UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

Check the appropriate box:

|

☒

|

Preliminary Information Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

☐

|

Definitive Information Statement

|

|

|

NANO MOBILE HEALTHCARE, INC.

|

|

|

|

(Name of Registrant As Specified In Its Charter)

|

|

Payment of Filing Fee (Check the appropriate box):

|

☒

|

No fee required

|

|

|

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11

|

|

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

(5)

|

Total fee paid:

|

|

|

☐ Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

(1)

|

Amount Previously Paid:

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

(3)

|

Filing Party:

|

|

(4)

|

Date Filed:

|

Nano Mobile Healthcare, Inc.

One Boston Place Suite 2600

Boston, MA 02108

NOTICE OF ACTIONS TAKEN BY

WRITTEN CONSENT OF STOCKHOLDERS

Date J

une __, 2018

Dear

Nano Mobile Healthcare

,

Inc.

Stockholders:

This Information Statement is being furnished by the Board of Directors (the “

Board

”) of Nano Mobile Healthcare, Inc., a Delaware corporation (“

Nano

” or the “

Compan

y”), to holders of record of the Company’s Common Stock, $0.00001 par value (the “

Common

Stock

”), pursuant to Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended (the “

Exchan

g

e Act

”) and pursuant to Section 228(a) of the Delaware General Corporation Law. The purpose of this Information Statement is to inform those with voting rights to our Common Stock (the “

Stockholders

”) of the following:

On February 27, 2018 those Stockholders holding at least a majority of voting power of our company who are entitled to vote, acted by written consent in lieu of a special meeting of Stockholders in accordance with Sections 5 and 6 of the Company’s Bylaws (the “

B

y

laws

”) to authorize and approve the Certificate of Amendment to the Certificate of Incorporation (the “

Certificate of Incorporation

”) to authorize and approve an increase in our authorized Common Stock from 900,000,000 to 100,000,000,000 shares, and reduce the par value of the Common Stock and the Preferred Stock to $0.00001 (the “

Chan

g

e in Authorized Common Stock

”); attached hereto as

Exhibit A

; and authorize the Corporation’s reverse split of its Common Stock in a ratio of 1 for 10 to 1 for 100,000 with such ratio being determined by the Corporation’s Board of Directors

; and

On May 24, 2018

those Stockholders holding at least a majority of voting power of our company who are entitled to vote acted by written consent in lieu of a special meeting of Stockholders in accordance with Sections 5 and 6 of the Company’s Bylaws to amend Certificate of Incorporation approving the reverse split of the Series A Preferred Stock that took place on March 21, 2016 when the reverse split of the Common Stock took place; the Certificate of Incorporation to complete a reverse split of the Series A Preferred Stock is attached hereto as

Exhibit B.

On June 6, 2018

those Stockholders holding at least a majority of voting power of our company who are entitled to vote, acted by written consent in lieu of a special meeting of Stockholders in accordance with Sections 5 and 6 of the Company’s Bylaws (the “

B

y

laws

”) to

authorize and approve a Certificate of Incorporation to lower the Authorized shares of the Series A Preferred Stock to 2,347,337 shares and clarify the number of Authorized shares for the Convertible Preferred. The

Certificate of Incorporation to

lower the authorized shares of Series A Preferred

clarify the number of Authorized shares for the Convertible Preferred is hereto attached as

Exhibit C

; and

No action is required by you. The accompanying Information Statement is furnished to inform our Stockholders of the actions described above before they take effect in accordance with Rule 14c-2 promulgated under the Exchange Act. This Information Statement is being first mailed to you on or about June 29, 2018.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

PLEASE NOTE THAT THE COMPANY’S CONTROLLING STOCKHOLDERS HAVE VOTED TO APPROVE

|

(1)

|

THE COMPANY’S PROPOSED AMENDMENT TO ITS CERTIFICATE OF INCORPORATION PURSUANT TO WHICH THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK SHALL BE INCREASED FROM 900,000,000 SHARES TO 100,000,000,000; ATTACHED HERETO AS

EXHIBIT A

; AND

|

|

(2)

|

THE COMPANY’S REVERSE SPLIT OF ITS COMMON STOCK IN A RATIO OF BETWEEN 1 FOR 10 TO 1 FOR 100,000, SUCH RATIO TO BE DETERMINED BY THE COMPANY’S BOARD OF DIRECTORS; AND

|

|

(3)

|

THE COMPANY’S PROPOSED AMENDMENT TO ITS CERTIFICATE OF INCORPORATION ARTICLE FIFTH BY REPLACING THE FIRST AND SECOND PARAGRAPH OF SECION D TO AUTHORIZE THE REVERSE SPLIT OF THE SERIES A PREFERRED STOCK THAT WAS NOT DONE ON MARCH 21, 2016 WHEN THE COMMON STOCK REVERSE SPLIT WAS COMPLETED; THE CERTIFICATE OF AMENDMENT TO THE CERTIFICATE OF INCORPORATION TO COMPLETE A REVERSE SPLIT OF THE SERIES A PREFERRED STOCK IS ATTACHED HERETO AS

EXHIBIT B

; AND

|

|

(4)

|

THE COMPANY’S PROPOSED AMENDMENT TO THE CERTIFICATE OF INCORPORATION TO LOWER THE AUTHORIZED SHARES OF SERIES A PREFERRED AND CLARIFY THE NUMBER OF AUTHORIZED SHARES OF THE CONVERTIBLE PREFERRED IS ATTACHED HERETO AS

EXHIBIT C.

|

|

|

By Order of the Board of Directors

|

|

|

|

|

|

Joseph C. Peters

|

|

|

Chief Executive Officer

|

Boston, MA

June __, 2018

TABLE OF CONTENTS

Nano Mobile Healthcare

,

Inc.

