Report of Foreign Issuer (6-k)

June 01 2018 - 6:08AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of

May

2018

Commission File Number

1-12260

COCA-COLA FEMSA, S.A.B. de C.V.

(Translation of registrant’s name into English)

(Jurisdiction of incorporation or organization)

Calle Mario Pani No. 100,

Santa Fe Cuajimalpa,

Cuajimalpa de Morelos,

05348, Ciudad de México,

México

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

X

Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes

No

X

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7)

Yes

No

X

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

No

X

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with

Rule 12g3-2(b): 82-__.

Report on the level of adherence to the

Code of Best Corporate Practices

by

Coca-Cola FEMSA, S.A.B. de C.V.

(hereinafter referred to as the “

company

”)

for the fiscal year ended

December 31, 2017

in compliance with the provisions

of article 4.033.00, section XI of the Internal Regulations

of the Mexican Stock Exchange (

Reglamento Interior

de la Bolsa Mexicana de Valores, S.A.B. de C.V.

)

6.

Shareholders’ Meetings

|

6.1 Information and Agenda of the Shareholders’ Meeting.

|

Yes

|

No

|

Comments

|

|

1.

In the Agenda you do not classify matters related with different subjects? (Best Practice 1)

|

X

|

|

|

|

2.

In the Agenda you do not include an item of “Miscellaneous Matters”? (Best Practice1)

|

X

|

|

|

|

3.

The information with respect to each item in the Agenda is available at least with 15 calendar days in advance? (Best Practice 2)

|

X

|

|

|

|

4.

Is there a form containing the detailed information and possible voting alternatives in which the shareholders may provide instructions to their proxies with respect to the direction in which they shall exercise their corresponding voting rights in the Shareholders’ Meeting? (Best Practice 3)

|

X

|

|

|

|

5.

In the information made available to the shareholders:

|

|

|

|

|

a)

The proposal of members of the Board of Directors is included? (Best Practice 4)

|

X

|

|

|

|

b)

The curriculum of the proposed members with enough information to evaluate their classification and in its case independency is included? (Best Practice 4)

|

X

|

|

|

|

6.2 Information and Communication between the Board of Directors and Shareholders.

|

Yes

|

No

|

Comments

|

|

6.

The Board of Directors, in its “Annual Report to the Shareholders’ Meeting”, includes relevant aspects of the duties of the intermediate bodies or committees that perform the role of? (Best Practice 5):

|

|

|

|

|

a)

Audit***.

|

X

|

|

|

|

b)

Evaluation and compensation.

|

X

|

|

It is carried out by the Corporate Practices Committee.

|

|

c)

Finance and planning.

|

X

|

|

|

|

d)

Corporate Practices***.

|

X

|

|

|

|

e)

Other (describe).

|

|

|

N/A

|

|

7.

The reports by each intermediate body or committee submitted to the Board are made available to the shareholders together with the materials for the Shareholders’ Meeting, except for confidential information? (Best Practice 5)

|

X

|

|

Pursuant to article 28, section IV of the Mexican Securities Market Law, the Board of Directors shall submit to the shareholders at the end of each fiscal year, the reports that the Audit and Corporate Practices Committees submit to the Board.

|

|

8.

The “Annual Report” submitted to the Shareholders’ Meeting includes the names of the members of each intermediate body? (Best Practice 5)

|

X

|

|

|

|

9.

The company has the necessary communication mechanisms to allow the shareholders and investors to be properly informed? (Best Practice 6). If yes, please specify the mechanisms and if no, please explain why.

|

X

|

|

|

|

a)

Specify and/or Explain

|

The company has an investor relations department that directly reports to the finance department of the company. In addition to the periodical financial information, news and press releases that the company announces to the public investors through the website of the Mexican Stock Exchange, the company’s website

(

www.coca-colafemsa.com

)

in the investor relations section, has available the financial information, press releases and presentations prepared for the investors to keep them informed about the business and financial condition of the company.

In addition, the company annually presents a financial and non-financial information report, (the “Integrated Annual Report 2017”), which allows detailing key information for decision-making on economic, environmental, social and corporate governance aspects aligned to the business strategy of the company. The document is available on the company´s website: https://www.coca-colafemsa.com/kof2017/pdf/KOF17_english.pdf

|

*** Mandatory task for publicly traded companies, which may be together with other functions or in a single committee.

7.

Board of Directors

|

7.1 Duties of the Board of Directors.

|

Yes

|

No

|

Comments

|

|

10.

The Board of Directors performs the following duties? (Best Practice 7)

|

|

|

|

|

a)

Establishes the strategic vision.

|

X

|

|

|

|

b)

Supervises the operation of the company.

|

X

|

|

|

|

c)

Approves the business operation

|

X

|

|

|

|

d)

Appoints the chief executive officer and relevant officers of the company.

|

X

|

|

Appoints the Chief Executive Officer and establishes the guidelines for the election of the relevant officers of the company.

|

|

e)

Evaluates and approves the performance of the chief executive officer and relevant officers of the company.

|

X

|

|

|

|

f)

Verifies that all shareholders:

|

|

|

|

|

i.

