Additional Proxy Soliciting Materials (definitive) (defa14a)

May 23 2018 - 4:12PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

|

|

|

|

|

Filed by the Registrant

x

|

|

Filed by a Party other than the Registrant

o

|

|

Check the appropriate box:

|

|

o

|

Preliminary Proxy Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2))

|

|

o

|

Definitive Proxy Statement

|

|

x

|

Definitive Additional Materials

|

|

o

|

Soliciting Material under §240.14a‑12

|

|

|

|

|

|

|

|

Criteo S.A.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

x

|

No fee required.

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a‑6(i)(1) and 0‑11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

o

|

Fee paid previously with preliminary materials.

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0‑11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

Paris, May 23, 2018

Dear Shareholder,

We are pleased to hereby inform you that you are convened to the CRITEO S.A. (the “

Company

”) combined ordinary and extraordinary shareholders’ meeting to be held on

June 27, 2018 at 2:00 p.m., Paris time

(the “

Combined Shareholders

Meeting

”), at the

Company’s registered office

, in order to deliberate on the agenda detailed in the enclosed document.

Any shareholder, regardless of the number of shares he/she holds, can participate in the Combined Shareholders Meeting.

The right to participate at the Combined Shareholders Meeting is evidenced by the registration, on

June 25, 2018, 12:00 a.m., Paris time,

of the shares in the name of the shareholder or of the intermediary registered on behalf of such shareholder, in the Company’s shareholders accounts held for it by its agent,

BNP Paribas Securities Services

.

You have several ways to participate in the Combined Shareholders Meeting:

|

|

|

|

•

|

being represented by proxy.

|

To attend the Combined Shareholders Meeting in person

, you can (i) request an admission card from BNP Paribas Securities Services by regular mail or (ii) present yourself on the meeting day directly at the desk specially provided for this purpose with a document showing your identity.

If you are not able to attend the Combined Shareholders Meeting in person

, you can (i) vote by mail or (ii) give a proxy to the Chairman of the Combined Shareholders Meeting or to your spouse or to the partner with whom you have entered into a civil union (

Pacs

) or to another shareholder.

To this effect, you can request a voting or proxy form and return it to BNP Paribas Securities Services at the address provided below. The requests for voting or proxy forms must be received by BNP Paribas Securities Services at the address mentioned below at least six days before the date of the Combined Shareholders Meeting,

i.e.

, on

June 21, 2018

at the latest.

To be taken into account, the voting forms must be received by BNP Paribas Securities Services (

Services Assemblées Générales

) by

June 23, 2018

at the latest.

However, please note that any shareholder who has already voted, sent a proxy or requested an admission card cannot choose any other form of participation.

Any request and/or correspondence relating to the Combined Shareholders Meeting, including proxy forms must be sent to:

BNP Paribas Securities Services

Les Grands Moulins de Pantin

Services Assemblées Générales

9 rue du Débarcadère

93761 Pantin Cedex - France

Tél. : + 33.1.57.43.02.30

Criteo - 32 rue Blanche, 75009 Paris, France - Tél +33 (0)1 .40.40.22.90

SA au capital de 1.656.208,78 € - RCS Paris 484 786 249 00066 – APE 6202A

All the documents that, according to law, must be communicated for the Combined Shareholders Meeting will be made available to the shareholders at the Company’s registered office, within the legal time period.

Note that you can also find all information regarding the Combined Shareholders Meeting online on the Company’s Investor Relations website: http://criteo.investorroom.com/annuals.

Yours sincerely,

________________________

For the Board of Directors

Jean-Baptiste Rudelle

Chairman of the Board and CEO

Encl.: agenda of the Combined Shareholders Meeting

COMBINED SHAREHOLDERS MEETING OF JUNE 27, 2018

Agenda for the Ordinary Shareholders’ Meeting

|

|

|

|

1.

|

Renewal of the term of office of Mr. Jean-Baptiste Rudelle as Director

|

|

|

|

|

2.

|

Renewal of the term of office of Ms. Sharon Fox Spielman as Director

|

|

|

|

|

3.

|

Renewal of the term of office of Mr. Edmond Mesrobian as Director

|

|

|

|

|

4.

|

Renewal of the term of office of Mr. James Warner as Director

|

|

|

|

|

5.

