Q1 Fiscal 2019

Revenues Increased 15% to $521 Million; Increased 8% in Constant

Currency

Q1 Fiscal 2019 GAAP

Net Loss Per Share of $0.27, Compared to $0.26 in Q1 Fiscal 2018;

Q1 Fiscal 2019 Adjusted Loss Per Share of $0.23, Compared to $0.24

in Q1 Fiscal 2018

Guess?, Inc. (NYSE: GES) today reported financial results for

its first quarter ended May 5, 2018.

Victor Herrero, Chief Executive Officer, commented, “I am

pleased to report that our first quarter results finished above the

high-end of our expectations for revenues, adjusted operating

margin and adjusted earnings per share. Overall, the Company

revenues increased 15% in U.S. dollars and 8% in constant currency,

driven by continued momentum in Europe and Asia. We were also able

to expand the Company’s operating margin, despite cost pressures

related to our transition to our new distribution center in Europe.

Operating margin in Asia improved by 430 basis points as we

continue to leverage our infrastructure investments in China and

Japan. Turning to the Americas, I am especially proud of the work

that has been accomplished in retail where we ended the quarter

with positive comps while being significantly less promotional.

This translated into a 910 basis point improvement in operating

margin for the Americas Retail segment.”

Mr. Herrero concluded, “Overall, I am very excited by the

continued momentum, as the first quarter marks the seventh

consecutive quarter of revenue growth for the Company. For me, it

speaks to the global strength and potential of the Guess brand.

More than ever, we remain focused on executing our strategic

initiatives that have been the pillars of our revenue and profit

growth.”

This press release contains certain non-GAAP, or adjusted,

financial measures. References to “adjusted” results exclude the

impact of (i) net gains on lease terminations, (ii) asset

impairment charges, (iii) certain professional service and legal

fees and related costs and (iv) the related tax effects of these

adjustments, where applicable. A reconciliation of reported GAAP

results to comparable non-GAAP results is provided in the

accompanying tables and discussed under the heading “Presentation

of Non-GAAP Information” below.

First Quarter Fiscal 2019

Results

For the first quarter of fiscal 2019, the Company recorded GAAP

net loss of $21.2 million, a 0.3% improvement compared to $21.3

million for the first quarter of fiscal 2018. GAAP diluted loss per

share deteriorated 3.8% to $0.27 for the first quarter of fiscal

2019, from $0.26 for the prior-year quarter. The Company estimates

that currency had a negative impact on diluted loss per share of

$0.03 in the first quarter of fiscal 2019.

For the first quarter of fiscal 2019, the Company recorded

adjusted net loss of $17.8 million, a 7.9% improvement compared to

$19.4 million for the first quarter of fiscal 2018. Adjusted

diluted loss per share improved 4.2% to $0.23, compared to $0.24

for the prior-year quarter.

Net Revenue. Total net revenue for the first quarter of

fiscal 2019 increased 14.7% to $521.3 million, compared to $454.3

million in the prior-year quarter. In constant currency, net

revenue increased by 7.7%.

- Americas Retail revenues decreased 1.4%

in U.S. dollars and 2.1% in constant currency. Retail comp sales

including e-commerce increased 2% in U.S. dollars and 1% in

constant currency.

- Americas Wholesale revenues increased

13.4% in U.S. dollars and 11.3% in constant currency.

- Europe revenues increased 24.2% in U.S.

dollars and 9.1% in constant currency. Retail comp sales including

e-commerce increased 15% in U.S. dollars and 1% in constant

currency.

- Asia revenues increased 32.6% in U.S.

dollars and 25.1% in constant currency. Retail comp sales including

e-commerce increased 22% in U.S. dollars and 15% in constant

currency.

- Licensing revenues increased 23.5% in

U.S. dollars and constant currency.

Operating Loss. GAAP operating loss for the first quarter

of fiscal 2019 improved 0.3% to $24.9 million (including a $4.0

million unfavorable currency translation impact), compared to $25.0

million in the prior-year quarter. GAAP operating margin in the

first quarter improved 70 basis points to negative 4.8%, compared

to negative 5.5% in the prior-year quarter, driven primarily by

segment mix and lower markdowns in Americas Retail, partially

offset by higher distribution costs resulting from the relocation

of the Company’s European distribution center and certain

professional service and legal fees and related costs. The negative

impact of currency on operating margin for the quarter was

approximately 30 basis points.

For the first quarter of fiscal 2019, adjusted operating loss

improved 7.8% to $20.5 million, compared to $22.2 million in the

same prior-year quarter. Adjusted operating margin was negative

3.9%, an improvement of 100 basis points compared to the same

prior-year quarter, driven primarily by segment mix and lower

markdowns in Americas Retail, partially offset by higher

distribution costs resulting from the relocation of the Company’s

European distribution center.

