Current Report Filing (8-k)

June 15 2018 - 11:31AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 14, 2018

GAMING AND LEISURE PROPERTIES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

PENNSYLVANIA

|

|

001-36124

|

|

46-2116489

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(Commission file number)

|

|

(IRS Employer Identification Number)

|

845 Berkshire Blvd., Suite 200

Wyomissing, PA 19610

(Address of principal executive offices)

610-401-2900

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (See General Instruction A.2 below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On June 14, 2018, the shareholders of Gaming and Leisure Properties, Inc. ("GLPI" or the "Company") approved an amendment and restatement of the Company's articles of incorporation (the "Amended Articles") to provide for a majority voting standard in uncontested director elections. Under the majority voting standard, in an uncontested director election, a candidate must receive the affirmative vote of a majority of the votes cast with respect to the election of that candidate. The full text of the Amended Articles is attached as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated herein by reference. The Amended Articles became effective upon filing with the Secretary of the Commonwealth of Pennsylvania on June 14, 2018.

The Company also adopted Amended and Restated Bylaws (the “Amended Bylaws”) to remove the plurality voting standard in director elections. The Amended Articles and Amended Bylaws also remove the provisions relating to, and references to, the process through which the Company is declassifying its Board of Directors (the “Board”). The Amended Bylaws also add a requirement that a person recommended for nomination for election as a director by a shareholder must represent that he or she currently intends to serve as a director for the full term for which he or she is standing for election. The full text of the Amended Bylaws is attached as Exhibit 3.2 to this Current Report on Form 8-K and is incorporated herein by reference. The Amended Bylaws became effective on June 14, 2018.

Item 5.07. Submission of Matters to a Vote of Security Holders.

On June 14, 2018, the Company held its Annual Meeting of Shareholders (the "Annual Meeting"). A total of 213,745,319 shares of the Company's common stock were entitled to vote as of April 12, 2018, the record date for the Annual Meeting, of which 193,783,961, were present in person or by proxy at the Annual Meeting. The following is a summary of the final voting results for each matter presented to shareholders.

PROPOSAL 1.

Election of directors to hold office until the 2019 Annual Meeting of Shareholders and until their respective

successors have been duly elected and qualified.

|

|

|

|

|

|

|

|

|

|

|

Nominee

|

|

For

|

|

Withheld

|

|

Broker Non-Votes

|

|

David A. Handler

|

|

174,922,794

|

|

3,637,868

|

|

15,223,299

|

|

Joseph W. Marshall, III

|

|

176,119,680

|

|

2,440,982

|

|

15,223,299

|

|

James B. Perry

|

|

176,880,907

|

|

1,679,755

|

|

15,223,299

|

|

Barry F. Schwartz

|

|

177,016,147

|

|

1,544,515

|

|

15,223,299

|

|

Earl C. Shanks

|

|

177,025,220

|

|

1,535,442

|

|

15,223,299

|

|

E. Scott Urdang

|

|

167,334,856

|

|

11,225,806

|

|

15,223,299

|

PROPOSAL 2.

Ratification of the appointment of Deloitte & Touche LLP as the Company's independent registered public accounting firm for the current fiscal year ending December 31, 2018.

|

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstentions

|

|

193,328,234

|

|

66,733

|

|

388,994

|

PROPOSAL 3.

Approval of, on a non-binding advisory basis, the Company's executive compensation.

|

|

|

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstentions

|

|

Broker Non-Votes

|

|

165,987,477

|

|

12,404,307

|

|

168,878

|

|

15,223,299

|

PROPOSAL 4.

Approval of an amendment and restatement of the Company's Articles of Incorporation to adopt a majority voting standard in uncontested director elections.

|

|

|

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstentions

|

|

Broker Non-Votes

|

|

178,297,133

|

|

131,701

|

|

131,828

|

|

15,223,299

|

Item 8.01 Other Events.

On June 14, 2018, in connection with the adoption of a majority voting standard in uncontested director elections as described above under Item 5.03, the Board amended the Company’s Corporate Governance Guidelines to adopt a resignation policy. The resignation policy requires that any director nominee who fails to receive the requisite majority vote at a shareholder meeting must, promptly following certification of the shareholder vote, tender his or her resignation from the Board and all committees upon which he or she serves. The Board will then assess the appropriateness of such nominee continuing to serve as a director and decide whether to accept or reject the resignation, or whether other action should be taken. The policy further provides that any director who tenders his or her resignation shall not participate in the Board action regarding whether to accept the resignation offer. The Board will act upon the tendered resignation and publicly disclose its decision and rationale within ninety (90) days following certification of the shareholder vote. A copy of the Corporate Governance Guidelines, as amended, is available at the Company’s website at www.glpropinc.com, under the “About” section. The contents of the Company’s website are not incorporated into this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(d)

Exhibits

|

|

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

|

3.1

|

|

|

|

|

|

|

|

3.2

|

|

|

* * *

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Dated: June 15, 2018

|

GAMING AND LEISURE PROPERTIES, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Steven T. Snyder

|

|

|

Name:

|

Steven T. Snyder

|

|

|

Title:

|

Interim Chief Financial Officer

|

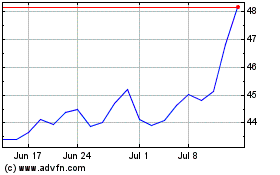

Gaming and Leisure Prope... (NASDAQ:GLPI)

Historical Stock Chart

From Mar 2024 to Apr 2024

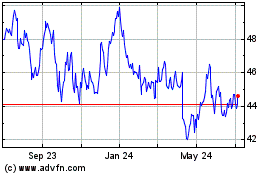

Gaming and Leisure Prope... (NASDAQ:GLPI)

Historical Stock Chart

From Apr 2023 to Apr 2024