Statement of Changes in Beneficial Ownership (4)

May 23 2018 - 3:01PM

Edgar (US Regulatory)

|

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue.

See

Instruction 1(b).

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Moyes Michael

|

2. Issuer Name

and

Ticker or Trading Symbol

Knight-Swift Transportation Holdings Inc.

[

KNX

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director

_____ 10% Owner

_____ Officer (give title below)

__

X

__ Other (specify below)

Member of 10% owner group

|

|

(Last)

(First)

(Middle)

C/O SWIFT AVIATION GROUP, INC., 2710 E. OLD TOWER ROAD

|

3. Date of Earliest Transaction

(MM/DD/YYYY)

5/21/2018

|

|

(Street)

PHOENIX, AZ 85034

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_

X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

|

Explanation of Responses:

|

|

(1)

|

Effective as of May 21, 2018, M Capital Group Investors II, LLC ("M Capital II"), amended certain prepaid variable share forward contracts (each a "VPF" and, collectively, the "VPFs"), as further described herein.

|

|

(2)

|

Under the VPFs, M Capital II is obligated to deliver a variable amount of Class A Common Stock, par value $0.01 per share, of Knight-Swift Transportation Holdings Inc. ("Class A Common Stock"), or an equivalent amount of cash, upon certain dates set forth in the VPFs. The number of shares deliverable under the VPFs depends on the "Forward Floor Price," "Forward Cap Price," "Number of Shares," and "Settlement Price," each as defined in the applicable VPFs. The VPFs have one or more components, each with its own "Valuation Date" and "Number of Shares."

|

|

(3)

|

The actual number of shares required to be delivered under each component of the VPFs depends on the Settlement Price with respect to such component. If the Settlement Price is less than or equal to the Forward Floor Price on the relevant Valuation Date, the Number of Shares attributable to that component must be delivered. If the Settlement Price is greater than the Forward Floor Price but less than or equal to the Forward Cap Price, the number of shares to be delivered equals the Forward Floor Price, divided by the Settlement Price, multiplied by the Number of Shares. If the Settlement Price is greater than the Forward Cap Price, the number of shares to be delivered is equal to the product of (i) the Number of Shares and (ii) a fraction (a) the numerator of which is the sum of (x) the Forward Floor Price and (y) the Settlement Price minus the Forward Cap Price, and (b) the denominator of which is the Settlement Price.

|

|

(4)

|

The Settlement Price under the VPFs is defined as the volume-weighted average price per share of Class A Common Stock on the New York Stock Exchange on the relevant "Valuation Date" (as defined in each component). The shares or cash deliverable generally must be delivered on the date that is one Settlement Cycle (as defined in 2002 ISDA Equity Derivatives Definitions) following the relevant Valuation Date.

|

|

(5)

|

The reported transactions involve an amendment to an existing and previously reported VPF by M Capital II. The number of components remained unchanged at twenty. The Number of Shares underlying each component remained unchanged at 442,585 shares underlying nineteen of the components and 442,577 shares underlying the twentieth component. The amendment amended the Valuation Dates from August 14, 2018 through September 11, 2018, to February 15, 2019 through March 15, 2019. The maximum number of shares to be delivered under this VPF remained unchanged at 8,851,692.

|

|

(6)

|

The Forward Floor Price and Forward Cap Price under this VPF changed from $38.00 and $45.00, respectively, to amounts determined by reference to a table depending upon the average of the volume-weighted average price per Share of Class A Common Stock on each of the 10 scheduled trading days following May 21, 2018 (the "Amendment and Restatement Reference Price"). The lowest Amendment and Restatement Reference Price in the table is $38.00, in which case the Forward Floor Price will be $39.00 and the Forward Cap Price will be $44.25. The highest Amendment and Restatement Reference Price in the table is $42.00, in which case the Forward Floor Price will be $39.00 and the Forward Cap Price will be $45.50. If the Amendment and Restatement Reference Price is below the lowest or exceeds the highest Amendment and Restatement Reference Price, the Forward Floor Price and Forward Cap Price will each be extrapolated from the table by the Calculation Agent in a commercially reasonable manner.

|

|

(7)

|

The reported transactions involve an amendment to an existing and previously reported VPF by M Capital II. The number of components remained unchanged at twenty. The Number of Shares underlying each component remained unchanged at 493,200. The amendment amended the Valuation Dates from August 14, 2018 through September 11, 2018, to February 15, 2019 through March 15, 2019. The maximum number of shares to be delivered under this VPF remained unchanged at 9,864,000.

|

|

(8)

|

The Forward Floor Price and Forward Cap Price under this VPF changed from $36.14 and $44.55, respectively, to amounts determined by reference to a table depending upon the Amendment and Restatement Reference Price. The lowest Amendment and Restatement Reference Price in the table is $38.00, in which case the Forward Floor Price will be $38.55 and the Forward Cap Price will be $43.80. The highest Amendment and Restatement Reference Price in the table is $42.00, in which case the Forward Floor Price will be $37.50 and the Forward Cap Price will be $44.55. If the Amendment and Restatement Reference Price is below the lowest or exceeds the highest Amendment and Restatement Reference Price, the Forward Floor Price and Forward Cap Price will each be extrapolated from the table by the Calculation Agent in a commercially reasonable manner.

|

|

(9)

|

Shares are held directly by M Capital II. The reporting person is the trustee of five trusts that constitute certain of the members of M Capital II and is the beneficiary of a trust that is also a member of M Capital II. The reporting person disclaims any beneficial ownership of these shares except to the extent of his pecuniary interest therein, and the inclusion of these shares in this report shall not be deemed an admission of beneficial ownership of these shares for Section 16 or for any other purpose.

|

Reporting Owners

|

|

Reporting Owner Name / Address

|

Relationships

|

|

Director

|

10% Owner

|

Officer

|

Other

|

Moyes Michael

C/O SWIFT AVIATION GROUP, INC.

2710 E. OLD TOWER ROAD

PHOENIX, AZ 85034

|

|

|

|

Member of 10% owner group

|

Signatures

|

|

/s/ Michael Moyes, by Earl Scudder, attorney-in-fact, pursuant to a POA previously filed

|

|

5/23/2018

|

|

**

Signature of Reporting Person

|

Date

|

|

Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly.

|

|

*

|

If the form is filed by more than one reporting person,

see

Instruction 4(b)(v).

|

|

**

|

Intentional misstatements or omissions of facts constitute Federal Criminal Violations.

See

18 U.S.C. 1001 and 15 U.S.C. 78ff(a).

|

|

Note:

|

File three copies of this Form, one of which must be manually signed. If space is insufficient,

see

Instruction 6 for procedure.

|

|

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

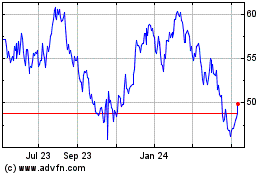

Knight Swift Transportat... (NYSE:KNX)

Historical Stock Chart

From Mar 2024 to Apr 2024

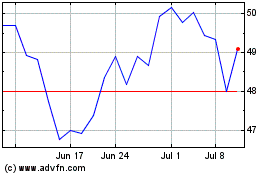

Knight Swift Transportat... (NYSE:KNX)

Historical Stock Chart

From Apr 2023 to Apr 2024