offer to sell or the solicitation of an offer to buy common shares or other securities of our company.

Our

common shares issued and sold in the Private Placement will not be registered under the Securities Act or any state securities laws and may not be sold, offered for sale, pledged or

hypothecated in the absence of a registration statement in effect with respect to our common shares under the Securities Act or an applicable exemption from the registration requirements.

Please

see our Annual Report on Form 10-K filed with the SEC on June 11, 2018 for more information regarding the Purchase Agreement and the License Agreement.

Reason for Shareholder Approval

Our common shares are traded on the Nasdaq Global Select Market, so we are subject to Listing Rules of The Nasdaq Stock Market LLC

("

Nasdaq

"). The issuance of securities under the Purchase Agreement implicates certain of Nasdaq's Listing Rules requiring prior shareholder approval in

order to maintain our listing on the Nasdaq Global Select Market, including Nasdaq Listing Rule 5635(a), which requires shareholder approval prior to the issuance of securities in connection

with the acquisition of assets of another company if any director, officer or a "substantial shareholder" (generally defined as a 5% or greater shareholder) has a 5% or greater interest (or such

persons collectively have a 10% or greater interest), directly or indirectly, in the consideration to be paid in the

2

transaction,

and the present or potential issuance of common shares could result in an increase in outstanding common shares or voting power of 5% or more.

In

order to comply with these Nasdaq Listing Rules, we would need to obtain the approval of the holders of a majority of our outstanding common shares prior to the issuance of securities

as contemplated by the Purchase Agreement.

Interests of Certain Persons

Prior to the consummation of the Private Placement, RSL beneficially owns 69.6% of our outstanding common shares. At the time of our approval of

the Private Placement, Vivek Ramaswamy, our former principal executive officer and chairman of our board of directors, was also a member of RSL's board of directors and chief executive

officer of Roivant Sciences, Inc. ("

RSI

"), a wholly owned subsidiary of RSL. Ilan Oren, who is a member of the boards of directors of RSL and

Dexcel Pharma Technologies Ltd., joined our board of directors on June 6, 2018.

As

set forth below, certain independent directors of RSL, including Patrick Machado, may be deemed to be beneficial owners of our common shares directly owned by RSL. Patrick Machado

resigned from his position as a member of our board of directors effective February 11, 2018. Neither Vivek Ramaswamy nor Ilan Oren has voting or dispositive power, and therefore beneficial

ownership, over the shares held of record by RSL.

No Dissenters' or Preemptive Rights

Under Bermuda law, holders of our common shares are not entitled to dissenter's rights of appraisal with respect to the approval of the issuance

of shares under the Purchase Agreement. Holders of common shares have no pre-emptive, redemption, conversion or sinking fund rights. Holders of common shares are generally entitled to one vote per

share on all matters submitted to a vote of holders of common shares.

Consenting Shareholders

The approval of the issuance of shares under the Purchase Agreement required the affirmative vote of the holders of a majority of the issued and

outstanding shares of our common shares. RSL, which holds 75,000,000 shares, or 69.6% of the 107,788,074 shares outstanding and eligible to vote on this matter as of June 5, 2018, consented in

writing on June 5, 2018 to approval of the issuance of shares under the Purchase Agreement.

3

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding beneficial ownership of our common shares as of May 31, 2018 and following the

consummation of the Private Placement by:

-

•

-

all of those known by us to be beneficial owners of more than five percent of our common shares;

-

•

-

each of our named executive officers;

-

•

-

each of our directors; and

-

•

-

all of our executive officers and directors as a group.

This

table is based upon information supplied by officers, directors and principal shareholders and filings with the SEC. Unless otherwise indicated in the footnotes to this table and

subject to community property laws where applicable, we believe that each of the shareholders named in this table has sole voting and dispositive power with respect to the shares indicated as

beneficially owned. We have deemed common shares subject to options that are currently exercisable or exercisable within 60 days of May 31, 2018, to be outstanding and to be beneficially

owned by the person holding the option for the purpose of computing the percentage ownership of that person but have not treated them as outstanding for the purpose of computing the percentage

ownership of any other person.

Percentage

of shares beneficially owned prior to the Private Placement is based on 107,788,074 shares outstanding on May 31, 2018. Percentage of shares beneficially owned

after the Private Placement include an additional 14,285,714 common shares to be issued in connection with the Private Placement.