Are treated equally.

|

X

|

|

|

|

ii.

Their interests are protected.

|

X

|

|

|

|

iii.

Have access to the information of the company.

|

X

|

|

|

|

g)

Ensures value creation for the shareholders, as well as sustainability and continuity of the company.

|

X

|

|

|

|

h)

Promotes:

|

|

|

|

|

i.

The responsible release of information.

|

X

|

|

|

|

ii.

The responsible disclosure of information.

|

X

|

|

|

|

iii.

The ethical management of the business.

|

X

|

|

|

|

i)

Promotes the management transparency.

|

X

|

|

|

|

j)

Promotes the establishment of internal control mechanisms.

|

X

|

|

|

|

k)

Promotes the establishment of mechanisms to ensure the quality of the information.

|

X

|

|

|

|

l)

Establishes policies for related party transactions.

|

X

|

|

|

|

m)

Approves transactions with related parties.

|

X

|

|

|

|

n)

Ensures the establishment of mechanisms for:

|

|

|

|

|

i.

Risk identification;

|

X

|

|

For this role, the Board of Directors relies on the Audit, Finance and Planning and Corporate Practices Committees.

|

|

ii.

Risk analysis;

|

X

|

|

For this role, the Board of Directors relies on the Audit, Finance and Planning and Corporate Practices Committees.

|

|

iii.

Risk management;

|

X

|

|

For this role, the Board of Directors relies on the Audit, Finance and Planning and Corporate Practices Committees.

|

|

iv.

Risk control;

|

X

|

|

For this role, the Board of Directors relies on the Audit, Finance and Planning and Corporate Practices Committees.

|

|

v.

Adequate risk disclosure.

|

X

|

|

For this role, the Board of Directors relies on the Audit, Finance and Planning and Corporate Practices Committees.

|

|

o)

Promotes the establishment of a succession plan for:

|

|

|

|

|

i.

The chief executive officer;

|

X

|

|

|

|

ii.

The relevant officers.

|

X

|

|

|

|

p)

Promotes that the company be socially responsible. The way(s) in which the company is socially responsible is(are):

|

X

|

|

The company has a sustainability strategy based on the positive transformation of the environment through a continuous and simultaneous creation of economic, social and environmental value, and on a comprehensive strategy focused on three areas: our people, our community and our planet.

The company has established goals for 2020 considering the business risks, materiality and mega trends in order to contribute and generate sustainable communities. The complete detail of the strategy and actions carried out by the company is found in the Integrated Annual Report 2017.

The Integrated Annual Report 2017 follows the guidelines provided by the

Global Reporting Initiative

Standards

for the report of results and it´s corresponding external verification for the information presented. Additionally the Integrated Annual Report 2017 was prepared considering the recommendations of the indexes and rankings to which it belongs, such as the IPC of the Mexican Stock Exchange, of the social Responsibility and sustainability Dow Jones emerging markets sustainability index, FTSE4Good Emerging Index and Vigeo-Eiris Emerging 100 Best Emerging Markets Performers Ranking. The complete document is available on the company's website:

https://www.cocacolafemsa.com/kof2017/pdf/KOF17_english.pdf

.

|

|

i.

Actions with the community;

|

X

|

|

The company is committed to develop the communities where it operates and through its sustainability strategy leads actions focused to

engaging in close communication and developing collaborative processes for mutual benefit. The work in the communities aims to contribute to improve the quality of life of people, generating economic, social and environmental value simultaneously. It is achieved through the following areas of action:

·

Our people. The company undertakes actions to guarantee the integral wellbeing of our employees in all areas of their personal and work life, also promoting participation with the community through voluntary actions.

·

Our community. Result from this area, three strategic lines of action, from which the following activities are oriented:

·

Healthy lifestyle, in order to promote the integration of healthy habits with programs of physical activation, nutrition and food, as well as having a portfolio of products adapted to each lifestyle. In 2017, about 1.6 million people benefited from healthy habits programs.

·

Community development, in order to strengthen their local communities through development programs and local initiatives focused on social and environmental aspects. From 2016 to this date we trained 37 work centers with the risk identification and community relationship model oriented to having a social license methodology.

·

Sustainable procurement, in order to contribute to the sustainable development of suppliers. During 2017, 735 suppliers participated in evaluation and development programs.

·

Our planet. From this area activities are carried out aiming to supply water to the communities and preserve watersheds where we operate; post-consumer collection and recycling programs and the use of recycled PET in our packaging; as well as actions aiming to reduce our carbon emissions and the use of clean energy.

For more information of the actions of the company in the communities where it operates you may consult our Integrated Annual Report 2017 at: https://www.coca-colafemsa.com/kof2017/pdf/KOF17_english.pdf

.

|

|

ii.

Changes in mission and vision;

|

X

|

|

|

|

iii.

Changes in the company’s business strategy;

|

X

|

|

|

|

iv.

Consideration of third parties involved;

|

X

|

|

|

|

v.

Other:

|

N/A

|

|

q)

Promotes that the company states its business ethical principles. The way(s) in which the Company promotes its ethical principles is(are):

|

|

|

|

|

i.

