Current Report Filing (8-k)

June 15 2018 - 6:06AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

June 12, 2018

Date

of report (date of earliest event reported)

salesforce.com, inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-32224

|

|

94-3320693

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification Number)

|

The Landmark @ One Market, Suite 300

San Francisco, CA 94105

(Address of principal executive offices)

Registrant’s telephone number, including area code: (415)

901-7000

N/A

(Former name or

former address, if changed since last report)

Check the appropriate box below

if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as

defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging growth company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13A. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On June 12, 2018,

salesforce.com, inc. (the “Company”) entered into agreements (the “Warrant Amendments”) with each of BNP Paribas, Bank of America, N.A., and Morgan Stanley & Co. International plc (collectively, the

“Counterparties”) to amend and settle early those certain warrant transactions that the Company entered into with the Counterparties on March 12, 2013 and March 15, 2013 (the “Warrants”), whereby the Company sold to the

Counterparties Warrants in respect of, in the aggregate, approximately 17.3 million shares of the Company’s common stock (after taking into account the

4-1

split of the Company’s common stock

effected in April 2013) at a strike price of $90.395 per share (after taking into account the

4-1

split of the Company’s common stock effected in April 2013), subject to anti-dilution adjustments.

Pursuant to the Warrant Amendments, the Company will settle the Warrants on a net share basis, with the number of shares to be issued in settlement of the Warrants calculated based on the daily average of the volume weighted average prices of the

Company’s common stock during the averaging period under such Warrant Amendments. The averaging periods contemplated by the Warrant Amendments are expected to be completed in July 2018.

The description of the Warrant Amendments contained herein is qualified in its entirety by reference to the Warrant Amendments attached as

Exhibits 10.1, 10.2 and 10.3 to this Current Report on Form

8-K

and incorporated herein by reference.

|

Item 3.02.

|

Unregistered Sales of Equity Securities.

|

The information set forth in Item 1.01

above is incorporated by reference into this Item 3.02. The shares of common stock to be issued under the Warrant Amendments are expected to be issued pursuant to the exemption from the registration requirements of the Securities Act of 1933, as

amended (the “Securities Act”), afforded by Section 3(a)(9) of the Securities Act.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

10.1

|

|

Settlement Agreement between salesforce.com, inc. and BNP Paribas, dated June 12, 2018

|

|

|

|

|

10.2

|

|

Settlement Agreement between salesforce.com, inc. and Bank of America, N.A., dated June 12, 2018

|

|

|

|

|

10.3

|

|

Settlement Agreement between salesforce.com, inc. and Morgan Stanley & Co. International plc, dated June 12, 2018

|

2

EXHIBIT INDEX

|

|

|

|

|

Exhibit

Number

|

|

Exhibit Title

|

|

|

|

|

10.1

|

|

Settlement Agreement between salesforce.com, inc. and BNP Paribas, dated June 12, 2018

|

|

|

|

|

10.2

|

|

Settlement Agreement between salesforce.com, inc. and Bank of America, N.A., dated June 12, 2018

|

|

|

|

|

10.3

|

|

Settlement Agreement between salesforce.com, inc. and Morgan Stanley & Co. International plc, dated June 12, 2018

|

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

Dated: June 14, 2018

|

|

|

|

|

salesforce.com, inc.

|

|

|

|

/s/ Mark Hawkins

|

|

Name:

|

|

Mark Hawkins

|

|

Title:

|

|

President and Chief Financial Officer

|

4

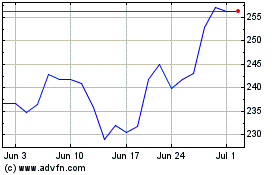

Salesforce (NYSE:CRM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Salesforce (NYSE:CRM)

Historical Stock Chart

From Apr 2023 to Apr 2024