CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement and the accompanying prospectus and the documents incorporated by reference herein and therein contain

"forward-looking statements" (including within the meaning of the Private Securities Litigation Reform Act of 1995) concerning the Company and other matters. These statements may discuss goals,

intentions, and expectations as to future plans, trends, events, dividends, results of operations, or financial condition, or otherwise, based on current beliefs of the management of the Company as

well as assumptions made by, and information currently available to, such management. Forward-looking statements may be accompanied by words such as "aim," "anticipate," "believe," "plan," "could,"

"would," "should," "shall," "continue," "estimate," "expect," "forecast," "future," "guidance," "intend," "may," "will," "possible," "potential," "predict," "project" or the negative or other

variations of them. These forward-looking statements speak only as of the date on which such statements are made and are subject to various risks and uncertainties, many of which are outside the

Company's control. Should one or more of these risks or uncertainties materialize, or should any of the underlying assumptions prove incorrect, actual results may differ materially from those

predicted in the forward-looking statements and from past results, performance, or achievements. Therefore, you should not place undue reliance on such statements. Factors that could cause actual

results to differ materially from those in the forward-looking statements include (but are not limited to):

-

•

-

the possibility that the Company will be unable to pay future dividends to shareholders or that the amount of such dividends may be less than

anticipated;

-

•

-

the possibility that the Company may not obtain its anticipated financial results in one or more future periods;

-

•

-

reduction in customer spending;

-

•

-

a slowdown in customer payments and changes in customer demand for products and services as a result of changing economic conditions or

otherwise;

-

•

-

unanticipated changes relating to competitive factors in the industries in which the Company operates;

-

•

-

the Company's ability to hire and retain key personnel;

-

•

-

the Company's ability to attract new customers and retain existing customers in the manner anticipated;

-

•

-

reliance on and integration of information technology systems;

-

•

-

changes in legislation or governmental regulations affecting the Company;

-

•

-

international, national or local economic, social or political conditions that could adversely affect IGT PLC or its customers;

-

•

-

conditions in the credit markets;

-

•

-

risks associated with assumptions the Company makes in connection with its critical accounting estimates;

-

•

-

the resolution of pending and potential future legal, regulatory or tax proceedings and investigations; and

-

•

-

the Company's international operations, which are subject to the risks of currency fluctuations and foreign exchange controls.

The

foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties that affect IGT PLC's business,

including those described in

S-4

Table of Contents

IGT PLC's

Annual Report on Form 20-F for the fiscal year ended December 31, 2017 and other documents filed from time to time with the SEC, which are available on the SEC website

at www.sec.gov and on the investor relations section of IGT PLC's website at www.IGT.com. The contents of such websites are not incorporated into this prospectus supplement.

Except

as required under applicable law, IGT PLC does not assume any obligation to update the forward-looking statements. Nothing in this prospectus supplement, the accompanying

prospectus and the documents that are referenced and which have been incorporated by reference herein and therein is intended, or is to be construed, as a profit forecast or to be interpreted to mean

that earnings per IGT PLC share for the current or any future financial years will necessarily match or exceed the historical published earnings per IGT PLC share, as applicable. All

forward-looking statements contained in this prospectus supplement, the accompanying prospectus and the documents that are referenced and which have been incorporated by reference herein and therein

are qualified in their entirety by this cautionary statement.

S-5

Table of Contents

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights certain information contained elsewhere in this prospectus supplement, the accompanying

prospectus or the documents that are incorporated by reference herein and therein. You should read this entire prospectus supplement, the accompanying prospectus and the documents incorporated by

reference herein and therein, including the section entitled "Risk Factors" in this prospectus supplement, the accompanying prospectus and in our Annual Report on Form 20-F for the fiscal year

ended December 31, 2017 and in other reports we file with the SEC, before deciding whether to invest in our ordinary shares. In addition, this prospectus supplement and the accompanying

prospectus and the documents incorporated by reference herein and therein include forward-looking information that involves risks and uncertainties. See "Cautionary Statement Regarding Forward-Looking

Statements."

The Company

International Game Technology PLC, a public limited company incorporated under the laws of England and Wales ("IGT PLC"), has its

corporate headquarters in London, England. IGT PLC is the successor to GTECH S.p.A., a

società per azioni

incorporated

under the laws of Italy ("GTECH"), and the sole stockholder of International Game Technology, a Nevada corporation ("IGT"). IGT PLC, together with its consolidated subsidiaries, has principal

operating facilities in Providence, Rhode Island; Las Vegas, Nevada; and Rome, Italy.

On

April 7, 2015, IGT PLC became the successor to GTECH, when GTECH acquired IGT through the merger of GTECH with and into IGT PLC (the "Holdco Merger") and the

merger of Georgia Worldwide Corporation, a Nevada corporation and a wholly-owned subsidiary of IGT PLC ("Sub"), with and into IGT (the "Subsidiary Merger" and, together with the Holdco Merger,

the "Mergers"), all pursuant to the terms of the Agreement and Plan of Merger, dated as of July 15, 2014, as amended on September 23, 2014, by and among GTECH, IGT PLC, Sub, IGT,

and, solely with respect to Section 5.02(a) and Article VIII thereof, GTECH Corporation. In this prospectus supplement, unless otherwise specified, the terms "we," "us" and "our," and

the "Company" refer to IGT PLC together with its consolidated subsidiaries or, for periods of or points in time prior to the completion of the Holdco Merger, to GTECH together with its

consolidated subsidiaries, or any one or more of them, as the context may require.

Recent Developments

On April 7, 2018, the third anniversary of the completion of the Mergers, each shareholder that maintained its ownership of our ordinary

shares continuously from and after the completion of the Mergers became entitled, upon election, to direct the voting rights with respect to one special voting share of $0.000001 (each a "Special

Voting Share") per ordinary share held for such period, provided that such shareholder met certain conditions. In addition, from and after April 7, 2018, any shareholder who held (or may in the

future hold) ordinary shares continuously for a three-year period became (or will become) entitled to participate in the loyalty plan with respect to such ordinary shares and to exercise its rights to

direct the voting with respect to the Special Voting Shares associated with such ordinary shares. De Agostini has elected to exercise its rights to participate in the loyalty plan with respect to all

of its owned ordinary shares. As of May 18, 2018, there were 203,904,990 ordinary shares outstanding and De Agostini held 103,422,324 ordinary shares. De Agostini has elected to participate in

the loyalty plan with respect to all of our ordinary shares held by it, effective as of May 25, 2018. As a result, on May 25, 2018, De Agostini will have the right to direct the voting

with respect to 103,422,324 Special Voting Shares. No other shareholder has elected to participate in the loyalty plan as of the date hereof. Therefore, as of May 25, 2018, De Agostini's

effective voting interest will be approximately 67.30% of the total voting power. If De Agostini pledges any of our ordinary shares to secure its obligations under the variable forward transaction, De

Agostini will lose its right to direct the voting of the number of Special Voting Shares corresponding to the number of pledged ordinary shares.

S-6

Table of Contents

The

Company was recently informed of findings by the State of Washington's Office of Financial Management with respect to an investigation into potential ethics violations by Washington

state lottery employees who may have received items of value from various vendors, including employees of the Company, beyond allowable limits. As a result, the Company has begun an internal

investigation. For more information, see the Company's Report of Foreign Private Issuer on Form 6-K filed with the SEC on May 21, 2018 (the third such Report on Form 6-K filed by the Company on May

21, 2018).