Code of Ethics.

|

X

|

|

The Code of Business Conduct and Ethics of the company, it´s available in spanish, english and portuguese for 100% of the employees through the company Intranet and the Internet externally including customers and suppliers, establishes the basic criteria to regulate the conduct of all persons that work in the company taking into account the mission, vision and values of the company, as well as the respect for human rights.

|

|

ii.

Promotion and application of the Code internally and externally.

|

X

|

|

|

|

iii.

Whistleblower mechanism of violations to the Code.

|

X

|

|

|

|

iv.

Protection mechanism for the informants.

|

X

|

|

|

|

v.

Others:

|

N/A

|

|

r)

Promotes that the company considers the third parties involved in the decision making. The way(s) in which the company considers the third parties involved in the decision making is(are):

|

|

|

|

|

i.

Responsible management of the business;

|

X

|

|

The company takes in to account the interests of different groups (employees and their families, suppliers, communities, customers and consumers, authorities and business associations, unions, shareholders and investors, civil society organizations, media and educational institutions) for the decision making through different communication channels and strategic sustainability programs.

Taking into account the comments or proposals made by the interest groups the company develops initiatives that help improve the relationship with the communities where they operate. The information on the Integrated Annual Report 2017 seeks to respond to the concerns of the different groups in a more complete way and detail on the projects and actions carried out during 2017.

The complete Document is available at the company´s website:

https://www.coca-colafemsa.com/kof2017/pdf/KOF17_english.pdf

.

|

|

ii.

Sustainability programs;

|

X

|

|

The company carried out programs based on its sustainability strategy and considering its relevant interest groups. For more information on these programs: https://www.coca-colafemsa.com/kof2017/pdf/KOF17_english.pdf

|

|

iii.

Others:

|

N/A

|

|

s)

Promotes the disclosure of violations to the Code of Ethics and the protection of the informants. The way(s) in which the company promotes the disclosure of illegal actions and the protection of the informants (is)are:

|

|

|

|

|

i.

Promotion of the Code of Ethics;

|

X

|

|

The Code of Business Conduct and Ethics of the company is available in spanish, english and portuguese for 100% of its employees through Intranet of the company and the Internet externally including suppliers and customers.

|

|

ii.

Special telephone number and/or website;

|

X

|

|

The company has a system known as DILO (whistleblower), a formal and permanent mechanism, known by 100% of the employees of the company that brings an open communication space to inform any conduct or practice that is not aligned with the provisions of the Code of Ethics. The reports can be generated by telephone, e-mail, or instant messaging.

|

|

iii.

Other:

|

N/A

|

|

t)

Verifies that the company has the necessary mechanisms that allow confirming the compliance of different applicable legal provisions?

|

X

|

|

|

|

11.

For the purpose of having transparent authorities and responsibilities, the activities of senior management are separated from those of the Board of Directors? (Best Practice 8)

|

X

|

|

|

|

7.2 Composition of the Board of Directors.

|

Yes

|

No

|

Comments

|

|

12.

How many directors comprise the Board of Directors? (Best Practice 9, Mexican Securities Market Law) ***

|

21

|

As of the date of the company´s shareholders meeting of March 9, 2018, the Board of Directors of the company was comprised by 21 directors, of which 13 are directors appointed by Series “A” shares, 5 by Series “D” shares and 3 by Series “L” shares.

|

|

a)

Of these, how many are women

|

2

|

|

|

13.

If applicable, how many alternate directors comprise the Board of Directors? (Best Practice 10)

|

18

|

|

|

a)

Of these, how many are women

|

4

|

|

|

14.

If alternate directors, please indicate:

|

|

|

|

|

a)

Each proprietary director suggests who should be appointed as its alternate director? (Best Practice 10)

|

X

|

|

|

|

b)

Each independent proprietary director has an alternate director who is also independent? (Best Practice 12)

|

X

|

|

Except for three proprietary independent directors that do not have alternate.

|

|

15.

Is there a communication process established between the proprietary directors and its alternates that allows them to have an effective participation? (Best Practice 10)

|

X

|

|

|

|

16.

The independent directors upon appointment deliver to the Chairman of the Shareholders’ Meeting a Statement of compliance with the requirements of independence (Best Practice 11)

|

X

|

|

|

|

17.

The independent directors represent at least 25% of all the directors? (Best Practice 12)

|

X

|

|

|

|

18.

From the total of the proprietary members of the Board of Directors, how many are (Best Practices 12):

|

|

As of the date of the company´s shareholders meeting of March 9, 2018 there were 10 proprietary directors that could not be classified within the proposed classification of the Code of Best Corporate Practices, since they were not equity directors (did not own shares of the company), they were not related directors (were not officers of the company) and they were not independent (the Shareholders’ Meeting did not qualify them as such).

|

|

a)

Independent.

(Director who complies with the statutory independence requirements).

|

7

|

|

|

b)

Equity.

(Shareholders that are part of the controlling group, but not part of the management).

|

1

|

|

|

c)

Equity independent.

(Shareholders without significant influence neither control power, and who are not part of the management of the company).

|

2

|

|

|

d)

Related.

