Table of Contents

As filed with the Securities and Exchange Commission on June 15, 2018

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________

FORM

S-

3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF

1933

SEACOR MARINE HOLDINGS INC

.

(Exact name of Registrant as specified in its charter)

__________________

|

Delaware

|

47-2564547

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

incorporation or organization)

|

Identification Number)

|

__________________

7910 Main Street, 2

nd

Floor

Houma, LA

70360

(

985)-876-5400

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

__________________

John Gellert

President and

Chief Executive Officer

SEACOR Marine Holdings Inc.

7910 Main Street, 2

nd

Floor

Houma, LA

70360

(

985)-876-5400

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

__________________

|

Copies to

:

|

|

|

|

Brett Nadritch

|

Andrew H. Everett II

|

|

David Zeltner

Milbank, Tweed, Hadley & McCloy LLP

28 Liberty Street

New York,

NY

10005

(212) 530-5301

|

Senior Vice President, General Counsel and Secretary

SEACOR Marine Holdings Inc.

7910 Main Street, 2

nd

Floor

Houma, LA

70360

(985)-876-5400

|

|

|

|

__________________

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, or the Securities Act, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462 (c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” and emerging growth company in Rule 12b-2 of the Securities Exchange Act of 1934, as amended, or the Exchange Act.

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

|

Non-accelerated filer ☒ (Do not check if a smaller reporting company)

|

Smaller reporting company ☐

|

|

Emerging growth company ☒

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☒

____________________________

Calculation of Registration Fee

|

|

|

Title of Each Class of

Securities To Be Registered (1)

|

Securities to be

Registered

|

Proposed

Maximum

Aggregate Price

Per Unit

|

Proposed

Maximum

Aggregate

Offering Price

|

A

mount of

Registration Fee

|

|

Primary Offering:

|

|

|

|

|

|

Common Stock, $0.01 par value per share

|

(1)

|

(2)

|

(2)

|

|

|

Preferred Stock, $0.01 par value per share

|

(1)

|

(2)

|

(2)

|

|

|

Debt Securities

|

(1)

|

(2)

|

(2)

|

|

|

Warrants to purchase Common Stock

|

(1)

|

(2)

|

(2)

|

|

|

Units

|

(1)

|

(2)

|

(2)

|

|

|

Primary Offering Total

|

|

|

$200,000,000.00

|

$24,900.00(3)

|

|

Secondary Offering:

|

|

|

|

|

|

Common Stock, $0.01 par value per share (4)

|

7,740,147

|

$21.82

|

$168,890,007.54

|

$21,026.81(6)

|

|

Warrants to purchase Common Stock (5)

|

5,178,906

|

N/A

|

N/A

|

N/A(7)

|

|

Secondary Offering Total

|

12,919,053

|

|

|

$21,026.81

|

|

Total

Fee

for Primary and Secondary Offerings:

|

|

|

|

$45,926.81

|

|

(1)

|

With respect to the primary offering, there are being registered hereunder such indeterminate number of shares of common stock and preferred stock, such indeterminate principal amount of debt securities, such indeterminate number of warrants to purchase common stock, preferred stock or debt securities and such indeterminate amount of units, which shall have an aggregate initial offering price not to exceed $200,000,000 (the “Maximum Offering Amount”). If any debt securities are issued at an original issue discount, then the principal amount of such debt securities at maturity shall not exceed the Maximum Offering Amount, less the aggregate dollar amount of all securities previously issued hereunder. Any securities registered hereunder may be sold separately or as units with other securities registered hereunder. The securities registered also include such indeterminate number of shares of common stock and preferred stock and the amount of debt securities as may be issued upon conversion of, or exchange for, preferred stock or debt securities that provide for conversion or exchange, upon exercise of warrants or pursuant to the anti-dilution provisions of any such securities. In addition, pursuant to Rule 416 under the Securities Act, the shares being registered hereunder include such indeterminate number of shares of common stock and preferred stock as may be issuable with respect to the shares being registered hereunder as a result of stock splits, stock dividends or similar transactions.

|

|

(2)

|

The proposed maximum aggregate offering price per class of security will be determined from time to time by the registrant in connection with the issuance by the registrant of the securities registered hereunder and is not specified as to each class of security pursuant to General Instruction II.D. of Form S-3 under the Securities Act.

|

|

(3)

|

The registration fee has been calculated in accordance with Rule 457(o) under the Securities Act of 1933, as amended.

|

|

(4)

|

This registration statement registers 2,561,241 shares of currently outstanding common stock, 2,271,406 shares of common stock issuable upon the exercise of currently outstanding warrants and 2,907,500 shares of common stock issuable upon the conversion of the Company’s 4.25% Convertible Senior Notes due 2023 currently held by certain affiliates of The Carlyle Group (“The Carlyle Group” and such notes, the “Convertible Notes”) as well as the shares of common stock underlying warrants issuable upon the conversion of the Convertible Notes.

|

|

(5)

|

This registration statement registers 2,271,406 currently outstanding warrants to purchase a like amount of our common stock as well as 2,907,500 warrants issuable upon conversion of the Convertible Notes under certain circumstances.

|

|

(6)

|

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act on the basis of the average of the high and low sales prices of the registrant’s shares of common stock on June 12, 2018 of $21.82, as reported on the New York Stock Exchange (“NYSE”).

|

|

(7)

|

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) of the Securities Act. Pursuant to Rule 457(g), no separate fee is required to be paid in respect of the warrants which are being registered concurrently.

|

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section

8(a) of the Securities Act, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section

8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell or accept an offer to buy these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any jurisdiction where such offer or sale is not permitted.

Subject to Completion, Dated

June

15

, 201

8

PROSPECTUS

Primary Offering

$

200,000,000

Common Stock

Preferred Stock

Debt Securities

Warrants

Units

__________________

Secondary Offering

2,561,241

Sh

ares of Common Stock

2,271,406

Warrants

to Purchase Common Stock

2,271,406

S

hares of Common Stock

Issuable Upon the Exercise of Warrants

2,907,500

Shares of Common Stock

(or Warrants in Lieu of

Such

Common Stock

(the “Conversion

Warrants”

)

)

Issuable Upon

Conversion of the Convertible Notes

, as well as any shares of common stock

underlying the Conversion Warrants

We may, from time to time, offer and sell up to $200,000,000 of any combination of our common stock, preferred stock, debt securities or warrants described in this prospectus, either individually or in combination with other securities, at prices and on terms described in one or more supplements to this prospectus. We may also offer common stock or preferred stock upon conversion of debt securities, common stock upon conversion of preferred stock, or common stock, preferred stock or debt securities upon the exercise of warrants. We may also authorize one or more free writing prospectuses to be provided to you in connection with these offerings.

