Net revenue growth of 8.2%, with comparable

brand revenue growth of 5.5%GAAP diluted EPS of $0.54;

non-GAAP diluted EPS of $0.67Raises 2018 full-year

guidance

Williams-Sonoma, Inc. (NYSE: WSM) today announced operating

results for the first fiscal quarter (“Q1 18”) ended April 29, 2018

versus the first fiscal quarter (“Q1 17”) ended April 30, 2017.

KEY HIGHLIGHTS

1st Quarter

2018

- Net revenue growth of 8.2%

- Comparable brand revenue growth of

5.5%

- E-commerce net revenue growth

accelerates double-digits, to 53.7% of total company net

revenues

- GAAP operating margin of 5.5%; non-GAAP

operating margin of 6.3%

- GAAP diluted EPS of $0.54; non-GAAP

diluted EPS of $0.67 outperforms guidance

- Merchandise inventories growth of 1.5%,

significantly below net revenue growth

These results include the adoption of ASU No. 2014-09, which

pertains to revenue recognition, in the first quarter of 2018. The

year-over-year impact of this change in accounting is a financial

benefit of $13.6 million in net revenues, $1.6 million in operating

income and $0.01 in EPS. From a rate perspective, this amounts to a

benefit of approximately 130bps of revenue growth, 30bps of

comparable brand revenue growth, 70bps of gross margin improvement,

60bps of selling, general and administrative expense deleverage and

10bps of operating margin improvement. See Exhibit 2 for more

details on the financial impact of adoption.

Fiscal Year 2018

Guidance

- Net revenue guidance raised to $5,495

billion – $5,655 billion

- Non-GAAP diluted EPS raised to $4.15 –

$4.25

Laura Alber, President and Chief Executive Officer,

commented, “Following a robust fourth quarter, we saw continued

strength in the first quarter. We achieved strong results against

our guidance range across all metrics, with our e-commerce revenues

outpacing to almost 54% of our total revenues. Our customer growth

continued to trend positively for both new and existing customers,

demonstrating the success of our balanced customer acquisition

strategy.”

Alber continued, “These results speak to the power of our

established multi-channel model, distinctive brand portfolio and

world-class customer service heritage – all of which are our

company’s competitive strengths. Based on this strong start to the

year, we are raising our full year guidance for net revenues by $20

million and for EPS by $0.03.”

1st QUARTER 2018 RESULTS

Net revenues increased 8.2% to $1.203 billion in Q1 18

from $1.112 billion in Q1 17. Excluding certain discrete items,

non-GAAP net revenues were $1.202 billion in Q1 18 or an 8.2%

increase on Q1 17. See Exhibit 1.

Comparable brand revenue in Q1 18 increased 5.5% compared

to an increase of 0.1% in Q1 17 as shown in the table below:

1st Quarter Comparable

Brand Revenue Growth (Decline) by Concept*

Q1 18

Q1 17

Pottery Barn 2.7% (1.4%) West Elm 9.0% 6.0% Williams Sonoma

5.6% 3.2% Pottery Barn Kids and Teen1 5.3% (8.0%)

Total 5.5% 0.1%

*See the Company’s 10-K and 10-Q filings

for the definition of comparable brand revenue.

1Starting in Q1 18, the performance of the

Pottery Barn Kids and PBteen brands are beingreported on a combined

basis as Pottery Barn Kids and Teen. For reference, thecomparable

brand revenue growth for Pottery Barn Kids and PBteen were 4.3% and

8.2%,respectively, for Q1 18, and (5.7%) and (14.3%), respectively,

for Q1 17.

E-commerce net revenues in Q1 18 increased 11.3% to $646

million from $581 million in Q1 17. Excluding certain discrete

items, non-GAAP e-commerce net revenues were $645 million in Q1 18

or an 11.2% increase on Q1 17. See Exhibit 1.

Retail net revenues in Q1 18 increased 4.9% to $557

million from $531 million in Q1 17.

Operating margin in Q1 18 was 5.5% compared to 5.6% in Q1

17. Excluding certain discrete items, non-GAAP operating margin was

6.3% in Q1 18 versus 6.1% in Q1 17. See Exhibit 1.

–

Gross margin was 35.9% in Q1 18 versus

35.6% in Q1 17. Excluding certain discrete items, non-GAAP gross

margin was 36.0% in Q1 18. See Exhibit 1.

