Current Report Filing (8-k)

June 06 2018 - 12:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________

FORM 8-K

__________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): June 1, 2018

|

SECURITY NATIONAL FINANCIAL CORPORATION

|

|

(Exact name of registrant as specified in this Charter)

|

|

|

|

|

|

Utah

|

000-09341

|

87-0345941

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

|

5300 South 360 West, Salt Lake City, Utah

|

|

84123

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

|

|

|

|

Registrant's Telephone Number, Including Area Code:

(801) 264-1060

|

Does Not Apply

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2 below):

[ ]

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ]

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ]

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ]

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item 8.01.

Other Events

Acquisition of Beta Capital Corp.

On June 1, 2018, Security National Financial Corporation (the "Company") completed a stock purchase transaction with Beta Capital Corp. ("Beta Capital") and Ronald D. Maxson ("Maxson"), the sole owner of all the outstanding shares of common stock of Beta Capital, to purchase all of the outstanding shares of common stock of Beta Capital. Beta Capital is engaged in the operation of a factoring business with the principal purpose of providing funding for funeral homes and mortuaries. For the year ended December 31, 2017, Beta Capital had revenues of $1,208,000 with a net pre-tax income of $204,000. As of December 31, 2017, the total assets of Beta Capital were $3,270,000 and total equity was $1,832,000.

Under the terms of the transaction, as set forth in the Stock Purchase Agreement dated June 1, 2018 (the "Purchase Agreement"), by and among the Company, Beta Capital and Maxson, the Company paid Maxson the purchase consideration at the closing of the transaction equal to the sum of (i) $890,000 in cash

plus

(ii) the accounts receivable value of $2,515,783, representing the total amount of the Company's outstanding receivables as of the closing date of June 1, 2018, for a total closing payment of $3,405,783. From the $3,405,783 closing payment, a holdback amount equal to $175,000 was deposited into an interest bearing escrow account to be held for a period of eighteen months from the closing date to pay off any uncollected accounts receivable and other liabilities of Beta Capital as of the closing date.

In addition to the escrow amount, prior to closing Maxson estimated the amount of outstanding, accrued or unpaid liabilities and indebtedness owed by Beta Capital as of the closing date, including but not limited to salaries, commissions, employment taxes, and accounts payable (the "Trailing Liabilities") and left a cash balance in the Company's checking account at closing in the amount of at least 200% of such estimate (the "Cash Amount"). Sixty days after closing, Beta Capital is required to provide Maxson with an accounting of all post-closing payments by Beta Capital of the Trailing Liabilities from the Cash Amount and transfer the remaining balance of the Cash Amount to Maxson. In the event the Cash Amount is insufficient to pay the entire amount of the Trailing Liabilities, Maxson is required to reimburse the Company until the Company has been reimbursed in full for the total amount of the Trailing Liabilities.

Moreover, during the 18-month period from the closing date, the Company shall cause Beta Capital to use commercially reasonable efforts to collect all outstanding accounts receivable as of the closing date. Within 15 days after expiration of the 18-month period following the closing date, the Company shall provide written notice to Maxson of the amounts of the outstanding accounts receivables that had not been collected in full by the Company during the 18-month period. Maxson shall then be required to reimburse the Company for such uncollected accounts receivable. These payments shall be made by Maxson to the Company from the escrow funds then held in the escrow account. The balance of funds, if any, in the escrow account after disbursement of the uncollected accounts receivable payment to the Company shall be paid to Maxson by the escrow agent.

Also

at closing, the Company and Beta Capital entered into a non-competition and confidentiality agreement with Maxson. Further at closing, the Company and Beta Capital entered into a lease agreement with Maxson for the use of the office space currently occupied by Beta Capital in Portsmouth, Virginia. The lease is for a period of two years payable in the amount of $3,000 per month.

Item 9.01

. Financial Statements and Exhibits

|

|

(c) Exhibits

|

|

|

|

|

|

|

|

|

10.1

|

Stock Purchase Agreement by and among Security National Financial Corporation, Beta Capital Corp., and Ronald D. Maxson, the sole owner of all the outstanding shares of common stock of Beta Capital.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

SECURITY NATIONAL FINANCIAL CORPORATION

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

Date: June 6, 2018

|

By:

/s/ Scott M. Quist

|

|

|

Scott M. Quist, Chairman, President and

|

|

|

Chief Executive Officer

|

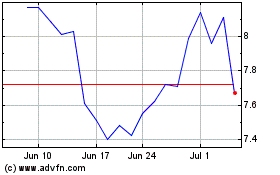

Security National Financ... (NASDAQ:SNFCA)

Historical Stock Chart

From Mar 2024 to Apr 2024

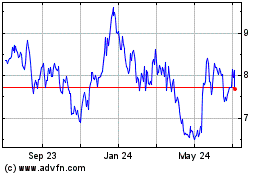

Security National Financ... (NASDAQ:SNFCA)

Historical Stock Chart

From Apr 2023 to Apr 2024