In addition, the selling security holders may from time to time, offer and sell up to 2,561,241 shares of our currently outstanding common stock (the “Outstanding Secondary Shares”), 2,271,406 outstanding warrants (the “Outstanding Warrants”) to purchase a like amount of our common stock (the “Warrant Shares”), 2,271,406 Warrant Shares underlying the Outstanding Warrants and 2,907,500 shares of our common stock or warrants to purchase a like amount of our common stock (as well as the shares underlying such warrants (such shares, the “Conversion Warrant Shares”)) issuable upon conversion of our 4.25% Convertible Senior Notes due 2023 (the “Convertible Notes”) (such common stock, the “Conversion Shares,” such warrants, the “Conversion Warrants” and together with the Outstanding Secondary Shares, the Outstanding Warrants, the Warrant Shares and the Conversion Warrant Shares, the “Secondary Securities”). We will not receive any of the proceeds from the sales of the Secondary Securities by the selling security holders except for the exercise price of the Outstanding Warrants and Conversion Warrants (if any). See “Use of Proceeds” below for additional information. The selling security holders may sell the Secondary Securities described in this prospectus in a number of different ways and at varying prices. See “Plan of Distribution” below for additional information on how the selling security holders may conduct sales of the Secondary Securities. We have agreed to bear the expenses of the registration of the Secondary Securities under the federal and state securities laws on behalf of the selling security holders.

Each time we offer securities, to the extent applicable, we will provide the specific terms of the securities offered in one or more supplements to this prospectus. We may also authorize one or more free writing prospectuses to be provided to you in connection with these offerings. The prospectus supplement and any related free writing prospectus may also add, update or change information contained in this prospectus. You should carefully read this prospectus, the applicable prospectus supplement and any related free writing prospectus, as well as any documents incorporated by reference, before buying any of the securities being offered. If required, we will also file a prospectus supplement in connection with sales of Secondary Securities by the selling security holders.

The securities offered by this prospectus may be sold directly to investors, through agents designated from time to time or to or through underwriters or dealers. We will set forth the names of any underwriters or agents and any applicable fees, commissions, discounts and over-allotments in an accompanying prospectus supplement. For additional information on the methods of sale, you should refer to the section entitled “Plan of Distribution” in this prospectus and in the applicable prospectus supplement. The price to the public of such securities and the net proceeds we expect to receive from such sale will also be set forth in a prospectus supplement.

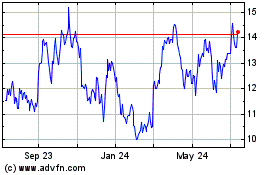

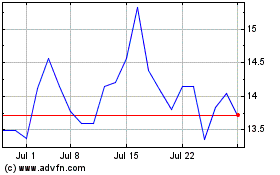

Our common stock is traded on the New York Stock Exchange (“NYSE”) under the symbol “SMHI.” On June 12, 2018, the last reported sale price of a share of our common stock on the NYSE was $21.65. The applicable prospectus supplement (if any) will contain information, where applicable, as to any other listing, if any, on the NYSE or any securities market or other exchange of the securities covered by the applicable prospectus supplement.

_________________

Investing in our securities involves a

high degree of risk.

You should review carefully the risks and uncertainties referenced under the heading “

risk factors

” on page

5

of this prospectus as well as those contained in the applicable prospectus supplement and any related free writing prospectus, and in the

documents that are incorporated by reference into this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

_________________

The date of this prospectus is

, 201

8

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or the SEC, utilizing a “shelf” registration process. Under this shelf registration process, we may offer shares of our common stock, preferred stock, debt securities, and/or warrants to purchase our common stock, preferred stock or debt securities, either individually or in units, in one or more offerings, up to a total dollar amount of $200,000,000. In addition, selling security holders may sell up to an aggregate of 2,561,241 Outstanding Secondary Shares, 2,271,406 Outstanding Warrants, 2,271,406 Warrant Shares and 2,907,500 Conversion Shares or Conversion Warrants (as well as any Conversion Warrant Shares). This prospectus provides you with a general description of the securities we and the selling security holders may offer. Each time we or the selling security holders offer a type or series of securities under this prospectus, to the extent required, we will provide a prospectus supplement that will contain more specific information about the specific terms of the offering. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. Each such prospectus supplement (and any related free writing prospectus that we may authorize to be provided to you) may also add, update or change information contained in this prospectus or in documents incorporated by reference into this prospectus. We urge you to carefully read this prospectus, any applicable prospectus supplement and any related free writing prospectus, together with the information incorporated herein by reference as described under the headings “Where You Can Find Additional Information” and “Incorporation of Certain Information by Reference” before buying any of the securities being offered. We or the selling security holders will deliver a prospectus supplement with this prospectus, to the extent appropriate, to update the information contained in this prospectus.

You should rely only on the information contained or incorporated by reference in this prospectus, any applicable prospectus supplement and any related free writing prospectus. We have not authorized anyone to provide you with different information in addition to or different from that contained in this prospectus, any applicable prospectus supplement and any related free writing prospectus. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus that we may authorize to be provided to you. You must not rely on any unauthorized information or representation. This prospectus is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the information in this prospectus, any applicable prospectus supplement or any related free writing prospectus is accurate only as of the date on the front of the document and that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus, any applicable prospectus supplement or any related free writing prospectus, or any sale of a security.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the heading “Where You Can Find Additional Information.”

SUMMARY

This summary highlights selected information from this prospectus or incorporated by reference in this prospectus, and does not contain all of the information that you need to consider in making your investment decision.

You should carefully read the entire prospectus, the applicable prospectus supplement and any related free writing prospectus, including the risks of investing in our securities contained in the applicable prospectus supplement and any related free writing prospectus, and in the other documents that are incorporated by reference into this prospectus.

You should also carefully read the information incorporated by reference into this prospectus, including our financial statements, and the exhibits to the registration statement of which this prospectus is a part.

Unless otherwise indicated or unless the context otherwise requires, references in this prospectus to the “Company,”

“SEACOR Marine,”

“

SMHI

,” “we,” “us,” or “our” are to

SEACOR Marine Holdings

Inc. and its subsidiaries.

Overview

The Company provides global marine and support transportation services to offshore oil and natural gas exploration, development and production facilities worldwide. The Company and its joint ventures operate a diverse fleet of offshore support and specialty vessels that (i) deliver cargo and personnel to offshore installations, (ii) handle anchors and mooring equipment required to tether rigs to the seabed, (iii) tow rigs and assist in placing them on location and moving them between regions, (iv) provide construction, well work-over and decommissioning support and (v) carry and launch equipment used underwater in drilling and well installation, maintenance, inspection and repair. Additionally, the Company’s vessels provide accommodations for technicians and specialists, safety support and emergency response services.

As of March 31, 2018, the Company operated a diverse fleet of 186 support and specialty vessels, of which 141 are owned or leased-in, 31 are joint ventured, and 14 are managed on behalf of unaffiliated third parties. The primary users of the Company’s services are major integrated oil companies, large independent oil and gas exploration and production companies and emerging independent companies.

The Company operates its fleet in five principal geographic regions: the United States, primarily in the Gulf of Mexico; Africa, primarily in West Africa; the Middle East and Asia; Brazil, Mexico, Central and South America; and Europe, primarily in the North Sea. The Company’s vessels are highly mobile and regularly and routinely move between countries within a geographic region. In addition, the Company’s vessels are redeployed among its geographic regions, subject to flag restrictions, as changes in market conditions dictate. The number and type of vessels operated, their rates per day worked and their utilization levels are the key determinants of the Company’s operating results and cash flows. Unless a vessel is cold-stacked, there is little reduction in daily running costs and, consequently, operating margins are most sensitive to changes in rates per day worked and utilization. The Company manages its fleet utilizing a global network of shore side support, administrative and finance personnel.