–

Selling, general and administrative

(“SG&A”) expenses were $366 million, or 30.4% of net revenues

in Q1 18, versus $333 million, or 30.0% of net revenues in Q1 17.

Excluding certain discrete items, non-GAAP SG&A expenses were

$358 million, or 29.7% of net revenues in Q1 18 versus $328

million, or 29.5% of net revenues in Q1 17. See Exhibit 1.

The effective income tax rate in Q1 18 was 30.9% versus

36.8% in Q1 17. Excluding certain discrete items, the non-GAAP

effective income tax rate was 23.8% in Q1 18 versus 34.5% in Q1 17.

See Exhibit 1.

EPS in Q1 18 was $0.54 versus $0.45 in Q1 17. Excluding

certain discrete items, non-GAAP EPS was $0.67 in Q1 18 versus

$0.51 in Q1 17. See Exhibit 1.

Merchandise inventories at the end of Q1 18 increased

1.5% to $1.053 billion from $1.037 billion at the end of Q1 17.

STOCK REPURCHASE PROGRAM

During Q1 18, we repurchased 732,000 shares of common stock at

an average cost of $51.53 per share and a total cost of

approximately $38 million. As of April 29, 2018, there was

approximately $481 million remaining under our current stock

repurchase program.

FISCAL YEAR 2018 FINANCIAL

GUIDANCE

2nd Quarter 2018

Financial Guidance*

Total Net Revenues (millions) $1,250 – $1,275 Comparable

Brand Revenue Growth 3% – 5% Non-GAAP Diluted EPS $0.65 – $0.70

Fiscal Year 2018 Financial

Guidance*

Total Net Revenues (millions) $5,495 – $5,655 Comparable

Brand Revenue Growth 2% – 5% Non-GAAP Operating Margin 8.2% – 9.0%

Non-GAAP Diluted EPS $4.15 – $4.25 Non-GAAP Income Tax Rate 24.0% –

26.0% Capital Spending (millions) $200 – $220 Depreciation and

Amortization (millions) $185 – $195

* We have not provided a reconciliation of

non-GAAP guidance measures to the corresponding

GAAP measures on a forward-looking basis due to the

potential variability of discrete items.

Store Opening and Closing Guidance by

Retail Concept**

FY 2017 ACTUAL FY 2018 GUIDANCE

Total New

Close

End Williams Sonoma 228 5 (15) 218 Pottery Barn 203 4 (3)

204 West Elm 106 9 (3) 112 Pottery Barn Kids 86 - (9) 77

Rejuvenation 8 2

-

10

Total 631 20 (30) 621

** Included in the FY 17 store count are

19 stores in Australia and two stores in the

UK. FY 18 guidance includes

one additional UK store.

CONFERENCE CALL AND WEBCAST INFORMATION

Williams-Sonoma, Inc. will host a live conference call today,

May 23, 2018, at 2:00 P.M. (PT). The call, hosted by Laura Alber,

President and Chief Executive Officer, will be open to the general

public via live webcast and can be accessed at

http://ir.williams-sonomainc.com/events. A replay of the webcast

will be available at http://ir.williams-sonomainc.com/events.

SEC REGULATION G — NON-GAAP INFORMATION

This press release includes non-GAAP financial measures. Exhibit

1 provides reconciliations of these non-GAAP financial measures to

the most comparable financial measures calculated and presented in

accordance with accounting principles generally accepted in the

U.S. (“GAAP”). We believe that these non-GAAP financial measures,

when reviewed in conjunction with GAAP financial measures, can

provide meaningful supplemental information for investors regarding

the performance of our business and facilitate a meaningful

evaluation of current period performance on a comparable basis with

prior periods. Our management uses these non-GAAP financial

measures in order to have comparable financial results to analyze

changes in our underlying business from quarter to quarter. These

non-GAAP financial measures should be considered as a supplement

to, and not as a substitute for or superior to the GAAP financial

measures presented in this press release and our financial

statements and other publicly filed reports. Non-GAAP financial

measures as presented herein may not be comparable to similarly

titled measures used by other companies.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements that

involve risks and uncertainties, as well as assumptions that, if

they do not fully materialize or are proven incorrect, could cause

our results to differ materially from those expressed or implied by

such forward-looking statements. Such forward-looking statements

include statements relating to: our ability to continue to improve

performance and increase our competitive advantage; our focus on

operational excellence; our ability to improve customers’

experience; our optimism about the future; our ability to drive

long-term profitable growth; our future financial guidance,

including Q2 18 and FY 2018 guidance; our stock repurchase program;

and our proposed store openings and closures.