Selling Shareholder

Immediately prior to the completion of the Mergers on April 7, 2015, De Agostini held 93,349,318 ordinary shares of GTECH, equal to

approximately 53.30% of GTECH's then-outstanding ordinary share capital, and its wholly-owned subsidiary, DeA Partecipazioni S.p.A., held 10,073,006 shares of GTECH, equal to approximately

5.75% of GTECH's then-outstanding ordinary share capital, resulting in a consolidated ownership of approximately 59.05% of GTECH's then-outstanding share capital. In connection with the Mergers, IGT

issued 198,526,804 ordinary shares, which was the primary cause of the decrease in the percent of ordinary shares owned by De Agostini. Effective January 1, 2018, DeA

Partecipazioni S.p.A. merged into De Agostini, resulting in the transfer of ownership of 10,073,006 ordinary shares from DeA Partecipazioni S.p.A. to De Agostini. Through its voting

power, De Agostini has the ability to determine the outcome of certain decisions submitted to a vote of our shareholders, including approval of annual dividends, the election and removal of directors,

mergers or other business combinations, the acquisition or disposition of assets and issuances of equity and the incurrence of indebtedness.

S-7

Table of Contents

The Offering

|

|

|

|

|

Selling Shareholder

|

|

De Agostini S.p.A.

|

|

Ordinary Shares Offered

|

|

We have been advised that to establish its initial hedge position with respect to the variable forward transaction, the

counterparty or its affiliates will borrow from third-party stock lenders 13,200,000 ordinary shares (the "underwritten shares") and will sell the underwritten shares in an underwritten public offering (the "offering") through Credit Suisse

Securities (USA) LLC, acting as the underwriter. The underwriter proposes to offer the underwritten shares in the offering from time to time in one or more transactions, in block sales, on the NYSE, in the over-the-counter market or in

negotiated transactions, at market prices prevailing at the time of sale or at negotiated prices.

|

|

|

|

This prospectus supplement also relates to an additional 4,800,000 of our ordinary shares, which we have been advised are

also being borrowed by the counterparty or its affiliates from third-party stock lenders. We have been advised that the counterparty or its affiliates or their agents expect to sell these additional ordinary shares, from time to time, in block sales,

on the NYSE, in the over-the-counter market or in negotiated transactions, at market prices prevailing at the time of sale or at negotiated prices. These additional ordinary shares will not be included in the offering. Notwithstanding the foregoing,

subject to satisfying the specified gaming-related regulatory and other conditions, De Agostini may pledge some of our ordinary shares held by it to secure its obligations under the variable forward transaction and, after that pledge, De Agostini may

obtain prepayment from the counterparty of the purchase price for the ordinary shares underlying the variable forward transaction. We have been advised by the counterparty that it expects that, over the same period when the counterparty or its

affiliates or their agents sell these additional ordinary shares, the counterparty or its affiliates or their agents will purchase an approximately equal number of ordinary shares in the open market.

|

|

|

|

See "Plan of Distribution."

|

|

Ordinary Shares Outstanding Before and After the Offering

|

|

203,904,990 shares as of May 18, 2018

|

|

Listing

|

|

Our ordinary shares are listed on the NYSE under the symbol "IGT."

|

S-8

Table of Contents

|

|

|

|

|

Use of proceeds

|

|

Neither we nor De Agostini will receive any of the proceeds from the sale of ordinary shares in the offering. Notwithstanding the foregoing,

subject to satisfying the specified gaming-related regulatory and other conditions, De Agostini may pledge some of our ordinary shares held by it to secure its obligations under the variable forward transaction and, after that pledge, De Agostini may

obtain prepayment from the counterparty of the purchase price for the ordinary shares underlying the variable forward transaction.

|

|

Lock-Up

|

|

We and De Agostini have agreed with the underwriter, subject to certain customary exceptions and except for the sales by De

Agostini described in "Plan of Distribution," not to dispose of or hedge any of our ordinary shares during the period from the date of the underwriting agreement until the date that is 60 days thereafter, except with the prior written consent of

the underwriter. The foregoing does not, however, apply to any employee benefit plans. See "Plan of Distribution."

|

|

Dividend Policy

|

|

IGT PLC paid interim cash dividends on its ordinary shares during each of 2016, 2017 and 2018 but has not implemented a

formal policy on dividends.

|

|

Variable Forward Transaction

|

|

We are not party to the variable forward transaction.

|

|

|

|

We have been advised that De Agostini is entering into a variable forward transaction with the counterparty relating to

18,000,000 of our ordinary shares that has economic characteristics similar to a collar.

|

|

|

|

Subject to satisfying specified gaming-related regulatory and other conditions, De Agostini may pledge some of our ordinary

shares held by it to secure its obligations under the variable forward transaction and, after that pledge, De Agostini may request prepayment of the purchase price for the ordinary shares underlying the variable forward transaction.

|

S-9

Table of Contents

|

|

|

|

|

|

|

Settlement of the variable forward transaction will occur in multiple tranches that are scheduled to mature over a period commencing on or

about four years from May 2018. The variable forward transaction will be settled for any tranche at De Agostini's election either (i) in cash, or (ii) by physical delivery if certain gaming-related regulatory and other conditions are

satisfied. If there has been no prior prepayment, De Agostini will receive from the counterparty an amount equal to an agreed floor price multiplied by the number of ordinary shares underlying the tranche. Upon a cash settlement, De Agostini will be

required to pay the cash equivalent of a number of ordinary shares to be determined pursuant to a formula specified in the agreement documenting the variable forward transaction based on the volume-weighted average price per share and agreed floor

and cap prices. If De Agostini elects physical settlement, then it may elect to deliver either a number of ordinary shares based on the specified formula, or all the ordinary shares underlying the tranche; in the latter case, the counterparty may owe

De Agostini an additional or increased payment.

|

|

|

|

We have been advised that the sale of the shares by the counterparty or its affiliates in the offering will establish its

initial hedge position with respect to the variable forward transaction, and that the counterparty or its affiliates may modify their hedge positions by buying or selling our ordinary shares or engaging in derivatives or other transactions from time

to time thereafter during the term of the variable forward transaction. The effect of the variable forward transaction, including any purchases and sales of our ordinary shares by the counterparty and its affiliates or agents, which may include the

underwriter, to establish or modify the counterparty's hedge positions from time to time during the term of the variable forward transaction, may variously have a positive, negative or neutral impact on the market price of our ordinary shares,

depending on market conditions at such times.

|

S-10

Table of Contents

|

|

|

|

|

|

|

We have been advised that upon the early termination of the variable forward transaction (in whole or in part) or upon the cash settlement

of the variable forward transaction (in whole or in part) at maturity, the counterparty or its affiliates or their agents may purchase a number of our ordinary shares in secondary market transactions to return our ordinary shares to stock lenders to

unwind the counterparty's hedge positions, and such purchases may have the effect of increasing, or limiting a decrease in, the market price of our ordinary shares during the relevant unwind period. In addition, we have been advised that, if De