One Boston Place Suite 2600

Boston, MA 02108

INFORMATION STATEMENT PURSUANT TO SECTION 14(C) OF THE SECURITIES EXCHANGE ACT OF 1934 AND REGULATION 14C PROMULGATED THEREUNDER

Nano Mobile Healthcare, Inc. (“Nano” or the “Company”) is a Delaware corporation with principal executive offices located at One Boston Place Suite 2600, Boston, MA 02108. The telephone number is 617-336-7001.

On February 27, 2018 those Stockholders holding at least a majority of voting power of our company who are entitled to vote (57%) approved the Certificate of Incorporation to Authorize an increase in Common Stock from 900,000,000 shares to 100,000,000,000 shares and approve the Company’s reverse split of its Common Stock in a ratio of between 1 for 10 to 1 for 100,000, such ratio to be determined by the Company’s board of directors.

On February 27, 2018 the Unanimous Consent of the Board was completed that approved Company’s proposed amendment to its Certificate of Incorporation to which the number of authorized shares of Common Stock shall be increased from 900,000,000 shares to 100,000,000,000, and the par value of the Company’s Common Stock and Preferred Stock shall be reduced to $.00001; and approved the Company’s reverse split of its Common Stock in a ratio of between 1 for 10 to 1 for 100,000, such ratio to be determined by the Company’s board of directors. A copy of the Certificate of Amendment of the Certification of Incorporation of Nano Mobile Healthcare, Inc.is being filed as

Exhibit A

.

On May 24, 2018 those Stockholders holding at least a majority of voting power of our company who are entitled to vote (57%) approved Certificate of Incorporation to accomplish a Reverse Split of the Series A Convertible Preferred Stock done on March 21, 2016 when the reverse split of the Common Stock took place.

On May 24, 2018, the Unanimous Consent of the Board was completed that approved Company’s proposed amendment to its Certificate of Incorporation to accomplish a Reverse Split of the Series A Convertible Preferred Stock done on March 21, 2016 when the reverse split of the Common Stock took place. A copy of the Certificate of Incorporation for the Reverse Split of the Series A Convertible Preferred Stock is filed as

Exhibit B

.

On June 6, 2018, those Stockholders holding at least a majority of voting power of our company who are entitled to vote (57%) authorized and approved a Certificate of Incorporation to lower the Authorized shares of the Series A Preferred Stock to 2,347,337 shares and clarify the number of Authorized shares for the Convertible Preferred.

On June 6, 2018 the Unanimous Consent of the Board was completed that approved the Certificate of Incorporation to lower the Authorized shares of the Series A Preferred Stock to 2,347,337 shares and clarify the number of Authorized shares for the Convertible Preferred. A copy of the Certificate of Incorporation of Nano Mobile Healthcare, Inc. is filed as

Exhibit C.

This Information Statement is being sent to holders of record of the Company’s Common Stock as of June 15, 2018 (the “Record Date”) by the Board to notify them about actions that the Company’s Stockholders have taken by written consent in lieu of a special meeting of the Stockholders to approve the actions set forth herein. The written consents were obtained on February 27, 2018, May 24, 2018 and June 6, 2018 2018 accordance with the Company’s Certificate of Incorporation and Bylaws.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE NOT REQUESTED TO SEND US A PROXY.

Copies of this Information Statement are expected to be mailed on or about June 29, 2018, to the holders of record on the Record Date of our outstanding Common Stock. This Information Statement is being delivered only to inform you of the corporate actions described herein before they take effect in accordance with Rule 14c-2 promulgated under the Exchange Act.

We have asked brokers and other custodians, nominees and fiduciaries to forward this Information Statement to the beneficial owners of our Common Stock held of record and will reimburse such persons for out-of-pocket expenses incurred in forwarding such material.

THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND NO STOCKHOLDERS’ MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

PLEASE NOTE THAT THOSE STOCKHOLDERS HOLDING AT LEAST A MAJORITY OF VOTING POWER OF OUR COMPANY WHO ARE ENTITLED TO VOTE HAVE VOTED TO APPROVE 1) THE COMPANY’S PROPOSED AMENDMENT TO ITS CERTIFICATE OF INCORPORATION PURSUANT TO WHICH THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK SHALL BE INCREASED FROM 900,000,000 SHARES TO 100,000,000,000; AND 2) THE COMPANY’S REVERSE SPLIT OF ITS COMMON STOCK IN A RATIO OF BETWEEN 1 FOR 10 TO 1 FOR 100,000, SUCH RATIO TO BE DETERMINED BY THE COMPANY’S BOARD OF DIRECTORS; AND 3) THE COMPANY’S PROPOSED AMENDMENT TO ITS CERTIFICATE OF INCORPORATION AUTHORIZE THE REVERSE SPLIT OF THE SERIES A PREFERRED STOCK THAT WAS NOT DONE ON MARCH 21, 2016 WHEN THE COMMON STOCK REVERSE SPLIT WAS COMPLETED; AND 4) THE COMPANY’S PROPOSED AMENDMENT TO THE CERTIFICATE OF INCORPORATION TO LOWER THE AUTHORIZED SHARES OF SERIES A PREFERRED AND CLARIFY THE NUMBER OF AUTHORIZED SHARES OF THE CONVERTIBLE PREFERRED