The risks and uncertainties that could cause our results to

differ materially from those expressed or implied by such

forward-looking statements include: continuing changes in general

economic conditions, and the impact on consumer confidence and

consumer spending; new interpretations of or changes to current

accounting rules or tax regulations; our ability to anticipate

consumer preferences and buying trends; dependence on timely

introduction and customer acceptance of our merchandise; changes in

consumer spending based on weather, political, competitive and

other conditions beyond our control; delays in store openings;

competition from companies with concepts or products similar to

ours; timely and effective sourcing of merchandise from our foreign

and domestic vendors and delivery of merchandise through our supply

chain to our stores and customers; effective inventory management;

our ability to manage customer returns; successful catalog

management, including timing, sizing and merchandising;

uncertainties in e-marketing, infrastructure and regulation;

multi-channel and multi-brand complexities; our ability to

introduce new brands and brand extensions; challenges associated

with our increasing global presence; dependence on external funding

sources for operating capital; disruptions in the financial

markets; our ability to control employment, occupancy and other

operating costs; our ability to improve our systems and processes;

changes to our information technology infrastructure; general

political, economic and market conditions and events, including

war, conflict or acts of terrorism; and other risks and

uncertainties described more fully in our public announcements,

reports to stockholders and other documents filed with or furnished

to the SEC, including our Annual Report on Form 10-K for the fiscal

year ended January 28, 2018 and all subsequent quarterly reports on

Form 10-Q and current reports on Form 8-K. All forward-looking

statements in this press release are based on information available

to us as of the date hereof, and we assume no obligation to update

these forward-looking statements.

ABOUT WILLIAMS-SONOMA, INC.

Williams-Sonoma, Inc. is a specialty retailer of high-quality

products for the home. These products, representing distinct

merchandise strategies — Williams Sonoma, Pottery Barn, Pottery

Barn Kids, West Elm, PBteen, Williams Sonoma Home, Rejuvenation,

and Mark and Graham — are marketed through e-commerce websites,

direct-mail catalogs and retail stores. We operate in the U.S.,

Puerto Rico, Canada, Australia and the United Kingdom, offer

international shipping to customers worldwide, and have

unaffiliated franchisees that operate stores in the Middle East,

the Philippines, Mexico and South Korea, as well as e-commerce

websites in certain locations. In 2017, we acquired Outward, Inc.,

a 3-D imaging and augmented reality platform for the home

furnishings and décor industry.

Williams-Sonoma, Inc.

Condensed Consolidated Statements of

Earnings

(unaudited)

Thirteen Weeks Ended April 29, 2018 April 30,

2017 In thousands, except per share amounts $ %

ofRevenues $ % ofRevenues E-commerce net revenues

646,180 53.7% 580,510 52.2% Retail net revenues

556,820 46.3% 530,997 47.8%

Net

revenues 1,203,000 100.0% 1,111,507

100.0% Cost of goods sold 770,836 64.1%

715,747 64.4%

Gross profit 432,164

35.9% 395,760 35.6% Selling, general and

administrative expenses 365,614 30.4% 333,286

30.0%

Operating income 66,550 5.5%

62,474 5.6%

Interest (income) expense, net

1,201 0.1% (103) -

Earnings before

income taxes 65,349 5.4% 62,577

5.6% Income taxes 20,181 1.7% 23,022

2.1%

Net earnings 45,168

3.8% 39,555 3.6% Earnings per

share (EPS): Basic $0.54 $0.45 Diluted $0.54

$0.45

Shares used in calculation of

EPS: Basic 83,392 86,962 Diluted 84,174

87,710

Williams-Sonoma, Inc.