(Director who is only an officer of the company).

|

0

|

|

|

e)

Equity Related.

(Shareholders who are also officers of the company)

|

1

|

|

|

19.

The independent and equity directors, as a whole, constitute at least 60% of the Board of Directors? (Best Practice 13)

|

|

X

|

|

|

20.

The “Annual Report to the Shareholders’ Meeting” submitted to the Board of Directors classifies each director? (Best Practice 14)

|

|

X

|

It only classifies the independent directors

|

|

21.

The Annual Report presented by the Board of Directors specifies?: (Best Practice 14)

|

|

|

a)

The classification of each director.

|

|

X

|

It only classifies the independent directors

|

|

b)

The business experience of each director.

|

X

|

|

|

|

***: Publicly traded companies cannot have more than 21 directors.

|

|

7.3 Board of Directors’ Structure.

For the compliance of its duties, the Board of Directors may create one or more committees to support it. On each of the following duties, in comments you should indicate the body that executes it or, if applicable, explain why is it not executed (Best Practice 15)

|

Yes

|

No

|

Comments

|

|

22.

In order to make more informed decisions, indicate if the following duties are executed by the Board of Directors (Best Practice 16):

|

|

|

a)

Audit***.

|

X

|

|

The audit committee is responsible of reviewing the accuracy and integrity of quarterly and annual financial statements in accordance with accounting, internal control and auditing requirements. The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the independent auditor, who reports directly to the Audit Committee; the internal auditing function also reports directly to the Audit Committee. The Audit Committee has implemented procedures for receiving, retaining and addressing complaints regarding accounting, internal control and auditing matters, including the submission of confidential, anonymous complaints from employees regarding questionable accounting or auditing matters. To carry out its duties, the Audit Committee may hire independent counsel and other advisors. As necessary, the company compensates the independent auditor and any outside advisor hired by the Audit Committee and provides funding for ordinary administrative expenses incurred by the Audit Committee in the course of its duties.

|

|

b)

Evaluation and Compensation.

|

X

|

|

The Corporate Practices Committee carries out the duties of the evaluation and compensation committee.

|

|

c)

Finance and Planning.

|

X

|

|

The Finance and Planning Committee works with management to set our annual and long-term strategic and financial plans and monitors adherence to these plans. It is responsible for setting our optimal capital structure and recommends the appropriate level of borrowing as well as the issuance of securities. Financial risk management is another responsibility of the Finance and Planning Committee.

|

|

d)

Corporate Practices***

|

X

|

|

The Corporate Practices Committee, which consists exclusively of independent directors, is responsible for preventing or reducing the risk of performing operations that could harm the value of

the

company or that benefit a particular group of shareholders. The committee may call a shareholders meeting and include matters on the agenda for that meeting that it deems appropriate, approve policies for related party transactions, approve the compensation plan of the chief executive officer and relevant officers, and support the board of directors in the elaboration of related reports.

|

|

e)

Others. (describe)

|

|

|

N/A

|

|

23.

Indicate which committee executes each of the following tasks

|

|

|

|

|

a)

Audit***

|

Audit Committee

|

|

b)

Evaluation and Compensation.

|

Corporate Practices Committee

|

|

c)

Finance and Planning.

|

Finance and Planning Committee

|

|

d)

Corporate Practices***

|

Corporate Practices Committee

|

|

e)

Others. (describe in Comments)

|

N/A

|

|

24.

Indicate the number of proprietary directors that comprise each of the intermediate bodies (Best Practice 16)

|

As of the date of the company´s shareholders meeting of March 9, 2018, the intermediate bodies were comprised as follows:

|

|

Audit***

|

4

|

|

Evaluation and Compensation.

|

3

|

|

Finance and Planning.

|

5

|

|

Corporate Practices***

|

3

|

|

Other. (describe)

|

N/A

|

|

25.

Indicate the number of independent proprietary directors that comprised each of the intermediate bodies (Best Practice 16)

|

|

|

Audit***

|

4

|

|

Evaluation and Compensation.

|

3

|

|

Finance and Planning.

|

1

|

|

Corporate Practices***

|

3

|

|

Others. (describe in Comments)

|

N/A

|

|

26.

How frequently these intermediate bodies inform their activities to the Board of Directors? (Best Practice 16)

|

|

|

|

a)

Audit***

|

Quarterly

|

|

|

b)

Evaluation and Compensation.

|

Quarterly

|

|

|

c)

Finance and Planning.

|

Quarterly

|

|

|

d)

Corporate Practices***

|

Quarterly

|

|

|

e)

Others. (describe)

|

|

|

27.

The chairman of each intermediate body calls the officers of the company to its meetings whose responsibilities are related to the duties of the intermediate body? (Best Practice 16)

|

X

|

|

|

|

28.

All of the independent directors participate in any of the intermediate bodies? (Best Practice 16)

|

|

X

|

|

|

29.

If the answer to the above question was negative, explain why.

|

The intermediate bodies have a maximum number of members to ensure a good performance and decision making therefore the company has considered integrating such committees with persons that have more knowledge and experience in each one of the related subjects.

|

|

30.