FORWARD-LOOKING STATEMENTS

This Information Statement contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties that could cause actual results to be materially different from historical results or from any future results expressed or implied by such forward-looking statements. Such forward-looking statements include, among other things statements with respect to our objectives and strategies to achieve those objectives, as well as statements with respect to our beliefs, plans, expectations, anticipations, estimates or intentions. Such forward-looking statements may also include statements, among other things, concerning the efficacy, safety and intended utilization of the Company’s product candidates, the conduct and results of future clinical trials, plans regarding regulatory filings, future research and clinical trials and plans regarding partnering activities. Factors that may cause actual results to differ materially include, among others, the risk that product candidates that appeared promising in early research and clinical trials do not demonstrate safety and/or efficacy in larger-scale or later clinical trials, trials may have difficulty enrolling, the Company may not obtain approval to market its product candidates, or outside financing may not be available to meet capital requirements. These forward-looking statements are based on our current expectations. We caution that all forward- looking information is inherently uncertain and actual results may differ materially from the assumptions, estimates or expectations reflected or contained in the forward-looking information, and that actual future performance will be affected by a number of factors, including economic conditions, technological change, regulatory change and competitive factors, many of which are beyond our control. Therefore, future events and results may vary significantly from what we currently foresee.

For a further list and description of the risks and uncertainties the Company faces, please refer to the Company’s most recent Annual Report on Form 10-K and other periodic and other filings the Company has filed with the Securities and Exchange Commission (the “SEC”) and are available at www.sec.gov. Such forward-looking statements are current only as of the date they are made, and the Company assumes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

APPROVAL BY OUR STOCKHOLDERS OF THE INCREASE IN AUTHORIZED

COMMON STOCK, APPROVE THE REVERSE SPLIT OF COMMON STOCK, APPROVE THE REVERSE SPLIT OF SERIES A PREFERRED, APPROVE THE

LOWERERING THE AUTHORIZED SHARES OF SERIES A

PREFERRED STOCK

General

After due deliberation and careful consideration, the Board unanimously deemed advisable and determined that such matters are in the best interests of the Company and the Stockholders approved the Company’s proposed amendment to its Certificate of Incorporation pursuant to which the number of authorized shares of Common Stock shall be increased from 900,000,000 shares to 100,000,000,000 shares; authorize and approve the Company’s reverse split of its Common Stock in a ratio of 1 for 10 to 1 for 100,000 with such ratio being determined by the Company’s Board of Directors; authorize and approve the reverse split of the Series A Convertible Preferred Stock that was not done on March 21, 2016 when the Common Stock reverse split was completed; and authorize and approve an amendment to the Certificate of Incorporation to lower the authorized shares of Series A Convertible Preferred Stock and clarify the number of authorized shares the Convertible Preferred and to amend the Certificate of Incorporation.

Under our Certificate of Incorporation and our Bylaws, Stockholders holding at least a majority of voting power of our company who are entitled to vote must approve the Amendment, increasing the number of authorized shares of the Company.

On February 27, 2018 those Stockholders holding at least a majority of voting power of our company who are entitled to vote (57%) approved the Company’s Certificate of Incorporation to the Increase the authorized Common Stock from 900,000,000 shares to 100,000,000,000 shares; and authorize the Company’s reverse split of its Common Stock in a ratio of 1 for 10 to 1 for 100,000 with such ratio being determined by the Company’s Board of Directors; and

On May 24, 2018 those Stockholders holding at least a majority of voting power of our company who are entitled to vote (57%) approved the Certificate of Incorporation to complete a reverse split of the Series A Convertible Preferred Stock that was not completed when the common stock reverse split was accomplished on March 21, 2016.

On June 6, 2018, those Stockholders holding at least a majority of voting power of our company who are entitled to vote (57%) approved the amendment to the Certificate of Incorporation to lower the Series A Convertible Preferred Stock to 2,243,337 shares and clarify the number of Authorized shares of the Convertible Preferred Stock.

On June 15, 2018, there were 882,229,341 shares of Common Stock issued and outstanding.

Interest of Certain Persons in or Opposition to Matters to be Acted Upon

No officer, director or director nominee of the Company has any substantial interest in the matters acted upon, other than his role as an officer, director or director nominee of the Company. No director of the Company informed the Company that such director opposed any of the action as set forth in this Information Statement.

CERTIFICATE OF AMENDMENT TO THE CERTIFICATE OF

INCORPORATION TO

APPROVE THE INCREASE IN AUTHORIZED SHARES

The Board has determined that it is advisable and in the best interests of our Stockholders to increase our authorized Common Stock from 900,000,000 shares to 100,000,000,000 shares.

