Current Report Filing (8-k)

June 05 2018 - 4:05PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 1, 2018

Protect Pharmaceuticals Corporation

(Exact Name of Registrant as Specified in Charter)

|

Nevada

|

|

000-54001

|

|

82-4148346

|

|

(State of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

16820 SW 39th Street, Miramar, Florida

|

|

|

|

33027

|

|

(Address of principal executive offices)

|

|

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (954) 866-3726

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 DFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4(c))

In this Current Report on Form 8-K, “Company,” “our company,” “us,” “

Protect Pharmaceutical,”

and “our” refer to Protect Pharmaceutical Corporation, unless the context requires otherwise.

FORWARD-LOOKING STATEMENTS

Our disclosure and analysis in this Current Report on Form 8-K contains some forward-looking statements. Certain of the matters discussed concerning our operations, cash flows, financial position, economic performance and financial condition, and the effect of economic conditions include forward-looking statements. Statements that are predictive in nature, that depend upon or refer to future events or conditions or that include words such as "expects," "anticipates," "intends," "plans," "believes," "estimates" and similar expressions are forward-looking statements. Although we believe that these statements are based upon reasonable assumptions, including projections of orders, sales, operating margins, earnings, cash flow, research and development costs, working capital, capital expenditures and other projections, they are subject to several risks and uncertainties.

Investors are cautioned that our forward-looking statements are not guarantees of future performance and the actual results or developments may differ materially from the expectations expressed in the forward-looking statements.

As for the forward-looking statements that relate to future financial results and other projections, actual results will be different due to the inherent uncertainty of estimates, forecasts and projections may be better or worse than projected. Given these uncertainties, you should not place any reliance on these forward-looking statements. These forward-looking statements also represent our estimates and assumptions only as of the date that they were made. We expressly disclaim a duty to provide updates to these forward-looking statements, and the estimates and assumptions associated with them, after the date of this filing to reflect events or changes in circumstances or changes in expectations or the occurrence of anticipated events. You are advised, however, to consult any additional disclosures we make in our reports on Form 10-K, Form 10-Q, Form 8-K, or their successors.

Item 3.02 Unregistered Sale of Equity Securities.

June 1, 2018, we completed private financing transactions with Una Taylor in which Una Taylor contributed/invested cash and securities pursuant to a subscription agreement in exchange for 2,500,000 preferred shares of the Company. The shares represent the only preferred shares issued and 25% of the preferred shares authorized by the company.

Item 5.01

Changes in Control of Registrant.

As reported on Form 14f, filed with the Securities and Exchange Commission on

June

5

, 201

8

, effective

June

5

, 201

8

,

Start Capital LLC, a Florida LLC and Renewable Energy LLC, a Florida LLC

, the principal stockholders of the Company (“

StartRenewable

”), entered into a Stock Purchase Agreement (the “

Agreement

”), dated, June 1, 201

8

, with

J

& Y Property Preservation LLC

(the “

Buyer

”), a Nevada LLC

, pursuant to which, among other things, StartRenewable agreed to sell to the Buyer, and the Buyer agreed to purchase from StartRenewable, a total of

10,215,000

shares of Common Stock owned of record and beneficially by StartRenew

able

(the“

Purchased Shares

”). The Purchased Shares represented approximately

70.4

% of the Company’s issued and outstanding shares of Common Stock as of the Record Date. In connection with the transactions contemplated by the Agreement, Yvette Sanchez removed the current directors and appointed

herself to the

Company’s Board of Directors, except that such appointment will not become effective until at least 10 days following the mailing of this Information Statement, specifically at the close business as of

June

15

, 201

8

.

Except as described herein, there were no arrangements or understandings among members of both the former and new control groups and their associates with respect to the election of directors or other matters.

The intent of the transaction was to initiate the development of a business plan as described in Item 8.01 herein.

As required to be disclosed by Regulation S-K Item 403(c), there are no arrangements, known to the Company, including any pledge by any person of securities of the Company or any of its parents, the operation of which may at a subsequent date result in a change in control of the Company.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

In connection with the transactions contemplated by the Agreement described in Item 5.01 herein, the

majority shareholders

appointed

Yvette Sanchez

to

the Company’s Board of Directors, effective at the close business as of

June

1

5

, 201

8

. In addition, Ms.

Sanchez

was appointed on

June

1

, 201

8

, as President of the Company.