- Operating margin for the Company’s

Americas Retail segment improved 910 basis points to negative 3.3%

in the first quarter of fiscal 2019, compared to negative 12.4% in

the prior-year quarter, driven primarily by the favorable impact

from lower markdowns, negotiated rent reductions and higher initial

markups.

- Operating margin for the Company’s

Americas Wholesale segment decreased 470 basis points to 14.8% in

the first quarter of fiscal 2019, from 19.5% in the prior-year

quarter, due primarily to lower gross margins.

- Operating margin for the Company’s

Europe segment decreased 930 basis points to negative 9.9% in the

first quarter of fiscal 2019, from negative 0.6% in the prior-year

quarter, driven primarily by higher distribution costs resulting

from the relocation of the Company’s European distribution

center.

- Operating margin for the Company’s Asia

segment increased 430 basis points to 4.8% in the first quarter of

fiscal 2019, compared to 0.5% in the prior-year quarter, driven

primarily by higher gross margins due mainly to overall leveraging

of expenses and higher overall product margins driven primarily by

product mix.

- Operating margin for the Company’s

Licensing segment increased 440 basis points to 88.4% in the first

quarter of fiscal 2019, compared to 84.0% in the prior-year

quarter.

Other net expense was $2.6 million for the first quarter of

fiscal 2019, which primarily includes net unrealized mark-to-market

revaluation losses on foreign currency balances and unrealized

losses on non-operating assets, partially offset by net unrealized

mark-to-market revaluation gains on foreign exchange currency

contracts, compared to other net income of $1.9 million in the

prior-year quarter.

Segment Reclassifications

During the first quarter of fiscal 2019, the Company changed the

segment accountability for funds received from licensees on the

Company’s purchases of its licensed products. These amounts were

treated as a reduction of cost of product sales within the

Licensing segment but now are considered in the results of the

segments that control the respective purchases for purposes of

segment performance evaluation. This change is consistent with how

the management team now evaluates overall business strategy,

allocates resources and assesses performance of the Company. There

has been no change to total segment earnings (loss) from operations

as a result of this reclassification. This reclassification

increased the segment quarterly operating profits for fiscal 2018

by approximately $2 million for Americas Retail; minimal for

Americas Wholesale; $2 million for Europe; minimal for Asia and

reduced Licensing by approximately $5 million per quarter.

In addition, during the first quarter of fiscal 2019, the

Company adopted new authoritative guidance which requires that the

non-service components of net periodic defined benefit pension cost

be presented outside of earnings (loss) from operations. This

guidance required retrospective adoption, and as a result, the

Company reclassified approximately $0.5 million in total costs from

earnings (loss) from operations per quarter from within the Europe

and Asia segments and corporate overhead into other income

(expense).

For comparative purposes, segment earnings (loss) from

operations for each of the quarters in fiscal 2018 have been

restated to conform to the current presentation and are presented

below (in thousands):

Three Months Ended

Year Ended

April 29, 2017

July 29, 2017

October 28, 2017

February 3, 2018

February 3, 2018

Earnings (loss) from operations: Americas Retail $ (21,581 ) $

(3,555 ) $ (2,414 ) $ 16,454 $ (11,096 ) Americas Wholesale 6,983

5,238 8,562 5,062 25,845 Europe (1,006 ) 30,058 9,095 56,398 94,545

Asia 339 2,441 2,954 9,075 14,809 Licensing 13,461 14,389

18,347 17,341 63,538 Total segment

earnings (loss) from operations (1,804 ) 48,571 36,544 104,330

187,641 Corporate overhead (20,409 ) (23,551 ) (23,443 ) (33,031 )

(100,434 ) Net gains (losses) on lease terminations — — (11,494 )

121 (11,373 ) Asset impairment charges (2,762 ) (1,233 ) (2,018 )

(2,466 ) (8,479 ) Total earnings (loss) from operations $ (24,975 )

$ 23,787 $ (411 ) $ 68,954 $ 67,355

Impact from Adoption of New Revenue Recognition

Standard

The Company also adopted a comprehensive new revenue recognition

standard during the first quarter of fiscal 2019 under a modified

retrospective method that does not restate prior periods to be

comparable to the current period presentation. The adoption of this

guidance primarily impacted the presentation of advertising

contributions received from the Company’s licensees and the related

advertising expenditures incurred by the Company. Under previous

guidance, the Company recorded advertising contributions received

from its licensees and the related advertising expenditures

incurred by the Company on a net basis in its consolidated balance

sheet. To the extent that the advertising contributions exceeded

the Company’s advertising expenditures for its licensees, the

excess contribution was treated as a deferred liability and was

included in accrued expenses in the Company’s consolidated balance

sheet. Under the new revenue recognition standard, advertising

contributions and related advertising expenditures related to the

Company’s licensing business are recorded on a gross basis. This

resulted in an increase in net royalty revenue within the Company’s

Licensing segment of approximately $2.3 million for the quarter, as

well as an increase in selling, general and administrative expenses

in our Licensing, Americas Retail and Americas Wholesale segments

and corporate overhead of $0.2 million, $1.8 million, $0.7 million

and $0.6 million, respectively during the three months ended

May 5, 2018 compared to the same prior-year period. The net

impact was approximately $1.0 million reduction in earnings (loss)

from operations for the three months ended May 5, 2018.