The increase in authorized shares of Common Stock was approved by our Board on February 27, 2018. Those Stockholders holding at least a majority of voting power of our company who are entitled to vote, approved the Amendment increasing the number of authorized shares of Common Stock of the Company on February 27, 2018. The Company’s amendment to its Certificate of Incorporation, attached hereto as

Exhibit A

, shall increase the number of authorized shares of Common Stock from 900,000,000 shares to 100,000,000,000 shares, and the par value of the Company’s Common Stock and Preferred Stock shall be reduced to $.00001.

As of June 15, 2018, 882,229,341 shares of our Common Stock were issued and outstanding. Accordingly, a total of 17,770,659 shares of our Common Stock are available for future issuance. After filing the amendment with the Secretary of State of the State of Delaware, the number of shares of Common Stock available for future issuance will increase to 98,277,746,146 shares due to an additional 99,100,000,000 shares of Common Stock would be a part of the existing class of Common Stock and, if and when issued, would have the same rights and privileges as the shares of Common Stock presently issued and outstanding. The Board believes it is desirable to increase the number of shares of Common Stock authorized to provide the Company with adequate flexibility for business and financial purposes in the future. The additional shares will be used for the issuance to the Company’s Convertible debt holders and the Company’s Preferred Stock holders upon conversions of their notes and Preferred Stock, respectively. In addition, the additional shares may be used for various purposes which may not require further Stockholder approval, these purposes may include: raising capital; providing equity incentives to employees, officers or directors; establishing strategic relationships with other companies; expanding our business through the acquisition of other businesses or products; and other purposes. Our Board believes it is prudent to have this flexibility.

The Company currently has 100,000,000 authorized shares of Preferred Stock. There are currently 94,650,128 shares of

Authorized Preferred Stock will be available to authorize allocations for additional future Preferred Series of Stock

The Charter Amendments will become effective after Stockholder approval is deemed effective in accordance with Rule 14c-2 promulgated under the Exchange Act and upon its acceptance by the Delaware Secretary of State.

APPROVAL OF THE COMPANY’S REVERSE STOCK SPLIT

The Board has determined that it is advisable and in the best interests of our Stockholders to have the ability to do a reverse split of its Common Stock in a ratio of between 1 for 10 to 1 for 100,000, such ratio to be determined by the Company’s Board of Directors in its sole discretion.

This authorization provides the Board of Directors with the ability to effectuate a reverse Stock split on behalf of our Stockholders in which there is a unanimous consent of the Board Members for such reverse Stock split. The ability to do a reverse split of its Common Stock in a ratio of between 1 for 10 to 1 for 100,000, such ratio to be determined by the Company’s Board of Directors in its sole discretion was approved by the Company’s Board on February 27, 2018. Those Stockholders holding at least a majority of voting power of the Company that are entitled to vote, have already approved the Company’s reverse split of its Common Stock in a ratio of between 1 for 10 to 1 for 100,000, such ratio to be determined by the Company’s Board of Directors on February 27, 2018.

CERTIFICATE OF AMENDMENT TO THE CERTIFICATE OF INCORPORATION TO COMPLETE A REVERSE SPLIT OF THE SERIES A CONVERTIBLE PREFERRED STOCK

The Board has determined that it is advisable and in the best interests of our Stockholders to authorize the reverse split of the Series A Convertible Preferred Stock that was not done on March 21, 2016 when the Common Stock reverse split was completed.

The reverse split of Series A Convertible Preferred Stock was approved by our Board on May 24, 2018. On May 24, 2018 the Stockholders holding at least a majority of voting power of our company who are entitled to vote, approved the Amendment to its Certificate of Incorporation, to implement the reverse split of the Convertible Preferred shares that was not done on March 21, 2016 when the reverse split of the Common Stock took place of shares. The Company’s amendment to its Certificate of Incorporation is attached hereto as

Exhibit B.

CERTIFICATE OF AMENDMENT TO THE CERTIFICATE OF INCORPORATION TO

LOWER THE AUTHORIZED SHARES OF SERIES A CONVERTIBLE PREFERRED AND CLARIFY THE COMPANY’S SERIES A, B, C AND D CONVERTIBLE PREFERRED STOCK

OF NANO MOBILE HEALTHCARE, INC.

The Board has determined that it is advisable and in the best interests of our Stockholders lower the authorized number of shares of the Series A Convertible Preferred Stock and clarify the Authorized Convertible Preferred Stock.

The lowering of the Authorized Series A Convertible Preferred Stock and the Clarification of the Company’s Convertible Preferred Stock was approved by our Board on May 24, 2018. On May 24, 2018, the Stockholders holding at least a majority of voting power of our company who are entitled to vote, approved the

Certificate of Incorporation to

lower the authorized shares of Series A Convertible Preferred and clarify the company’s Convertible Preferred Stock. The Company’s

Certificate of Incorporation to

lower the authorized shares of Series A preferred and clarify the company’s Convertible Preferred Stock is attached hereto as