The intermediate body in charge of the audit is chaired by an independent director who has knowledge and experience in financial and accounting aspects? (Best Practice 16)

|

X

|

|

José Manuel Canal Hernando is the chairman of the Audit Committee and has a degree in Accounting from the Universidad Nacional Autónoma de México and is licensed as a Certified Public Accountant and has vast experience in accounting and audit issues.

|

|

31.

If the answer to the above question was negative, explain why.

|

|

|

*** Mandatory task for publicly traded companies, which may be performed together with other functions or in a single committee

.

|

|

7.4 Operation of the Board of Directors.

|

Yes

|

No

|

Comments

|

|

32.

How many meetings the Board of Directors have during each fiscal year? (Best Practice 17)

|

4

|

4 Minimum

|

|

33.

If the answer to the above question was less than 4, explain why:

|

|

|

|

|

a)

The information is not provided on time.

|

|

|

|

|

b)

It is customary.

|

|

|

|

c)

It is not given the importance.

|

|

|

|

|

d)

Others (describe):

|

|

|

34.

Are there any provisions by which with the agreement of 25% of the directors or the Chairman of any intermediate body a Board meeting may be called? (Best Practice 18)

|

X

|

|

|

|

35.

If the answer to the above question was affirmative, please describe such provisions.

|

Article 27 of the Mexican Securities Market Law and article 27 of our bylaws establish that, among others, the Chairman of the Corporate Practices Committee, Audit Committee or 25% of the directors may call a Board meeting.

|

|

36.

With how many days in advance do the members of the board have access to the information that is relevant and necessary for the decision making, in accordance with the Agenda? (Best Practice 17)

|

5

|

With at least 5 business days in advance.

|

|

37.

Is there a mechanism that ensures that directors may evaluate matters that require confidentiality? Even if they do not receive the necessary information with at least 5 business days prior to the meeting as provided by the Code for non-confidential matters (Best Practice 19)

|

X

|

|

|

|

38.

If the answer to the above question is affirmative, select which (is) are the mechanism(s)?

|

|

|

|

a)

By telephone.

|

X

|

|

The proprietary directors may request all the information necessary to be able to discuss, evaluate and make decisions during the meeting, or to the contrary, have the right to postpone up to three days the meetings in case they were not sufficiently informed, pursuant to article 30 of the Mexican Securities Market Law.

|

|

b)

By e-mail.

|

X

|

|

|

c)

By Internet.

|

|

|

|

|

d)

By printed document.

|

|

|

|

|

e)

Others (describe):

|

|

|

39.

New directors are provided with the necessary information in order for them to be up to date on the matters of the company and they may fulfill their new responsibility? (Best Practice 20)

|

X

|

|

The new director receives complete information on the status of the company, annual reports from previous years and meetings are scheduled for such director with the relevant officers, whom explain the status of the company in more detail and respond to any question the incoming director has.

|

|

|

|

|

|

|

|

7.5 Duties of the Directors.

|

Yes

|

No

|

Comments

|

|

40.

Each member of the Board is given the necessary information with

respect to the obligations, responsibilities and rights that imply to be

member of the Board of Directors of the company? (Best Practice 21)

|

X

|

|

|

|

41.

Directors inform to the Chairman and the other members of the

Board of Directors any situation where it exists or that may result in a

conflict of interest, abstaining from participating in the corresponding

discussions? (Best Practice 22)

|

X

|

|

|

|

42.

Directors use the company’s assets or services only for the

performance of its corporate purpose? (Best Practice 22)

|

X

|

|

|

|

43.

If applicable, clear policies are defined for when directors

exceptionally use the company’s assets for personal matters? (Best Practice

22)

|

X

|

|

|

|

44.

Directors invest the necessary time and attention to their

duties by attending at least 70% of the meetings to which they are called?

(Best Practice 22)

|

X

|

|

Directors attend to

meetings 89.2% in average.

|

|

45.

Is there a mechanism that ensures that the directors maintain

absolute confidentiality about all the information they receive in the

performance of their duties, especially with respect to their own

participation and the participation of the other directors, in the

discussions that take place in the Board meetings? (Best Practice 22)

|

X

|

|

|

|

46.

If the answer to the above question is affirmative, explain such

mechanism:

|

|

|

a)

Confidentiality agreement.

|

X

|

|

The secretary of the Board of Directors periodically reminds the

directors of the scope of their confidentiality obligation.

|

|

b)

Exercise of its fiduciary duties.

|

|

|

|

|

c)

Others (describe):

|

|

|

47.

Proprietary directors and, if applicable, their respective

alternate directors, keep each other informed about

the matters discussed in the meetings of the Board of Directors in which they

participate? (Best Practice 22)

|

X

|

|

|

|

48.

Proprietary directors and, if applicable, their respective

alternate directors, assist the Board of Directors with opinions and

recommendations resulting from the analysis of the performance of the

company; in order for the decisions to be taken are properly substantiated?

(Best Practice 22)

|

X

|

|

|

|

49.

Is there a performance assessment and compliance of

responsibilities and fiduciary duties mechanism for directors? (Best Practice

22)

|

X

|

|

|

|

|

|

|

|

|

|

8.