Agostini has satisfied the conditions for physical settlement and elects to physically settle the variable forward transaction (in whole or in part) at maturity, depending on the market price of our ordinary shares at the time of physical settlement

and the type of physical settlement elected, the counterparty or its affiliates or their agents may purchase or sell our ordinary shares in secondary market transactions to establish, modify or, in some cases, unwind the counterparty's hedge

positions and such purchases or sales may have a positive, negative or neutral impact on the market price of our ordinary shares, depending on market conditions at such time.

|

|

|

|

See "Plan of Distribution" and "Risk Factors" for more information.

|

|

Risk factors

|

|

You should carefully read and consider the information set forth under "Risk Factors" on page S-11 of this prospectus

supplement and any risk factors described in the documents we incorporate by reference, as well as all the other information set forth in this prospectus supplement, the accompanying prospectus and in the documents we incorporate by reference herein

and therein, before investing in our ordinary shares.

|

|

Underwriter

|

|

Credit Suisse Securities (USA) LLC

|

S-11

Table of Contents

RISK FACTORS

Investing in our ordinary shares involves significant risks. Before you invest in our ordinary shares, in addition to the other information

contained in this prospectus supplement and the accompanying prospectus, you should carefully consider the risk factors described under "Risk Factors" in our most recent Annual Report on

Form 20-F, and in any updates to those risk factors set forth in our reports on Form 6-K incorporated by reference herein, together with all of the other information appearing or

incorporated by reference in this prospectus supplement and the accompanying prospectus, in light of your particular investment objectives and financial circumstances. See "Where You Can Find

Additional Information and Incorporation by Reference." These risks are not the only risks that we face. Our business, financial condition and results of operations could also be affected by

additional factors that are not presently known to us or that we currently do not consider to be material.

Risks Related to the Offering

The market price of our ordinary shares may decline after the offering.

The price per share of ordinary shares sold in the offering may be more or less than the market price of our ordinary shares on the date the

offering is consummated. If the purchase price is greater than the market price at the time of sale, purchasers may experience an immediate decline in the market value of the ordinary shares purchased

in the offering. If the actual purchase price is less than the market price for the ordinary shares, some purchasers in the offering may be inclined to immediately sell ordinary shares to attempt to

realize a profit. Any such sales, depending on the volume and timing, could cause the price of our ordinary shares to decline. Additionally, because stock prices generally fluctuate over time, there

is no assurance that purchasers of our ordinary shares in the offering will be able to sell shares after the offering at a price that is equal to or greater than the actual purchase price. Purchasers

should consider these possibilities in determining whether to purchase shares in the offering and the timing of any sales of ordinary shares.

There may be future sales or other dilution of our equity, which may adversely affect the market price of our

ordinary shares.

We are not restricted from issuing additional ordinary shares, subject to the underwriting agreement entered into with the underwriter in

connection with the offering, including any securities that are convertible into or exchangeable for, or that represent the right to receive, ordinary shares or any substantially similar securities.

The market price of our ordinary shares could decline as a result of sales of a large number of our ordinary shares in the market after the offering, by us, De Agostini or other of our shareholders,

or the perception that such sales could occur.

The effect of the borrowing of our ordinary shares in connection with the variable forward transaction, and

the sales of our ordinary shares by the counterparty or its affiliates or agents to establish, modify or, in some cases, unwind the counterparty's hedge positions in connection with the variable

forward transaction, may have a negative effect on the market price of our ordinary shares.

We have been advised that the counterparty will borrow from third-party stock lenders an aggregate amount of 18,000,000 ordinary shares, which

ordinary shares are being offered pursuant to this prospectus supplement. We have been advised by the counterparty that it or its affiliates or their agents intend to establish the counterparty's

initial hedge position in respect of the variable forward transaction by establishing a short position in our ordinary shares through an underwritten public offering under this prospectus supplement

of an aggregate amount of 13,200,000 ordinary shares the counterparty has borrowed from third-party stock lenders. The establishment of such short positions could have the effect of decreasing, or

limiting an increase in, the market price of our ordinary shares. The effect of the variable forward transaction, including any purchases and sales of our ordinary shares

S-12

Table of Contents

by

the counterparty and its affiliates or agents, which may include the underwriter, to establish or modify the counterparty's hedge positions from time to time during the term of the variable forward

transaction, may variously have a positive, negative or neutral impact on the market price of our ordinary shares, depending on market conditions at such times.

We

have been advised that upon early the termination of the variable forward transaction (in whole or in part) or upon the cash settlement of the variable forward transaction (in whole

or in part) at maturity, the counterparty or its affiliates or their agents may purchase a number of our ordinary shares in secondary market transactions to return our ordinary shares to stock lenders

to unwind the counterparty's hedge positions, and such purchases may have the effect of increasing, or limiting a decrease in, the market price of our ordinary shares during the relevant unwind

period. In addition, we have been advised that if De Agostini has satisfied the conditions for physical settlement and elects to physically settle the variable forward transaction (in whole or in

part) at maturity, depending on the market price of our ordinary shares at the time of physical settlement and the type of physical settlement elected, the counterparty or its affiliates or their

agents may purchase or sell our ordinary shares in secondary market transactions to establish, modify or, in some cases, unwind the counterparty's hedge positions in connection with the variable

forward transaction and such purchases or sales may have a positive, negative or neutral impact on the market price of our ordinary shares, depending on market conditions at such time. See "Plan of

Distribution" for more information.

Risks Related to Our Capital Structure

The concentrated voting power held by De Agostini and loyalty plan may limit another shareholder's ability to

acquire a controlling interest, change our management or strategy or otherwise exercise influence over us.

The loyalty plan set forth in our Articles of Association became effective on April 7, 2018. Under the loyalty plan, each shareholder

that maintains its ownership of our ordinary shares continuously for at least three (3) years will be entitled, upon election, to direct the voting rights with respect to one special voting

share per ordinary share held for such period, provided that such shareholder meets certain conditions. As a result of the loyalty plan, a relatively large proportion of our voting power could be

concentrated in a relatively small number of shareholders who would have significant influence over us.

De

Agostini has elected to exercise its rights to participate in the loyalty plan with respect to all of the ordinary shares held by it, effective as of May 25, 2018.

De Agostini currently holds 103,422,324 ordinary shares as of May 18, 2018. As of May 25, 2018, De Agostini will also have the right to direct the voting with respect to

103,422,324 Special Voting Shares. No other shareholder has elected to participate in the loyalty plan as of the date hereof. Therefore, as of May 25, 2018, De Agostini's effective voting

interest will be approximately 67.30% of the total voting power.

If

any such ordinary shares held by De Agostini are sold, disposed of, transferred, pledged or subjected to any lien, fixed or floating charge or other encumbrance (including in

connection with the variable forward transaction), De Agostini will cease to have the right to direct the voting with respect to the Special Voting Shares associated with those ordinary shares and De

Agostini's proportionate voting interest would decrease. However, if any other shareholder withdraws his or her ordinary shares from the register with respect to the Special Voting Shares (the

"Loyalty Register") or otherwise loses the right to direct the voting with respect to any Special Voting Shares, De Agostini's effective voting interest would increase. De Agostini may make decisions

with which other shareholders may disagree, including, among other things, delaying, discouraging or preventing a change of control of IGT PLC or a potential merger, consolidation, tender

offer, takeover or other business combination and may also prevent or discourage shareholders' initiatives aimed at changes in our management.

