Current Report Filing (8-k)

June 14 2018 - 4:38PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 14, 2018 (June 12, 2018)

WARRIOR MET COAL, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

Delaware

|

|

001-38061

|

|

81-0706839

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

16243 Highway 216

Brookwood, Alabama

|

|

35444

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (205)

554-6150

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as

defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

Underwriting Agreement

On June 12, 2018, Warrior Met Coal, Inc. (the “Company”) entered into an Underwriting Agreement (the “Underwriting

Agreement”) with the selling stockholders named therein (the “Selling Stockholders”) and Credit Suisse Securities (USA) LLC, as underwriter (the “Underwriter”), pursuant to which the Selling Stockholders agreed to sell

5,000,000 shares of common stock, par value $0.01 per share, of the Company, to the Underwriter at a price of $28.35 per share (the “Offering”). The Offering closed on June 14, 2018. The Company did not receive any of the proceeds

from the Offering.

The Underwriting Agreement contains customary representations, warranties and agreements of the Company and the

Selling Stockholders and other customary obligations of the parties and termination provisions. The Company and the Selling Stockholders, in each case severally and not jointly, have agreed to indemnify the Underwriter against certain liabilities

under the Securities Act of 1933, as amended (the “Securities Act”), or to contribute to payments the Underwriter may be required to make because of any such liabilities.

The Offering was made pursuant to the Company’s effective automatic shelf registration statement on Form

S-3

(File

No. 333-224734),

filed with the Securities and Exchange Commission (the “SEC”) on May 8, 2018, and a prospectus, which consists of a base

prospectus, filed with the SEC May 8, 2018, a preliminary prospectus supplement, filed with the SEC on June 11, 2018, and a final prospectus supplement, filed with the SEC on June 13, 2018.

The Underwriter and its affiliates have, from time to time, performed, and may in the future perform, various financial advisory and

investment banking services for the Company, for which they received or will receive customary fees and expenses. Further, the Underwriter and its affiliates are lenders under or provided to the Company services in connection with the Company’s

asset-based revolving credit agreement (the “ABL Facility”). Credit Suisse Securities (USA) LLC served as joint lead arranger and joint bookrunner in connection with the ABL Facility, and Credit Suisse AG, Cayman Islands Branch, an

affiliate of Credit Suisse Securities (USA) LLC, serves as a letter of credit issuer under the ABL Facility.

The preceding summary of the

Underwriting Agreement is qualified in its entirety by reference to the full text of such agreement, a copy of which is attached as Exhibit 1.1 hereto and incorporated herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

WARRIOR MET COAL, INC.

|

|

|

|

|

|

Date: June 14, 2018

|

|

By:

|

|

/s/ Dale W. Boyles

|

|

|

|

|

|

Dale W. Boyles

|

|

|

|

|

|

Chief Financial Officer

|

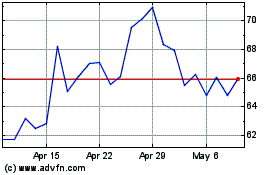

Warrior Met Coal (NYSE:HCC)

Historical Stock Chart

From Mar 2024 to Apr 2024

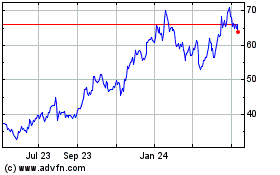

Warrior Met Coal (NYSE:HCC)

Historical Stock Chart

From Apr 2023 to Apr 2024