Corporate Information

Our principal executive offices are located at 7910 Main Street, 2

nd

Floor, Houma, LA 70360, and our telephone number is (985) 876-5400. Additional information about us is available on our website at

www.seacormarine

.com

. The information contained on or that may be obtained from our website is not, and shall not be deemed to be, a part of this prospectus. You can review filings we make with the SEC at its website (

www.sec.gov

), including our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports electronically filed or furnished pursuant to Section 15(d) of the Exchange Act.

The Securities We May Offer

We may offer shares of our common stock, various series of preferred stock, debt securities and/or warrants to purchase our common stock, preferred stock or debt securities, either individually or in units, with a total aggregate value of up to $200,000,000 from time to time under this prospectus at prices and on terms to be determined at the time of any offering. In addition, the selling security holders may sell up to an aggregate of 2,561,241 Outstanding Secondary Shares, 2,271,406 Outstanding Warrants, 2,271,406 Warrant Shares and 2,907,500 Conversion Shares or Conversion Warrants (as well as any Conversion Warrant Shares). This prospectus provides you with a general description of the securities we and the selling security holders may offer. Each time we offer a type or series of securities under this prospectus, to the extent applicable, we will provide a prospectus supplement that will describe the specific amounts, prices and other important terms of the securities, including, to the extent applicable:

|

|

●

|

designation or classification;

|

|

|

|

|

|

|

●

|

aggregate principal amount or offering price;

|

|

|

●

|

maturity, if applicable;

|

|

|

●

|

original issue discount, if any;

|

|

|

●

|

rates and times of payment of interest or dividends, if any;

|

|

|

●

|

redemption, conversion, exchange or sinking fund terms, if any;

|

|

|

●

|

conversion or exchange prices or rates, if any, and, if applicable, any provisions for changes to or adjustments in the conversion or exchange prices or rates and in the securities or other property receivable upon conversion or exchange;

|

|

|

●

|

restrictive covenants, if any; and

|

|

|

●

|

voting or other rights, if any.

|

If required, we will also file a prospectus supplement in connection with sales of Secondary Securities by the selling security holders.

The prospectus supplement and any related free writing prospectus that we may authorize to be provided to you may also add, update or change information contained in this prospectus or in documents we have incorporated by reference. However, no prospectus supplement or free writing prospectus will offer a security that is not registered and described in this prospectus at the time of the effectiveness of the registration statement of which this prospectus is a part.

We and the selling security holders may sell the securities directly to investors or to or through agents, underwriters or dealers. We and the selling security holders, and our agents or underwriters, reserve the right to accept or reject all or part of any proposed purchase of securities. If we or the selling security holders do offer securities to or through agents or underwriters, to the extent required, we will include in the applicable prospectus supplement:

|

|

●

|

the names of those agents or underwriters;

|

|

|

|

|

|

|

●

|

applicable fees, discounts and commissions to be paid to them;

|

|

|

●

|

details regarding over-allotment options, if any; and

|

|

|

●

|

the net proceeds to us.

|

To facilitate compliance with the Jones Act, the Company’s second amended and restated certificate of incorporation (the “Certificate of Incorporation”) and second amended and restated by-laws (the “Bylaws”): (i) limit (a) the aggregate percentage ownership by non-U.S. citizens of any class of the Company’s capital stock (including common stock) to 22.5% of the outstanding shares of each such class to ensure that ownership by non-U.S. citizens will not exceed the maximum percentage permitted by applicable maritime law (presently 25%) but authorize the Company’s board of directors, under certain circumstances, to increase the foregoing percentage to not more than 24% and (b) ownership of shares of any class or series of its capital stock by a single non-U.S. citizen (and any other non-U.S. citizen whose ownership position would be aggregated with such non-U.S. citizen for purposes of the Jones Act) to not more than 4.9% of the outstanding shares of each such class or series (each such limitation, the “Permitted Percentage”); (ii) allow for the institution of a dual stock certification system to help determine such ownership; (iii) provide that any issuance or transfer of shares in excess of the Permitted Percentage shall be ineffective as against the Company and that neither the Company nor its transfer agent shall register such purported issuance or transfer of shares or be required to recognize the purported transferee or owner as a stockholder of the Company for any purpose whatsoever except to exercise the Company’s remedies under the Certificate of Incorporation; (iv) provide that any excess shares above the Permitted Percentage shall not have any voting or dividend rights; (v) permit the Company to redeem or transfer to a charitable trust any such excess shares; and (vi) permit the board of directors to make such reasonable determinations as may be necessary to ascertain such ownership and implement such limitations. In addition, the Company’s Bylaws provide (w) that the number of non-U.S. citizen directors shall not exceed a minority of the number necessary to constitute a quorum for the transaction of business, (x) for an increase in the number of directors necessary to constitute a quorum when the number of non-U.S. citizen directors is equal to or greater than 50% of the number of directors present at a meeting, (y) that the President and the Chief Executive Officer of the Company must be a U.S. citizen and (z) that any non-U.S. citizen officer is restricted from acting in the absence or disability of the chairman of the board of directors, the Chief Executive Officer or the President.

Common Stock

. We may issue shares of our common stock from time to time and the selling security holders may offer up to 7,740,147 shares of common stock, including 2,561,241 Outstanding Secondary Shares, 2,271,406 Warrant Shares and 2,907,500 Conversion Shares (or Conversion Warrant Shares). Holders of shares of our common stock are entitled to one vote for each share on all matters submitted to a vote of stockholders and do not have cumulative voting rights. The common stock votes together as a single class. Directors are elected by a plurality of the votes of the shares of common stock present in person or by proxy at a meeting of stockholders and voting for nominees in the election of directors. Except as otherwise provided in our Certificate of Incorporation, Bylaws or required by law, all matters to be voted on by our stockholders must be approved by a majority of the shares present in person or by proxy at a meeting of stockholders and entitled to vote on the subject matter. Holders of common stock are entitled to receive proportionately any dividends as may be declared by our board of directors, subject to any preferential dividend rights of outstanding preferred stock. Upon our liquidation, dissolution or winding up, the holders of common stock are entitled to receive proportionately our net assets available after the payment of all debts and other liabilities and subject to the prior rights of any outstanding preferred stock. Holders of common stock have no preemptive, subscription, redemption or other conversion rights and do not have any sinking fund provisions. The rights, preferences and privileges of holders of common stock are subject to, and may be adversely affected by, the rights of the holders of shares of any series of preferred stock which we may designate and issue in the future. Shares of our common stock are not convertible into any other shares of our capital stock.