S-13

Table of Contents

USE OF PROCEEDS

Neither we nor De Agostini will receive any proceeds from the sale of the ordinary shares being offered hereby. Notwithstanding the foregoing,

subject to satisfying the specified gaming-related regulatory and other conditions, De Agostini may pledge some of our ordinary shares held by it to secure its obligations under the variable forward

transaction and, after that pledge, De Agostini may obtain prepayment from the counterparty of the purchase price for the ordinary shares underlying the variable forward transaction.

S-14

Table of Contents

CAPITALIZATION AND INDEBTEDNESS

The following table sets forth our cash and cash equivalents, capitalization and indebtedness as of as of March 31, 2018.

|

|

|

|

|

|

($ in thousands)

|

|

As of

March 31, 2018

|

|

|

Cash and cash equivalents

|

|

$

|

569,620

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total debt(1)

|

|

|

8,094,239

|

|

|

Redeemable non-controlling interests

|

|

|

377,243

|

|

|

Total equity

|

|

|

2,319,292

|

|

|

|

|

|

|

|

|

Total capitalization

|

|

|

10,790,774

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-

(1)

-

For

additional information regarding the Company's indebtedness, please refer to note 5 to the Company's unaudited condensed consolidated financial statements

contained in the Company's Report of Foreign Private Issuer on Form 6-K filed with the SEC on May 21, 2018 (the third such Report on Form 6-K filed by the Company on May 21,

2018), and to notes 12 and 13 to the Company's audited consolidated financial statements contained in the Company's Annual Report on Form 20-F for the fiscal year ended

December 31, 2017, filed with the SEC on March 15, 2018.

S-15

Table of Contents

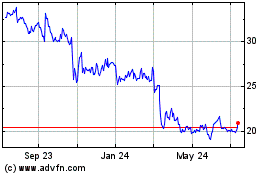

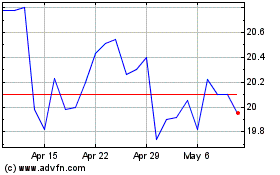

PRICE RANGE OF ORDINARY SHARES AND DISTRIBUTIONS

As of May 18, 2018, the total number of ordinary shares outstanding was 203,904,990, of which 103,422,324 ordinary shares were held by De

Agostini. Our ordinary shares began trading on the NYSE on April 7, 2015. Our ordinary shares are traded on the NYSE under the symbol "IGT."

The

following table sets forth, for the periods indicated, the high and low sales prices for our ordinary shares, as reported by the NYSE. The last reported sale price of our ordinary

shares on the NYSE on May 18, 2018 was $30.41 per ordinary share.

|

|

|

|

|

|

|

|

|

|

|

High

|

|

Low

|

|

|

Year ended December 31, 2017

|

|

$

|

29.36

|

|

$

|

17.25

|

|

|

Year ended December 31, 2016

|

|

$

|

32.07

|

|

$

|

12.48

|

|

|

Year ended December 31, 2015(1)

|

|

$

|

21.23

|

|

$

|

14.34

|

|

|

Second quarter 2018 (through May 18, 2018)

|

|

$

|

31.00

|

|

$

|

25.30

|

|

|

First quarter 2018

|

|

$

|

30.82

|

|

$

|

25.10

|

|

|

Fourth quarter 2017

|

|

$

|

29.36

|

|

$

|

22.34

|

|

|

Third quarter 2017

|

|

$

|

24.92

|

|

$

|

17.92

|

|

|

Second quarter 2017

|

|

$

|

23.98

|

|

$

|

17.25

|

|

|

First quarter 2017

|

|

$

|

28.15

|

|

$

|

23.01

|

|

|

Fourth quarter 2016

|

|

$

|

32.07

|

|

$

|

22.95

|

|

|

Third quarter 2016

|

|

$

|

24.95

|

|

$

|

17.83

|

|

|

Second quarter 2016

|

|

$

|

19.91

|

|

$

|

16.65

|

|

|

First quarter 2016

|

|

$

|

18.37

|

|

$

|

12.48

|

|

|

Month ended May 2018 (through May 18, 2018)

|

|

$

|

31.00

|

|

$

|

27.27

|

|

|

Month ended April 30, 2018

|

|

$

|

28.49

|

|

$

|

25.30

|

|

|

Month ended March 31, 2018

|

|

$

|

30.82

|

|

$

|

25.95

|

|

|

Month ended February 28, 2018

|

|

$

|

29.89

|

|

$

|

25.10

|

|

|

Month ended January 31, 2018

|

|

$

|

29.51

|

|

$

|

26.41

|

|

|

Month ended December 31, 2017

|

|

$

|

28.29

|

|

$

|

25.82

|

|

-

(1)

-

For

the period from April 7, 2015 through December 31, 2015.

S-16

Table of Contents

SELLING SHAREHOLDER

Although De Agostini is deemed to be the selling shareholder under this prospectus supplement, its ownership of our ordinary shares will not be

reduced by the transactions described in this prospectus supplement unless it is entitled to and elects to physically settle the variable forward transaction.

The

following table sets forth, as of the date of this prospectus supplement, the number of ordinary shares and percentage of outstanding ordinary shares beneficially owned by De

Agostini prior to the offering, the number of ordinary shares offered in the offering and the number of ordinary shares and percentage of outstanding ordinary shares to be beneficially owned by it

after the offering. The table is based on information provided to us by De Agostini.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percentage of

Total Voting

Power

Owned Prior

to the

Offering(3)

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary Shares

Owned Prior to the

Offering

|

|

|

|

Ordinary Shares

Owned After the

Offering(4)

|

|

Percentage of

Total Voting

Power Owned

After the

Offering(5)(6)

|

|

|

|

Number of

Ordinary Shares

Offered in the

Offering(4)

|

|

|

Name of Selling Shareholder

|

|

Number

|

|

Percentage(2)

|

|

Number

|

|

Percentage(2)

|

|

|

De Agostini S.p.A.(1)

|

|

103,422,324

|

|

|

50.72

|

%

|

|

67.30

|

%

|

|

18,000,000

|

|

|

85,422,324

|

|

|

41.89

|

%

|

|

59.04

|

%

|

-

(1)

-

The

address of both De Agostini's principal business and principal office is 15, Via Giovanni da Verrazano, 28100 Novara, Italy.

-

(2)

-

For

purposes of this table, information as to the percentage of ordinary shares beneficially owned is calculated based on 203,904,990 ordinary shares outstanding as

of May 18, 2018.

-

(3)

-

For

purposes of this table, information as to the percentage of total voting power held by De Agostini is calculated based on 203,904,990 ordinary shares outstanding

as of May 18, 2018, and 103,422,324 Special Voting Shares associated with ordinary shares registered in the Loyalty Register as of May 25, 2018, all of which are held by De Agostini.

-

(4)

-

For

purposes of this table, the number of ordinary shares offered in the offering includes the 13,200,000 ordinary shares relating to the underwritten public

offering and the additional 4,800,000 ordinary shares being borrowed by the counterparty or its affiliates from third-party stock lenders.

