Kroger Expands Online Meals Offerings -- WSJ

May 24 2018 - 3:02AM

Dow Jones News

Supermarket chain to acquire Home Chef in agreement valued at up

to $700 million

By Heather Haddon

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 24, 2018).

Kroger Co. is buying Home Chef, the largest private meal-kit

company in the U.S. by sales, its second deal in as many weeks

aimed at bolstering the supermarket chain's online business.

The deal -- $200 million initially and up to $700 million if

Home Chef hits performance targets -- comes about a week after the

Cincinnati-based grocer took a roughly $250 million stake in

British online grocery operator Ocado Group PLC. The companies are

poised to open a series of automated warehouses for grocery

delivery in the U.S.

Kroger, the largest U.S. supermarket chain by stores and sales,

is quickly pushing to shake up its business model as its faces

competition on all fronts. Amazon.com Inc. is ramping up delivery

service and discounts at Whole Foods stores for Prime members,

while Walmart Inc.'s investments in its stores and technology are

paying off. Deep discounters, meanwhile, have pressured Kroger to

slash costs as weak inflation in food prices haven't boosted sales

as grocers had hoped.

"We are not blind or ignoring what is going on in the space,"

said Yael Cosset, Kroger's chief digital officer, in an interview

Wednesday.

Kroger faces shareholder pressure to innovate. The company's

same-stores-sales growth has weakened after years of steady

increases and shareholders have punished Kroger for long-term

investments that have weighed on immediate profits. Kroger's stock

is down about 11% so far this year.

Kroger executives said Wednesday they are aware of the changes

sweeping the food retail sector, but were pursuing new ways to sell

food in response to customer demand, not Amazon, and that talks

with other companies about deals were continuing.

Meal kits offer their own risks. The business is extremely

competitive, with over 100 meal-kits companies operating online. A

number of grocery stores have started their own meal-kit lines,

including Kroger whose existing Prep+Pared meal kits would fold

into Chicago-based Home Chef, which is expected to operate as a

stand-alone company.

Making boxes of premeasured ingredients for meals have proven to

be operationally challenging and tough to do profitably. Blue Apron

Holdings Inc. is starting to sell its kits in Costco Wholesale

Corp. stores after a series of operation challenges led to a drop

in the number of its subscribers. Startups are increasingly looking

to team up with supermarkets to gain new customers.

Some analysts expect more deals between meal-kit companies and

food retailers as consumers want to buy the boxes both in stores

and online. Pentallect Inc., the food consultancy, projects that

the multibillion-dollar meal-kit market will continue to grow at

about 20% annually.

"These big retailers all see a window of opportunity in buying

these companies to get some expertise," said Bob Goldin, partner at

the Chicago firm.

Kroger's deal is the second tie-up between a national grocery

chain and a meal-kit startup, with Albertsons Cos. buying Plated

last year.

Home Chef has sought a niche in accessible meal kits that aren't

as involved to make as some of those sold by Blue Apron and some

other competitors. Executives said the company's menus and focus on

consumer data proved a good fit for Kroger, which seeks to cater to

mainstream shoppers and use technology to closely study buying

patterns.

Once the deal clears regulatory approvals, executives expect

Home Chef meals to quickly become available in many of Kroger's

2,800 stores. The company said it delivers three million meals a

month nationally. Each meal currently averages around $9.95 a

serving. Home Chef is the third largest meal-kit company by sales

after the two largest providers, publicly traded Blue Apron and

HelloFresh SE.

Home Chef said it made $250 million in sales in 2017 and has

posted two profitable quarters. Kroger executives said they don't

expect the acquisition will hurt earnings this year.

Private-equity firm L Catterton led Home Chef's most recent $40

million funding round, and the company had been involved in deal

talks in the past several months.

Write to Heather Haddon at heather.haddon@wsj.com

(END) Dow Jones Newswires

May 24, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

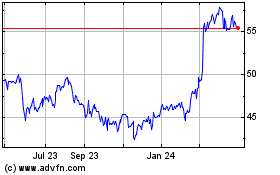

Kroger (NYSE:KR)

Historical Stock Chart

From Mar 2024 to Apr 2024

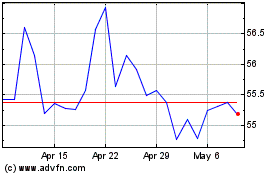

Kroger (NYSE:KR)

Historical Stock Chart

From Apr 2023 to Apr 2024