China Set to Approve Qualcomm Purchase of NXP Semiconductors -- Update

May 26 2018 - 10:05AM

Dow Jones News

By Yoko Kubota in Guiyang and Lingling Wei in Beijing

Chinese authorities are set to approve Qualcomm Inc.'s planned

$44 billion acquisition of Netherlands-based NXP Semiconductors NV

in the next few days, according to people familiar with the matter,

in what would be another significant step toward easing frayed

U.S.-China trade relations.

China's State Administration for Market Regulation, which has

been conducting the antitrust review, will hold a meeting on the

matter Monday, according to the people. They said a contingent of

Qualcomm's legal team arrived in Beijing this weekend to hammer out

final details.

Approval would remove the last hurdle for a deal that has been

stuck for months amid U.S.-China trade tensions, but one of the

people said it could come with conditions. Chinese regulators have

expressed concerns that the merged company would crowd out domestic

businesses in areas such as mobile payments. NXP offers technology

and services used for mobile payments.

The likely approval comes as the Trump administration is

battling Congress to roll back penalties on Chinese

telecommunications giant ZTE Corp., and as U.S. Commerce Secretary

Wilbur Ross prepares to lead an interagency delegation to Beijing

starting June 2, where he is set to meet China's chief economic

envoy, Liu He.

The acquisition of NXP is considered critical for San

Diego-based Qualcomm, which is dominant in smartphone chips but is

looking for growth in other areas. Among NXP's products are chips

for automobiles, a rapidly expanding sector as more technology is

packed into cars.

Qualcomm had been waiting for Beijing's approval to proceed with

the purchase of the Dutch company, having secured permission from

the eight other major antitrust regulators around the world.

A spokesman for China's Commerce Ministry said last month that

the agency had conducted a preliminary review of the Qualcomm

deal's impact on competitors and the market, and had found "issues

that are hard to resolve, making it difficult to eliminate the

negative impact."

The State Administration for Market Regulation couldn't be

reached immediately for comment.

On Saturday, Qualcomm's President Cristiano Amon spoke at the

Big Data Expo in Guiyang, southern China. While he didn't touch on

the company's plan to acquire NXP, he emphasized Qualcomm's

commitment to China. "China is very important for Qualcomm," he

said. "We're rooted in China, we have developed a number of very

strong partnerships. Nothing can separate us from China."

China had been holding up reviews of multibillion-dollar

takeovers as leverage as Beijing seeks to fend off the Trump

administration's trade offensives. But since earlier this month,

when President Donald Trump said in a tweet that he would step in

to get ZTE back into business, Beijing has shown a willingness to

ease the regulatory roadblocks faced by U.S. companies.

Last week, China approved U.S. private-equity firm Bain

Capital's $18 billion purchase of Toshiba Corp's memory-chip unit,

a move seen as a gesture of goodwill as President Xi Jinping's

economic envoy, Mr. Liu, was visiting Washington for trade talks.

That same week, China's Vice President Wang Qishan told a group of

visiting foreign business representatives, including a Qualcomm

executive, that the Qualcomm and NXP deal stood a good chance of

being approved by Chinese regulators, according to people with

knowledge of the meeting.

The U.S. and its allies have been pressing Beijing to green

light the deal. U.S. trade negotiators raised the issue with Mr.

Liu recently in Washington, people briefed on the talks said.

Chancellor Angela Merkel of Germany also lobbied for the deal in

her meeting with Mr. Xi this week, according to a person with

knowledge of the matter.

In the case of ZTE, the Trump administration is now working to

ease U.S. sanctions that had threatened to shutter China's

second-largest telecom-equipment maker and the fourth-largest

vendor of mobile phones in the U.S.

The U.S. Commerce Department last month banned U.S. companies

from supplying the Chinese company for failing to live up to the

terms of an agreement over ZTE's evasion of sanctions on sales to

Iran and North Korea. Qualcomm was one of ZTE's key suppliers.

But Trump administration officials have been trying to negotiate

a reprieve, saying that they never intended to put ZTE out of

business and noting that the action is also hurting U.S. firms that

supply ZTE.

That has drawn a backlash from Democratic lawmakers who say

ZTE's violations were serious and should be punished.

The developments come as both sides appear to be retreating from

the brink of trade war, declaring a truce amid ongoing

negotiations. China has agreed to buy more U.S. farm products,

energy and services, and last week said it would slash tariffs on

imported cars from 25% to 15% starting July 1.

--

Yang Jie

contributed to this article.

Write to Yoko Kubota at yoko.kubota@wsj.com and Lingling Wei at

lingling.wei@wsj.com

(END) Dow Jones Newswires

May 26, 2018 09:50 ET (13:50 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

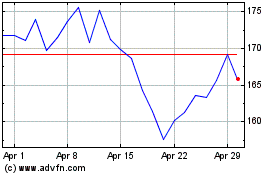

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Apr 2023 to Apr 2024