-

(5)

-

The

calculations in these columns assume that De Agostini will sell or transfer all of our ordinary shares offered in the offering pursuant to a pledge and physical

settlement of the variable forward transaction and will not acquire any additional ordinary shares. There is no obligation, and no assurance, that De Agostini will sell, pledge or transfer any or all

of such ordinary shares.

-

(6)

-

For

purposes of this table, information as to the percentage of total voting power held by De Agostini is calculated based on 203,904,990 ordinary shares outstanding

as of May 18, 2018, and 85,422,324 Special Voting Shares associated with ordinary shares registered in the Loyalty Register as of May 29, 2018, all of which are held by De Agostini.

S-17

Table of Contents

TAX CONSIDERATIONS

Certain tax considerations relating to an investment in our ordinary shares are set forth under the heading "Taxation" in our Annual Report on

Form 20-F for the fiscal year ended December 31, 2017, filed with the SEC on March 15, 2018, and such tax considerations set forth under the headings "Material U.K. Tax

Considerations" and "Material Italian Tax Considerations" are incorporated by reference herein.

S-18

Table of Contents

PLAN OF DISTRIBUTION

We

have been advised that De Agostini is entering into a variable forward transaction with the counterparty relating to 18,000,000 of our ordinary shares that has economic

characteristics similar to a collar. Subject to satisfying the specified gaming-related regulatory and other conditions, De Agostini may pledge some of our ordinary shares held by it to secure its

obligations under the variable forward transaction and, after that pledge, De Agostini may obtain prepayment from the counterparty of the purchase price for the ordinary shares underlying the variable

forward transaction. In such case, the transaction will have economic characteristics similar to a collar and loan. De Agostini will retain the ability to direct the voting of any pledged ordinary

shares during the term of the transaction, absent default.

Settlement

of the variable forward transaction will occur in multiple tranches that are scheduled to mature over a period commencing on or about four years from May 2018. The variable

forward transaction will be settled for any tranche at De Agostini's election either (i) in cash, or (ii) by physical delivery if certain gaming-related regulatory and other conditions

are satisfied. If there has been no prior prepayment, De Agostini will receive from the counterparty an amount equal to an agreed floor price multiplied by the number of ordinary shares underlying the

tranche. Upon a cash settlement, De Agostini will be required to pay the cash equivalent of a number of ordinary shares to be determined pursuant to a formula specified in the variable forward

transaction based on the volume-weighted

average price per share and agreed floor and cap prices. If De Agostini elects physical settlement, then it may elect to deliver either a number of ordinary shares based on the specified formula, or

all the ordinary shares underlying the tranche; in the latter case, the counterparty may owe De Agostini an additional or increased payment.

We

have been advised that, to establish its initial hedge position with respect to the variable forward transaction, the counterparty (or its affiliates) will borrow 13,200,000 ordinary

shares from third-party stock lenders (the "underwritten shares") and will sell the underwritten shares in an underwritten public offering (the "offering") through Credit Suisse Securities

(USA) LLC, acting as the underwriter, and that the counterparty or its affiliates may modify the counterparty's hedge positions by buying or selling our ordinary shares or engaging in

derivatives or other transactions with respect to our ordinary shares from time to time thereafter during the term of the variable forward transaction.

This

prospectus supplement also relates to an additional 4,800,000 of our ordinary shares, which we have been advised are also being borrowed by the counterparty or its affiliates from

third-party stock lenders. We have been advised that the counterparty or its affiliates or their agents expect to sell these additional ordinary shares, from time to time, in block sales, on the NYSE,

in the over-the-counter market or in negotiated transactions, at market prices prevailing at the time of sale or at negotiated prices. See "Underwriting—Additional offering by the

counterparty or its affiliates" below for more information. These additional ordinary shares will not be included in the offering. We have been advised by the counterparty that it expects that, over

the same period when the counterparty or its affiliates or their agents sell these additional ordinary shares, the counterparty or its affiliates or their agents will purchase an approximately equal

number of ordinary shares in the open market.

The

effect of the variable forward transaction, including any purchases and sales of our ordinary shares by the counterparty and its affiliates or their agents, which may include the

underwriter, to establish or modify the counterparty's hedge positions from time to time during the term of the variable forward transaction, may variously have a positive, negative or neutral impact

on the market price of our ordinary shares, depending on market conditions at such times.

We

have been advised that upon the early termination of the variable forward transaction (in whole or in part) or upon the cash settlement of the variable forward transaction (in whole

or in part) at maturity, the counterparty or its affiliates or their agents may purchase a number of our ordinary

S-19

Table of Contents

shares

in secondary market transactions to return our ordinary shares to stock lenders to unwind the counterparty's hedge positions, and such purchases may have the effect of increasing, or limiting a

decrease in, the market price of our ordinary shares during the relevant unwind period. In addition, we have been advised that, if De Agostini has satisfied the conditions for physical settlement and

elects to

physically settle the variable forward transaction (in whole or in part) at maturity, depending on the market price of our ordinary shares at the time of physical settlement and the type of physical

settlement elected, the counterparty or its affiliates or their agents may purchase or sell our ordinary shares in secondary market transactions to establish, modify or, in some cases, unwind the

counterparty's hedge positions and such purchases or sales may have a positive, negative or neutral impact on the market price of our ordinary shares, depending on market conditions at such time. See

"The Offering—Variable Forward Transaction" and "Risk Factors—The effect of the borrowing of our ordinary shares in connection with the variable forward transaction, and the

sales of our ordinary shares by the counterparty or its affiliates or agents to establish, modify or, in some cases, unwind the counterparty's hedge positions in connection with the variable forward

transaction, may have a negative effect on the market price of our ordinary shares" for more information.

We

are not party to the variable forward transaction and will not be issuing or selling any ordinary shares pursuant to the transaction or receiving any proceeds from the sales of the

ordinary shares in the offering.

S-20

Table of Contents

UNDERWRITING

Under the terms and subject to the conditions contained in an underwriting agreement among IGT PLC, De Agostini, the counterparty and

Credit Suisse Securities (USA) LLC, the underwriter in the offering, dated May 22, 2018, the counterparty has agreed to sell to the underwriter and the underwriter has agreed to purchase

from the counterparty, an aggregate of 13,200,000 of our ordinary shares at a price of $28.25 per share (gross of a 3% underwriting commission), which will result in $372,900,000 of proceeds, before

underwriting commissions and expenses, to the counterparty.

The

underwriting agreement provides that the underwriter is obligated to purchase all of the relevant ordinary shares in the offering if any are purchased.

The

underwriter proposes to offer the underwritten shares from time to time for sale in one or more transactions, in block sales, on the NYSE, in the over-the-counter market or in

negotiated transactions, at market prices prevailing at the time of sale or at negotiated prices, subject to receipt and acceptance and subject to the underwriter's right to reject any order in whole

or in part. In connection with the

sale of the underwritten shares, the underwriter may be deemed to have received compensation in the form of underwriting discounts. The underwriter may effect such transactions by selling ordinary

shares to or through dealers and such dealers may receive compensation in the form of discounts, concessions or commissions from the underwriter and/or purchasers of our ordinary shares for whom they

may act as agents or to whom they may sell as principal.