Dividends

The Company’s Board of Directors has approved a quarterly cash

dividend of $0.225 per share on the Company’s common stock. The

dividend will be payable on June 29, 2018 to shareholders of

record at the close of business on June 13, 2018.

Outlook

The Company’s expectations for the second quarter ending

August 4, 2018 and its updated outlook for the fiscal year

ending February 2, 2019 are as follows:

Outlook for Total Company1 Second

Quarter of Fiscal 2019 Fiscal Year 2019

Consolidated net revenue in U.S. dollars increase between 14.0% and

15.5% increase between 8.5% and 9.5% Consolidated net

revenue in constant currency2 increase between 11.0% and 12.5%

increase between 6.5% and 7.5% GAAP operating margin 5.0% to

5.5% 4.1% to 4.5% Adjusted operating margin3 5.0% to 5.5%

4.2% to 4.6% Currency impact included in operating margin4

60 basis points 10 basis points GAAP EPS $0.27 to $0.30

$0.84 to $0.95 Adjusted EPS3 $0.27 to $0.30 $0.88 to $0.99

Currency impact included in EPS4 $0.08 $0.10 Notes:

1The Company’s outlook for the second

quarter ending August 4, 2018 and the fiscal year ending February

2, 2019 assumes that foreign currency exchange rates remain at

prevailing rates.

2Eliminates the impact of expected foreign

currency translation to give investors a better understanding of

the underlying trends within the business.

3The adjusted operating margin and

adjusted EPS guidance for the fiscal year 2019 reflect the

exclusion of certain items which the Company believes are not

indicative of the underlying performance of its business. Refer to

the table below for a reconciliation of our GAAP and adjusted

outlook.

4Represents the estimated translational

and transactional gains (losses) of foreign currency rate

fluctuations within operating margin and EPS measures

presented.

A reconciliation of the Company’s outlook for GAAP operating

margin to adjusted operating margin and GAAP earnings per share to

adjusted earnings per share for the second quarter ending

August 4, 2018 and the fiscal year ending February 2,

2019 is as follows:

Reconciliation of GAAP Outlook to Adjusted Outlook

Second Quarter of Fiscal 2019 Fiscal Year 2019

GAAP operating margin 5.0% to 5.5% 4.1% to 4.5% Net gains on

lease terminations1 — 0.0% Asset impairment charges2 — 0.0% Certain

professional service and legal fees and related costs3 — 0.1%

Adjusted operating margin 5.0% to 5.5% 4.2% to 4.6%

GAAP earnings per share $0.27 to $0.30 $0.84 to $0.95 Net gains on

lease terminations1 — $0.00 Asset impairment charges2 — $0.01

Certain professional service and legal fees and related costs3 —

$0.03 Adjusted earnings per share $0.27 to $0.30 $0.88 to

$0.99 Notes:

1Amounts for the full fiscal year include

net gains on lease terminations recorded during the first quarter

of fiscal 2019 related primarily to the early termination of

certain lease agreements in North America. The adjusted results do

not assume any additional gains (losses) from lease terminations as

the timing and exact amount of any future charges, if any, are not

known.

2Amounts for the full fiscal year include

asset impairment charges for certain retail locations recognized

during the first quarter of fiscal 2019 that resulted from store

under-performance and expected store closures. The adjusted results

do not assume any additional asset impairment charges as the

Company has recorded amounts currently anticipated under GAAP.

3Amounts for the full fiscal year include

certain professional service and legal fees and related costs

recognized during the first quarter of fiscal 2019 which the

Company otherwise would not have incurred as part of its business

operations. The Company is unable to predict future amounts as

these expenditures are inconsistent in amount and frequency and

certain elements used to estimate such items have not yet occurred

or are out of the Company’s control. As such, the Company has not

considered any future charges in the accompanying GAAP outlook.

