Route1 Inc. (OTCQB:ROIUF) (TSXV:ROI) (the “Company” or “Route1”), a

leading technology solutions innovator dedicated to delivering

secure data protection technologies and mobility solutions for

government and the enterprise sector, earlier today announced its

first quarter (Q1) financial results for the period ended March 31,

2018.

The Company’s Q1 results include results from

Group Mobile Int’l, LLC (“Group Mobile”) for the nine days from

March 22 to March 31, 2018.

|

Statement of operationsIn 000s of CAD dollars |

Q1 2018 |

|

Q42017 |

|

Q3 2017 |

|

Q2 2017 |

|

Q1 2017 |

|

Revenue |

|

|

|

|

|

|

Subscription revenue and services |

1,264 |

|

1,263 |

|

1,177 |

|

1,347 |

|

1,911 |

|

Devices and appliances |

388 |

|

109 |

|

159 |

|

24 |

|

30 |

|

Other |

32 |

|

48 |

|

2 |

|

- |

|

- |

| Total

revenue |

1,684 |

|

1,420 |

|

1,338 |

|

1,371 |

|

1,941 |

| Cost of

revenue |

585 |

|

331 |

|

362 |

|

298 |

|

335 |

| Gross

profit |

1,100 |

|

1,089 |

|

976 |

|

1,073 |

|

1,606 |

|

Operating expenses |

1,136 |

|

1,164 |

|

1,131 |

|

1,151 |

|

1,289 |

|

Operating (loss) profit 1 |

(36 |

) |

(75 |

) |

(155 |

) |

(78 |

) |

317 |

| Total

other expenses 2 |

(24 |

) |

170 |

|

183 |

|

157 |

|

109 |

|

Comprehensive net (loss) gain |

(60 |

) |

(245 |

) |

(338 |

) |

(235 |

) |

208 |

1 Before stock based compensation and patent

litigation2 Includes stock based compensation, AirWatch litigation,

gain on acquisition and foreign exchange

| |

|

Subscription revenue and services by quarterin

000s of CAD dollars |

Q1 2018 |

Q4 2017 |

Q32017 |

Q2 2017 |

Q1 2017 |

|

Application software |

1,260 |

1,263 |

1,177 |

1,347 |

1,759 |

| Appliance

licensing or yearly maintenance |

- |

- |

- |

- |

152 |

|

Technology as a service (TaaS) |

- |

- |

- |

- |

- |

| Other

services |

4 |

- |

- |

- |

- |

|

Total |

1,264 |

1,263 |

1,177 |

1,347 |

1,911 |

|

Adjusted EBITDA reconciliationin 000s of CAD

dollars |

Q12018 |

|

Q42017 |

|

Q32017 |

|

Q22017 |

|

Q12017 |

| Gross

Profit |

1,100 |

|

1,089 |

|

976 |

|

1,073 |

|

1,606 |

| Adjusted

EBITDA 3 |

46 |

|

24 |

|

(46 |

) |

16 |

|

406 |

|

Amortization |

82 |

|

99 |

|

109 |

|

94 |

|

89 |

| Operating

(loss) profit |

(36 |

) |

(75 |

) |

(155 |

) |

(78 |

) |

317 |

3 Adjusted EBITDA is defined as earnings before

interest, income taxes, depreciation and amortization, stock-based

compensation, patent litigation, restructuring and other costs.

Adjusted EBITDA does not have any standardized meaning prescribed

under IFRS and is therefore unlikely to be comparable to similar

measures presented by other companies. Adjusted EBITDA allows

Route1 to compare its operating performance over time on a

consistent basis.

Route1 used cash in operating activities of

approximately $0.2 million during Q1 2018 compared with cash

generated from operating activities of $0.4 million in Q1

2017. Non-cash working capital used was $0.4 million in Q1

2018 compared to $1.6 million used in the same period a year

earlier. Net cash used in the day–to-day operations for the

three months ended March 31, 2018 was $0.6 million compared to $1.2

million in Q1 2017, a decrease of $0.6 million. The decrease

in net cash used was a result of an increase in deferred revenue

for the three months ended March 31, 2018 and the working capital

balances acquired with the acquisition of Group Mobile.

|

Balance sheet extractsIn 000s of CAD dollars |

Mar 312018 |

Dec 312017 |

Sep 302017 |

Jun 302017 |

Mar 312017 |

| Cash |

600 |

1,037 |

1,408 |

2,080 |

704 |

| Total

current assets |

6,292 |

2,035 |

2,856 |

2,924 |

1,890 |

| Total

current liabilities |

6,292 |

1,829 |

2,534 |

2,396 |

1,113 |

| Net

working capital |

- |

206 |

322 |

528 |

777 |

| Total

assets |

8,646 |

3,171 |

4,081 |

4,213 |

3,114 |

| Bank

debt |

- |

- |

- |

- |

- |

| Total

shareholders’ equity |

2,256 |

1,236 |

1,432 |

1,720 |

1,904 |

Route1’s cash position historically has been at

its highest level during the second quarter of the fiscal year as a

direct result of the timing of annual MobiKEY subscription renewal

payments. With the closing of the Group Mobile acquisition,

this likely will change and the highest level of cash on Route1’s

balance sheet will be tied to the timing of payments related to

Group Mobile sales.