We

have agreed that we will not offer, sell, contract to sell, pledge or otherwise dispose of, directly or indirectly, or file with the Securities and Exchange Commission a registration

statement under the Securities Act of 1933 (the "Securities Act") relating to, any of our ordinary shares or securities convertible into or exchangeable or exercisable for any of our ordinary shares,

or publicly disclose the intention to make any offer, sale, pledge, disposition or filing, without the prior written consent of Credit Suisse Securities (USA) LLC for a period of 60 days

after the date of this prospectus supplement, except issuances pursuant to any employee plan, benefit or compensation arrangement or employment agreement.

Our

officers and directors have agreed that they will not offer, sell, contract to sell, pledge or otherwise dispose of, directly or indirectly, any of our ordinary shares or securities

convertible into or exchangeable or exercisable for any of our ordinary shares, enter into a transaction that would have the same effect, or enter into any swap, hedge or other arrangement that

transfers, in whole or in part, any of the economic consequences of ownership of our ordinary shares, whether any of these transactions are to be settled by delivery of our ordinary shares or other

securities, in cash or otherwise, or publicly disclose the intention to make any such offer, sale, pledge or disposition, or to enter into any such transaction, swap, hedge or other arrangement,

without, in each case, the prior written consent of Credit Suisse Securities (USA) LLC for a period of 60 days after the date of the underwriting agreement, subject to certain

exceptions.

International

Game Technology, a Nevada corporation and our wholly-owned subsidiary, De Agostini and the counterparty have agreed to indemnify the underwriter and certain of its

controlling persons against certain liabilities, including liabilities under the Securities Act, and to contribute to payments that the underwriter may be required to make in respect of those

liabilities.

In

connection with the offering the underwriter may engage in stabilizing transactions, over-allotment transactions, syndicate covering transactions and penalty bids in accordance with

Regulation M under the Exchange Act.

-

•

-

Stabilizing transactions permit bids to purchase the underlying security so long as the stabilizing bids do not exceed a specified maximum.

-

•

-

Over-allotment involves sales by the underwriter of shares in excess of the number of shares the underwriter are obligated to purchase, which

creates a syndicate short position.

S-21

Table of Contents

-

•

-

Syndicate covering transactions involve purchases of the ordinary shares in the open market after the distribution has been completed to cover

syndicate short positions. A short position is more likely to be created if the underwriter is concerned that there could be downward pressure on the price of the ordinary shares in the open market

after pricing that could adversely affect investors who purchase in the offering.

-

•

-

Penalty bids permit the underwriter to reclaim a selling concession from a syndicate member when the ordinary shares originally sold by the

syndicate member is purchased in a stabilizing transaction or a syndicate covering transaction to cover syndicate short positions.

These

stabilizing transactions, syndicate covering transactions and penalty bids may have the effect of raising or maintaining the market price of our ordinary shares or preventing or

retarding a decline in the market price of the ordinary shares. As a result the price of our ordinary shares may be higher than the price that might otherwise exist in the open market. These

transactions may be effected on the NYSE, in the over-the-counter market or otherwise and, if commenced, may be discontinued at any time.

A

prospectus supplement in electronic format may be made available on the web sites maintained by the underwriter, or selling group members, if any, participating in the offering and the

underwriter may distribute prospectus supplements electronically. The underwriter may agree to allocate a number of shares to selling group members for sale to their online brokerage account holders.

Internet distributions will be allocated by the underwriter and selling group members that will make internet distributions on the same basis as other allocations.

We

estimate that our share of the expenses for the offering will be approximately $3,067,770.

Conflicts of Interest

The underwriter and its affiliates are full-service financial institutions engaged in various activities, which may include securities trading,

commercial and investment banking, financial advisory, investment management, investment research, principal investment, hedging, financing and brokerage activities. The underwriter and its affiliates

have, from time to time, performed, and may in the future perform, various financial advisory and investment banking services for us, for which they received or will receive customary fees and

expenses.

In

addition, in the ordinary course of their business activities, the underwriter and its affiliates may make or hold a broad array of investments and actively trade debt and equity

securities (or related derivative securities) and financial instruments (including bank loans) for their own account and for the accounts of their customers. These investments and securities

activities may involve securities and/or instruments of ours or our affiliates. The underwriter and its affiliates may also make investment recommendations and/or publish or express independent

research views in respect of such securities or financial instruments and may hold, or recommend to clients that they acquire, long and/or short positions in such securities and instruments.

Additional offering by the counterparty or its affiliates

Additionally, we have been advised that the counterparty or its affiliates or agents will offer for sale an aggregate amount of 4,800,000 of our

ordinary shares using this prospectus supplement. The additional ordinary shares will not be included in the offering.

We

have been advised that the counterparty or its affiliates or agents propose to offer the additional ordinary shares from time to time after the offering, in block sales, on the NYSE,

in the over-the-counter market or in negotiated transactions, at market prices prevailing at the time of sale or at negotiated prices. In connection with the sale of these shares, we have been advised

that the counterparty or its affiliates or such agents may effect such transactions by selling the ordinary shares

S-22

Table of Contents

to

or through dealers, and these dealers may receive compensation in the form of discounts, concessions or commissions from those affiliates and/or from purchasers of shares for whom the dealers may

act as agents or to whom they may sell as principals. We have been advised by the counterparty that it expects that, over the same period that the counterparty or its affiliates or such agents sell

the additional ordinary shares, the counterparty or its affiliates or their agents expect to purchase an approximately equal number of ordinary shares in the open market.

Selling restrictions

Notice to Canadian Residents

The distribution of this prospectus supplement in Canada is being made only in the provinces of Ontario, Quebec, Alberta and British Columbia on

a private placement basis exempt from the requirement that we and De Agostini prepare and file a prospectus with the securities regulatory authorities in each province where trades of these

ordinary shares are made. Any resale of our ordinary shares in Canada must be made under applicable securities laws which may vary depending on the relevant jurisdiction, and which may require resales

to be made under available statutory exemptions or under a discretionary exemption granted by the applicable Canadian securities regulatory authority. Canadian purchasers are advised to seek legal

advice prior to any resale of our ordinary shares.

By purchasing our ordinary shares in Canada and accepting delivery of a purchase confirmation, a purchaser is representing to us and De Agostini

and the dealer from whom the purchase confirmation is received that:

-

•

-

the purchaser is entitled under applicable provincial securities laws to purchase such shares without the benefit of a prospectus qualified

under those securities laws as it is an "accredited investor" as defined under National Instrument 45-106—

Prospectus Exemptions

,

-

•

-

the purchaser is a "permitted client" as defined in National Instrument 31-103—

Registration

Requirements, Exemptions and Ongoing Registrant Obligations

,

-

•

-

where required by law, the purchaser is purchasing as principal and not as agent, and

-

•

-

the purchaser has reviewed the text above under "—Resale Restrictions."

Canadian purchasers are hereby notified that the underwriter is relying on the exemption set out in section 3A.3 or 3A.4, if applicable,

of National Instrument 33-105—

Underwriting Conflicts

from having to provide certain conflict of interest disclosure in this

prospectus supplement.

Securities legislation in certain provinces or territories of Canada may provide a purchaser with remedies for rescission or damages if the

offering memorandum (including any amendment thereto) such as this prospectus supplement contains a misrepresentation, provided that the remedies for rescission or damages are exercised by the

purchaser within the time limit prescribed by the securities legislation of the purchaser's province or territory. A purchaser of our ordinary shares in Canada should refer to any applicable

provisions of the securities legislation of the purchaser's province or territory for particulars of these rights or consult with a legal advisor.