On a segment basis, the Company expects the following ranges for

percentage changes for comparable sales including e-commerce

(“comps”) and net revenue in U.S. dollars and constant currency

compared to the same prior-year period:

Outlook by Segment1

Second Quarter of Fiscal 2019 Fiscal Year 2019

U.S. Dollars Constant Currency2 U.S. Dollars Constant Currency2

Americas Retail: Comps __ flat to up LSD __ down LSD to up

LSD Net Revenue down LSD down LSD down MSD to LSD down MSD

to LSD Americas Wholesale: Net Revenue up MSD up MSD up MSD

up MSD Europe: Comps __ up LSD __ up LSD Net Revenue

up mid-twenties up low-twenties up mid-teens up low-teens

Asia: Comps __ up low-teens to mid-teens __ up mid-teens Net

Revenue up low thirties up mid-twenties up mid-twenties up

low-twenties Licensing: Net Revenue3 up HSD __ up MSD __

Notes:

1As used in the table above, “LSD” is used

to refer to the range of Low-Single-Digits, “MSD” is used to refer

to the range of Mid-Single-Digits, “HSD” is used to refer to the

range of High-Single-Digits, and “LDD” is used to refer to the

range of Low-Double-Digits.

2Eliminates the impact of expected foreign

currency translation to give investors a better understanding of

the underlying trends within the business.

3Our outlook includes the impacts of

changes resulting from the prospective adoption of the revenue

accounting standard in the first quarter of fiscal 2019. Excluding

this impact, our guidance for Licensing net revenue would have been

down in the low-single digits in the second quarter of fiscal 2019

and down in the mid-single digits for fiscal year 2019.

Presentation of Non-GAAP

Information

The financial information presented in this release includes

non-GAAP financial measures such as adjusted results, constant

currency financial information and free cash flow measures. For the

three months ended May 5, 2018, the adjusted results exclude

the impact of net gains on lease terminations, asset impairment

charges, certain professional service and legal fees and related

costs, and the tax effects of these adjustments, where applicable.

For the three months ended April 29, 2017, the adjusted results

exclude the impact of asset impairment charges and the related tax

impact, where applicable. These non-GAAP measures are provided in

addition to, and not as alternatives for, the Company’s reported

GAAP results.

The Company has excluded these items from its adjusted financial

measures primarily because it believes these items are not

indicative of the underlying performance of its business and that

the adjusted financial information provided is useful for investors

to evaluate the comparability of the Company’s operating results

and its future outlook (when reviewed in conjunction with the

Company’s GAAP financial statements). A reconciliation of reported

GAAP results to comparable non-GAAP results is provided in the

accompanying tables.

This release also includes certain constant currency financial

information. Foreign currency exchange rate fluctuations affect the

amount reported from translating the Company’s foreign revenue,

expenses and balance sheet amounts into U.S. dollars. These rate

fluctuations can have a significant effect on reported operating

results under GAAP. The Company provides constant currency

information to enhance the visibility of underlying business

trends, excluding the effects of changes in foreign currency

translation rates. To calculate net revenue, comparable sales and

earnings (loss) from operations on a constant currency basis,

actual or forecasted results for the current-year period are

translated into U.S. dollars at the average exchange rates in

effect during the comparable period of the prior year. The constant

currency calculations do not adjust for the impact of revaluing

specific transactions denominated in a currency that is different

to the functional currency of that entity when exchange rates

fluctuate. However, in calculating the estimated impact of currency

on our earnings (loss) per share for our actual and forecasted

results, the Company estimates gross margin (including the impact

of merchandise-related hedges) and expenses using the appropriate

prior-year rates, translates the estimated foreign earnings at the

comparable prior-year rates, and excludes the year-over-year

earnings impact of gains or losses arising from balance sheet

remeasurement and foreign currency contracts not designated as

merchandise hedges. The constant currency information presented may

not be comparable to similarly titled measures reported by other

companies.

The Company also includes information regarding its free cash

flows in this release. The Company calculates free cash flows as

cash flows from operating activities less (i) purchases of property

and equipment and (ii) payments for property and equipment under

capital leases. Free cash flows is not intended to be an

alternative to cash flows from operating activities as a measure of

liquidity, but rather provides additional visibility to investors

regarding how much cash is generated for discretionary and

non-discretionary items after deducting purchases of property and

equipment and payments for property and equipment under capital

leases. Free cash flow information presented may not be comparable

to similarly titled measures reported by other companies. A

reconciliation of reported GAAP cash flows from operating

activities to the comparable non-GAAP free cash flow measure is

provided in the accompanying tables.

Investor Conference Call

The Company will hold a conference call at 4:45 pm (ET) on

May 30, 2018 to discuss the news announced in this press

release. A live webcast of the conference call will be accessible

at www.guess.com via the “Investor

Relations” link. The webcast will be archived on the website for 30

days.

About Guess?

Guess?, Inc. designs, markets, distributes and licenses a

lifestyle collection of contemporary apparel, denim, handbags,

watches, footwear and other related consumer products. Guess?

products are distributed through branded Guess? stores as well as

better department and specialty stores around the world. As of

May 5, 2018, the Company directly operated 1,020 retail stores

in the Americas, Europe and Asia. The Company’s licensees and

distributors operated 624 additional retail stores worldwide. As of

May 5, 2018, the Company and its licensees and distributors

operated in approximately 100 countries worldwide. For more

information about the Company, please visit www.guess.com.