Condensed Consolidated Balance

Sheets

(unaudited)

In thousands, except per share amounts April 29,

2018

January 28,

2018

April 30,

2017

ASSETS Current assets Cash and cash equivalents $ 290,244 $ 390,136

$ 93,975 Accounts receivable, net 102,630 90,119 63,982 Merchandise

inventories, net 1,052,892 1,061,593 1,037,107 Prepaid catalog

expenses — 20,517 20,341 Prepaid expenses 56,333 62,204 64,739

Other current assets 21,118 11,876

10,901 Total current assets 1,523,217

1,636,445 1,291,045 Property and

equipment, net 926,320 932,283 920,531 Deferred income taxes, net

58,842 67,306 124,977 Other long-term assets, net

148,526 149,715 54,624 Total assets

$ 2,656,905 $ 2,785,749 $ 2,391,177

LIABILITIES AND STOCKHOLDERS’ EQUITY Current liabilities Accounts

payable $

393,025

$

457,144

$

397,442

Accrued expenses 99,823 134,207 87,184 Gift card and other deferred

revenue 256,534 300,607 298,113 Borrowings under revolving line of

credit — — 45,000 Income taxes payable 72,036 56,783 37,792 Other

current liabilities

61,403

59,082

47,134

Total current liabilities 882,821

1,007,823 912,665 Deferred rent and lease incentives

204,599 202,134 195,201 Long-term debt 299,472 299,422 — Other

long-term liabilities 72,779 72,804

73,160 Total liabilities 1,459,671

1,582,183 1,181,026 Stockholders’

equity Preferred stock: $.01 par value; 7,500 shares authorized;

none issued — — —

Common stock: $.01 par value; 253,125

shares authorized; 83,222, 83,726 and 86,883

shares issued and outstanding at April 29,

2018, January 28, 2018 and April 30, 2017,

respectively

833

837 869 Additional paid-in capital 564,685 562,814 549,281 Retained

earnings 638,774 647,422 671,758

Accumulated other comprehensive loss

(6,755)

(6,782)

(10,830)

Treasury stock, at cost (303) (725)

(927)

Total stockholders’ equity 1,197,234

1,203,566 1,210,151 Total liabilities and

stockholders’ equity $ 2,656,905 $ 2,785,749 $

2,391,177

Retail Store

Data(unaudited)

January 28, 2018

Openings Closings April 29, 2018 April 30,

2017 Williams Sonoma 228 — (4) 224 233 Pottery Barn 203 1 (1) 203

199 West Elm 106 2 — 108 99 Pottery Barn Kids 86 — (2) 84 89

Rejuvenation 8 — — 8 8 Total

631 3 (7) 627 628

Williams-Sonoma, Inc.

Condensed Consolidated Statements of

Cash Flows

(unaudited)

Thirteen Weeks Ended In thousands April

29,2018 April 30,2017 Cash flows from operating activities:

Net earnings $ 45,168 $ 39,555 Adjustments to reconcile net

earnings to net cash provided by (used in) operating activities:

Depreciation and amortization 47,873 44,950 Loss on

disposal/impairment of assets

414

519 Amortization of deferred lease incentives (6,724)

(6,477)

Deferred income taxes (3,241)

(3,848)

Tax benefit related to stock-based awards 6,126 13,742 Stock-based

compensation expense 12,889 9,817 Other 64

(76)

Changes in: Accounts receivable

(9,556)

24,610 Merchandise inventories 2,388

(60,246)

Prepaid catalog expenses —

(844)

Prepaid expenses and other assets (4,399)

(11,069)

Accounts payable

(76,823)

(65,483)

Accrued expenses and other liabilities

(32,047)

(47,248)

Gift card and other deferred revenue

4,815

(4,648)

Deferred rent and lease incentives 10,004 5,806 Income taxes

payable 13,818 14,564 Net cash provided

by (used in) operating activities

10,769

(46,376)

Cash flows from investing activities: Purchases of property and

equipment (34,029)

(32,153)

Other

120

5 Net cash used in investing activities

(33,909)

(32,148)

Cash flows from financing activities: Repurchases of common stock

(37,713)

(38,350)

Payment of dividends (34,081)

(34,189)

Tax withholdings related to stock-based awards (7,438)

(13,780)

Borrowings under revolving line of credit —

45,000 Net cash used in financing activities

(79,232)

(41,319)

Effect of exchange rates on cash and cash equivalents 2,480 105 Net

decrease in cash and cash equivalents (99,892)

(119,738)

Cash and cash equivalents at beginning of period

390,136 213,713 Cash and cash equivalents at end of

period $ 290,244 $ 93,975

Exhibit 1

1st Quarter GAAP to

Non-GAAP Reconciliation*

(unaudited)

(Dollars in thousands, except per share

data)