S-23

Table of Contents

All of our directors and officers as well as the experts named herein and De Agostini may be located outside of Canada and, as a result, it may

not be possible for Canadian purchasers to effect service of process within Canada upon us or those persons. All or a substantial portion of our assets and the assets of those persons may be located

outside of Canada and, as a result, it may not be possible to satisfy a judgment against us or those persons in Canada or to enforce a judgment obtained in Canadian courts against us or those persons

outside of Canada.

Canadian purchasers of our ordinary shares should consult their own legal and tax advisors with respect to the tax consequences of an investment

in the shares in their particular circumstances and about the eligibility of our ordinary shares for investment by the purchaser under relevant Canadian legislation.

Notice to prospective investors in the European Economic Area

In relation to each member state of the European Economic Area that has implemented the Prospectus Directive (each, a "Relevant Member State"),

with effect from and including the date on which the Prospectus Directive is implemented in that Relevant Member State (the "Relevant Implementation Date"), none of our shares have been offered or

will be offered to the public in that Relevant Member State prior to the publication of a prospectus in relation to such shares which has been approved by the competent authority in that Relevant

Member State or, where appropriate, approved in another Relevant Member State and notified to the competent authority in the Relevant Member State, all in accordance with the Prospectus Directive,

except that with effect from and including the Relevant Implementation Date, the offering may be made to the public in that Relevant Member State at any time under the following exemptions, if they

are implemented in the Relevant Member State:

-

•

-

to any legal entity which is a "qualified investor" as defined in the Prospectus Directive;

-

•

-

to fewer than 100 or, if the Relevant Member State has implemented provisions of the relevant amending directive (2010/73/EU), 150 natural or

legal persons (other than "qualified investors" as defined in the Prospectus Directive), as permitted under the Prospectus Directive, subject to obtaining the prior consent of the relevant dealer or

dealers nominated by us for any such offer; or

-

•

-

in any other circumstances falling within Article 3(2) of the Prospectus Directive,

provided

that no such offer of shares shall require us or the underwriter to publish a prospectus pursuant to Article 3 of the Prospectus Directive, or supplement a prospectus pursuant to

Article 16 of the Prospectus Directive.

For

the purposes of this provision, the expression an "

offer of shares to the public

" in relation to any shares in any Relevant Member

State means the communication in any form and by any means of sufficient information on the terms of the offer and the shares to be offered so as to enable an investor to decide to purchase or

subscribe the shares, as the same may be varied in that Member State by any measure implementing the Prospectus Directive in that Member State, the expression "Prospectus Directive" means Directive

2003/71/EC (and amendments thereto, including Directive 2010/73/EU), and includes any relevant implementing measure in the Relevant Member State.

This

European Economic Area selling restriction is in addition to any other selling restrictions set out below.

S-24

Table of Contents

Notice to prospective investors in Hong Kong

The ordinary shares may not be offered or sold in Hong Kong by means of any document other than (i) to "professional investors" as

defined in the Securities and Futures Ordinance (Cap. 571, Laws of Hong Kong) (the "SFO") and any rules made thereunder; or (ii) in circumstances which do not constitute an offer to the public

within the meaning of the Companies (Winding up and Miscellaneous Provisions) Ordinance (Cap. 32, Laws of Hong Kong) (the "CO"); or (iii) in other circumstances which do not result in the

document being a "prospectus" as defined in the CO. No advertisement, invitation or document relating to the shares may be issued or may be in the possession of any person for the purpose of

issue (in each case whether in Hong Kong or elsewhere), which is directed at, or the contents of which are likely to be accessed or read by, the public in Hong Kong (except if permitted to do so under

the laws of Hong Kong) other than with respect to shares which are or are intended to be disposed of only to persons outside Hong Kong or only to "professional investors" as defined in the SFO and any

rules made thereunder.

Notice to prospective investors in Singapore

This prospectus supplement has not been registered as a prospectus with the Monetary Authority of Singapore. Accordingly, this prospectus

supplement and any other document or material in connection with the offer or sale, or invitation for subscription or purchase, of the shares may not be circulated or distributed, nor may the shares

be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor

under Section 274 of the Securities and Futures Act, Chapter 289 of Singapore (the "SFA"), (ii) to a relevant person pursuant to Section 275(1), or any person pursuant to

Section 275(1A), and in accordance with the conditions specified in Section 275 of the SFA or (iii) otherwise pursuant to, and in accordance with the conditions of, any other

applicable provision of the SFA, in each case subject to compliance with conditions set forth in the SFA.

Where

the shares are subscribed or purchased under Section 275 of the SFA by a relevant person which is:

-

•

-

a corporation (which is not an accredited investor (as defined in Section 4A of the SFA)) the sole business of which is to hold

investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor; or

-

•

-

a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and each beneficiary of the trust is an

individual who is an accredited investor,

shares,

debentures and units of shares and debentures of that corporation or the beneficiaries' rights and interest (howsoever described) in that trust shall not be transferred within six months after

that corporation or that trust has acquired the shares pursuant to an offer made under Section 275 of the SFA except:

-

•

-

to an institutional investor (for corporations, under Section 274 of the SFA) or to a relevant person defined in Section 275(2)

of the SFA, or to any person pursuant to an offer that is made on terms that such shares, debentures and units of shares and debentures of that corporation or such rights and interest in that trust

are acquired at a consideration of not less than S$200,000 (or its equivalent in a foreign currency) for each transaction, whether such amount is to be paid for in cash or by exchange of securities or

other assets, and further for corporations, in accordance with the conditions specified in Section 275 of the SFA;

-

•

-

where no consideration is or will be given for the transfer; or

-

•

-

where the transfer is by operation of law.

S-25

Table of Contents

Notice to prospective investors in Switzerland

This prospectus supplement is not intended to constitute an offer or solicitation to purchase or invest in the shares described herein. The

shares may not be publicly offered, sold or advertised, directly or indirectly, in, into or from Switzerland and will not be listed on the SIX Swiss Exchange or on any other exchange or regulated

trading facility in Switzerland. Neither this document nor any other offering or marketing material relating to the shares constitutes a prospectus as such term is understood pursuant to

article 652a or article 1156 of the Swiss Code of Obligations or a listing prospectus within the meaning of the listing rules of the SIX Swiss Exchange or any other regulated trading

facility in Switzerland, and neither this document nor any other offering or marketing material relating to the shares may be publicly distributed or otherwise made publicly available in Switzerland.

Neither this document nor any other offering or marketing material relating to the offering, nor the Company nor the shares have been or will be filed with or approved by any Swiss regulatory

authority. The shares are not subject to the supervision by any Swiss regulatory authority, e.g., the Swiss Financial Markets Supervisory Authority (FINMA), and investors in the shares will not

benefit from protection or supervision by such authority.

Notice to prospective investors in the United Kingdom

This prospectus supplement is only being distributed to and is only directed at (i) persons who are outside the United Kingdom or

(ii) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the "Order") or (iii) high net worth

companies, and other persons to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as "relevant

persons"). The shares are only available to, and any invitation, offer or agreement to subscribe, purchase or otherwise acquire such shares will be engaged in only with, relevant persons. Any person

who is not a relevant person should not act or rely on this document or any of its contents.