Exhibit C.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our Common Stock as of June 15, 2018 for (1) all persons who are beneficial owners of 5% or more of our voting securities, (2) each director, (3) each executive officer, and (4) all directors and executive officers as a group. The information regarding beneficial ownership of our Common Stock has been presented in accordance with the rules of the Securities and Exchange Commission. Under these rules, a person may be deemed to beneficially own any shares of capital Stock as to which such person, directly or indirectly, has or shares voting power or investment power, and to beneficially own any shares of capital Stock as to which such person has the right to acquire voting or investment power within 60 days through the exercise of any Stock option or other right. The percentage of beneficial ownership as to any person as of a particular date is calculated by dividing (a) (i) the number of shares beneficially owned by such person plus (ii) the number of shares as to which such person has the right to acquire voting or investment power within 60 days by (b) the total number of shares outstanding as of such date, plus any shares that such person has the right to acquire from us within 60 days. Including those shares in the tables does not, however, constitute an admission that the named Stockholder is a direct or indirect beneficial owner of those shares. Unless otherwise indicated, each person or entity named in the table has sole voting power and investment power (or shares that power with that person’s spouse) with respect to all shares of capital Stock listed as owned by that person or entity. The following table sets forth, as of June 15, 2018 certain information as to shares of our Common Stock and Series A, B, C and D Preferred Stock owned by (i) each person known by us to beneficially own more than 5% of our Outstanding voting Common Stock (Based on 882,229,341 shares of Common Stock as of June 15, 2018 plus the Common Stock equivalent of the Series A, B, C and D Preferred Stock plus the 90,353,459 shares of Common Stock due Martin Wood (when additional shares are available) per existing agreement. As of June 15, 2018, the total voting shares of the Company are 2,615,217,722 including of all the voting shares of Common Stock, the equivalent Common Stock of the Preferred and the Common Stock due shareholder Martin Wood. (ii) each of our directors, and (iii) all of our executive officers and directors as a group. Except as otherwise indicated, all shares are owned directly, and the shareholders listed possess sole voting and investment power with respect to the shares shown. Unless otherwise indicated below, each entity or person listed below maintains an address of One Boston Place Suite 2600, Boston Suite 2600, MA 02108.

|

|

|

Common Stock

|

|

Series A

Preferred Stock

|

|

Series B Preferred

Stock

|

|

Name and Address of Beneficial Owner

|

|

Number of

Shares

Owned (1)

|

Percent of

Class (2)

|

|

Number of

Shares

Owned

(1)

|

Percent of

Class (2)

|

|

Number of

Shares

Owned

(1)

|

Percent of

Class (2)

|

|

|

Robert Chicoski

|

|

0

|

*

|

%

|

|

|

|

|

|

|

|

Joseph C. Peters

|

|

0

|

*

|

%

|

|

|

|

|

|

|

|

Jim Katzaroff

|

|

0

|

*

|

%

|

|

|

|

|

|

|

|

All Directors and Executive Officers as a Group (3 persons)

|

|

0

|

*

|

%

|

|

|

|

|

|

|

|

5% Holders

|

|

|

|

|

|

|

|

|

|

|

|

John E. Groman (3)

|

|

26,462,712

|

1.01

|

%

|

|

|

|

1,323

|

52.19

|

%

|

|

John E. Groman – Bella Sante (4)

|

|

24,914,651

|

.95

|

%

|

|

|

|

1,212

|

47.81

|

%

|

|

|

|

Common Stock

|

|

Series C

Preferred Stock

|

|

Series D Preferred

Stock

|

|

Name and Address of Beneficial Owner

|

|

Number of

Shares

Owned (1)

|

Percent of

Class (2)

|

|

Number of

Shares

Owned

(1)

|

Percent of

Class (2)

|

|

Number of

Shares

Owned

(1)

|

Percent of

Class (2)

|

|

|

5% Holders (continued)

|

|

|

|

|

|

|

|

|

|

John E. Groman – Bella Sante (5)

|

|

85,771,845

|

3.28

|

%

|

|

|

|

4,289

|

14.97

|

%

|

|

John E. Groman – Groman Finnegan Trust (6)

|

|

403,235,141

|

15.42

|

%

|

20,146

|

40.0

|

%

|

|

|

|

|

John E. Groman JEG Irrevocable Trust (7)

|

|

241,902,085

|

9.25

|

%

|

12,088

|

24.0

|

%

|

|

|

|

|

John E. Groman - Gromax Ent. Inc. (8)

|

|

85,771,845

|

3.28

|

%

|

|

|

|

4,289

|

14.97

|

%

|

|

John E. Groman – JEG 2002 Trust (9)

|

|

120,896,042

|

4.62

|

%

|

6,004

|

12.0

|

%

|

|

|

|

|

John E. Groman ROTH IRA (10)

|

|

225,000

|

*

|

%

|

|

|

|

|

|

|

|

Cara Finnegan - (11)

|

|

685,429,240

|

26.21

|

%

|

34,248

|

68.0

|

%

|

|

|

|

|

Accent Healthcare Advisors LLC (12)

|

|

261,260,250

|

9.99

|

%

|

|

|

|

13,063

|

45.60

|

%

|

*

Less than 1%

|

|

(1)

|

Except as otherwise indicated, the persons named in this table have sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by them, subject to community property laws where applicable and to the information contained in the footnotes to this table.

|

|

|

(2)

|

Pursuant to Rules 13d-3 and 13d-5 of the Exchange Act, beneficial ownership includes any shares as to which a shareholder has sole or shared voting power or investment power, and any shares which the shareholder has the right to acquire within 60 days, including upon exercise of Common Stock purchase options or warrants. The percent of class of Common Stock is based on 882,229,341 shares of Common Stock as of June 15, 2018 plus the Common Stock equivalent of the Series A, B, C and D Preferred Stock plus the 90,353,459 shares of Common Stock due Martin Wood (when additional shares are available) per existing agreement. The total of all the voting shares of Common Stock, the shares due Martin Wood, and the equivalent Common Stock of the Preferred is 2,615,217,722 shares of voting Stock as of June 15, 2018

The percent of class of Series A Convertible Preferred Stock is based on 2,347,337 shares of Series A Preferred Stock Outstanding as of June 15, 2018. The percent of class of Series B Convertible Preferred Stock is based on 2,535 shares of Series B Preferred Stock Outstanding as of June 15, 2018.

