Current Report Filing (8-k)

May 22 2018 - 5:20PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (date of earliest event reported): May 21, 2018

TETRA Technologies, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

1-13455

|

|

74-2148293

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

24955 Interstate 45 North

The Woodlands, Texas 77380

(Address of Principal Executive Offices and Zip Code)

Registrant’s telephone number, including area code: (281) 367-1983

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 7.01. Regulation FD Disclosure.

Stuart M. Brightman, Chief Executive Officer and a director of TETRA Technologies, Inc. (“TETRA” or the “Company”), has adopted a pre-arranged trading plan (the “Plan”) to sell shares of the Company’s common stock in connection with the exercise of nonqualified stock options previously granted to Mr. Brightman. The Plan was designed to comply with Rule 10b5-1 under the Securities Exchange Act of 1934, as amended, and the Company’s policies regarding stock transactions. Under Rule 10b5-1, directors, officers and other affiliates of an issuer who are not in possession of material non-public information may adopt a pre-arranged plan or contract for the sale of the issuer’s securities under specified conditions and at specified times.

The Plan has been adopted by Mr. Brightman to facilitate his exercise of 100,000 nonqualified stock options that will expire on February 12, 2019. Under the terms of the Plan, the nonqualified stock options will be exercised and the underlying shares will be sold, in one or more transactions, on the open market at prevailing market prices, subject to minimum price thresholds, beginning on June 21, 2018. The Plan is scheduled to terminate on February 12, 2019 (or sooner under certain circumstances including the sale of all shares under the Plan). Mr. Brightman will have no control over the timing of sales of stock under the Plan. Mr. Brightman has exceeded the level of common stock ownership required under the Company’s stock ownership guidelines, and the sale by Mr. Brightman of the shares underlying the unexercised nonqualified stock options covered by the Plan will not affect his compliance with such ownership guidelines.

All sales of stock under the Plan will be disclosed publicly to the extent required by applicable securities laws, rules and regulations through Form 4 filings with the Securities and Exchange Commission. The Company does not undertake to report other Rule 10b5-1 plans that may be adopted by officers or directors of the Company in the future, or to report any modifications or termination of any publicly announced plan, except to the extent required by law. Additional officers of the Company may from time to time also adopt Rule 10b5-1 Plans.

The information furnished in Item 7.01 to this Current Report shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

TETRA Technologies, Inc.

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/Bass C. Wallace, Jr.

|

|

|

|

|

|

Bass C. Wallace, Jr.

|

|

|

|

|

|

Senior Vice President and General Counsel

|

|

Date: May 22, 2018

|

|

|

|

|

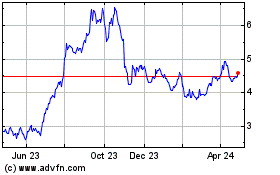

TETRA Technologies (NYSE:TTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

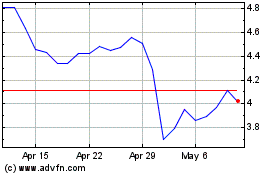

TETRA Technologies (NYSE:TTI)

Historical Stock Chart

From Apr 2023 to Apr 2024