Except

as set forth below, the principal business address of each such person or entity is c/o Axovant Sciences Ltd., Suite 1, 3rd Floor, 11-12 St. James's

Square, London, SW1Y 4LB, United Kingdom.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares Beneficially Owned Prior to the Private Placement

|

|

Shares Beneficially Owned After the Private Placement

|

|

|

Beneficial Owner

|

|

Shares

|

|

Percentage

|

|

Shares

|

|

Percentage

|

|

|

5% Shareholder:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Roivant Sciences Ltd.(1)

|

|

|

75,000,000

|

|

|

69.6

|

%

|

|

89,285,714

|

|

|

73.1

|

%

|

|

Named Executive Officers and Directors:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pavan Cheruvu, M.D.(2)

|

|

|

2,024,560

|

|

|

1.8

|

|

|

2,024,560

|

|

|

1.6

|

|

|

Gregory M. Weinhoff, M.D.(3)

|

|

|

1,679,096

|

|

|

1.5

|

|

|

1,679,096

|

|

|

1.3

|

|

|

Mark Altmeyer(4)

|

|

|

1,675,634

|

|

|

1.5

|

|

|

1,675,634

|

|

|

1.3

|

|

|

Vivek Ramaswamy(5)

|

|

|

357,000

|

|

|

*

|

|

|

357,000

|

|

|

*

|

|

|

Roger Jeffs, Ph.D.(5)

|

|

|

150,000

|

|

|

*

|

|

|

150,000

|

|

|

*

|

|

|

George Bickerstaff(6)

|

|

|

175,000

|

|

|

*

|

|

|

175,000

|

|

|

*

|

|

|

Berndt Modig(7)

|

|

|

234,000

|

|

|

*

|

|

|

234,000

|

|

|

*

|

|

|

Ilan Oren(8)

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

Atul Pande, M.D.(5)

|

|

|

224,000

|

|

|

*

|

|

|

224,000

|

|

|

*

|

|

|

All executive officers and directors as a group (9 persons)

|

|

|

6,519,290

|

|

|

5.7

|

|

|

6,519,290

|

|

|

5.1

|

|

-

*

-

Represents

beneficial ownership of less than one percent.

-

(1)

-

As

of May 31, 2018, RSL directly owned and had sole voting and dispositive power over 75,000,000 common shares. Following the Private Placement of 14,285,714

common shares to RSL, RSL will directly own and have sole voting and dispositive power over 89,285,714 common shares. Dispositive decisions of RSL require approval by a majority of the directors of

RSL, including

4

(a) at

least two independent directors (as defined in RSL's internal governance documents) or (b) if there is only one independent director, that sole independent

director. Each of Patrick Machado, a former member of our board of directors, and Andrew Lo is currently serving as an independent director of RSL and therefore may be deemed to share dispositive

power over, and to be an indirect beneficial owner of, our common shares directly beneficially owned by RSL. In addition, RSL's internal governance documents provide that four principal

shareholders of RSL, Dexxon, Viking, QVT and SoftBank (each as defined below), voting unanimously, have the right to override certain decisions of the board of directors of RSL, including with respect

to dispositions of our common shares. Accordingly, Dexxon Holdings Limited, Dexcel Pharma Technologies Ltd. and their sole shareholder, Dan Oren (collectively,

"

Dexxon

"), Viking Global Investors LP, Viking Global Performance LLC, Viking Global Equities LP, Viking Global Equities

II LP, VGE III Portfolio Ltd., Viking Long Fund GP LLC, Viking Long Fund Master Ltd., Viking Global Opportunities GP LLC, Viking Global Opportunities

Portfolio GP LLC, Viking Global Opportunities Illiquid Investments Sub-Master LP, O. Andreas Halvorsen, Rose S. Shabet and David C. Ott (collectively,

"

Viking

"), QVT Financial LP, QVT Financial GP LLC, QVT Associates GP LLC and QVT Fund V LP (collectively,

"

QVT

") and SVF Investments (UK) Limited, SVF Holdings (UK) LLP, SoftBank Vision Fund L.P. and SVF GP (Jersey) Limited

(collectively, "

SoftBank

") may each be deemed to have shared dispositive power, and therefore, beneficial ownership, over our common shares beneficially

owned directly by RSL. The principal business of Dexxon is 1 Dexcel Street, Or Akiva, 3060000, Israel. The principal business address of Viking is 55 Railroad Avenue, Greenwich, Connecticut

06830. The principal business address of QVT is c/o QVT Financial LP, 1177 Avenue of the Americas, 9

th

Floor, New York, New York 10036. The principal business address of

SoftBank is 69 Grosvenor Street, London, United Kingdom W1K 3JP, other than SVF GP (Jersey) Limited, whose principal business address is Aztec Group House, 11-15 Seaton Place,

St. Helier, Jersey JE4 0QH.

-

(2)

-

Represents

(i) 1,940,185 common shares issuable pursuant to an immediately exercisable option and (ii) 84,375 common shares issuable pursuant to

options that vested and became exercisable on or within 60 days after May 31, 2018 in accordance with their vesting schedules.

-

(3)

-

Represents

(i) 1,529,096 common shares issuable pursuant to an immediately exercisable option and (ii) 150,000 common shares issuable pursuant to

options that became exercisable when, on June 6, 2018, the last reported sale price of our common shares on The Nasdaq Global Select Market exceeded $4.38 (representing three times the exercise

price). Excludes 300,000 remaining common shares issuable pursuant to options subject to additional share price conditions.