Forward-Looking

Statements

Except for historical information contained herein, certain

matters discussed in this press release or the related conference

call and webcast, including statements concerning the Company’s

expectations, future prospects, business strategies and strategic

initiatives; statements expressing optimism or pessimism about

future operating results or events and projected sales (including

comparable sales), earnings, capital expenditures, operating

margins, cost savings and cash needs; and guidance for the second

quarter and full year of fiscal 2019, are forward-looking

statements that are made pursuant to the safe harbor provisions of

the Private Securities Litigation Reform Act of 1995.

Forward-looking statements, which are frequently indicated by terms

such as “expect,” “will,” “should,” “goal,” “strategy,” “believe,”

“estimate,” “continue,” “outlook,” “plan” and similar terms, are

only expectations, and involve known and unknown risks and

uncertainties, which may cause actual results in future periods to

differ materially from what is currently anticipated. Factors which

may cause actual results in future periods to differ materially

from current expectations include, among others: our ability to

maintain our brand image and reputation; domestic and international

economic conditions, including economic and other events that could

negatively impact consumer confidence and discretionary consumer

spending; changes in the competitive marketplace and in our

commercial relationships; our ability to anticipate and adapt to

changing consumer preferences and trends; our ability to manage our

inventory commensurate with customer demand; risks related to the

timing and costs of delivering merchandise to our stores and our

wholesale customers; unexpected or unseasonable weather conditions;

our ability to effectively operate our various retail concepts,

including securing, renewing, modifying or terminating leases for

store locations; our ability to successfully and/or timely

implement our growth strategies and other strategic initiatives;

our ability to expand internationally and operate in regions where

we have less experience, including through joint ventures; our

ability to successfully or timely implement plans for cost

reductions; our ability to complete the transfer of our European

distribution center without incurring additional shipment delays

and/or increased costs; our ability to attract and retain key

personnel; changes to our short or long-term strategic initiatives;

obligations arising from new or existing litigation, tax and other

regulatory proceedings (including the European Commission

proceeding initiated during the second quarter of fiscal 2018 to

investigate whether the Company breached certain European Union

competition rules); risks related to the complexity of the Tax

Reform and our ability to accurately interpret and predict its

impact on our cash flows and financial condition; significant

changes in our provisional estimates of the Tax Reform, changes in

U.S. or foreign tax or tariff policy including with respect to

apparel and other accessory merchandise; accounting adjustments

identified after issuance of this release; risk of future store

asset and/or goodwill impairments or restructuring charges; our

ability to adapt to new regulatory compliance and disclosure

obligations; risks associated with our foreign operations, such as

violations of laws prohibiting improper payments and the burdens of

complying with a variety of foreign laws and regulations (including

global data privacy regulations); risks associated with the acts or

omissions of our third party vendors, including a failure to comply

with our vendor code of conduct or other policies; risks associated

with cyber attacks and other cyber security risks; and changes in

economic, political, social and other conditions affecting our

foreign operations and sourcing, including the impact of currency

fluctuations, global tax rates and economic and market conditions

in the various countries in which we operate. In addition to these

factors, the economic, technological, managerial, and other risks

identified in the Company’s most recent annual report on Form 10-K

and other filings with the Securities and Exchange Commission,

including but not limited to the risk factors discussed therein,

could cause actual results to differ materially from current

expectations. The current global economic climate and uncertainty

surrounding potential changes in U.S. policies and regulations

under the new administration may amplify many of these risks. The

Company undertakes no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Guess?, Inc. and Subsidiaries Condensed Consolidated

Statements of Loss (amounts in thousands, except per share

data)

Three Months

Ended May 5, 2018 April 29, 2017 $

% $ %1 Product sales $

501,505 96.2 % $ 438,320 96.5 % Net royalties1 19,784 3.8 %

16,025 3.5 % Net revenue1 521,289 100.0 % 454,345 100.0 %

Cost of product sales1 347,351 66.6 % 309,703

68.2 % Gross profit 173,938 33.4 % 144,642 31.8 %

Selling, general and administrative expenses2 198,219 38.0 %

166,855 36.7 % Net gains on lease terminations (152 ) (0.0 %) — 0.0

%

Asset impairment charges

759 0.2 % 2,762 0.6 % Loss from operations2

(24,888 ) (4.8 %) (24,975 ) (5.5 %) Other income (expense):

Interest expense (739 ) (0.1 %) (414 ) (0.1 %) Interest income 977

0.2 % 871 0.2 % Other income (expense), net2 (2,614 ) (0.5 %) 1,888

0.4 % Loss before income tax benefit (27,264 ) (5.2

%) (22,630 ) (5.0 %) Income tax benefit (6,277 ) (1.2 %)