The percent of class of Series C Convertible Preferred Stock is based on 50,365 shares of Series C Preferred Stock Outstanding as of June 15, 2018. The percent of class of Series D Convertible Preferred Stock is based on 28,645 shares of Series C Preferred Stock Outstanding as of June 15, 2018.

|

|

|

(3)

|

Includes 1,323 shares of Series B Convertible Preferred Stock, which may be presently converted into a total of 26,462,712 shares of Common Stock. Address is 514 Americas Way #7697 Box Elder, SD 57719-7600.

|

|

|

(4)

|

Includes 677,363 shares of Common Stock and 1,212 shares of Series B Preferred which may be presently converted to 24,237,288 shares of Common Stock. The total beneficial interest is 24,914,651 shares of Common Stock. Address is 514 Americas Way #7697 Box Elder, SD 57719-7600.

|

|

|

(5)

|

Includes 4,289 shares of Series D Preferred Stock may be presently converted to 85,771,845 shares of Common Stock. The total beneficial interest is 85,771,845 shares of Common Stock. Address is 514 Americas Way #7697 Box Elder, SD 57719-7600.

|

|

|

(6)

|

Includes 315,000 shares of Common Stock and 20,146 shares of Series C Preferred Stock which may be presently converted into a total of 402,920,141 shares of Common Stock. The total beneficial interest is 403,235,141 shares. Address is 514 Americas Way #7697 Box Elder, SD 57719-7600.

|

|

|

(7)

|

Includes 50% of 300,000 shares or 150,000 shares of Common Stock and 50% of 24,175or 12,088 shares of Series C Preferred as he is the spouse of Cara Finnegan and is the beneficial owner of 50% of her trust. The 12,088 shares of Series C Preferred may be presently converted to 241,752,085 shares of Common Stock. The total beneficial interest is 241,902,085 shares of Common Stock and equivalent Common Stock from Preferred Series C. Address is 514 Americas Way #7697 Box Elder, SD 57719-7600.

|

|

|

(8)

|

Includes 4,289 shares of Series D Convertible Preferred Stock, which may be presently converted into a total of 85,771/845 shares of Common Stock. Address is 514 Americas Way #7697 Box Elder, SD 57719-7600.

|

|

|

(9)

|

Includes 20,000 shares of Common Stock and 6,044 shares of Series C Preferred. The 6,044 shares of Series C Preferred may be presently converted to 120,876,042 shares of Common Stock. The total beneficial interest is 120,896,042 shares of Common Stock and equivalent Common Stock from Preferred Series C. Address is 514 Americas Way #7697 Box Elder, SD 57719-7600.

|

|

(10)

|

Common Stock only. Address is 514 Americas Way #7697 Box Elder, SD 57719-7600.

|

|

(11)

|

Includes 315,000 shares of Common Stock and 50% of 300,000 shares of common Stock totaling 465,000 shares of Common Stock and 24,175 shares of Convertible Preferred C Stock, which may be presently converted into a total of 483,504,170 shares of Common Stock. In addition, includes 50% of 20,146 Shares of Convertible Preferred C Stock or 10,073 shares of Convertible Preferred C Stock. The total beneficial interest is 685,429,240 shares of Common Stock and equivalent Common Stock from Preferred Series C. Address is 514 Americas Way #7697 Box Elder, SD 57719-7600.

|

|

(12)

|

Includes 13,063 shares of Series D Convertible Preferred Stock, which may be presently converted into a total of 261,260,250 shares of Common Stock. Address is 1900 Avenue of the Stars # 7, Los Angeles, CA 90067.

|

DELIVERY OF DOCUMENTS TO SECURITY

HOLDERS SHARING AN ADDRESS

Only one copy of this Information Statement is being delivered to multiple Stockholders sharing an address, unless the Company has received contrary instructions from one or more of the Stockholders. The Company will deliver promptly, upon written or oral request, a separate copy of this Information Statement to a Stockholder at a shared address to which a single copy of this document was delivered. A Stockholder may mail a written request to Nano Mobile Healthcare, Inc., Attention: Secretary, One Boston Place Suite 2600, Boston, MA 02108, to request:

|

|

●

|

a separate copy of this Information Statement;

|

|

|

●

|

a separate copy of Information Statements in the future; or

|

|

|

●

|

delivery of a single copy of Information Statements, if such Stockholder is receiving multiple copies of those documents.

|

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the reporting requirements of the SEC. Accordingly, we are required to file reports with the SEC including annual reports, quarterly reports, current reports and other reports as required by SEC rules. All reports that we file electronically with the SEC are available for viewing free of charge over the Internet via the SEC’s EDGAR system at http://www.sec.gov. We will provide without charge to each person who receives a copy of this Information Statement, upon written or oral request, a copy of any information that is incorporated by reference in this Information Statement. Requests should be directed to Nano Mobile Healthcare, Inc., Attention: Secretary, One Boston Place Suite 2600, Boston, MA 02108, or call 617-336-7001. For further information about us, you may read and copy any reports, statements and other information filed by us at the SEC’s Public Reference Room at 100 F Street, N.E., Room 1580, Washington, D.C. 20549-0102. You may obtain further information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

CERTIFICATE OF AMENDMENT TO THE CERTIFICATE OF

INCORPORATION OF NANO MOBILE HEALTHCARE, INC.