Audit Committee’s Duties.

|

8.1 General Duties.

|

Yes

|

No

|

Comments

|

|

50.

The intermediate body that is responsible for the audit executes the following tasks? (Best Practice 23)

|

|

|

a)

Recommends to the Board of Directors:

|

|

|

i.

The candidates for external auditors of the company.

|

X

|

|

|

|

ii.

The hiring conditions.

|

X

|

|

|

|

iii.

The scope of their professional services.

|

X

|

|

|

|

b)

Recommends to the Board of Directors the approval of other than additional services to external audit.

|

X

|

|

|

|

c)

Supervises the compliance of the professional services of the external auditors.

|

X

|

|

|

|

d)

Evaluates the performance of the company that provides the services of external audit.

|

X

|

|

|

|

e)

Analyses the opinions or reports prepared by the external auditor, such as:

|

|

|

|

|

i.

Rulings.

|

X

|

|

|

|

ii.

Opinions.

|

X

|

|

|

|

iii.

Reports.

|

X

|

|

|

|

iv.

Statements.

|

X

|

|

|

|

f)

Meets at least once a year with the external auditor without the attendance of officers of the company.

|

X

|

|

|

|

g)

It is the channel of communication between the Board of Directors and the external auditors.

|

X

|

|

|

|

h)

Ensures the independence and impartiality of the external auditors.

|

X

|

|

|

|

i)

Reviews

|

|

|

i.

Work plan.

|

X

|

|

|

|

ii.

Letters with any comments or requirements.

|

X

|

|

|

|

iii.

Internal control reports.

|

X

|

|

|

|

j)

Meets periodically with the internal auditors, without the attendance of the officers of the company, to know about:

|

|

|

i.

Work plan.

|

X

|

|

|

|

ii.

Comments and observations to the work in progress.

|

X

|

|

|

|

iii.

Others:

|

|

|

k)

Provides its opinion to the Board of Directors about the policies and criteria used in the preparation of the financial information, as well as the issuance process.

|

X

|

|

|

|

l)

Contributes to the definition of the general guidelines of internal control and internal audit and evaluates its effectiveness.

|

X

|

|

|

|

m)

Verifies the compliance of the mechanisms established for risk control to which the company is subject.

|

X

|

|

|

|

n)

Coordinates the tasks of the external and internal auditors and the statutory examiner.

|

X

|

|

|

|

o)

Verifies that the company has the necessary mechanisms that allow complying with the different provisions to which it is subject.

|

X

|

|

|

|

p)

The frequency with which the company conducts a review to inform the Board of Directors about the legal situation of the same.

|

|

Quarterly.

|

|

q)

Contributes to the establishment of policies for related party transactions

. ***

|

X

|

|

|

|

r)

Analyses and evaluates the operations with related parties to recommend it´s approval to the Board of Directors. ***

|

X

|

|

|

|

s)

Decides the employment of third party experts to provide their opinion with respect to related party transactions or any other matter, which allows the adequate performance of its duties.***

|

X

|

|

|

|

t)

Verifies the compliance of the Code

of Ethics.

|

X

|

|

|

|

u)

Verifies the compliance of the disclosure mechanism of illegal acts and protection of whistle blowers

.

|

X

|

|

|

|

v)

Supports the Board of Directors in the analysis of the contingency plans and information recovery.

|

X

|

|

|

|

Note ***: Publicly traded companies carry out these recommendations through their Corporate Practices Committee.

|

|

|

|

|

|

8.2 Election of Auditors.

|

Yes

|

No

|

Comments

|

|

51.

It abstains from engaging firms in which the fees for the external audit and other additional services rendered to the company, represent a percentage more than or equal to 10% of their total income? (Best Practice 24)

|

X

|

|

|

|

52.

Rotation:

|

|

|

|

|

a) Is there a rotation of the partner who audits the financial statements at least once every 5 years? (Best Practice 25)

|

X

|

|

|

b) Is there a rotation of the work team who audits the financial statements at least once every 5 years? (Best Practice 25)

|

X

|

|

|

53.

The person who signs the audit report of the company’s annual financial statements is different from the one who acts as statutory examiner? (Best Practice 26) ***

|

|

|

N/A

|

|

54.

The profile of the statutory examiner is disclosed in the annual report submitted to the Shareholders’ Meeting by the Board of Directors? (Best Practice 27) ***

|

|

|

N/A

|

Note ***: For publicly traded Companies this practice does not apply.

|

8.3 Financial Information.

|

Yes

|

No

|

Comments

|

|

55.

With its opinion, the intermediate body in charge of the audit supports the Board of Directors so that the Board takes decisions with reliable financial information? (Best Practice 28)

|

X

|

|

|

|

56.

Such financial information, is executed by: (Best Practice 28)

|

|

|

a)

The Chief Executive Officer.

|

X

|

|

|

|

b)

The officer responsible of its preparation.

|

X

|

|

|

|

57.

The company has an internal audit department? (Best Practice 29)

|

X

|

|

Certain services of internal audit are provided by a company member of our business group (as defined in the Mexican Securities Market Law).

|

|

58.

