Current Report Filing (8-k)

May 29 2018 - 4:37PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 25, 2018

CENTERPOINT ENERGY, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Texas

|

|

1-31447

|

|

74-0694415

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

1111 Louisiana

Houston, Texas

|

|

77002

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (713)

207-1111

Check the

appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☒

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as

defined in Rule 405 of the Securities Act of 1933 (§230.405) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2).

Emerging Growth Company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On May 25, 2018, CenterPoint Energy,

Inc. (“CenterPoint”), JPMorgan Chase Bank, N.A., as administrative agent, and the banks party thereto entered into a Second Amendment to the Amended and Restated Credit Agreement (the “Second Amendment”), amending

CenterPoint’s Amended and Restated Credit Agreement dated as of March 3, 2016, as previously amended by that certain First Amendment dated June 16, 2017 (the “Credit Agreement”).

The Second Amendment will increase the aggregate commitments under the Credit Agreement from $1.7 billion to $3.3 billion (the

“Incremental Facility”) effective the earlier of (i) the termination of all commitments by certain lenders to commit to provide a $5.0 billion

364-day

senior unsecured bridge term loan

facility (the “Bridge Facility”) and (ii) the payment in full of all obligations (other than contingent obligations) under the Bridge Facility and termination of all commitments to advance additional credit thereunder, and in each

case, so long as CenterPoint’s merger agreement with Vectren Corporation (the “Merger Agreement”) has not been terminated pursuant to the terms thereof without consummation of the merger.

The Incremental Facility will automatically expire on the earlier of the (a) termination date of the Credit Agreement and (b) if the

Merger Agreement is terminated without consummation of the merger, the date that is 90 days after such termination.

In addition, the

Second Amendment provides for a temporary increase on the maximum ratio of debt for borrowed money to capital permitted under the Credit Agreement from 65% to 75% until the earlier of (i) June 30, 2019 and (ii) the termination of all

commitments in respect of the Bridge Facility without any borrowing thereunder.

The Second Amendment is filed as Exhibit 4.1 to this

report and is incorporated by reference herein. The foregoing summary does not purport to be complete and is qualified in its entirety by reference to the Second Amendment.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

The exhibit listed below is filed herewith. The

agreement included as an exhibit is included only to provide information to investors regarding its terms. The agreement listed below may contain representations, warranties and other provisions that were made, among other things, to provide the

parties thereto with specified rights and obligations and to allocate risk among them, and such agreement should not be relied upon as constituting or providing any factual disclosures about us, any other persons, any state of affairs or other

matters.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

In connection with the proposed merger, Vectren Corporation (“Vectren”) expects to file a proxy statement, as well as other

materials, with the Securities and Exchange Commission (“SEC”).

WE URGE INVESTORS TO READ THE PROXY STATEMENT AND THESE OTHER MATERIALS FILED WITH THE SEC CAREFULLY WHEN THEY BECOME AVAILABLE BEFORE MAKING ANY VOTING OR INVESTMENT

DECISION BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER.

Investors will be able to obtain free copies of the proxy statement (when available) and other documents that will be filed by Vectren with the SEC at

http://www.sec.gov, the SEC’s website, or from Vectren’s website (http://www.vectren.com) under the tab, “Investors” and then under the heading “SEC Filings.” Security holders may also read and copy any reports,

statements and other information filed by Vectren with the SEC, at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 or visit the SEC’s website for further information on its

public reference room.

PARTICIPANTS IN THE SOLICITATION

CenterPoint, Vectren and certain of their respective directors, executive officers and other persons may be deemed to be participants in the

solicitation of proxies from Vectren’s shareholders with respect to the proposed transactions. Information regarding the directors and executive officers of CenterPoint is available in its definitive proxy statement for its 2018 annual meeting,

filed with the SEC on March 15, 2018, and information regarding the directors and executive officers of Vectren is available in its definitive proxy statement for its 2018 annual meeting, filed with the SEC on March 22, 2018. More detailed

information regarding the identity of potential participants, and their direct or indirect interests, by securities, holdings or otherwise, will be set forth in the proxy statement and other materials when they are filed with the SEC in connection

with the proposed transactions.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

CENTERPOINT ENERGY, INC.

|

|

|

|

|

|

|

Date: May 29, 2018

|

|

|

|

By:

|

|

/s/ Kristie L. Colvin

|

|

|

|

|

|

|

|

Kristie L. Colvin

|

|

|

|

|

|

|

|

Senior Vice President and

Chief Accounting

Officer

|

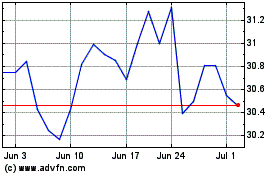

CenterPoint Energy (NYSE:CNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

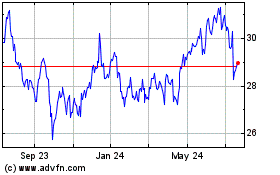

CenterPoint Energy (NYSE:CNP)

Historical Stock Chart

From Apr 2023 to Apr 2024