S-26

Table of Contents

EXPENSES

The following table sets forth the estimated expenses (other than underwriting discounts and commissions or agency fees and other items

constituting underwriters' or agents' compensation, if any) expected to be incurred by us in connection with the offering. All of the following expenses are expected to be paid by IGT PLC. De

Agostini has agreed to reimburse IGT PLC for all of the following expenses except for the fees and expenses incurred by IGT PLC in connection with the evaluation of the offering and the variable

forward transaction by the Audit Committee of the Board of Directors of IGT PLC (which non-reimbursable fees and expenses we estimate will amount to $600,000).

|

|

|

|

|

|

|

Expenses

|

|

Amount

|

|

|

SEC registration fee

|

|

$

|

62,770.41

|

|

|

Printing and engraving expenses

|

|

$

|

500,000.00

|

|

|

Legal fees and expenses

|

|

$

|

2,085,000.00

|

|

|

Accounting fees and expenses

|

|

$

|

105,000.00

|

|

|

Miscellaneous costs

|

|

$

|

315,000.00

|

|

|

Total

|

|

$

|

3,067,770.41

|

|

S-27

Table of Contents

LEGAL MATTERS

Certain legal matters in connection with the ordinary shares offered hereby will be passed upon for us by Wachtell, Lipton, Rosen & Katz,

New York, New York and Macfarlanes LLP, London, England. Certain legal matters relating to the offering and the variable forward transaction will be passed upon for the underwriter by Cleary

Gottlieb Steen & Hamilton LLP, New York, New York and for De Agostini by Shearman & Sterling LLP, New York, New York.

EXPERTS

The financial statements and management's assessment of the effectiveness of internal control over financial reporting (which is included in

Management's Report on Internal Control over Financial Reporting) incorporated in this Prospectus by reference to the Annual Report on Form 20-F of International Game Technology PLC for

the year ended December 31, 2017 and the audited historical financial statements of International Game Technology and management's assessment of the effectiveness of internal control over

financial reporting included on page 99 of International Game Technology's Annual Report on Form 10-K for the fiscal year ended September 27, 2014 have been so incorporated in

reliance on the reports (the report related to International Game Technology PLC contains an explanatory paragraph relating the Company's restatement of its financial statements as described in

Note 1 to the financial statements and also contains an adverse opinion on the effectiveness of internal control over financial reporting) of PricewaterhouseCoopers LLP, an independent

registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

S-28

Table of Contents

PROSPECTUS

INTERNATIONAL GAME TECHNOLOGY PLC

Ordinary Shares

Options

Warrants

Rights

Units

We or any selling securityholder may from time to time, in one or more offerings, offer and sell ordinary shares, as well as options, warrants or

rights to purchase ordinary shares and units described in this prospectus. Throughout this prospectus, we refer to the ordinary shares, the options, warrants and rights to purchase ordinary shares and

units collectively as the "securities."

From

the date of this prospectus, we or any selling securityholder may offer and sell these securities from time to time in amounts, at prices and on terms determined by market

conditions at the time of the offering. This prospectus describes only the general terms of these securities and the general manner in which we or a selling securityholder will offer and sell these

securities. The specific term of any securities we or a selling securityholder offer and sell will be included in a supplement to this prospectus. We or any selling securityholder may sell or

otherwise transfer the securities directly or

alternatively through underwriters, broker-dealers or agents. A prospectus supplement will describe the specific manner in which we or any selling securityholder will offer and sell the securities and

also may add, update or change information contained in this prospectus. The names of any underwriters and the specific terms of a plan of distribution will be stated in such a prospectus supplement.

We will not receive any proceeds from the sale of the securities by any selling securityholders.

Our

ordinary shares are listed on the New York Stock Exchange (the "NYSE") under the symbol "IGT." The last reported closing price of our ordinary shares on the NYSE on May 18,

2018 was $30.41 per share. We will provide information in the related prospectus supplement for the trading market, if any, for any securities that may be offered.

Neither

the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or

complete. Any representation to the contrary is a criminal offense.

Investing in our securities involves risks. Please carefully consider the risk factors described under "Risk Factors" on page 3 of this

prospectus and the "Risk Factors" section in any applicable prospectus supplement, for a discussion of the factors you should consider carefully before deciding to purchase our

securities.

The date of this prospectus is May 21, 2018.

Table of Contents

TABLE OF CONTENTS

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of a shelf registration statement that we have filed with the U.S. Securities and Exchange Commission (the "SEC") using

a "shelf" registration process. Under this shelf registration process, we or any selling securityholder may over time, in one or more offerings, offer and sell any combination of the securities

described in this prospectus and in an accompanying prospectus supplement, if required. No limit exists on the aggregate amount of the securities we or any selling securityholder may sell pursuant to

the registration statement to which this prospectus forms a part.

This

prospectus provides you with a general description of the securities we or any selling securityholder may offer and sell. Each time we or a selling securityholder offer and sell our

securities using this prospectus, if and to the extent necessary, we will provide a prospectus supplement that will contain specific information about the terms of that offering, including the number

of securities being offered, the manner of distribution, the identity of the selling securityholder(s), the identity of any

underwriters or other counterparties and other specific material terms related to the offering. Such prospectus supplement may also add, update or change information contained in this prospectus. To

the extent that any statement made in any prospectus supplement is inconsistent with statements made in this prospectus, the statements made in this prospectus will be deemed modified or superseded by

those made in such prospectus supplement. You should read both this prospectus and any prospectus supplement together.

You

should only rely on the information contained in this prospectus, any prospectus supplement and the documents incorporated by reference herein and therein. We have not authorized

anyone to provide you with different information. This prospectus may only be used where it is legal to sell these securities.

The

information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of the prospectus or any sale of

the securities. Additional information, including our financial statements and the notes thereto, is incorporated in this prospectus by reference to our reports filed with the SEC. Before you invest

in our securities, you should carefully read this prospectus, including the "Risk Factors," any prospectus supplement, the information incorporated by reference in this prospectus and any prospectus

supplement (including the documents described under the heading "Where You Can Find Additional Information" in both this prospectus and any prospectus supplement) and any additional information you

may need to make your investment decision.

1

Table of Contents

ABOUT THE COMPANY

Overview

International Game Technology PLC, a public limited company incorporated under the laws of England and Wales ("IGT PLC"), has its

corporate headquarters in London, England.

IGT PLC is the successor to GTECH S.p.A., a

società per azioni

incorporated under the laws of Italy ("GTECH"), and the sole

stockholder of International Game Technology, a Nevada corporation ("IGT"). IGT PLC, together with its consolidated subsidiaries, has principal operating facilities in Providence, Rhode Island;

Las Vegas, Nevada; and Rome, Italy.

On

April 7, 2015, GTECH acquired IGT through the merger of GTECH with and into IGT PLC (the "Holdco Merger"), and the merger of Georgia Worldwide Corporation, a Nevada

corporation and a wholly owned subsidiary of IGT PLC with and into IGT (the "Subsidiary Merger" and, together with the Holdco Merger, the "Mergers").

In

this prospectus, unless otherwise specified, the terms "we," "us" and "our," and the "Company" refer to IGT PLC and its consolidated subsidiaries or, for periods of or points