Preferred Stock

. Our board of directors is authorized to provide for the issuance of preferred stock in one or more series and to fix the preferences, powers and relative, participating, optional or other special rights, and qualifications, limitations or restrictions thereof, including the dividend rate, conversion rights, voting rights, redemption rights and liquidation preference and to fix the number of shares to be included in any such series without any further vote or action by our stockholders. Any preferred stock so issued may rank senior to our common stock with respect to the payment of dividends or amounts upon liquidation, dissolution or winding up, or both. In addition, any such shares of preferred stock may have class or series voting rights. The issuance of preferred stock may have the effect of delaying, deferring or preventing a change in control of our company without further action by the stockholders and may adversely affect the voting and other rights of the holders of our common stock.

If we sell any series of preferred stock under this prospectus, we will fix the preferences, powers and relative, participating, optional or other special rights, and qualifications, limitations or restrictions thereof, including the dividend rate, conversion rights, voting rights, redemption rights and liquidation preference and to fix the number of shares to be included in any such series in the certificate of designation relating to that series. We will file as an exhibit to the registration statement of which this prospectus is a part, or will incorporate by reference from reports that we file with the SEC, the form of any certificate of designation that describes the terms of the series of preferred stock that we are offering before the issuance of the related series of preferred stock. We urge you to read the applicable prospectus supplement (and any free writing prospectus that we may authorize to be provided to you) related to the series of preferred stock being offered, as well as the complete certificate of designation that contains the terms of the applicable series of preferred stock.

Debt Securities

. We may issue debt securities from time to time, in one or more series, as either senior debt or as senior convertible debt. The debt securities will rank equally with any other unsecured and unsubordinated debt. Convertible debt securities will be convertible into or exchangeable for our common stock or preferred stock. Conversion may be mandatory or at the holder’s option and would be at prescribed conversion rates.

The debt securities will be issued under a document called an indenture, which is a contract between us and a national banking association or other eligible party, as trustee. In this prospectus, we have summarized certain general features of the debt securities. We urge you, however, to read the applicable prospectus supplement (and any free writing prospectus that we may authorize to be provided to you) related to the series of debt securities being offered, as well as the complete indenture that contains the terms of the debt securities. A form of indenture has been filed as an exhibit to the registration statement of which this prospectus is a part, and supplemental indentures and forms of debt securities containing the terms of the debt securities being offered, will be filed as exhibits to the registration statement of which this prospectus is a part or will be incorporated by reference from reports that we file with the SEC.

Warrants

. We have issued 2,271,406 Outstanding Warrants to certain of the selling security holders and the holders of our Convertible Notes may, if required to maintain our compliance with the Jones Act, receive Conversion Warrants instead of Conversion Shares upon exercise of their conversion rights. For a description of the Outstanding Warrants and the Conversion Warrants see “—Outstanding Warrants and Conversion Warrants to be Offered by the Selling Security Holders.”

We may issue additional warrants for the purchase of common stock, preferred stock or debt securities in one or more series. We may issue warrants independently or together with common stock, preferred stock or debt securities or under certain circumstances to satisfy our obligations upon conversion of the Convertible Notes, if applicable, and such warrants may be attached to or separate from our common stock, preferred stock or debt securities, as applicable. In this prospectus, we have summarized certain general features of the warrants that we may issue in the future. We urge you, however, to read the applicable prospectus supplement (and any free writing prospectus that we may authorize to be provided to you) related to the particular series of warrants being offered, as well as the complete warrant agreements and/or warrant certificates that contain the terms of the warrants. We will file as exhibits to the registration statement of which this prospectus is a part, or will incorporate by reference from reports that we file with the SEC, the forms of warrant agreement and/or warrant certificates that describe the terms of the series of warrants we are offering before the issuance of the related series of warrants.

We will evidence each series of warrants by warrant certificates that we will issue. Warrants may be issued under an applicable warrant agreement that we enter into with a warrant agent. We will indicate the name and address of the warrant agent, if applicable, in the prospectus supplement relating to the particular series of warrants being offered.

Units

. We may issue, in one or more series, units consisting of common stock, preferred stock, debt securities and/or warrants for the purchase of common stock, preferred stock or debt securities in any combination. Each unit will be issued so that the holder of the unit is also the holder of each security included in the unit. In this prospectus, we have summarized certain general features of the units. We urge you, however, to read the applicable prospectus supplement (and any free writing prospectus that we may authorize to be provided to you) related to the series of units being offered, as well as the complete unit agreement, if any, which contains the terms of the units. We will file as exhibits to the registration statement of which this prospectus is a part, or will incorporate by reference from reports that we file with the SEC, any form of unit agreement and any supplemental agreements that describe the terms of the series of units we are offering before the issuance of the related series of units.

RISK FACTORS

An investment in our securities involves a certain degree of risk. You should carefully consider the factors contained in our Annual Report on Form 10-K for the fiscal year ended December 31, 2017 under the heading “Risk Factors” and updated, if applicable, in our Quarterly Reports on Form 10-Q before investing in our securities. You should also consider similar information contained in any Annual Report on Form 10-K, Quarterly Report on Form 10-Q or other document filed by us with the SEC after the date of this prospectus before deciding to invest in our securities. If any of these risks were to occur, our business, financial condition or results of operations could be adversely affected. In that case, the trading price of our common stock or other securities could decline and you could lose all or part of your investment. When we offer and sell any securities pursuant to a prospectus supplement, we may include additional risk factors relevant to such securities in the prospectus supplement.

FORWARD-LOOKING STATEMENTS

This prospectus, the documents incorporated by reference herein contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such forward-looking statements concern management’s expectations, strategic objectives, business prospects, anticipated economic performance and financial condition and other similar matters and involve significant known and unknown risks, uncertainties and other important factors that could cause the actual results, performance or achievements of results to differ materially from any future results, performance or achievements discussed or implied by such forward-looking statements. All of these forward-looking statements constitute the Company’s cautionary statements under the Private Securities Litigation Reform Act of 1995. The words “anticipate,” “estimate,” “expect,” “project,” “intend,” “believe,” “plan,” “target,” “forecast” and similar expressions are intended to identify forward-looking statements. Forward-looking statements speak only as of the date of the document in which they are made. The Company disclaims any obligation or undertaking to provide any updates or revisions to any forward-looking statement to reflect any change in the Company’s expectations or any change in events, conditions or circumstances on which the forward-looking statement is based. Forward-looking statements include, but are not necessarily limited to, those relating to:

|

|

•

|

decreased demand and loss of revenues as a result of a decline in the price of oil and resulting decrease in capital spending by oil and gas companies;

|

|

|

•

|

an oversupply of newly built offshore support vessels, additional safety and certification requirements for drilling activities in the U.S. Gulf of Mexico and delayed approval of applications for such activities;

|

|

|

•

|

the possibility of U.S. government implemented moratoriums directing operators to cease certain drilling activities in the U.S. Gulf of Mexico and any extension of such moratoriums;

|

|

|

•

|

weakening demand for the Company’s services as a result of unplanned customer suspensions, cancellations, rate reductions or non-renewals of vessel charters or failures to finalize commitments to charter vessels in response to a decline in the price of oil;

|

|

|

•

|

increased government legislation and regulation of the Company’s businesses could increase cost of operations;

|

|

|

•

|

increased competition if the Jones Act and related regulations are repealed;

