By Shalini Ramachandran and Erich Schwartzel

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 24, 2018).

Comcast Corp. is escalating its threat to disrupt Walt Disney

Co.'s megadeal to buy the bulk of 21st Century Fox Inc.'s assets, a

potential move that could reshape the power structure in the

entertainment industry.

Comcast said on Wednesday it is in advanced stages of preparing

a cash offer that would top Disney's all-stock, $52.4 billion deal

for Fox's entertainment businesses. One major Fox shareholder is

also urging the company to engage with Comcast, adding pressure as

the cable giant gets ready to appeal directly to Fox

shareholders.

Fox's board last year rejected Comcast's original bid, even

though it exceeded Disney's offer, because directors believed it

was more risky with regulators and would require the sale of too

many valuable assets to win approval.

Since then, Comcast has been laying the groundwork to make a

case for why it should be the one to acquire Fox's assets, setting

the stage for a potential bidding war that would pit Comcast Chief

Executive Brian Roberts against Disney CEO Robert Iger for

businesses long controlled by media titan Rupert Murdoch.

The Fox assets -- which range from international pay-TV

distribution to cable networks and a stake in streaming giant Hulu

-- are some of the most-prized entertainment properties likely to

come on the market for some time, and the Murdoch family's

willingness to sell these assets has come as a surprise to many in

the media industry.

The rare acquisition opportunity, combined with the need to

significantly expand overseas and acquire new distribution and

content, is adding a dimension of urgency for both Comcast and

Disney.

Comcast is dealing with a saturated pay-TV market at home and

could find new growth with Fox's international assets in countries

where the penetration of cable services is lower.

For Disney, a Fox tie-up would immediately give it an advantage

in its fight with Netflix Inc. by bolstering the movies and shows

available for its planned streaming service and giving it majority

ownership in Hulu.

Earlier this month, The Wall Street Journal and others reported

that Comcast was considering making a play to break up the Disney

deal and had lined up around $60 billion in financing. While no

final decision has been made on whether it will make a new run at

Fox, Comcast on Wednesday said the work to finance the offer is

well advanced.

The intended audience for Comcast's announcement is as much Fox

investors as Fox management. The company is preparing to begin

talks with Fox shareholders as soon as this week and wanted to send

a message to them that it is serious about an all-cash offer, a

person close to Comcast said.

Activist investor Chris Hohn would back a Comcast cash bid for

Fox's assets over the current deal with Disney, the investor told

Rupert Murdoch in a private letter Wednesday in which he urged the

media mogul to engage with Comcast on a deal. In the letter -- a

copy of which was reviewed by the Journal -- Mr. Hohn disclosed he

owned a 7.4% stake in Fox and said he was unconcerned about

regulatory risk with a Comcast-Fox deal.

Mr. Hohn also told Mr. Murdoch he believes the Murdoch family

could have a conflict of interest that would lead them to support

the Disney bid, at a lower price, because the all-stock deal would

be better for their taxes than the cash offer from Comcast.

On the company's earnings call this month, Lachlan Murdoch, the

executive co-chairman of 21st Century Fox, declined to comment on

what he called speculation about Comcast. He said Fox was committed

to its agreement with Disney, but Fox's directors "of course are

aware of their fiduciary duties on behalf of all shareholders."

Comcast attempted to allay the Fox board's prior concerns about

regulatory approval and implied it would be willing to agree to a

termination fee. Comcast said the regulatory risk provisions and

breakup fee "would be at least as favorable to Fox shareholders as

the Disney offer."

Because Comcast has yet to bid formally, Disney has no plans to

boost its offer or present a mix of cash and stock, a person

involved in the Disney-Fox transaction said.

21st Century Fox and Wall Street Journal-parent News Corp share

common ownership.

Comcast's moves have complicated Disney's planned acquisition.

Over the past several months, Disney has operated on the assumption

it would close the deal, including reorganizing the company and

granting a contract extension to Mr. Iger so he could oversee the

tie-up.

The takeover battle is the clearest evidence so far of the

potential implications for the government's lawsuit to block

AT&T Inc.'s proposed acquisition of Time Warner Inc.

Comcast made its announcement Wednesday because its executives

were worried Fox and Disney might rush a shareholder vote before

the judge's decision on the AT&T-Time Warner deal came down,

according to people close to Comcast. They said Comcast is still

likely to wait until a judge rules on the AT&T deal before

making a formal offer, since the government's fight against

AT&T was a key concern for Fox's board.

A decision in the AT&T case is expected by June 12.

The dates for the Disney and Fox meetings haven't yet been

announced. Mr. Hohn has urged Fox to not set a day before the start

of July, to give Comcast time to bid after the AT&T

decision.

Even if the ruling is unfavorable for AT&T, Comcast may

proceed with its Fox pursuit, one of the people said. The cable

company's executives believe AT&T, as a national wireless and

pay-TV provider, is subject to greater scrutiny than Comcast, which

doesn't have national reach as a cable TV and broadband provider,

the person said.

Disney executives see Comcast, which owns NBCUniversal, as

having scale in content and broadband that would still trigger

regulatory scrutiny, according to a person familiar with the

matter.

Comcast executives have already talked to Justice Department

officials about their potential pursuit of Fox as part of

discussions with regulators about the Disney-Fox deal, which is

undergoing review, a person close to Comcast said.

The assets Comcast and Disney are seeking to purchase include

the Twentieth Century Fox TV and film studio; cable networks;

international properties, including Star India and its stake in

U.K. pay-TV company Sky PLC; and Fox's stake in streaming service

Hulu.

Comcast has offered to buy Sky for about $30 billion, seeking to

scuttle Fox's agreement to buy the rest of Sky. While Fox has dealt

with an extensive regulatory review in the U.K., Comcast is

unlikely to face an antitrust review there.

The U.K. culture secretary is expected to make a final decision

on Fox's offer for Sky by June 13, and the Europe Union's antitrust

regulators are scheduled to make a decision on Comcast's Sky offer

by June 15.

--Ben Dummett and David Benoit contributed to this article.

Write to Shalini Ramachandran at shalini.ramachandran@wsj.com

and Erich Schwartzel at erich.schwartzel@wsj.com

(END) Dow Jones Newswires

May 24, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

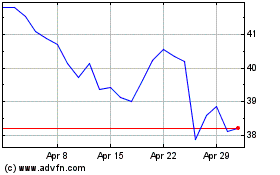

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024