UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM

8-K

Current

Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 29, 2018

TriCo Bancshares

(Exact

name of registrant as specified in its charter)

|

|

|

|

|

|

|

California

|

|

0-10661

|

|

94-2792841

|

|

(State or other jurisdiction of

|

|

(Commission

|

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

File No.)

|

|

Identification No.)

|

|

|

|

|

|

|

|

63 Constitution Drive, Chico, California

|

|

95973

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (530)

898-0300

Check the appropriate box below

if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☒

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as

defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging growth company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

Item 5.07 Submission of Matters to a Vote of Security Holders.

On May 29, 2018, TriCo Bancshares, a California corporation (“TriCo” or the “Company”), held a Special Meeting of Shareholders for the

purpose of considering and acting upon the following matters:

|

1.

|

To adopt the Agreement and Plan of Merger and Reorganization, dated as of December 11, 2017, by and between TriCo and FNB Bancorp. (“FNB”), as such agreement may be amended from time to time, pursuant to

which FNB will merge with and into TriCo, with TriCo as the surviving corporation (the “merger proposal”).

|

|

2.

|

To adjourn the Special Meeting to a later date or dates, if necessary, to permit further solicitation of proxies if there are not sufficient votes at the time of the TriCo special meeting to approve the merger proposal

(the “adjournment proposal”).

|

As of April 9, 2018, the record date for the special shareholder meeting, there were

22,958,323 shares of TriCo common stock outstanding and eligible to vote. 17,455,509 shares were present and counted toward a quorum at the Special Meeting. 17,455,509 shares (or 76.03% of the shares outstanding) were voted.

TriCo’s shareholders approved the merger proposal, which required the affirmative vote of holders of at least a majority of TriCo’s outstanding

shares.

The voting results for the merger proposal, including the votes for and against, and any abstentions or broker

non-votes,

are as follows.

|

|

|

|

|

|

|

|

|

Aggregate Votes

|

|

FOR

|

|

AGAINST

|

|

ABSTENTIONS

|

|

BROKER

NON-VOTES

|

|

17,291,384

|

|

56,194

|

|

107,931

|

|

0

|

As sufficient votes were cast in favor of the merger proposal, the adjournment proposal was not acted upon at the shareholder

meeting.

Item 7.01 Regulation FD Disclosure.

On May 31, 2018, TriCo and FNB issued a joint press release announcing the approval of the merger proposal by the shareholders of each of TriCo and FNB at

the respective special shareholder meetings of each company, both held on May 29, 2018, and the receipt of regulatory approval from the Federal Deposit Insurance Corporation for the proposed merger of their subsidiary banks (Tri Counties Bank

and First National Bank of Northern California). The transaction remains subject to receipt of all required regulatory approvals and satisfaction of customary closing conditions, and is expected to close in the third quarter of 2018.

A copy of the press release is being furnished as Exhibit 99.1 to this report and is incorporated by reference

under this Item 7.01. The information in Items 7.01 and 9.01 of this report (including Exhibits 99.1 hereto) is being “furnished” and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act

of 1934, as amended, is not subject to the liabilities of that section and is not deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as shall be

expressly set forth by specific reference in such a filing.

On May 31, 2018, TriCo and FNB issued a joint press release announcing the

receipt of regulatory approval from the Federal Deposit Insurance Corporation for the proposed merger of their subsidiary banks (Tri Counties Bank and First National Bank of Northern California). The joint press release, which also

announces the approval by shareholders of the merger proposal, is attached to this Current Report on

Form 8-K

as Exhibit 99.1 and is incorporated herein by reference.

Cautionary Statements Regarding Forward-Looking Information

Certain statements contained in this report which are not statements of historical fact constitute forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, certain plans, expectations, goals, projections and benefits relating to the transaction between the Company and FNB, which are subject to numerous

assumptions, risks and uncertainties. Words such as ‘‘believes,’’ ‘‘anticipates,’’ “likely,” “expected,” “estimated,” ‘‘intends’’ and other similar expressions

are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Please refer to each of the Company’s and FNB’s Annual Report on Form

10-K

for the

year ended December 31, 2017, as well as their other filings with the SEC, for a more detailed discussion of risks, uncertainties and factors that could cause actual results to differ from those discussed in the forward-looking statements.

Forward-looking statements are not historical facts but instead express only management’s beliefs regarding future results or events, many of which, by

their nature, are inherently uncertain and outside of the management’s control. It is possible that actual results and outcomes may differ, possibly materially, from the anticipated results or outcomes indicated in these forward-looking

statements. In addition to factors previously disclosed in reports filed by the Company and FNB with the SEC, risks and uncertainties for the Company, FNB and the combined company include, but are not limited to: the possibility that any of the

anticipated benefits of the proposed merger will not be realized or will not be realized within the expected time period; the risk that integration of FNB’s operations with those of the Company will be materially delayed or will be more costly

or difficult than expected; the inability to close the merger in a timely manner; diversion of management’s attention from ongoing business operations and opportunities; the failure to satisfy other conditions to complete the merger, including

receipt of required regulatory and other approvals; the failure of the proposed merger to close for any other reason; the challenges of integrating and retaining key employees; the effect of the announcement of the merger on the Company’s,

FNB’s or the combined company’s respective customer relationships and operating results; the possibility that the merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events; and general

competitive, economic, political and market conditions and fluctuations.

All forward-looking statements included in this filing are made as of the date hereof and are based on information available at the time of the filing. Except as required by law, neither the

Company nor FNB assumes any obligation to update any forward- looking statement.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d)

Exhibits.

The following exhibit is being filed herewith:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: May 31, 2018

|

|

|

|

TRICO BANCSHARES

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Richard P. Smith

|

|

|

|

|

|

|

|

Richard P. Smith

|

|

|

|

|

|

|

|

President, Chief Executive Officer

|

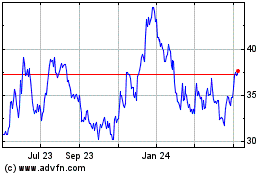

TriCo Bancshares (NASDAQ:TCBK)

Historical Stock Chart

From Mar 2024 to Apr 2024

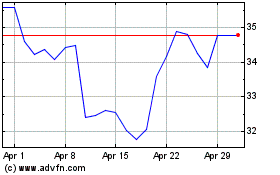

TriCo Bancshares (NASDAQ:TCBK)

Historical Stock Chart

From Apr 2023 to Apr 2024