|

|

|

|

|

|

|

•

|

liability, legal fees and costs in connection with the provision of emergency response services, such as the response to the oil spill as a result of the sinking of the Deepwater Horizon in April 2010;

|

|

|

•

|

decreased demand for the Company’s services as a result of declines in the global economy;

|

|

|

|

|

|

|

•

|

declines in valuations in the global financial markets and a lack of liquidity in the credit sectors, including, interest rate fluctuations, availability of credit, inflation rates, change in laws, trade barriers, commodity prices and currency exchange fluctuations;

|

|

|

•

|

the cyclical nature of the oil and gas industry, activity in foreign countries and changes in foreign political, military and economic conditions;

|

|

|

•

|

changes to the status of applicable trade treaties including as a result of the U.K.’s impending exit from the European Union;

|

|

|

•

|

changes in foreign and domestic oil and gas exploration and production activity, safety record requirements;

|

|

|

•

|

compliance with U.S. and foreign government laws and regulations, including environmental laws and regulations and economic sanctions;

|

|

|

|

|

|

|

•

|

the dependence on several key customers;

|

|

|

|

|

|

|

•

|

consolidation of the Company’s customer base;

|

|

|

|

|

|

|

•

|

the ongoing need to replace aging vessels;

|

|

|

|

|

|

|

•

|

industry fleet capacity;

|

|

|

•

|

restrictions imposed by the Jones Act and related regulations on the amount of foreign ownership of the Company’s common stock;

|

|

|

•

|

operational risks, effects of adverse weather conditions and seasonality, adequacy of insurance coverage;

|

|

|

•

|

the ability of the Company to maintain effective internal controls over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act; and

|

|

|

|

|

|

|

•

|

the attraction and retention of qualified personnel by the Company.

|

You should not place undue reliance on our forward-looking statements because the matters they describe are subject to known and unknown risks, uncertainties and other unpredictable factors, many of which are beyond our control. Our forward-looking statements are based on the information currently available to us and speak only as of the date on the cover of this prospectus. New risks and uncertainties arise from time to time, and it is impossible for us to predict these matters or how they may affect us. We have included important factors in the cautionary forward-looking statements included in this prospectus, particularly in the section of this prospectus entitled “Risk Factors,” which we believe over time, could cause our actual results, performance or achievements to differ from the anticipated results, performance or achievements that are expressed or implied by our forward-looking statements. We have no duty to, and do not intend to, update or revise the forward-looking statements in this prospectus after the date of this prospectus except to the extent required by the federal securities laws. You should consider all risks and uncertainties disclosed in our filings with the Securities and Exchange Commission, or the SEC, described in the sections of this prospectus entitled “Where You Can Find More Information” and “Incorporation of Certain Information by Reference,” all of which are accessible on the SEC’s website at

www.sec.gov

.

IMPLICATIONS OF BEING AN EMERGING GROWTH COMPANY

As a company with less than $1.07 billion in gross revenue during our last fiscal year, we qualify as an Emerging Growth Company as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). An Emerging Growth Company may take advantage of specified reduced regulatory and reporting requirements that are otherwise generally applicable to public companies including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation and financial statements in our periodic reports, proxy statements and registration statements, and exemptions from the requirements of holding a nonbinding advisory vote to approve executive compensation and shareholder approval of any golden parachute payments not previously approved.

We may take advantage of these exemptions until the last day of our fiscal year following the fifth anniversary of the closing of our spin-off from SEACOR Holdings Inc. in June 2017, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1.07 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period.

For as long as we continue to be an Emerging Growth Company, we expect that we will take advantage of certain reduced disclosure requirements available to us as a result of that classification. The JOBS Act permits an Emerging Growth Company, such as us, to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. We have chosen to “opt out” of this provision and, as a result, we will comply with new or revised accounting standards as required for public companies. This decision to opt out of the extended transition period under the JOBS Act is irrevocable.

RATIO OF EARNINGS TO FIXED CHARGES AND TO COMBINED FIXED CHARGES AND PREFERRED STOCK DIVIDENDS

The following table sets forth our ratio of earnings to fixed charges and the ratio of earnings to combined fixed charges and preferred stock dividends for each of the periods indicated. The following table is qualified by the more detailed information appearing in the computation table set forth in Exhibit 12.1 to the registration statement of which this prospectus is part and our historical financial statements, including the notes to those financial statements, which are incorporated by reference in this prospectus.

|

|

Quarter

E

nded

March

31,

201

8

|

Year

E

nded

December

31,

201

7

|

Year

E

nded

December

31,

201

6

|

Year

E

nded

December

31,

201

5

|

Year

E

nded

December

31,

201

4

|

Year

E

nded

December

31,

201

3

|

|

Ratio of earnings to fixed charges

|

deficiency

|

deficiency

|

deficiency

|

deficiency

|

4.9

|

4.0

|

|

Ratio of earnings to combined fixed charges and preferred stock dividends

|

deficiency

|

deficiency

|

deficiency

|

deficiency

|

4.9

|

4.0

|

|

Deficiency (in thousands) ($)

|

$42,628

|

$121,599

|

$203,482

|

$56,457

|

-

|

-

|

For these purposes, earnings are defined as income before income taxes and fixed charges, and fixed charges include interest expense on indebtedness, amortization of capitalized interest, and the portion of operating lease rental expense which is deemed to represent interest.

We have no preferred shares outstanding and paid no dividends on preferred shares during the periods indicated which is why the ratios of earnings to combined fixed charges and preferred dividends are the same as the ratios of earnings to fixed charges presented above.

USE OF PROCEEDS

We will retain broad discretion over the use of the net proceeds from the sale of the securities offered by us hereby. Except as described in any prospectus supplement or any related free writing prospectus that we may authorize to be provided to you, we currently intend to use the net proceeds from the sale of the securities offered by us hereby for general corporate purposes, which may include capital expenditures, working capital and general and administrative expenses. We will set forth in the applicable prospectus supplement or free writing prospectus our intended use for the net proceeds received from the sale of any securities sold pursuant to the prospectus supplement or free writing prospectus. Pending these uses, we intend to invest the net proceeds in U.S. government or agency obligations, commercial paper, money market accounts, short-term marketable securities, bank deposits or certificates of deposit, repurchase agreements collateralized by U.S. government or agency obligations or other short-term investments.

We will not receive any proceeds from the sale by the selling security holders of the Secondary Securities except that upon the exercise of the Outstanding Warrants, the Company will receive proceeds equal to the exercise price of $0.01 per share, for an aggregate amount of approximately $22,714.06 if all the Outstanding Warrants covered by this prospectus are exercised, subject to any adjustments. In addition, if any Conversion Warrants are issued in the future, we would receive the exercise price of $0.01 per share upon exercise of such warrants.

SELLING SECURITY HOLDERS

This prospectus also relates to the possible resale by certain of our security holders, who we refer to in this prospectus as the “selling security holders,” of up to (i) 7,740,147 shares of our common stock, consisting of 2,561,241 Outstanding Secondary Shares, 2,271,406 Warrant Shares and 2,907,500 Conversion Shares or Conversion Warrant Shares and (ii) warrants to purchase 5,178,906 shares of our common stock consisting of 2,271,406 Outstanding Warrants and 2,907,500 Conversion Warrants.