(1,403 ) (0.3 %) Net loss (20,987 ) (4.0 %) (21,227 ) (4.7

%) Net earnings attributable to noncontrolling interests 234

0.1 % 66 0.0 % Net loss attributable to

Guess?, Inc. $ (21,221 ) (4.1 %) $ (21,293 ) (4.7 %) Net

loss per common share attributable to common stockholders:

Basic $ (0.27 ) $ (0.26 ) Diluted $ (0.27 ) $ (0.26 )

Weighted average common shares outstanding attributable to common

stockholders: Basic 79,901 83,010 Diluted 79,901 83,010

Effective tax rate 23.0 % 6.2 % Adjusted selling,

general and administrative expenses2,3: $ 194,410 37.3 % $ 166,855

36.7 % Adjusted loss from operations2,3: $ (20,472 ) (3.9 %)

$ (22,213 ) (4.9 %) Adjusted net loss attributable to

Guess?, Inc.3: $ (17,831 ) (3.4 %) $ (19,351 ) (4.3 %)

Adjusted diluted loss per common share attributable to common

stockholders3: $ (0.23 ) $ (0.24 ) Adjusted effective tax

rate3: 23.0 % 2.9 % Notes:

1During the fourth quarter of fiscal 2018,

the Company reclassified net royalties received on the Company’s

inventory purchases of licensed product from net revenue to cost of

product sales to reflect its treatment as a reduction of the cost

of such licensed product. Accordingly, amounts related to net

royalties, net revenue and cost of product sales for the three

months ended April 29, 2017 have been adjusted to conform to the

current period presentation. This reclassification had no impact on

previously reported loss from operations, net loss or net loss per

share.

2During the first quarter of fiscal 2019,

the Company adopted new authoritative guidance which requires that

the non-service components of net periodic defined benefit pension

cost be presented outside of earnings (loss) from operations.

Accordingly, the Company reclassified approximately $0.5 million

from selling, general and administrative expenses to other income

(expense), net for the three months ended April 29, 2017 to conform

to the current period presentation. This reclassification had no

impact on previously reported net loss or net loss per share.

3The adjusted results for the three months

ended May 5, 2018 reflect the exclusion of net gains on lease

terminations, asset impairment charges, certain professional

service and legal fees and related costs, and the related tax

impacts that were recorded, where applicable. The adjusted results

for the three months ended April 29, 2017 reflect the exclusion of

asset impairment charges and the related tax impact, where

applicable. A complete reconciliation of actual results to adjusted

results is presented in the table entitled “Reconciliation of GAAP

Results to Adjusted Results.”

Guess?, Inc. and Subsidiaries Reconciliation of

GAAP Results to Adjusted Results (dollars in thousands)

The following table provides

reconciliations of reported GAAP selling, general and

administrative expenses to adjusted selling, general and

administrative expenses, reported GAAP loss from operations to

adjusted loss from operations, reported GAAP net loss attributable

to Guess?, Inc. to adjusted net loss attributable to Guess?, Inc.

and reported GAAP income tax benefit to adjusted income tax benefit

for the three months ended May 5, 2018 and April 29, 2017.

Three Months Ended May 5, 2018 April 29, 2017

$

% of Net

Revenue

$

% of Net

Revenue1

Reported GAAP selling, general and administrative expenses $

198,219 38.0 % $ 166,855 36.7 % Certain professional service and

legal fees and related costs2 (3,809 ) —

Adjusted

selling, general and administrative expenses $

194,410 37.3 % $ 166,855

36.7 % Reported GAAP loss from

operations $ (24,888 ) (4.8 %) $ (24,975 ) (5.5 %) Net gains on

lease terminations3 (152 ) — Asset impairment charges4 759 2,762

Certain professional service and legal fees and related costs2

3,809 —

Adjusted loss from operations

$ (20,472 ) (3.9 %) $

(22,213 ) (4.9 %) Reported GAAP

net loss attributable to Guess?, Inc. $ (21,221 ) (4.1 %) $ (21,293

) (4.7 %) Net gains on lease terminations3 (152 ) — Asset

impairment charges4 759 2,762 Certain professional service and

legal fees and related costs2 3,809 — Income tax adjustments5

(1,026 ) (820 ) Total adjustments affecting net loss

attributable to Guess?, Inc. 3,390 1,942

Adjusted net loss attributable to Guess?, Inc. $

(17,831 ) (3.4 %) $

(19,351 ) (4.3 %)

Reported GAAP income tax benefit $ (6,277 ) $ (1,403 ) Income tax

adjustments5 1,026 820

Adjusted income tax

benefit $ (5,251 ) $ (583

) Adjusted effective tax rate 23.0

% 2.9 % Notes:

1During the fourth quarter of fiscal 2018,

the Company reclassified net royalties received on the Company’s

inventory purchases of licensed product from net revenue to cost of

product sales to reflect its treatment as a reduction of the cost

of such licensed product. Accordingly, operating results as a

percentage of net revenue for the three months ended April 29, 2017

have been adjusted to conform to the current period

presentation.