The following table summarizes the estimated

fair value of the consideration transferred and the preliminary

estimated fair values of the assets acquired and liabilities

assumed at the acquisition date of for Group Mobile. Route1

may adjust the preliminary purchase price allocation up to one year

after the acquisition closing date.

| Assets acquired (in 000s of US Dollars) |

Liabilities assumed (in 000s of US Dollars) |

|

| Cash

and cash equivalents |

$ |

246 |

|

Trade

and other payables |

$ |

1,724 |

|

|

| Trade

and other receivables |

$ |

1,233 |

|

Employee

liabilities |

$ |

80 |

|

|

|

Inventory |

$ |

590 |

|

Sales

tax payable |

$ |

51 |

|

|

|

Prepaid expenses |

$ |

3 |

|

Contract

liability |

$ |

85 |

|

|

|

Current assets |

$ |

2,072 |

|

Total

liabilities |

$ |

1,940 |

|

|

|

Furniture and fixtures (net) |

$ |

47 |

|

Fair

value of net assets acquired |

$ |

1,039 |

|

|

| TaaS

assets (net) |

$ |

860 |

|

|

|

|

|

|

Fixed assets |

$ |

907 |

|

|

|

|

|

| Total

assets |

$ |

2,979 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

in 000s of CAD Dollars |

|

|

|

|

|

|

| Fair

value of net assets acquired |

$ |

1,341 |

|

|

|

|

|

| Less:

Consideration paid |

$ |

1,034 |

|

|

|

|

|

| Gain on

acquisition |

$ |

307 |

|

|

|

|

|

| Less:

Acquisition costs |

$ |

200 |

|

|

|

|

|

| Net

purchase gain on acquisition |

$ |

107 |

|

|

|

|

|

Investor Conference Call and

Webcast

Route1 will hold a conference call and web cast

to discuss the Company’s financial results and provide a business

update on Tuesday, May 29, 2018 at 4 p.m. eastern.

Participants should dial Toll-Free: 1-800-263-0877 or

Toll/International: 1-646-828-8143 at least 10 minutes prior to the

conference, pass code 7132615. For those unable to attend the

call, a replay will be available on May 29, 2018 after 7 p.m. at

Toll-Free 1-844-512-2921 or Toll/International 1-412-317-6671, pass

code 7132615 until 11:59 am on June 12, 2018.

The webcast will be presented live at

http://public.viavid.com/index.php?id=129861.

About Route1 Inc.Route1 Inc. is

a leading technology solutions innovator dedicated to enabling

mobility for government and focused enterprise vertical markets by

delivering secure data protection technologies and mobility

solutions. The Company’s suite of patented enterprise

security solutions, which includes MobiKEY, ActionPLAN, Powered by

MobiNET, MobiENCRYPT and DerivID, delivers best-in-class

authentication, data security, data analytics and secure remote

access, running on a proven, trusted infrastructure, which meets or

exceeds the highest security standards for government and

industry. Route1 has earned a Full Authority to Operate from

the U.S. Department of Defense, the U.S. Department of the Navy,

the U.S. Department of the Interior, and other government

agencies. The Company is proud to be a trusted solutions

partner in the banking, healthcare, legal, education, public

sector, manufacturing, logistics, field service and warehousing

industries.

Through Route1’s wholly owned subsidiary, Group

Mobile Int’l, LLC, the Company is a trendsetter in the enterprise

technology space by providing expertise in building mobility

solutions and deploying complete offerings into vertical markets

through specialized hardware, software and our expanding services

capabilities. Route1 is a pioneer in IIoT (Industrial

Internet of Things) through the delivery of our ActionPLAN, Powered

by MobiNET technology, which not only captures data from electrical

inputs including sensor data but takes it to the next level by

interpreting, analyzing, transforming the data to deliver

strategic business intelligence.

The diverse but complimentary technologies our

Company provides, along with the level of experience and expertise

of our team, uniquely positions us as the pre-emptive leader in

secure and complete mobile technology solutions. Route1

remains focused and dedicated to serving the needs of our business

partners; to positively influence their profitability, contribute

to their longevity and share in their success. With offices

and staff in Washington, D.C., Boca Raton, FL, Phoenix AZ,

Chattanooga TN and Toronto, Canada, Route1 provides leading-edge

solutions to public and private sector clients around the

world. Route1 is listed on the OTCQB in the United States

under the symbol ROIUF and in Canada on the TSX Venture Exchange

under the symbol ROI. For more information, visit:

www.route1.com.

For More Information Contact:

Tony BusseriCEO, Route1 Inc.+1 416

814-2635tony.busseri@route1.com

This news release, required by applicable

Canadian laws, does not constitute an offer to sell or a

solicitation of an offer to buy any of the securities in the United

States. The securities have not been and will not be registered

under the United States Securities Act of 1933, as amended (the

"U.S. Securities Act") or any state securities laws and may not be

offered or sold within the United States or to U.S. Persons unless

registered under the U.S. Securities Act and applicable state

securities laws or an exemption from such registration is

available.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

© 2018 Route1 Inc. All rights reserved. No part

of this document may be reproduced, transmitted or otherwise used

in whole or in part or by any means without prior written consent

of Route1 Inc. See

https://www.route1.com/terms-of-use/ for notice of Route1’s

intellectual property.

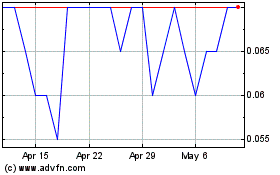

Route 1 (TSXV:ROI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Route 1 (TSXV:ROI)

Historical Stock Chart

From Apr 2023 to Apr 2024