The Brian P. Cheramie Issuance

On March 26, 2018, the Company issued 103,213 shares of common stock to an accredited investor, Brian P. Cheramie, pursuant to a private placement in reliance on the exemption from registration set forth in Section 4(a)(2) of the Securities Act (the “Brian Cheramie Private Placement”).

The PIPE Issuance

On April 26, 2018, the Company closed a private placement of its common stock and warrants to purchase its common stock (to facilitate compliance with Jones Act restrictions) for aggregate gross proceeds of $56,855,000 (the “PIPE Private Placement”). The PIPE Private Placement included the issuance of approximately 2,168,586 shares of the Company's common stock (the “PIPE Shares”) and warrants (the “PIPE Warrants”) to purchase 674,164 shares of the Company’s common stock at an exercise price of $0.01 per share.

The PIPE Warrants were issued to Proyectos Globales de Energia y Servicios CME, S.A. de C.V. a variable capital corporation (sociedad anónima de capital variable) incorporated and existing under the laws of the United Mexican States (“CME”) and have a 25-year term, which commenced April 26, 2018.

The PIPE Shares and PIPE Warrants are subject to a registration rights agreement dated as of April 26, 2018 with the purchasers that participated in the PIPE Private Placement (the “PIPE Private Placement Registration Rights Agreement”). Under the PIPE Private Placement Registration Rights Agreement, the Company is required to file and maintain an effective shelf registration statement to register secondary sales of the PIPE Shares, PIPE Warrants and the shares underlying the PIPE Warrants until the earlier of (i) the date that all such securities covered by the registration statement have been sold or (ii) the date on which all such securities cease to be Registrable Securities (as defined in the PIPE Private Placement Registration Rights Agreement). The PIPE Private Placement Registration Rights Agreement includes customary indemnification provisions whereby the Company and the other parties to the agreement have agreed to indemnify one another under certain circumstances. The registration statement of which this prospectus forms apart is being filed to comply with the Company’s obligations under the PIPE Private Placement Registration Rights Agreement.

The PIPE Shares and PIPE Warrants were issued in reliance upon the exemption from registration provided by Section 4(a)(2) of the Securities Act.

The Carlyle Group

Convertible

Notes and Warrants

The Company issued $175.0 million aggregate principal amount of its Convertible Notes to affiliates of The Carlyle Group pursuant to a Note Purchase Agreement dated as of November 30, 2015 between the Company and the purchasers identified on Schedule A thereto (the “Note Purchase Agreement” and such issuance, the “Convertible Notes Issuance”). Prior to the Exchange (as defined below), the Convertible Notes were scheduled to mature in 2022 and were convertible into shares of the Company’s common stock, par value $0.01 per share, at a conversion rate of 23.26 shares per $1,000 principal amount of the Convertible Notes subject to certain conditions. Pursuant to the Note Purchase Agreement, the Company may, under certain circumstances, settle any of the Convertible Notes submitted for conversion into its common stock through the issuance of warrants to purchase a like amount of common stock in order to facilitate the Company’s compliance with the provisions of the Jones Act (such warrants, the “Conversion Warrants”). The Conversion Warrants, if issued, would entitle their holders to purchase an equal number of shares of Common Stock at an exercise price of $0.01 per share upon the resolution of any Jones Act compliance issues and would expire on the 25

th

anniversary of the date that they are issued.

On May 2, 2018, the Company and The Carlyle Group entered into an exchange transaction (the “Exchange”) pursuant to which The Carlyle Group exchanged $50 million in principal amount of the Convertible Notes for warrants to purchase 1,886,792 shares of the Company’s common stock (to facilitate compliance with Jones Act restrictions) at an exercise price of $0.01 per share, subject to adjustments (the “Carlyle Warrants”), representing an implied exchange rate of approximately 37.73 shares per $1,000 in principal amount of the Convertible Notes (equivalent to an exchange price of $26.50 per share). The Carlyle Warrants have a 25-year term, which commenced May 2, 2018. The Company and The Carlyle Group also amended the outstanding $125 million in principal amount of Convertible Notes that remained outstanding following the Exchange to (i) increase the interest rate from 3.75% per annum to 4.25% per annum and (ii) extend the maturity date of the Convertible Notes by 12 months to December 2023. The Conversion Shares, the Conversion Warrants and the Carlyle Warrants are subject to that certain registration rights agreement dated as of November 30, 2015 by and among the Company and the persons listed on Schedule I thereto (the “Carlyle Registration Rights Agreement”). The registration statement of which this prospectus forms apart is being filed to comply with our obligations under the Carlyle Registration Rights Agreement.

The Carlyle Registration Rights Agreement provides The Carlyle Group with customary demand and piggyback registration rights. Both demand and piggyback registration rights are subject to customary underwriter cutback provisions. The Carlyle Registration Rights Agreement includes customary indemnification provisions whereby the Company and the other parties to the agreement have agreed to indemnify one another under certain circumstances.

The warrants issuable in the Exchange were issued in reliance upon the exemption from registration provided by Section 4(a)(2) of the Securities Act.

Exercise of

Warrants by The Carlyle Group and CME

On May 31, 2018, The Carlyle Group exercised 250,693 warrants for a total of 250,585 shares of common stock of the Company (after giving effect to the withholding of shares of common stock of the Company as payment for the exercise price of the warrants) (the “Carlyle Warrant Exercise”). Following the warrant exercise, The Carlyle Group holds warrants to purchase 1,636,099 shares of the Company’s common stock at an exercise price of $0.01 per share (the “Outstanding Carlyle Warrants”).

On June 8, 2018, CME exercised 38,857 warrants and paid an aggregate exercise price of $388.57 for a total of 38,857 shares of common stock of the Company (the “CME Warrant Exercise”). Following the warrant exercise, CME holds warrants to purchase 635,307 shares of the Company’s common stock at an exercise price of $0.01 per share (the “Outstanding CME Warrants” and together with the Outstanding Carlyle Warrants, the “Outstanding Warrants”).

Selling Security Holder

s

Tables

Unless the context otherwise requires, as used in this prospectus, “selling security holders” includes the selling security holders named in the table below and donees, pledgees, transferees or other successors-in-interest selling shares received from the selling security holders as the result of a gift, pledge, partnership distribution or other transfer after the date of this prospectus, and any such persons will be named in the applicable prospectus supplement.

The following table, based upon information currently known by us, sets forth as of May 29, 2018 (other than with respect to the updates discussed in “— Exercise of Warrants by The Carlyle Group and CME”, which are as of the dates noted in that section): (i) the number of shares of common stock held of record or beneficially owned by the selling security holders, including the number of Outstanding Secondary Shares, Warrant Shares and Conversion Shares (or Conversion Warrant Shares, as applicable), as of such date (as determined below), (ii) the number of shares of common stock held of record or beneficially owned by the selling security holders, including the number of Outstanding Secondary Shares, Warrant Shares and Conversion Shares (or Conversion Warrant Shares, as applicable) that may be offered under this prospectus by the selling security holders, (iii) the number of shares of common stock beneficially owned upon completion of the offering and (iv) the percentage of common stock beneficially owned upon completion of this offering. The beneficial ownership of the common stock set forth in the following table is determined in accordance with Rule 13d-3 under the Exchange Act based on 20,422,305 shares of common stock outstanding as of June 8, 2018, and the information is not necessarily indicative of beneficial ownership for any other purpose.