-

(4)

-

Represents

(i) 2,300 common shares held, (ii) 1,640,000 common shares issuable pursuant to an immediately exercisable option and (iii) 33,334

common shares issuable pursuant to options that became exercisable when, on June 6, 2018, the last reported sale price of our common shares on The Nasdaq Global Select Market exceeded $4.38

(representing three times the exercise price). Excludes 66,666 remaining common shares issuable pursuant to options subject to additional share price conditions.

-

(5)

-

Represents

common shares issuable pursuant to an immediately exercisable option.

-

(6)

-

Includes

150,000 common shares issuable pursuant to an immediately exercisable option.

-

(7)

-

Includes

156,086 common shares issuable pursuant to an immediately exercisable option.

-

(8)

-

Ilan

Oren joined our board of directors on June 6, 2018.

5

SHAREHOLDERS ENTITLED TO INFORMATION STATEMENT

This Information Statement is being mailed to you on or about June 18, 2018. We will pay all costs associated with the distribution of

this Information Statement, including the costs of printing and mailing. We will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in

sending this Information Statement to the beneficial owners of our common shares.

We

have established June 5, 2018 as the Record Date for the determination of shareholders entitled to receive this Information Statement.

HOUSEHOLDING OF MATERIALS

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for the

Information Statement materials with respect to two or more shareholders sharing the same address by delivering a single set of Information Statement materials addressed to those shareholders. This

process, which is commonly referred to as "householding," potentially means extra convenience for shareholders and cost savings for companies.

A

number of brokers with account holders who are Axovant shareholders will be "householding" the Information Statement materials. A single set of Information Statement materials will be

delivered to multiple shareholders sharing an address unless contrary instructions have been received from the affected shareholders. Once you have received notice from your broker that they will be

"householding" communications to your address, "householding" will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in

"householding" and would prefer to receive a separate set of Information Statement materials, please notify your broker or Axovant. Direct your written request to Axovant Sciences, Ltd., Attn:

Corporate Secretary, at Clarendon House, 2 Church Street, Hamilton HM 11, Bermuda. Shareholders who currently receive multiple copies of the Information Statement materials at their addresses and

would like to request "householding" of their communications should contact their brokers.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC under the Exchange Act. You may read and copy

this information at, or obtain copies of this information by mail from, the SEC's Public Reference Room at 100 F Street NE, Washington, D.C. 20549, at prescribed rates. You may obtain

information on the operation of the Public Reference Room by calling the SEC at (800) SEC-0330. The SEC maintains a website that contains reports, proxy statements and other information

regarding issuers that file electronically with the SEC, including Axovant. The address of the SEC website is www.sec.gov.

The

following documents, as filed with the SEC by the Company, are incorporated herein by reference:

-

•

-

our Annual Report on Form 10-K for the fiscal year ended March 31, 2018, filed with the SEC on June 11, 2018; and

-

•

-

our Current Report on Form 8-K filed with the SEC on June 6, 2018 (excluding Items 2.02, 7.01 and 9.01 thereunder).

Notwithstanding

the foregoing, no information is incorporated by reference in this information statement where such information under applicable forms and regulations of the SEC is not

deemed to be "filed" under Section 18 of the Exchange Act or otherwise subject to the liabilities of that section,

unless we indicate in the report or filing containing such information that the information is to be considered "filed" under the Exchange Act.

6

You

may request a copy of these filings, at no cost, at: Axovant Sciences Ltd., Attn: Investor Relations, 11 Times Square, 33rd Floor, New York, NY 10036, telephone:

(631) 892-7014. Any statement contained in a document that is incorporated by reference will be modified or superseded for all purposes to the extent that a statement contained in this

Information Statement (or in any other document that is subsequently filed with the SEC and incorporated by reference) modifies or is contrary to such previous statement. Any statement so modified or

superseded will not be deemed a part of this Information Statement except as so modified or superseded.

7

|

|

|

|

|

|

|

BY ORDER OF THE BOARD OF DIRECTORS,

|

|

|

/s/ GREGORY WEINHOFF

Gregory Weinhoff

Principal Financial Officer

|

June 18, 2018

|

|

|

8

QuickLinks

THE ACCOMPANYING INFORMATION STATEMENT IS BEING MAILED TO SHAREHOLDERS ON OR ABOUT JUNE 18, 2018 WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY

VOTING REQUIREMENTS

SHARE ISSUANCE

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

SHAREHOLDERS ENTITLED TO INFORMATION STATEMENT

HOUSEHOLDING OF MATERIALS

WHERE YOU CAN FIND MORE INFORMATION

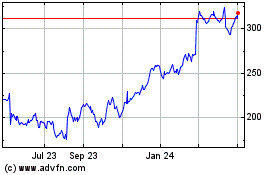

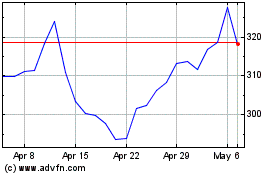

Axon Enterprise (NASDAQ:AXON)

Historical Stock Chart

From Mar 2024 to Apr 2024

Axon Enterprise (NASDAQ:AXON)

Historical Stock Chart

From Apr 2023 to Apr 2024