As of the effective date June 15th, 2018 t

he Board of Directors and the Company’s new officers consist of the following person are as follows:

|

Name

|

|

Age

|

|

Position

|

|

|

|

|

|

|

|

Yvette Sanchez

4876 Cecile Ave

Las Vegas, NV 89115

|

|

49

|

|

Director and President

|

The

director will serve until the next annual meeting of stockholders of the Company and until such director’s successor is elected and qualified or until such director’s earlier death, resignation or removal. The following is information concerning the business backgrounds of each of Ms.

Sanchez

Yvette Sanchez

.

Ms. Yvette M. Sanchez started the in residential rehabilitation business in 2000 by purchasing, restoring, and selling homes. She was managing on average 4 homes per month. After accepting a position with Pulte Homes in 2005, Ms. Sanchez duties involved overseeing the final construction close-out of projects. On average, she managed 60 home closing per month. Using the knowledge obtained from her first business venture and tenure with Pulte Homes, Ms. Sanchez established J&Y Property Preservation, Inc. (JYPP) in 2008. As Chief Executive Officer of JYPP, she was responsible for increasing the company’s revenue from $225,000 (start-up year in 2008) to $1,639,000 (year ending 2016). During her first decade, Ms. Sanchez spear-headed the growth of rehabilitating residential units from 160 units to 600 units per month.

She was 2016 Safeguard contractor of the Year nationwide out of 2,000 contractors.

Effective

June

5

, 201

8

, Yvette Sanchez

removed by majority vote (70.4%) from the Company’s Board of Directors Shedrick Daniels, Stuart Sandweiss, and Shimson Bandman. Una Taylor

resigned as a member

of the Board of Directors effective June 15, 2018. There were no disagreements with these former directors of the Company as to its operations, policies or practices.

There are presently no plans or commitments with regard to such compensation or remuneration. The Company has no employee benefit plans or other compensation plans.

The Board of Directors will not adopt a procedure for stockholders to send communications to the Board of Directors until it has considered and reviewed the merits of several possible alternative communications procedures. The Company has no policy and does not presently intend to consider director candidates for election to the Board of Directors recommended by security holders, although that policy may be reconsidered in the future.

Item 8.01 Other Events

Completion of Acquisition or Disposition of Assets.

The Company purchased a 20% minority Member Interest in J & Y Property Preservation LLC in exchange for 10,000,000 shares of the company’s common stock.

Future Plans

Protect Pharmaceutical intends to acquire J & Y P

roperty

Preservatio

n LLC

a Nevada LLC in a transaction that will result in the J & Y Property Preser

vation

entity becoming the operating entity in our public company (“Merger”) and that will also result in Protect Pharmaceutical acquiring 100% of the issued and outstanding equity of

J & Y Property Preservation LLC

. While no assurances can be provided as to the final consummation of this transaction, it is intended that going-forward

J & Y Property Preservation LLC

shall produce operations and cash flow which shall sustain the enterprise. Prior to the Merger, the

J & Y Property Preservation LLC

business will be incorporated into the business of our Company.

J & Y Property Preservation LLC

intends to create an entire real estate serv

icing

ecosystem whose mission is to transform the construction and property preservation landscape to be inclusive, diversified and successful!

J & Y Property Preservation LLC

is currently operated by related parties, specifically Yvette Sanchez.

Code of Ethics

The Board of Directors has adopted a Financial Code of Ethics and has attached it hereto as Exhibit 14.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are furnished herewith:

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

14.1

|

|

FINANCIAL CODE OF ETHICS

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

June

5

, 201

8

|

|

Protect Pharmaceutical Corporation

|

|

|

|

|

|

|

|

|

By:/s/

Yvette Sanchez

|

|

|

|

Yvette Sanchez

, President

|

4

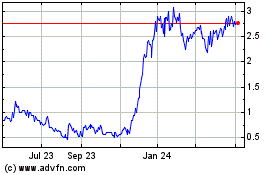

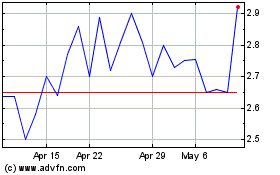

Protect Pharmaceutical (PK) (USOTC:PRTT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Protect Pharmaceutical (PK) (USOTC:PRTT)

Historical Stock Chart

From Apr 2023 to Apr 2024