Current Report Filing (8-k)

May 30 2018 - 5:20PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

Current

Report

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): May 21, 2018

hopTo

Inc.

(Exact

Name of Registrant as Specified in Charter)

|

Delaware

|

|

0-21683

|

|

13-3899021

|

(State

or Other Jurisdiction

of Incorporation)

|

|

Commission

File Number

|

|

(IRS

Employer

Identification No.)

|

|

6

Loudon Road, Suite 200

|

|

|

|

Concord,

NH

|

|

03301

|

|

(Address

of Principal Executive Offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (800) 472-7466

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (

see

General Instruction A.2. below):

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR

§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

1.01 Entry into a Material Definitive Agreement.

Exchange

Transaction

Consistent

with its prior disclosures in its annual report on Form 10-K, on May 21, 2018, hopTo Inc. (the “Company”) entered

into an Exchange Agreement (the “Exchange Agreement”) with certain holders (the “Holders”) of existing

warrants originally issued on June 17, 2013 and January 7, 2014 (the “Existing Warrants”) to purchase shares of the

Company’s common stock, par value $0.0001 per share (the “Common Stock”). The Existing Warrants were exercisable

for an aggregate of 564,556 shares of the Company’s Common stock and have a weighted average exercise price of approximately

$10.77.

Pursuant

to the Exchange Agreement, the Company agreed to exchange the Existing Warrants held by the Holders for new warrants exercisable

for an aggregate 564,556 shares of the Company’s Common Stock, having an exercise price of $0.01 per share and a five year

term (the “New Warrants”). The Exchange Agreement provides for a full release of all claims by the Holders related

to damages (including liquidated damages) related to alleged failures by the Company to file or maintain certain registration

statements, and also includes representations and warranties, covenants and conditions customary in agreements of this type. The

transactions contemplated by the Exchange Agreement closed on May 21, 2018. Accordingly, the Existing Warrants have been

canceled and the New Warrants issued to the Holders.

The

foregoing descriptions of the Exchange Agreement and the New Warrants are qualified entirely by reference to the Exchange Agreement

and the Form of Warrant, which are attached hereto as Exhibits 10.1 and 4.1, respectively.

The

New Warrants issued pursuant to the Exchange Agreement were, in each case, exchanged pursuant to exemptions from the registration

requirements afforded by Section 3(a)(9) and/or Section 4(a)(2) of the Securities Act of 1933, as amended, and/or Regulation D

promulgated thereunder.

Registration

Rights Agreement

On

May 21, 2018, in connection with the Exchange Agreement, the Company entered into a Registration Rights Agreement (the

“Registration Rights Agreement”) with the Holders pursuant to which, among other things, the Company agreed to file

a registration statement to register for resale the shares of Common Stock issuable upon the exercise of the New Warrants. The

Company is required to cause the registration statement to be declared effective under the 1933 Act as soon as practicable. The

Company also agreed, among other things, to indemnify the investors under the registration statement from certain liability and

to pay all fees and expenses incident to the Company’s performance of or compliance with the Registration Rights Agreement.

The

foregoing description of the Registration Rights Agreement is qualified in its entirety by reference to the Registration Rights

Agreement, which is attached hereto as Exhibit 4.2.

Item

3.02 Unregistered Sales of Equity Securities.

The

information relating to the exchange of securities pursuant to the Exchange Agreement disclosed in Item 1.01 of this Current Report

on Form 8-K is incorporated by reference into this Item 3.02.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits. The following exhibits are being filed with this report:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf

by the undersigned thereunto duly authorized.

|

|

hopTo

Inc.

|

|

|

|

|

|

Dated:

May 30, 2018

|

By:

|

/s/

Jean-Louis Casabonne

|

|

|

|

Jean-Louis

Casabonne

|

|

|

|

Interim

Chief Executive Officer, Chief Financial Officer, Secretary

|

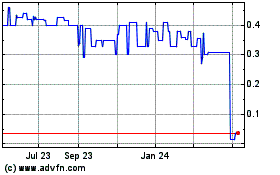

hopTo (CE) (USOTC:HPTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

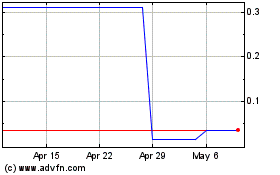

hopTo (CE) (USOTC:HPTO)

Historical Stock Chart

From Apr 2023 to Apr 2024