Bayer's Monsanto Purchase Proceeds -- WSJ

May 30 2018 - 3:02AM

Dow Jones News

By Brent Kendall

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 30, 2018).

WASHINGTON -- The Justice Department granted antitrust approval

Tuesday to Bayer AG's planned acquisition of Monsanto Co., after

requiring the German company to sell off about $9 billion in assets

in order to preserve competition.

The department said the Bayer assets, which are being sold to

chemicals rival BASF SE, amount to the largest divestiture ever in

a U.S. merger-approval settlement. The acquisition was originally

valued at more than $60 billion.

"American farmers and consumers will continue to benefit from

competition in this industry," Justice Department antitrust chief

Makan Delrahim said.

The approval clears one of the last remaining regulatory hurdles

for the Bayer-Monsanto transaction, one of three recent megadeals

that have reshaped the global market for crop seeds and chemicals.

Last year Dow Chemical Co. and DuPont Co. merged, while China

National Chemical Corp. acquired Swiss seed and pesticide maker

Syngenta AG.

Mr. Delrahim said BASF "has the experience, financial

capabilities and the know-how to fully replace Bayer as a

competitor."

The settlement requires Bayer to sell off its businesses that

have competed directly with St. Louis-based Monsanto and other

assets designed to boost BASF as a future innovator.

Among the divestitures to BASF, Bayer will sell its cotton,

canola, soybean and vegetable seed businesses, as well as its

Liberty herbicide business, which has been a competitor to

Monsanto's Roundup product. Bayer is selling off some intellectual

property and research-and-development capabilities, as well as its

digital agriculture business, which provides data-driven farming

advice and services.

The Justice Department said that without the divestitures, the

merger would have suppressed competition for an array of seed and

crop protection products, leading to higher prices and few

choices.

The department said the asset sales also address antitrust

concerns about vertically integrating Monsanto's seeds with Bayer's

chemical seed treatments, both of which are important to

farmers.

Bayer, a pharmaceutical and chemical conglomerate, is a leading

player in the pesticide industry, while Monsanto is a market leader

in seeds and crop genes. The deal, which was announced in September

2016, would make Bayer the world's biggest supplier of pesticides

and seeds for farmers.

Bayer said it has received "almost all" regulatory clearances to

close the transaction and expects to receive any outstanding

approvals "very shortly."

The company has won antitrust approval from the European Union

after pledging similar asset sales.

Bayer Chief Executive Werner Baumann said, "Receipt of the DOJ's

approval brings us close to our goal of creating a leading company

in agriculture."

BASF said it was "delighted" with the Justice Department's

approval, while Monsanto said Tuesday's clearance by U.S.

authorities "is another important step as we work to close the

deal."

The Wall Street Journal reported last month that the Justice

Department and the companies had reached an agreement that would

allow approval of the merger.

The settlement marks the second major merger decision for the

department's antitrust division under Trump administration

leadership. The Justice Department last November filed a lawsuit to

block AT&T Inc.'s acquisition of Time Warner Inc.

In negotiations before the lawsuit, the department sought asset

sales from AT&T, but the company believed no divestitures

should be required to win approval to buy Time Warner. A federal

judge is expected to issue a decision by June 12 on whether to

allow the deal.

Write to Brent Kendall at brent.kendall@wsj.com

(END) Dow Jones Newswires

May 30, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

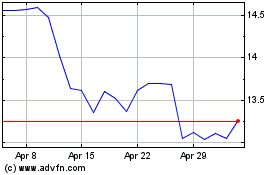

BASF (QX) (USOTC:BASFY)

Historical Stock Chart

From Mar 2024 to Apr 2024

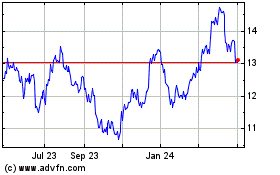

BASF (QX) (USOTC:BASFY)

Historical Stock Chart

From Apr 2023 to Apr 2024