It is hereby certified that:

1. The current name of the corporation is Nano Mobile Healthcare, Inc. (the “

Corporation

”).

2. The Corporation filed its Certificate of Incorporation with the Delaware Secretary of State on January 9, 2015 under the name Vantage mHealthcare, Inc. and filed an Amendment to its Certificate of Incorporation with the Delaware Secretary of State on September 8, 2015 to change its name to Nano Mobile Healthcare, Inc. (as amended, the “

Certificate

”).

3. The Certificate of the Corporation is hereby amended as follows:

By deleting the first sentence in Article FIFTH, Section A, in its entirety and replacing it with the following:

“The total number of shares of all classes of Stock which the Corporation shall have the authority to issue is 100,100,000,000 shares, consisting of 100,000,000,000 shares of Common Stock, par value $0.00001 (the “

Common Stock

”), and 100,000,000 shares of Convertible Preferred Stock, par value $0.00001 (the “

Preferred Stock

”).”

4. This Certificate of Amendment to the Certificate was duly adopted pursuant to the provisions of Sections 141 and 242 of the Delaware General Corporation Law (the “

DGCL

”).

5. Pursuant to Section 228(a) of the DGCL, the holders of outstanding shares of the Corporation having no less than the minimum number of votes that would be necessary to authorize or take such actions at a meeting at which all shares entitled to vote thereon were present and voted, consented to the adoption of the aforesaid amendments without a meeting, without a vote and without prior notice and that written notice of the taking of such actions has been given in accordance with Section 228(e) of the DGCL.

IN WITNESS WHEREOF, the undersigned has executed this Certificate of Amendment to the Certificate of Incorporation as of March 5, 2018.

|

|

NANO MOBILE HEATHCARE, INC.

|

|

|

|

|

|

By:

/s/ Joseph C. Peters

|

|

|

Joseph C. Peters, Chief Executive Officer

|

CERTIFICATE OF AMENDMENT TO THE CERTIFICATE OF INCORPORATION TO COMPLETE A REVERSE SPLIT OF THE SERIES A PREFERRED STOCK OF

NANO MOBILE HEALTHCARE, INC.

It is hereby certified that:

1. The current name of the corporation is Nano Mobile Healthcare, Inc. (the “

Corporation

”).

2. The Corporation filed its Certificate of Incorporation with the Delaware Secretary of State on January 9, 2015 under the name Vantage mHealthcare, Inc. and filed an Amendment to its Certificate of Incorporation with the Delaware Secretary of State on September 8, 2015 to change its name to Nano Mobile Healthcare, Inc. (as amended, the “

Certificate

”). The Corporation filed an Amendment to its Certificate of Incorporation with the Delaware Secretary of State on March 5, 2018 increasing the number of Common Stock to 100,000,000,000 and changing the par value to $.00001 per share for the Common Stock and the Preferred Stock and authorizing the Corporations reverse split of its Common Stock in a ratio of 1 for 10 to 1 for 100,000 with such ratio being determined by the Corporation’s Board of Directors. The Corporation filed an Amendment to its Certificate of Incorporation with the Delaware Secretary of State on March 6, 2018 to provide for the reverse split of the Preferred Stock that was not completed when the Common Stock reverse split was accomplished on March 21, 2016.

3. The Certificate of the Corporation is hereby amended as follows:

Article Fifth of the Corporation's Certificate is hereby amended replacing the following to the first and second paragraph of Section D:

Upon the effectiveness of this Certificate of Amendment to the Certificate of Incorporation of the Corporation, the shares of the Corporation's Common Stock and Preferred Stock issued and outstanding prior to March 21, 2016 at 5:00pm Eastern time (the "Effective Time") and the shares of Common Stock and Preferred Stock issued and held in treasury of the Corporation immediately prior to the Effective Time shall automatically be reclassified into a smaller number of shares such that each ten (10) shares of the Corporation's issued and outstanding Common Stock and Preferred Stock immediately prior to the Effective Time are reclassified into one ( l) validly issued, fully paid and nonassessable share of Common Stock and Preferred Stock, without any further action by the Corporation or the holder thereof.