The inclusion of any shares in this table does not constitute an admission of beneficial ownership for the selling security holders named below.

|

|

Common Stock

|

|

|

Name of Selling

Security holder

s

|

Beneficially

Owned as of

May 29

, 201

8

(1)

|

Common Stock

Offered

Pursuant to this

Prospectus

(1)

|

Beneficially

Owned upon

Completion of

this Offering

(1)

(2)

|

Percentage Of

Common Stock

Beneficially

Owned upon

Completion of

this

Offering

(1)

(2)

|

|

Oppenheimer-Close Investment Partnership LP

(3

)

|

72,457

|

25,000

|

47,457

|

0.23%

|

|

Oppenheimer-Close International LTD

(4

)

|

9,655

|

2,750

|

6,905

|

0.03%

|

|

JMG GST LLC

(5

)

|

95,158

|

50,000

|

45,158

|

0.22%

|

|

Brian P. Cheramie

(

6

)

|

402,809

|

331,377

|

71,432

|

0.35%

|

|

Cheramie Futures LLC

(

7

)

|

29,758

|

21,836

|

7,922

|

0.04%

|

|

ELCANO Special Situations, SICAV, S.A.

(8

)

|

154,825

|

150,000

|

4,825

|

0.02%

|

|

Third Avenue Small Cap Value Fund

(

9

)

|

356,900

|

65,000

|

291,900

|

1.43%

|

|

Proyectos Globales de Energia y Servicios CME, S.A. de C.V.

(1

0

)

|

1,640,027

|

1,000,000

|

640,027

|

3.04%

|

|

CVI Investments, Inc.

(1

1

)

|

150,000

|

150,000

|

–

|

–

|

|

T. Rowe Price U.S. Small-Cap Value Equity Trust

(1

2

)

(1

3

)

|

170,950

|

57,165

|

113,785

|

0.56%

|

|

T. Rowe Price Small-Cap Value Fund, Inc.

(1

2

)

(1

4

)

|

989,913

|

335,870

|

654,043

|

3.20%

|

|

T. Rowe Price U.S. Equities Trust

(1

2

)(1

5

)

|

43,615

|

5,149

|

38,466

|

0.19%

|

|

MassMutual Select Funds – MassMutual Select T. Rowe Price Small and Mid Cap Blend Fund

(12

)(1

6

)

|

17,006

|

1,816

|

15,190

|

0.07%

|

|

CEOF II DE I AIV, L.P.

(1

7

)(1

8

)

|

948,056

(21

)

|

5,253,128

|

–

|

–

|

|

CEOF II Coinvestment (DE), L.P.

(17

)(

19

)

|

48,538

(21

)

|

268,942

|

–

|

–

|

|

CEOF II Coinvestment B (DE), L.P.

(1

7

)(2

0

)

|

3,991

(21

)

|

22,114

|

–

|

–

|

|

Total

|

5,133,65

8

|

7,740,147

|

1,937,110

|

–

|

|

*

|

Less than one percent (1%).

|

|

(1)

|

We do not know when or in what amounts the selling security holders may offer shares of common stock for sale. The selling security holders may decide not to sell any or all of the shares offered by this prospectus. Because the selling security holders may offer all, some or none of the shares pursuant to this offering, we cannot estimate the number of the shares that will be held by the selling security holders after completion of the offering. However, for purposes of this table, we have assumed that the selling security holders will sell all of their shares of our common stock covered by this prospectus.

|

|

(2)

|

Assumes that the selling security holders will sell all shares of common stock included in this prospectus.

|

|

(3)

|

Includes 25,000 shares of common stock purchased in the PIPE Private Placement. Carl K. Oppenheimer and Philip V. Oppenheimer, each in their capacity as managing members of Oppvest, LLC, the General Partner of Oppenheimer-Close Investment Partnership LP, have the discretionary authority to vote and dispose of the shares of common stock held by Oppenheimer-Close Investment Partnership LP and may be deemed to be the beneficial owners of these shares of common stock. Each of Carl K. Oppenheimer and Philip V. Oppenheimer disclaim any such beneficial ownership of the shares of common stock except with regards to their pecuniary interest therein. The address for Oppenheimer-Close Investment Partnership LP is 119 West 57

th

Street, Suite 1515, New York, NY 10019.

|

|

(4)

|

Includes 2,750 shares of common stock purchased in the PIPE Private Placement. Carl K. Oppenheimer and Philip V. Oppenheimer, each in their capacity as directors of Oppenheimer-Close International Ltd. have the discretionary authority to vote and dispose of the shares of common stock held by Oppenheimer-Close International Ltd, and may be deemed to be the beneficial owners of these shares of common stock. Each of Carl K. Oppenheimer and Philip V. Oppenheimer disclaim any such beneficial ownership of the shares of common stock except with regards to their pecuniary interest therein. The U.S. mailing address for Oppenheimer-Close International Ltd is 119 West 57

th

Street, Suite 1515, New York, NY 10019 and the registered corporate office address for Oppenheimer-Close International Ltd is BeesMont Corporate Services Ltd., 5th floor, Andrew’s Place, 51 Church Street, Hamilton, HM12, Bermuda.

|

|

(5)

|

Includes 50,000 shares of common stock purchased in the PIPE Private Placement. JMG GST LLC is an entity managed in part by John M. Gellert, the President, Chief Executive Officer and a Director of the Company. John M. Gellert in his capacity as Manager, David B. Spohngellert in his capacity as Vice President and Fred C. Farkouh in his capacity as Vice President each has the discretionary authority to vote and dispose of the shares of common stock held by JMG GST LLC, and may be deemed to be the beneficial owners of these shares of common stock. Each of John M. Gellert, David B Spohngellert and Fred C. Farkouh disclaim any such beneficial ownership of the shares of common stock except with regards to their pecuniary interest therein. The address for JMG GST LLC is 750 Third Avenue, Suite 3300, New York, NY 10017. The shares of common stock listed in the table do not include any shares of common stock owned by John M. Gellert in his individual capacity.

|

|

(6)

|

Includes 103,213 shares of common stock purchased in the Brian Cheramie Private Placement and 228,164 shares of common stock purchased in the PIPE Private Placement. Brian P. Cheramie and Emelie Cheramie have the discretionary authority to vote and dispose of these shares of common stock, and may be deemed to be the beneficial owners of these shares of common stock. Each of Brian P. Cheramie and Emelie Cheramie disclaims any such beneficial ownership of the shares of common stock except with regards to their pecuniary interest therein. The address for Brian P. Cheramie is 132 Ridgewood Blvd., Golden Meadow, LA 70357.

