Growth in Blockchain and Cryptocurrencies for Banks

June 15 2018 - 12:50PM

InvestorsHub NewsWire

Bitcoin Global News (BGN)

June 15, 2018 -- ADVFN Crypto NewsWire

-- Research published by U.S. based

market intelligence firm Greenwich Associates shows huge growth in

the budgets banks are setting aside for blockchain technology

development. The study interviewed around 200 global institutions

that are working with blockchain technology.

The global financial services industry

totalled $1.7 billion in 2017 toward the technology. This is a 67%

increase from the year prior.

-

10% of the surveyed banking

institutions reported increases to $10 million or more.

-

14% percent claimed to have already

deployed a blockchain solution.

-

75% expect shift from

proof-of-concepts to live production within the next two

years.

-

50 percent of the executives

interviewed said that implementing the technology "was harder than

they expected."

Job

Creation

One of the most telling components

of information gained from the study deals with the work force

required to implement the new technology. Companies interviewed

said the number of staff dedicated to blockchain doubled in the

past year. Top-tier banks now have an average of 18 full-time

employees focusing on blockchain development.

Cryptocurrency Exchanges

Relationship with Banks

Only a handful of exchanges have

been able to secure banking licenses, allowing them to list fiat

pairs and accept deposits and withdrawals in fiat currencies. This

is both due to regulation, as well as the fact that many of the

major banks are simply unwilling to get involved in the

cryptocurrency space at this time.

Most notably the largest crypto

exchange by volume Binance just announced that it has set up a

banking partnership in Malta. They will be able to link Euro pairs

through a new platform, similar to that of Coinbase and GDAX.The

largest bank that partnered with a cryptocurrency based business is

Barclays (1.1 trillion in assets), which partnered with Coinbase.

Small banks look to cryptocurrencies as an opportunity to attract

new customers.

-

Hypothekarbank Lenzburg of

Switzerland ($5 billion in assets) maintains accounts for

blockchain and crypto companies.

-

Falcon Private Bank of Switzerland

($2.9 billion in assets) offers crypto asset management

services.

-

Metropolitan Commercial Bank of the

U.S. ($2 billion in assets) provides services to BitPay and Shift

Card.

-

Silvergate Bank of the U.S. ($1.9

billion in assets) offers banking to crypto companies (Gemini,

bitFlyer, etc.).

-

VersaBank of Canada ($1.7 billion

in assets) provides virtual safety deposit box for

cryptocurrencies.

By: BGN Editorial Staff

News:

Blockchain

Cryptocurrencies

Cryptocurrency

Exchanges

Binance

(BNB)

BitPay

Coinbase

Gemini

Exchange

BitFlyer

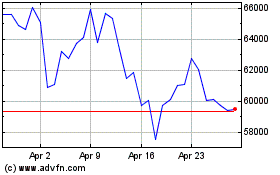

Bitcoin (COIN:BTCEUR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bitcoin (COIN:BTCEUR)

Historical Stock Chart

From Apr 2023 to Apr 2024

Real-Time news about Bitcoin (Cryptocurrency): 0 recent articles

More Bitcoin News Articles