Thirteen Weeks Ended April 29, 2018

GAAP Basis

(as reported)

Outward-Related1

Employment-

Related Expense2

Tax Reform3

Impact of Equity

Accounting Rules4

Non-GAAP Basis Net revenues $ 1,203,000 $ (694) $ 1,202,306

Gross profit 432,164

582

432,746

% of Revenues 35.9% 36.0% Selling, general and administrative

expenses 365,614 (6,344) (1,702) - - 357,568 % of Revenues 30.4%

29.7% Operating income 66,550 6,926 1,702 - - 75,178 % of Revenues

5.5% 6.3% Earnings before income taxes 65,349 6,930 1,702 - -

73,981 Income taxes 20,181 1,467 402 $ (3,298) $ (1,146) 17,606 Tax

rate 30.9%

23.8% Net earnings $ 45,168

$ 5,463 $

1,300

$ 3,298 $ 1,146 $ 56,375

Diluted EPS

$0.54 $0.06 $0.02 $0.04 $0.01

$0.67 Thirteen Weeks Ended April 30, 2017

GAAP Basis

(as reported)

Severance-Related

Expense5

Adoption of Equity

Accounting Rules4

Non-GAAP

Basis

Selling, general and administrative expenses $ 333,286 $ (5,705) -

$ 327,581 % of Revenues 30.0% 29.5% Operating income 62,474 5,705 -

68,179 % of Revenues 5.6% 6.1% Earnings before income taxes 62,577

5,705 - 68,282 Income taxes 23,022 1,971 $ (1,429) 23,564 Tax rate

36.8% 34.5%

Net earnings $ 39,555 $ 3,734 $ 1,429 $

44,718

Diluted EPS $0.45 $0.04 $0.02

$0.51

*Per share amounts may not sum across due

to rounding to the nearest cent per diluted share.

Reconciliation of GAAP to Non-GAAP By

Segment**

(unaudited)

In

thousands E-commerce Retail Unallocated

Total Q1 18 Q1 17 Q1 18 Q1 17 Q1 18

Q1 17 Q1 18 Q1 17 Net revenues $ 646,180 $ 580,510 $

556,820 $ 530,997 - - $ 1,203,000 $ 1,111,507 Outward-related1

(694)

(694) Non-GAAP net revenues

645,486 580,510 556,820

530,997 1,202,306

1,111,507 Net revenue growth 11.3% 0.7% 4.9% 1.8% 8.2% 1.2%

Non-GAAP net revenue growth 11.2% 0.7%

4.9% 1.8% 8.2%

1.2% GAAP operating income (expense)

142,805 132,004 22,061 21,714

(98,316) (91,244) 66,550 62,474 GAAP

operating margin 22.1% 22.7%

4.0% 4.1% (8.2)% (8.2)% 5.5%

5.6% Outward-related1 5,551 - - - 1,375 - 6,926 -

Employment-related expense2 - - - - 1,702 - 1,702 -

Severance-related expenses5 - -

- - - 5,705 - 5,705

Non-GAAP operating income (expense) 148,356

132,004 22,061 21,714 (95,239)

(85,539) 75,178 68,179 Non-GAAP operating

margin 23.0% 22.7% 4.0%

4.1% (7.9)% (7.7)% 6.3% 6.1%

**See the Company’s 10-K and 10-Q filings

for additional information on segment reporting and the definition

of operating income (expense) and operating margin.

SEC Regulation G – Non-GAAP Information – These tables

include non-GAAP net revenues, gross profit, gross margin,

SG&A, operating income, operating margin, earnings before

income taxes, income taxes, effective tax rate, net earnings and

diluted EPS. We believe that these non-GAAP financial measures

provide meaningful supplemental information for investors regarding

the performance of our business and facilitate a meaningful

evaluation of our quarterly actual results on a comparable basis

with prior periods. Our management uses these non-GAAP financial

measures in order to have comparable financial results to analyze

changes in our underlying business from quarter to quarter. These

non-GAAP financial measures should be considered as a supplement

to, and not as a substitute for, or superior to, financial measures

calculated in accordance with GAAP. Non-GAAP financial measures as

presented herein may not be comparable to similarly titled measures

used by other companies.

Notes to Exhibit 1:

1

During Q1 18, we incurred approximately

$6.9 million of expense, primarily associated with

acquisition-related compensation expense, amortization of

intangible assets, as well as the operations of Outward, Inc.