If the previous answer is affirmative, please indicate whether its general guidelines and work plans are approved by the Board of Directors. (Best Practice 29)

|

X

|

|

|

|

59.

The intermediate body in charge of the audit, previously provides its opinion to the Board of Directors for the approval of the accounting policies and criteria used in the preparation of the financial information of the company? (Best Practice 30)

|

X

|

|

|

|

60.

The intermediate body in charge of the audit provides its opinion to the Board of Directors for the approval of the changes made to the accounting policies and criteria used in the preparation of the financial information of the company? (Best Practice 31)

|

X

|

|

|

|

61.

The Board of Directors approves, with a previous opinion of the audit committee, the necessary mechanisms to ensure the quality of the financial information that is presented to it? (Best Practice 32)

|

X

|

|

|

|

62.

In the event the financial information corresponds to intermediate periods during the fiscal year, the audit committee supervises that it is made with the same policies, criteria and practices with which the annual information is prepared? (Best Practice 32)

|

X

|

|

|

|

8.4 Internal Control.

|

Yes

|

No

|

Comments

|

|

63.

The general guidelines of internal control and, if applicable, the review to such guidelines are submitted for the approval of the Board of Directors, with the prior opinion of the intermediate body in charge of the audit? (Best Practice 33)

|

X

|

|

|

|

64.

The Board of Directors is supported to? (Best Practice 34)

|

|

|

a)

Ensure the effectiveness of the internal control.

|

X

|

|

Representatives of the internal audit department work together with the audit committee and the external auditors to analyze the effectiveness of the control system. Periodically reports are prepared and sent to the members of the audit committee in advance, prior to its meetings.

|

|

b)

Ensure the process of issuance of the financial information.

|

X

|

|

|

|

65.

The internal and external auditors: (Best Practice 35)

|

|

|

a)

Evaluate, according to their normal work plan, the effectiveness of the internal control, as well as the process of issuance of the financial information?

|

X

|

|

|

|

b)

Are the results included in the reporting letters informed and reviewed with them?

|

X

|

|

|

|

8.5 Related Parties.

|

Yes

|

No

|

Comments

|

|

66.

The intermediate body in charge of the audit supports the Board of Directors in? (Best Practice 36) ***

|

|

|

|

|

a)

The establishment of policies for transactions with related parties.

|

X

|

|

|

|

b)

The analysis of the approval process of the transactions with related parties.

|

X

|

|

|

|

c)

The analysis of engagement conditions for transactions with related parties.

|

X

|

|

|

|

67.

The intermediate body in charge of the audit assists the Board of Directors in the analysis of the proposals to carry out transactions with related parties outside of the company’s ordinary course of business? (Best Practice 37) ***

|

X

|

|

|

|

68.

The transactions with related parties outside of the ordinary course of business that may represent more than 10 per cent of the consolidated assets of the company are submitted for approval to the Shareholders’ Meeting? (Best Practice 37) ***

|

X

|

|

Our bylaws provide that any transaction with related parties must be approved by the board and only those that exceed 20% of the consolidated assets must be approved by the General Shareholders' Meeting.

|

|

Note ***: Publicly traded companies carry out these recommendations through its Corporate Practices Committee.

|

|

|

|

|

8.6 Review of compliance of provisions.

|

Yes

|

No

|

Comments

|

|

69.

The intermediate body in charge of the audit makes sure of the existence of mechanisms that allow determining if the company properly complies with applicable legal provisions? (Best Practice 38)

|

X

|

|

|

|

70.

If the answer to the above question is affirmative, describe those mechanisms.

|

|

|

a)

Due diligence.

|

|

|

|

|

b)

Reports of pending legal matters.

|

X

|

|

|

c)

Others (describe):

|

|

|

71.

At least once a year, a review of the legal situation of the company is conducted and informed to the Board of Directors? (Best Practice 38)

|

X

|

|

|

9.

Evaluation and Compensation’s Duties.

|

9.1 General Duties.

|

Yes

|

No

|

Comments

|

|

72.

The intermediate body in charge of the evaluation and compensation duties submits to the Board of Directors, for its approval, the following? (Best Practice 39)

|

|

|

|

|

a)

The criteria to appoint or remove the Chief Executive Officer and the relevant officers of the company. ***

|

X

|

|

|

|

b)

The criteria for the evaluation and compensation of the Chief Executive Officer and the relevant officers of the company. ***

|

X

|

|

|

|

c)

The criteria

to determine the severance payment for

the Chief Executive Officer and the relevant officers of the company.

|

X

|

|

|

|

d)

The criteria for the compensation of the directors

.

|

X

|

|

|

|

e)

The proposal made by the Chief Executive Officer about the structure and criteria for the compensation of the company’s personnel.

|

X

|

|

|

|

f)

The proposal to declare the company as socially responsible.

|

X

|

|

|

|

g)

The

Code of Business Conduct and Ethics

of the company.

|

X

|

|

This duty is executed by the Audit Committee

|

|

h)

The information system for illegal acts and protection of the whistle blowers.

|

X

|

|

This duty is executed by the Audit Committee

|

|

i)

The formal succession plan for the Chief Executive Officer and relevant officers, and verifies its compliance.

|

X

|

|

|

|

73.