Each Stock certificate that, immediately prior to the Effective Time, represented shares of Common Stock and Preferred Stock that were issued and outstanding immediately prior to the Effective Time shall, from and after the Effective Time, be submitted to the transfer agent to be automatically exchanged for certificates representing the appropriate number of whole shares of Common Stock and Preferred Stock after the Effective Time. No new certificates will be issued to a Stockholder until such Stockholder has surrendered all certificates representing shares of Common Stock and Preferred Stock that were issued and outstanding immediately prior to the Effective Time, together with a properly completed and executed letter of transmittal, to the transfer agent. Upon surrender of such certificates, new certificates evidencing and representing the number of whole shares of Common Stock and Preferred Stock after the Effective Time into which the shares of Common Stock and Preferred Stock formerly represented by such certificate shall have been reclassified shall be issued. Until surrendered all Stock certificates representing shares of Common Stock and Preferred Stock that were issued and outstanding immediately prior to the Effective Time will be deemed to be cancelled."

4. This Certificate of Amendment to the Certificate was duly adopted pursuant to the provisions of Sections 141 and 242 of the Delaware General Corporation Law (the “

DGCL

”).

5. Pursuant to Section 228(a) of the DGCL, the holders of outstanding shares of the Corporation having no less than the minimum number of votes that would be necessary to authorize or take such actions at a meeting at which all shares entitled to vote thereon were present and voted, consented to the adoption of the aforesaid amendments without a meeting, without a vote and without prior notice and that written notice of the taking of such actions has been given in accordance with Section 228(e) of the DGCL.

IN WITNESS WHEREOF, the undersigned has executed this Certificate of Amendment to the Certificate of Incorporation as of May 24, 2018.

|

|

NANO MOBILE HEATHCARE, INC.

|

|

|

|

|

|

By:

/s/ Joseph C. Peters

|

|

|

Joseph C. Peters, Chief Executive Officer

|

CERTIFICATE OF AMENDMENT TO THE CERTIFICATE OF INCORPORATION TO

LOWER THE AUTHORIZED SHARES OF SERIES A PREFERRED AND CLARIFY THE COMPANY’S PREFERRED STOCK

OF NANO MOBILE HEALTHCARE, INC.

It is hereby certified that:

1. The current name of the corporation is Nano Mobile Healthcare, Inc. (the “

Corporation

”).

2. The Corporation filed its Certificate of Incorporation with the Delaware Secretary of State on January 9, 2015 under the name Vantage mHealthcare, Inc. and filed an Amendment to its Certificate of Incorporation with the Delaware Secretary of State on September 8, 2015 to change its name to Nano Mobile Healthcare, Inc. (as amended, the “

Certificate

”). The Corporation filed an Amendment to its Certificate of Incorporation with the Delaware Secretary of State on March 5, 2018 increasing the number of Common Stock to 100,000,000,000 and changing the par value to $.00001 per share for the Common Stock and the Preferred Stock and authorizing the Corporations reverse split of its Common Stock in a ratio of 1 for 10 to 1 for 100,000 with such ratio being determined by the Corporation’s Board of Directors. The Corporation filed an Amendment to its Certificate of Incorporation with the Delaware Secretary of State on May 24, 2018 to provide for the reverse split of the Preferred Stock that was not completed when the Common Stock reverse split was accomplished on March 21, 2016.

3. The Certificate of the Corporation is hereby amended as follows:

By deleting the first sentence in Article FIFTH, Section A, in its entirety and replacing it with the following:

“The total number of shares of all classes of Stock which the Corporation shall have the authority to issue is 100,100,000,000 shares, consisting of 100,000,000,000 shares of Common Stock, par value $0.00001 (the “

Common Stock

”), and 100,000,000 shares of Preferred Stock, par value $0.00001 (the “

Preferred Stock

”). The 100,000,000 shares of Preferred Stock includes the Authorization of 2,347,337 Shares of Series A Preferred Stock; and 2,535 Shares of Series B Preferred Stock and 2,000,000 shares of Series C Preferred Stock and 1,000,000 shares of Series D Preferred Stock. The Remaining 94,650,128 of the 100,000,000 Authorized Preferred Stock will be available to authorize allocations by for additional future Preferred Series of Stock”

4. This Certificate of Amendment to the Certificate was duly adopted pursuant to the provisions of Sections 141 and 242 of the Delaware General Corporation Law (the “

DGCL

”).

5. Pursuant to Section 228(a) of the DGCL, the holders of outstanding shares of the Corporation having no less than the minimum number of votes that would be necessary to authorize or take such actions at a meeting at which all shares entitled to vote thereon were present and voted, consented to the adoption of the aforesaid amendments without a meeting, without a vote and without prior notice and that written notice of the taking of such actions has been given in accordance with Section 228(e) of the DGCL.

IN WITNESS WHEREOF, the undersigned has executed this Certificate of Amendment to the Certificate of Incorporation as of June 6, 2018.

|

|

NANO MOBILE HEATHCARE, INC

|

|

|

|

|

|

By:

/s/ Joseph C. Peters

|

|

|

Joseph C. Peters, Chief Executive Officer

|

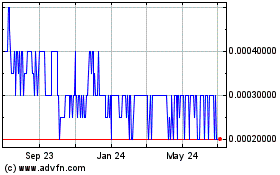

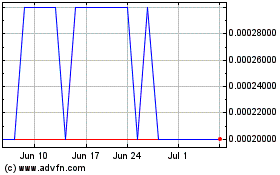

Nano Mobile Healthcare (PK) (USOTC:VNTH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nano Mobile Healthcare (PK) (USOTC:VNTH)

Historical Stock Chart

From Apr 2023 to Apr 2024