|

|

(7)

|

Includes 21,836 shares of common stock purchased in the PIPE Private Placement. Brian P. Cheramie and Emelie Cheramie in their capacity as members of Cheramie Futures LLC have the discretionary authority to vote and dispose of the shares of common stock held by Cheramie Futures LLC, and may be deemed to be the beneficial owners of these shares of common stock. Mickey Cheramie, Ron Paul Cheramie and Erika Lynn Cheramie are entitled to 99% of the economic interest of the shares of common stock but do not have the discretionary authority to vote and dispose of the shares of common stock held by Cheramie Futures LLC. Brian P. Cheramie, Emelie Cheramie, Mickey Cheramie, Ron Paul Cheramie and Erika Lynn Cheramie disclaim any such beneficial ownership of the shares of common stock except with regards to their pecuniary interest therein. The address for Cheramie Futures LLC is 132 Ridgewood Blvd., Golden Meadow, LA 70357.

|

|

(8)

|

Includes 150,000 shares of common stock purchased in the PIPE Private Placement. Elcano Special Situations, SICAV, S.A. (“Elcano”) has entered into a delegated fund management agreement with Credit Suisse Gestion, SGIIC, SA (the “CS Entity”) granting the CS Entity through one of its portfolio managers and head of investment strategy, Gabriel Ximenez de Embun, discretionary authority to dispose of the shares of common stock. As a result, the CS Entity and Gabriel Ximenez de Embun may be deemed the beneficial owners of the shares. Elcano has not delegated the authority to vote the shares. Voting decisions are made by the Board of Directors of Elcano, comprised of Marc Batlle Mercade, Francisco Javier Batlle Mercade and Ignacio Mercade Vila. The CS Entity, Gabriel Ximenez de Embun, Marc Batlle Mercade, Francisco Javier Batlle Mercade and Ignacio Mercade Vila. disclaim any such beneficial ownership of the shares of common stock except with regards to their pecuniary interest therein. The address for Elcano SICAV, SA is c/ Ayala, 42 – 5

a

Planta A, 28001 Madrid, Spain.

|

|

(9)

|

Includes 65,000 shares of common stock purchased in the PIPE Private Placement. Third Avenue Small Cap Value Fund is a publicly traded open-end mutual fund issued as a series of the Third Avenue Trust. Third Avenue Trust is a Delaware business trust that is registered as an investment company pursuant to the Investment Company Act of 1940. Pursuant to an investment advisory agreement, the Trust has delegated all discretionary investment authority over the assets of Third Avenue Small Cap Value Fund to Third Avenue Management LLC (“TAM”). Victor Cunningham has discretionary authority to vote and dispose of the shares of common stock owned by TAM in his position as portfolio manager. Victor Cunningham disclaims any such beneficial ownership of these shares of common stock. The address for Third Avenue Small Cap Value Fund is 622 Third Avenue. 32

nd

Floor, New York, NY 10017.

|

|

(10)

|

Includes 325,836 shares of common stock purchased in the PIPE Private Placement, 38,857 shares of common stock acquired in the CME Warrant Exercise and 635,307 Warrant Shares that may be issuable in respect of the warrants acquired in the PIPE Private Placement (674,164 Warrant Shares acquired in the PIPE Private Placement less the 38,857 Warrant Shares cancelled as a result of the CME Warrant Exercise). Alfredo Miguel and Jose Miguel each in their capacity as shareholders of Proyectos Globales de Energia y Servicios CME, S.A. de C.V., have discretionary authority to vote and dispose of the shares of common stock held by Proyectos Globales de Energia y Servicios CME, S.A. de C.V. and may be deemed to be the beneficial owners of these shares of common stock. Alfredo Miguel and Jose Miguel, each in their capacity as shareholders of Proyectos Globales de Energia y Servicios CME, S.A. de C.V., may also be deemed to have investment discretion and voting power over the shares of common stock held by Proyectos Globales de Energia y Servicios CME, S.A. de C.V. The address for Proyectos Globales de Energia y Servicios CME, S.A. de C.V. is Paseo de la Reforma #2654 19th floor, Lomas Altas, 11950, CDMX, Mexico. The Company and Proyectos Globales de Energia y Servicios CME, S.A. de C.V. are joint venture partners, 49% and 51% respectively, in Mantenimiento Express Maritimo, S.A.P.I. de C.V.

|

|

(11)

|

Includes 150,000 shares of common stock purchased in the PIPE Private Placement. Heights Capital Management, Inc., the authorized agent of CVI Investments, Inc. (“CVI”), has discretionary authority to vote and dispose of the shares held by CVI and may be deemed to be the beneficial owner of these shares. Martin Kobinger, in his capacity as Investment Manager of Heights Capital Management, Inc., may also be deemed to have investment discretion and voting power over the shares held by CVI. Mr. Kobinger disclaims any such beneficial ownership of the shares. The address for CVI is c/o Heights Capital Management, Inc., 101 California Street, Suite 3250, San Francisco, CA 94111.

|

|

(12)

|

T. Rowe Price Associates, Inc. (“TRPA”) serves as investment adviser or subadviser, as applicable, with power to direct investments and/or sole power to vote the securities owned by (i) T. Rowe Price Small-Cap Value Fund, Inc., (ii) T. Rowe Price U.S. Small-Cap Value Equity Trust, (iii) T. Rowe Price U.S. Equities Trust and (iv) MassMutual Select Funds – MassMutual Select T. Rowe Price Small and Mid Cap Blend Fund. The T. Rowe Price Proxy Committee develops the firm’s positions on all major proxy voting issues, creates guidelines, and oversees the voting process. Once the Proxy Committee establishes its recommendations, they are distributed to the firm’s portfolio managers as voting guidelines. Ultimately, the portfolio managers for each account decide how to vote on the proxy proposals of companies in their portfolios. More information on the T. Rowe Price proxy voting guidelines is available on its website at troweprice.com. The T. Rowe Price portfolio manager of the funds and accounts that hold the securities is J. David Wagner. For purposes of reporting requirements of the Securities Exchange Act, TRPA may be deemed to be the beneficial owner of all such shares; however, TRPA expressly disclaims that it is, in fact, the beneficial owner of such securities. T. Rowe Price Associates, Inc. is the wholly-owned subsidiary of T. Rowe Price Group, Inc., which is a publicly-traded financial services holding company. The address for T. Rowe Price Associates, Inc. is 100 East Pratt Street, Baltimore, Maryland 21202. T. Rowe Price Investment Services, Inc., or TRPIS, a registered broker-dealer, is a subsidiary of T. Rowe Price Associates, Inc. TRPIS was formed primarily for the limited purpose of acting as the principal underwriter and distributor of shares of the funds in the T. Rowe Price fund family and complements the other services provided to shareholders of the T. Rowe Price funds. TRPIS does not engage in underwriting or market-making activities involving individual securities.

|

|

(13)

|

Includes 57,165 shares of common stock purchased in the PIPE Private Placement.

|

|

(14)

|

Includes 335,870 shares of common stock purchased in the PIPE Private Placement.

|

|

(15)

|

Includes 5,149 shares of common stock purchased in the PIPE Private Placement.

|

|

(16)

|

Includes 1,816 shares of common stock purchased in the PIPE Private Placement.

|

|

(17)

|