2During the three months ended May 5,

2018, the Company recorded certain professional service and legal

fees and related costs, which it otherwise would not have incurred

as part of its business operations.

3During the three months ended May 5,

2018, the Company recorded net gains on lease terminations related

primarily to the early termination of certain lease agreements in

North America.

4During the three months ended May 5, 2018

and April 29, 2017, the Company recognized asset impairment charges

for certain retail locations resulting from under-performance and

expected store closures.

5The income tax effect of the net gains on

lease terminations, asset impairment charges and certain

professional service and legal fees and related costs was based on

the Company’s assessment of deductibility using the statutory tax

rate (inclusive of the impact of valuation allowances) of the tax

jurisdiction in which the charges were incurred.

Guess?, Inc. and Subsidiaries Consolidated Segment

Data (dollars in thousands)

Three Months Ended May 5,

April 29, % 2018 2017 change

Net revenue: Americas Retail $ 171,340 $ 173,694 (1%)

Americas Wholesale 40,679 35,857 13% Europe 205,435 165,388 24%

Asia 84,051 63,381 33% Licensing1 19,784 16,025 23%

Total net revenue1 $ 521,289 $ 454,345 15%

Earnings (loss) from operations: Americas Retail2,3 $ (5,680

) $ (21,581 ) 74% Americas Wholesale2,3 6,026 6,983 (14%)

Europe2,3,4 (20,333 ) (1,006 ) (1,921%) Asia2,3 4,065 339 1,099%

Licensing2,3 17,486 13,461 30% Total segment earnings

(loss) from operations4 1,564 (1,804 ) 187% Corporate

overhead2,4 (25,845 ) (20,409 ) 27% Net gains on lease

terminations2 152 — Asset impairment charges2 (759 ) (2,762 ) Total

loss from operations4 $ (24,888 ) $ (24,975 ) 0%

Operating margins: Americas Retail2,3 (3.3 %) (12.4 %) Americas

Wholesale2,3 14.8 % 19.5 % Europe2,3,4 (9.9 %) (0.6 %) Asia2,3 4.8

% 0.5 % Licensing1,2,3 88.4 % 84.0 % GAAP operating margin

for total Company1,4 (4.8 %) (5.5 %) Net gains on lease

terminations2 (0.0 %) 0.0 % Asset impairment charges2 0.2 % 0.6 %

Certain professional service and legal fees and related costs 0.7 %

0.0 % Adjusted operating margin for total Company1,4 (3.9 %) (4.9

%) Notes:

1During the fourth quarter of fiscal 2018,

the Company reclassified net royalties received on the Company’s

inventory purchases of licensed product from net revenue to cost of

product sales to reflect its treatment as a reduction of the cost

of such licensed product. Accordingly, net revenue for the three

months ended April 29, 2017 have been adjusted to conform to the

current period presentation. This reclassification had no impact on

previously reported loss from operations.

2During the third quarter of fiscal 2018,

segment results were adjusted to exclude corporate

performance-based compensation costs, net gains (losses) on lease

terminations and asset impairment charges due the fact that these

items are no longer included in the segment results provided to the

Company’s chief operating decision maker in order to allocate

resources and assess performance. Accordingly, segment results have

been adjusted for the three months ended April 29, 2017 to conform

to the current period presentation.

3During the first quarter of fiscal 2019,

the Company changed the segment accountability for funds received

from licensees on the Company’s purchases of its licensed products.

These amounts were treated as a reduction of cost of product sales

within the Licensing segment but now are considered in the results

of the segments that control the respective purchases for purposes

of segment performance evaluation. Accordingly, segment results for

the three months ended April 29, 2017 have been adjusted to conform

to the current period presentation.

4During the first quarter of fiscal 2019,

the Company adopted new authoritative guidance which requires that

the non-service components of net periodic defined benefit pension

cost be presented outside of earnings (loss) from operations.

Accordingly, loss from operations and segment results for the three

months ended April 29, 2017 have been adjusted to conform to the

current period presentation.