2

During Q1 18, we incurred approximately

$1.7 million of employment-related expense in our corporate

functions, which is recorded in selling, general and administrative

expenses within the unallocated segment.

3

During Q1 18, we recorded income tax

expense of approximately 3.3 million, primarily related to the

measurement of the income tax effect of the Tax Cuts and Jobs Act

enacted in Q4 17.

4 During Q1 18 and Q1 17, we recorded income tax expense of

approximately $1.1 million and $1.4 million, respectively,

associated with the adoption of accounting rules related to

stock-based compensation. 5 During Q1 17, we incurred approximately

$5.7 million for severance-related reorganization expenses

primarily in our corporate functions, which is recorded in selling,

general and administrative expenses within the unallocated segment.

Exhibit 2

ASU No. 2014-09 Impact of

Adoption*

(unaudited)

(Dollars in thousands)

Q1

2018GAAPAs Reported ASU 2014-09Adjustment Q1

2018GAAPAs Adjusted Net revenues $ 1,203,000 $ (25,101) $ 1,177,899

Cost of goods sold 770,836 (6,144) 764,692 Gross profit 432,164

(18,957) 413,207 SG&A expenses 365,614 (12,262) 353,352

Operating income $ 66,550 $ (6,695) $ 59,855

*We adopted ASU No. 2014-09, which

pertains to revenue recognition, in the first quarter of fiscal

2018. This table shows the impact of adopting ASU No. 2014-09 on

our consolidated statement of earnings for the first quarter of

fiscal 2018.

Pro Forma Effect of ASU No.

2014-09**

(unaudited)

(Dollars in thousands, except per share

data)

As Reported Pro Forma

Q1 2018

Non-

GAAP1

Q1 2017

Non-

GAAP2

Q1

Year-

Over-

Year

Q1 2018

Non-

GAAP1

Q1 2017 Non-

GAAP Including

the Effect of

ASU 2014-093

Q1

Year-

Over-

Year

Year-Over-Year

Impact of

Accounting Change

Net revenues $1,202,306 $1,111,507 $90,799 $1,202,306

$1,125,131 $77,175 $13,624 Net revenue growth 8.2% 6.9% 1.3%

Revenue comp 5.5% 5.2%

0.3% Gross margin % 36.0% 35.6% 0.4% 36.0% 36.3% -0.3% 0.7%

SG&A expenses % 29.7% 29.5% -0.2% 29.7% 30.1%

0.4% -0.6% Operating income 75,178 68,179 $6,999 75,178 69,751

$5,427 $1,572 Operating margin % 6.3% 6.1% 0.2% 6.3%

6.2% 0.1% 0.1% Diluted EPS $0.67 $0.51 $0.16 $0.67

$0.52 $0.15 $0.01 ** We adopted ASU No. 2014-09 in the first

quarter of fiscal 2018 using the modified retrospective method.

Results for reporting periods beginning after January 29, 2018 are

presented under ASU No. 2014-09, while prior period amounts are not

adjusted and continue to be reported in accordance with the prior

revenue recognition standard. This table presents the pro forma

effect of ASU No. 2014-09 as if the recognition and presentation

guidance in the accounting standard had been applied in fiscal

2017.

1

These numbers represent Q1 2018 non-GAAP

financial results as disclosed in Exhibit 1, and include the impact

of adopting the new revenue standard (ASU 2014-09).

2

These numbers represent Q1 2017 non-GAAP financial results as

disclosed in Exhibit 1, and exclude the impact of the new revenue

standard.

3

In order to provide a meaningful

year-over-year comparison of our Q1 financial results, we have

adjusted our Q1 2017 results for informational purposes to reflect

the impact as if the new revenue standard had been adopted in Q1

2017.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180523006248/en/

WILLIAMS-SONOMA, INC.Julie Whalen, 415-616-8524EVP, Chief

Financial Officer-or-Elise Wang, 415-616-8571Vice President,

Investor Relations

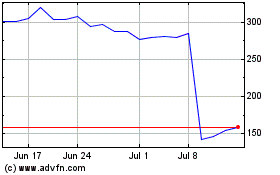

Williams Sonoma (NYSE:WSM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Williams Sonoma (NYSE:WSM)

Historical Stock Chart

From Apr 2023 to Apr 2024