The Chief Executive Officer and relevant officers abstain from participating in the discussions of the matters mentioned in question 72, a), b) and c) with the purpose of preventing a possible conflict of interest? (Best Practice 40)

|

X

|

|

|

Note ***: Publicly traded companies carry out these recommendations through its Corporate Practices Committee.

|

9.2 Operational Matters.

|

Yes

|

No

|

Comments

|

|

74.

In determining the compensation of the Chief Executive Officer and the relevant officers matters related to their duties, scope of their goals and evaluation of their performance are considered? (Best Practice 41)

|

X

|

|

|

|

75.

In the annual report submitted by the Board of Directors to the Shareholders’ Meeting, the policies used and the items that form part of the compensation package of the Chief Executive Officer and relevant officers of the company are disclosed? (Best Practice 42)

|

X

|

|

|

|

76.

The intermediate body in charge of the evaluation and compensation duties supports the Board of Directors in previously reviewing the employment conditions of the Chief Executive Officer and relevant officers, in order to assure that their contingent severance payments are aligned with the guidelines approved by the Board of Directors? (Best Practice 43)

|

X

|

|

|

|

77.

In order to ensure a stable succession process, the company has a formal succession plan for the Chief Executive Officer and relevant officers of the same? (Best Practice 44)

|

X

|

|

|

|

78.

If the answer to the above question is negative, explain why or select one of the following reasons:

|

|

|

a)

The Company was recently incorporated.

|

|

|

|

|

b)

The officers are young.

|

|

|

|

c)

The officers were recently hired.

|

|

|

|

d)

Not an important matter.

|

|

|

|

e)

Others: (describe)

|

|

|

|

|

|

|

|

|

10.

Finance and Planning’s Duties.

|

10.1 General Duties.

|

Yes

|

No

|

Comments

|

|

79.

The intermediate body in charge of the finance and planning duties executes the following tasks? (Best Practice 45)

|

|

|

|

|

a)

Studies and proposes to the Board of Directors the company’s strategic vision to ensure its sustainability and continuity.

|

X

|

|

|

|

b)

Analyzes and proposes general guidelines for the determination and monitoring of the company’s strategic plan.

|

X

|

|

|

|

c)

Evaluates and provides an opinion with respect to the company’s investment and finance policies proposed by the management.

|

X

|

|

|

|

d)

Provides an opinion with respect to the assumptions of the annual budget and follows up its execution, as well as its control system. (Best Practice 49)

|

X

|

|

|

|

e)

Evaluates the mechanisms presented by the senior management for the identification, analysis, management and risk control to which the company is subject. (Best Practice 50)

|

X

|

|

|

|

f)

Evaluates the criteria presented by the Chief Executive Officer for the risk disclosure to which the company is subject. (Best Practice 50)

|

X

|

|

|

|

10.2 Operational Matters.

|

Yes

|

No

|

Comments

|

|

80.

The intermediate body in charge of finance and planning duties assists the Board of Directors so that a session is addressed to define or update the long-term vision of company?: (Best Practice 46)

|

X

|

|

|

|

81.

The intermediate body in charge of finance and planning duties supports the Board of Directors in reviewing the strategic plan submitted by the senior management for approval? (Best Practice 47)

|

X

|

|

|

|

82.

The intermediate body in charge of finance and planning duties supports the Board of Directors in the analysis of the policies submitted by the Chief Executive Officer for its approval regarding? (Best Practice 48)

|

|

|

|

|

a)

The management of the treasury department.

|

X

|

|

|

|

b)

The execution of financial derivative instruments.

|

X

|

|

|

|

c)

Capital expenditures.

|

X

|

|

|

|

d)

New liabilities.

|

X

|

|

|

|

83.

Regarding the previous question the intermediate body in charge of finance and planning duties ensures that such matters are aligned with the strategic plan and that such correspond to the ordinary course of business of the company? (Best Practice 48)

|

X

|

|

|

|

84.

The Chief Executive Officer submits to the Board of Directors in each meeting a report on the situation of each of the identified risks? (Best Practice 51)

|

X

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

COCA-COLA FEMSA, S.A.B. DE C.V.

|

|

|

By:

/s/ Héctor Treviño Gutiérrez

|

|

|

Héctor Treviño Gutiérrez

Chief Financial Officer

|

|

|

|

|

Date:

May 31

, 2018

|

|

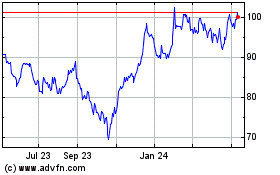

Coca Cola FEMSA SAB De CV (NYSE:KOF)

Historical Stock Chart

From Mar 2024 to Apr 2024

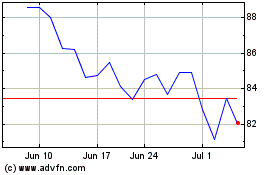

Coca Cola FEMSA SAB De CV (NYSE:KOF)

Historical Stock Chart

From Apr 2023 to Apr 2024