Guess?, Inc. and Subsidiaries Constant Currency

Financial Measures (dollars in thousands)

Three Months Ended May

5, 2018 April 29, 2017 % change As

Reported

Foreign

Currency

Impact

Constant

Currency

As Reported

As

Reported

Constant

Currency

Net revenue: Americas Retail $ 171,340 $ (1,380 ) $ 169,960 $

173,694 (1%) (2%) Americas Wholesale 40,679 (787 ) 39,892 35,857

13% 11% Europe 205,435 (24,965 ) 180,470 165,388 24% 9% Asia 84,051

(4,743 ) 79,308 63,381 33% 25% Licensing1 19,784 —

19,784 16,025 23% 23% Total net revenue1 $ 521,289

$ (31,875 ) $ 489,414 $ 454,345 15% 8%

Notes:

1During the fourth quarter of fiscal 2018,

the Company reclassified net royalties received on the Company’s

inventory purchases of licensed product from net revenue to cost of

product sales to reflect its treatment as a reduction of the cost

of such licensed product. Accordingly, net revenue for the three

months ended April 29, 2017 has been adjusted to conform to the

current period presentation.

Guess?, Inc. and Subsidiaries Selected Condensed

Consolidated Balance Sheet Data (in thousands)

May

5, February 3, April 29, 2018 2018

2017 ASSETS Cash and cash equivalents $

232,492 $ 367,441 $ 316,395 Receivables, net 243,138 259,996

193,643 Inventories 434,922 428,304 402,673 Other

current assets 73,320 52,964 66,695 Property and equipment,

net 286,915 294,254 245,131 Restricted cash 232 241 1,529

Other assets 250,162 252,434 246,058

Total Assets $ 1,521,181 $ 1,655,634 $ 1,472,124

LIABILITIES AND STOCKHOLDERS’ EQUITY Current

portion of capital lease obligations and borrowings $ 3,363 $ 2,845

$ 571 Other current liabilities 390,426 465,000 323,995

Long-term debt and capital lease obligations 37,217 39,196

23,322 Other long-term liabilities 210,847 209,528 179,324

Redeemable and nonredeemable noncontrolling interests 21,637

22,246 18,796 Guess?, Inc. stockholders’ equity 857,691

916,819 926,116 Total Liabilities and

Stockholders’ Equity $ 1,521,181 $ 1,655,634 $

1,472,124

Guess?, Inc. and Subsidiaries Condensed

Consolidated Cash Flow Data (in thousands)

Three Months Ended May 5,

April 29, 2018 2017 Net cash used in

operating activities $ (67,576 ) $ (29,947 ) Net cash used

in investing activities (20,877 ) (19,234 ) Net cash used in

financing activities (38,284 ) (35,960 ) Effect of exchange

rates on cash, cash equivalents and restricted cash (8,221 ) 5,415

Net change in cash, cash equivalents and restricted

cash (134,958 ) (79,726 ) Cash, cash equivalents and

restricted cash at the beginning of the year 367,682 397,650

Cash, cash equivalents and restricted cash at the end of the

period $ 232,724 $ 317,924

Supplemental information:

Depreciation and amortization $ 16,499 $ 15,011 Rent

$ 72,226 $ 66,207

Guess?, Inc. and Subsidiaries

Reconciliation of Net Cash Used in Operating Activities to Free

Cash Flow (in thousands)

Three Months Ended May 5,

April 29, 2018 2017 Net cash used in

operating activities $ (67,576 ) $ (29,947 ) Less: Purchases

of property and equipment (19,004 ) (18,846 ) Less: Payments

for property and equipment under capital leases (386 ) —

Free cash flow $ (86,966 ) $ (48,793 )

Guess?,

Inc. and Subsidiaries Retail Store Data Global Store

and Concession Count

As of May 5, 2018 Stores

Concessions Directly Partner Directly

Partner Region Total Operated

Operated Total Operated Operated

United States 299 297 2 1 — 1 Canada 86 86 — — — — Central and

South America 103 61 42 27 27 — Total Americas 488 444 44 28

27 1 Europe and the Middle East 656 407 249 34 34 — Asia and

the Pacific 500 169 331 369 175 194 Total

1,644

1,020 624 431 236 195

As of April 29, 2017 Stores Concessions

Directly Partner Directly Partner

Region Total Operated Operated

Total Operated Operated United States

332 330 2 1 — 1 Canada 108 108 — — — — Central and South America 94

51 43 30 30 — Total Americas 534 489 45 31 30 1

Europe and the Middle East 647 354 293 30 30 — Asia and the Pacific

489 106 383 380 190 190 Total

1,670 949

721 441 250 191

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180530006316/en/

Guess?, Inc.Fabrice BenaroucheVP, Finance and Investor

Relations(213) 765-5578

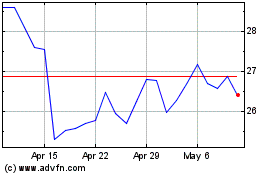

Guess (NYSE:GES)

Historical Stock Chart

From Mar 2024 to Apr 2024

Guess (NYSE:GES)

Historical Stock Chart

From Apr 2023 to Apr 2024