|

Non-binding advisory vote to approve the compensation for the named executive officers of the Company

|

|

|

|

|

6.

|

Approval of the statutory financial statements for the fiscal year ended December 31, 2017

|

|

|

|

|

7.

|

Approval of the consolidated financial statements for the fiscal year ended December 31, 2017

|

|

|

|

|

8.

|

Discharge (

quitus

) of the members of the Board of Directors and the Statutory Auditors for the performance of their duties for the fiscal year ended December 31, 2017

|

|

|

|

|

9.

|

Approval of the allocation of profits for the fiscal year ended December 31, 2017

|

|

|

|

|

10.

|

Approval of the agreements referred to in Articles L. 225-38 et seq. of the French Commercial Code

|

|

|

|

|

11.

|

Renewal of the term of office of RBB Business Advisors (previously named Rouer, Bernard, Bretout) as statutory auditor

|

|

|

|

|

12.

|

Delegation of authority to the Board of Directors to execute a buyback of Company stock in accordance with Article L. 225-209-2 of the French Commercial Code

|

Agenda for the Extraordinary Shareholders’ Meeting

|

|

|

|

13.

|

Delegation of authority to the Board of Directors to reduce the Company’s share capital by cancelling shares as part of the authorization to the Board of Directors allowing the Company to buy back its own shares in accordance with the provisions of Article L. 225-209-2 of the French Commercial Code

|

|

|

|

|

14.

|

Delegation of authority to the Board of Directors to issue and grant warrants (

bons de souscription d’actions

) for the benefit of a category of persons meeting predetermined criteria, without shareholders’ preferential subscription rights

|

|

|

|

|

15.

|

Approval of the overall limits on the amount of ordinary shares to be issued pursuant to resolution 15 (authorization to grant options to purchase or to subscribe shares), resolution 16 (authorization to grant time-based free shares/restricted stock units to employees of the Company and of its subsidiaries) and resolution 17 (authorization to grant performance-based free shares/restricted stock units to executives and certain employees of the Company and its subsidiaries) adopted by the Shareholders’ Meeting held on June 28, 2017 and to Resolution 14 above

|

|

|

|

|

16.

|

Delegation of authority to the Board of Directors to increase the Company’s share capital by issuing ordinary shares, or any securities giving access to the Company’s share capital, through a public offering, without shareholders’ preferential subscription rights

|

|

|

|

|

17.

|

Delegation of authority to the Board of Directors to increase the Company’s share capital by issuing ordinary shares, or any securities giving access to the Company’s share capital, in the context of a private placement, without shareholders’ preferential subscription rights

|

|

|

|

|

18.

|

Delegation of authority to the Board of Directors to increase the Company’s share capital by issuing ordinary shares, or any securities giving access to the Company’s share capital, while preserving the shareholders’ preferential subscription rights

|

|

|

|

|

19.

|

Delegation of authority to the Board of Directors to increase the Company’s share capital by issuing ordinary shares, or any securities giving access to the Company’s share capital, for the benefit of a category of persons meeting predetermined criteria (underwriters), without shareholders’ preferential subscription rights

|

|

|

|

|

20.

|

Delegation of authority to the Board of Directors to increase the number of securities to be issued as a result of a share capital increase pursuant to the delegations in Resolutions 16 to 19 above, with or without shareholders’ preferential subscription rights

|

|

|

|

|

21.

|

Approval of the overall limits on the amount of ordinary shares to be issued pursuant to the delegations in Resolutions 16 to 20 above and Resolution 22 below

|

|

|

|

|

22.

|

Delegation of authority to the Board of Directors to increase the Company’s share capital by way of issuing shares and securities giving access to the Company’s share capital for the benefit of members of a Company savings plan (

plan d'épargne d’entreprise

)

|

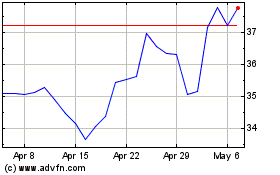

Criteo (NASDAQ:CRTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

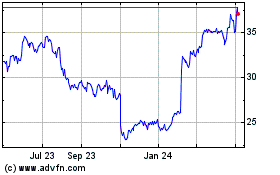

Criteo (NASDAQ:CRTO)

Historical Stock Chart

From Apr 2023 to Apr 2024